Retirement planning has become one of the biggest concerns for government employees in recent years. With rising living costs, longer life expectancy, and uncertainty linked to market-driven pension returns, many employees are searching for stability rather than risk. That is where the Unified Pension Scheme India 2026 has started drawing serious attention across government departments.

The idea behind the Unified Pension Scheme India 2026 is to create a pension structure that offers predictable income after retirement while still remaining financially practical for the government. As discussions around pension reforms continue in 2026, thousands of employees are following every development closely, hoping for a system that provides clarity and long-term financial security. For many employees under the current system, retirement planning feels uncertain because final pension amounts depend heavily on market performance. A scheme that allows employees to estimate their pension in advance naturally creates confidence. The proposed unified approach attempts to address this gap by combining defined pension benefits with a contribution-based structure, making it easier for employees to plan their future without worrying about market fluctuations in their final working years.

The Unified Pension Scheme India 2026 is being discussed as a balanced alternative between the Old Pension Scheme and the National Pension System. Instead of relying completely on investment returns, the proposal introduces a defined pension formula that offers better predictability. The objective is to ensure that employees receive a stable retirement income while maintaining fiscal discipline through shared contributions from employees and the government. Many policy observers believe that this model could reshape pension planning by offering minimum guaranteed pension benefits, family protection provisions, and a transparent calculation method. The growing interest around the Unified Pension Scheme India 2026 shows how strongly employees value certainty when it comes to post-retirement financial security.

Unified Pension Scheme India 2026

| Feature | Proposed Details |

|---|---|

| Target Beneficiaries | Central Government employees under NPS (joined after April 1, 2004) |

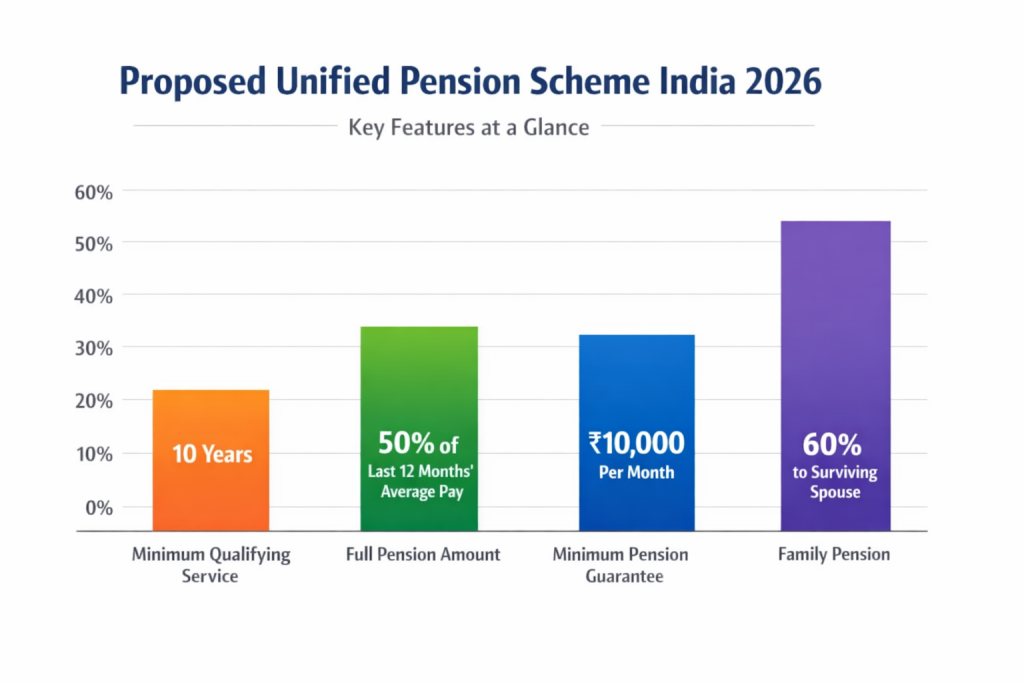

| Minimum Qualifying Service | 10 years |

| Pension Formula | 50% of average basic pay of last 12 months after 25 years of service |

| Pension For 10–25 Years Service | Proportionate pension benefit |

| Minimum Pension Guarantee | ₹10,000 per month |

| Family Pension | 60% of pension to surviving spouse |

| Employee Contribution | 10% of Basic Pay plus Dearness Allowance |

| Government Contribution | Matching contribution with guarantee support |

| Key Advantage | Predictable and defined pension outcome |

| Current Status | Proposal under discussion |

The Core Objective: Bridging Certainty And Sustainability

- The central goal of the proposed pension framework is to balance employee security with long-term financial sustainability. Under the existing NPS structure, retirement income depends largely on market performance, which can fluctuate over time. This uncertainty has been a major concern among employees approaching retirement. The Unified Pension Scheme India 2026 aims to reduce this risk by introducing a predictable pension outcome without completely abandoning the contribution-based model.

