India’s most trusted digital payment rail just got a performance upgrade. From August 1, 2025, the government-backed ecosystem has implemented a clear set of UPI payment guidelines to reduce failed transactions, ease peak-hour congestion, and keep everyday payments smooth for users and merchants. In plain terms: routine UPI from bank accounts stays free for consumers, while stricter technical limits on balance checks, API calls, and autopay timing make the network faster and more reliable.

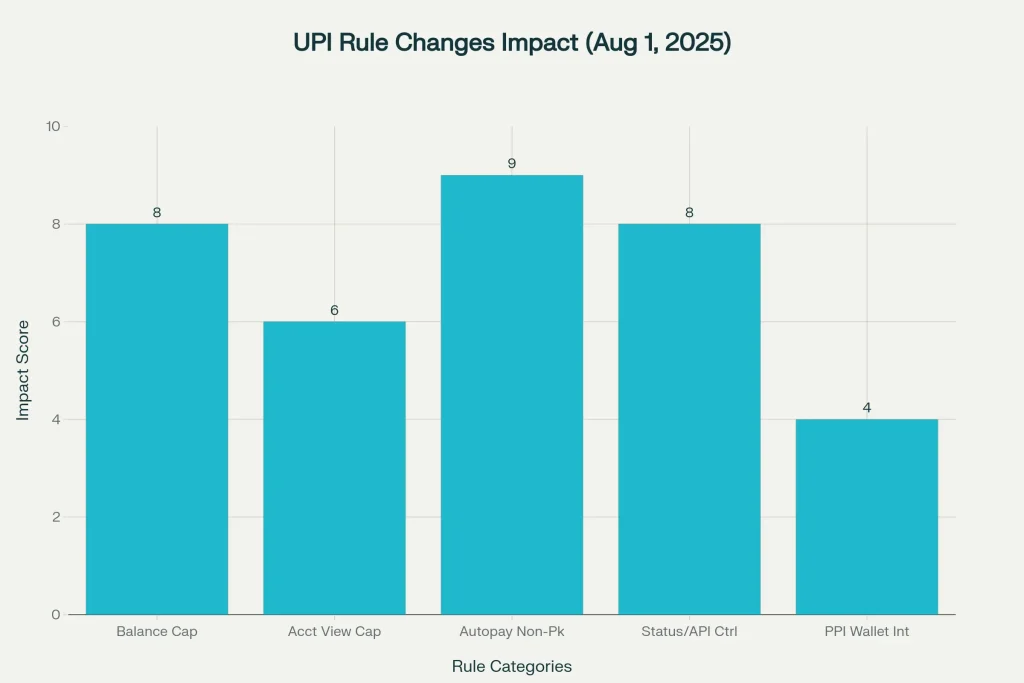

Let’s get straight to it. The new UPI Payment Guidelines introduce daily caps on balance checks per app, limits on how often linked accounts can be viewed, defined non-peak windows for autopay mandate execution, and standardized retry behavior for transaction status checks. These rules target the backend “noise” that slows the system, which is why users should now see fewer “pending” transactions and a better success rate during busy hours. For costs, consumer payments from bank accounts remain free; interchange applies only to merchant-side PPI wallet transactions above ₹2,000.

UPI Payment Guidelines

| Key Change | What It Means | Who’s Impacted | Effective |

|---|---|---|---|

| Balance Enquiry Limit | Max 50 balance checks per UPI app per day; feature may lock for 24 hours if exceeded | All users | August 1, 2025 |

| Linked Accounts View Cap | Typical cap of 25 times per app per day to reduce background calls | All users | August 1, 2025 |

| Autopay Execution Windows | UPI Autopay runs in non-peak hours with defined retries | Subscribers and billers | August 1, 2025 |

| Status/API Retry Controls | Spaced, capped retries to prevent overload and reduce stuck transactions | Apps, PSPs, banks | August 1, 2025 |

| PPI Wallet Interchange | Up to about 1.1% on merchant PPI transactions over ₹2,000; merchant-borne | Merchants using PPI-on-UPI | Ongoing per model |

The UPI Payment Guidelines are a systems-first upgrade that keeps consumer costs unchanged while tuning performance where it matters behind the scenes. If you stick to simple habits limit compulsive balance checks, ensure funds are ready before non-peak Autopay windows, and use direct bank-account UPI for high-ticket purchases you’ll enjoy faster, cleaner approvals with fewer hiccups. For merchants and platforms, the task is to align routing, retries, and schedules to the new normal. The result is a more resilient UPI built for scale, speed, and everyday reliability.

What’s Changing for Everyday Users

- Balance checks: You can check your bank balance up to 50 times per day in each UPI app. Go beyond that and the balance feature may be paused on that app for the day. Most users won’t feel this, but power users should consolidate checks.

- Linked account views: Viewing linked accounts is capped (commonly 25 per day per app). This curbs unnecessary account list refreshes that flood the network.

- Autopay schedules: Recurring debits like subscriptions, EMIs, and bills now run in non-peak windows with defined retry logic, so these don’t compete with heavy real-time traffic.

- Status checks: Apps won’t spam bank systems asking “what’s the status” endlessly. Capped, spaced retries reduce pending states and speed up final outcomes.

What Stays Free and Where Fees Apply

- Still free for consumers: Person-to-person and bank-account-to-merchant UPI transactions remain free for users. Your typical QR scan at the kirana or online checkout from a bank account doesn’t add a fee to you.

- Where interchange applies: If a merchant accepts UPI via a PPI wallet and the ticket size is above ₹2,000, interchange is charged on the merchant side. This does not change your payable amount as a consumer.

- Wallet top-ups: Provider-to-provider fees may apply in the backend for large wallet loads; this doesn’t translate into a direct consumer charge at checkout in standard usage.

Why These UPI Changes Matter

- Less congestion, more speed: The ecosystem has grown dramatically. By capping high-frequency API calls and moving autopay to calmer windows, banks and apps can process real-time payments faster.

- Fewer failures and pending states: Standardized retry logic keeps systems responsive and reduces the “stuck” or “in-progress forever” experience.

- Reliability for scale: As UPI volumes rise, these guardrails protect the experience without shifting costs onto everyday users.

How To Adapt Without Friction

- Space out balance checks: Rely on the post-transaction auto-balance display when available. If you’re in the habit of tapping balance after every small payment, switch to a periodic check routine.

- Prepare for autopay timing: Keep funds ready ahead of the known non-peak windows. If a payment is time-sensitive, consider a manual UPI pay slightly ahead of the window.

- Large merchant payments: If you want to sidestep wallet-related merchant fees influencing routing, pay directly from your bank account UPI for high-value transactions.

Impact On Merchants and Platforms

- Better throughput: Capped retries and scheduled autopay can reduce midday “API storms,” improving success rates and checkout conversions.

- Cost planning for PPI routes: For PPI-on-UPI above ₹2,000, account for interchange and route intelligently without compromising approval rates.

- Consumer clarity: Make it clear to customers that bank-account UPI remains free for them; the updated rules are about performance, not adding consumer fees.

Practical Scenarios

- Heavy balance checkers: A user who taps balance after every micro-spend may hit the 50-per-app daily limit. Switching to end-of-day or periodic checks avoids lockouts.

- Subscription/autopay: An OTT subscription via UPI Autopay won’t trigger in peak windows; it will process in the next non-peak slot with spaced retries if needed.

- High-ticket purchase: A ₹2,500 payment routed via a wallet QR could attract merchant-side interchange; paying bank-to-bank UPI keeps consumer cost unchanged and avoids wallet route fees considerations.

Fresh 2025 Context You Should Know

- Daily UPI transaction limits: For most banks, the general per-day cap remains around ₹1 lakh for typical categories, with higher limits for select use cases like IPOs, insurance, and hospital or education payments. Banks can set their own operational caps within this framework.

- Peak vs non-peak: Peak hours generally cluster in late morning to early afternoon and early evening. Moving autopay into non-peak helps real-time payments clear faster during busy periods.

- App-by-app limits: The balance check limit applies per app. Using multiple apps doesn’t merge the cap; each app enforces its own limit.

| Key Change | What It Means | Who’s Impacted | Effective |

|---|---|---|---|

| Balance Enquiry Limit | Max 50 per app/day; feature can lock if exceeded | All users | August 1, 2025 |

| Linked Accounts View Cap | About 25 per app/day to reduce background calls | All users | August 1, 2025 |

| Autopay Execution Windows | Runs in non-peak hours with defined retries | Subscribers and billers | August 1, 2025 |

| Status/API Retry Controls | Limited, spaced retries to cut overload | Apps, PSPs, banks | August 1, 2025 |

| PPI Wallet Interchange | Up to roughly 1.1% on >₹2,000, merchant-borne | Merchants using PPI-on-UPI | Ongoing |

Actionable Tips For Users And Merchants

- Users: Keep your balance topped up before non-peak windows if you rely on Autopay. If a transaction seems stuck, wait for the system retries rather than force-refreshing repeatedly.

- Small businesses: Train staff to reassure customers that bank-account UPI payments remain free to them. If you accept wallets for tickets above ₹2,000, account for interchange in pricing strategy.

- Fintech teams: Audit API usage, implement rate limiters, and align retry logic to the recommended cadence. Offer post-transaction balance display to reduce manual checks.

FAQs on UPI Payment Guidelines

Are UPI payments still free for users?

Yes. Sending money from your bank account via UPI whether person-to-person or paying a merchant remains free for consumers. Fees can apply on the merchant side for wallet-based UPI transactions above ₹2,000.

What happens if I exceed 50 balance checks in a day?

That app may block further balance enquiries for roughly a day. Use the app’s auto-balance after each transaction and consolidate your checks to avoid hitting the cap.

When exactly do Autopay mandates run now?

Autopay executes in non-peak windows. Think before 10 AM, a mid-day off-peak band, and after 9:30 PM. Your bank/app schedules retry within those windows to improve success.

Do these changes reduce failed or pending payments?

Yes. By capping noisy API calls and spacing retries, banks and apps handle load better, which reduces failed and stuck transactions and improves speed during busy hours.