- Instead of returning entirely to the old pension structure, the proposal attempts to create a modern system suited to current economic realities. Employees continue contributing toward their retirement fund, while the government provides assurance through a defined pension formula. This approach seeks to ensure that employees feel financially secure while the system remains manageable for public finances over the long term.

Eligibility Criteria for Unified Pension Scheme India 2026

- The proposal mainly focuses on central government employees who joined service on or after April 1, 2004, and are currently enrolled under the National Pension System. A minimum qualifying service of ten years is expected to be required for pension eligibility. This condition ensures that even employees with shorter service periods are not left without retirement support.

- By widening eligibility, the Unified Pension Scheme India 2026 aims to provide a safety net for a broader section of employees. Many employees who entered service after the shift from the Old Pension Scheme have long demanded more certainty in retirement benefits. The proposed structure attempts to address those concerns by offering a clearer pension pathway.

Calculating Your Pension: A Transparent Formula

- One of the most discussed aspects of the proposal is the clarity in pension calculation. Employees completing 25 years or more of service may receive a pension equal to 50 percent of the average basic pay drawn during the last twelve months before retirement. For employees with service between 10 and 25 years, the pension amount would be calculated proportionately.

- This transparent formula makes retirement planning more practical. Employees can estimate their future income well in advance and make informed financial decisions. The Unified Pension Scheme India 2026 emphasizes predictability, which is often missing in market-linked pension systems. For many employees, this transparency is one of the strongest reasons behind the growing interest in the proposal.

Guaranteed Minimum and Family Protection

- Another important feature being discussed is the minimum pension guarantee. The proposal suggests that eligible retirees should receive at least ₹10,000 per month as pension. This provision is particularly significant for employees in lower pay scales who may otherwise face financial challenges after retirement.

- Family protection is also an essential component of the proposed system. In the event of the pensioner’s death, the surviving spouse would receive 60 percent of the pension amount as family pension. This ensures that families continue to have financial support even after the loss of the primary pensioner. Such provisions make the Unified Pension Scheme India 2026 more than just a retirement benefit; it functions as a broader social security mechanism.

Contribution Structure: A Shared Responsibility

- Unlike the Old Pension Scheme, the proposed model continues with a contribution-based structure. Employees would contribute 10 percent of their basic salary along with Dearness Allowance, while the government provides a matching contribution. The government’s role also includes supporting the guaranteed pension component.

- This shared responsibility is designed to maintain financial balance. Employees actively contribute toward their retirement savings, while the government ensures stability through defined benefits. The Unified Pension Scheme India 2026 reflects an effort to combine financial discipline with retirement assurance, which many experts consider necessary for sustainable pension reforms.

Distinguishing UPS From NPS: The Predictability Factor

- The primary difference between the proposed unified system and the existing NPS lies in certainty. Under NPS, the final pension depends on investment performance and annuity rates at the time of retirement. This creates uncertainty, especially during volatile market periods.

- The proposed unified structure introduces a defined benefit element, allowing employees to understand their expected pension in advance. This predictability is a major reason why the Unified Pension Scheme India 2026 has become a topic of discussion among government employees across the country. A predictable pension allows better financial planning and reduces anxiety associated with retirement income.

Free Laptop Yojana 2026 – 30 Million Students Eligible Learn How to Apply Step-by-Step

Why Lakhs Are Watching The Scheme Closely

- Over the past decade, concerns about retirement security have steadily increased among government employees covered under NPS. Inflation, rising healthcare costs, and longer retirement periods have made stable income more important than ever. The possibility of a guaranteed minimum pension and a clear calculation method has naturally generated strong interest.

- Although the scheme is still under discussion and not officially implemented, employees see it as a potential turning point in pension reforms. Many believe that if introduced in its proposed form, it could significantly improve retirement confidence for future pensioners. The attention surrounding the Unified Pension Scheme India 2026 reflects a broader shift in expectations, where employees value stability and predictability over uncertain investment returns.

FAQs on Unified Pension Scheme India 2026

What Is the Unified Pension Scheme India 2026?

It is a proposed pension framework designed to provide predictable retirement income to government employees while retaining a contribution-based structure similar to the National Pension System.

Who Is Eligible for The Proposed Scheme?

The proposal mainly targets central government employees who joined service after April 1, 2004, and are currently covered under NPS, subject to minimum service requirements.

Is There A Minimum Pension Guarantee?

Yes, discussions around the proposal include a minimum monthly pension of ₹10,000 for eligible retirees.

How Is Pension Calculated Under The Scheme?

Employees completing 25 years of service may receive around 50 percent of their average basic pay from the last twelve months before retirement, with proportionate benefits for shorter service periods.