If you are a Central Government employee trying to make sense of your retirement options, the Unified Pension Scheme 2025 is probably the biggest financial decision on your radar right now. This new framework promises something simple but powerful: if you meet the service conditions, you can lock in up to 50% of your average basic pay as a guaranteed, lifelong pension instead of depending purely on market-linked NPS returns. In this guide, the Unified Pension Scheme 2025 is broken down in plain language so you can quickly see whether opting out of NPS and into UPS fits your income needs, risk tolerance, and family responsibilities.

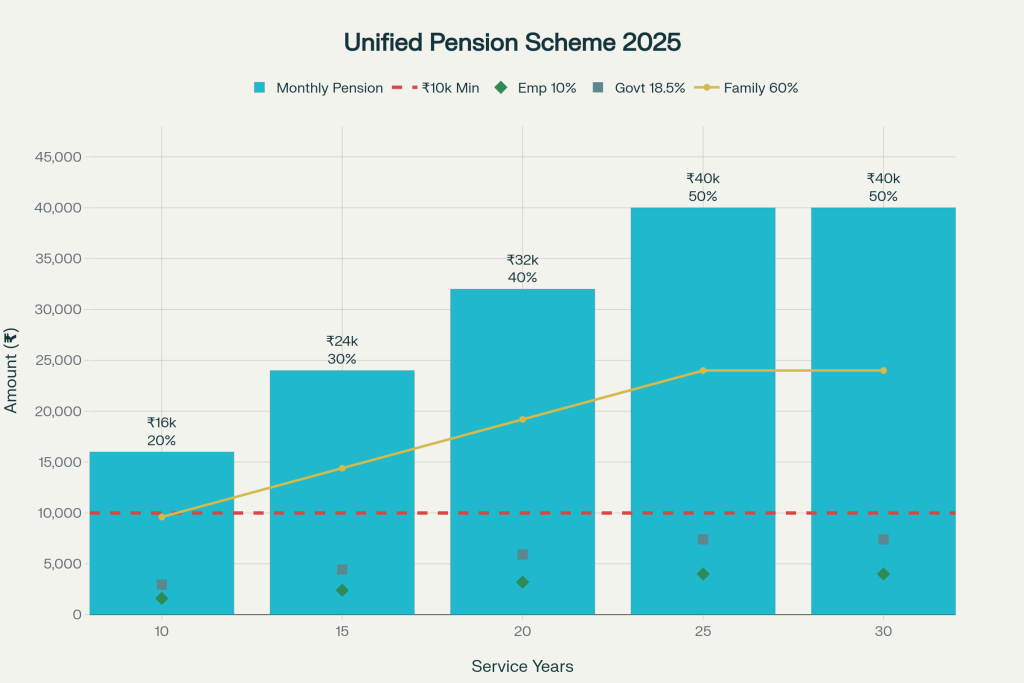

At its core, Unified Pension Scheme 2025 is a contributory, government-backed pension system for Central Government staff who want assured, inflation-indexed income after retirement instead of fully market-driven payouts. You contribute 10% of your basic salary plus dearness allowance (DA), while the government puts in a far higher 18.5%, taking the total monthly contribution to 28.5% of your basic plus DA, which is more generous than the 24% total contribution under NPS. If you complete at least 25 years of qualifying service and retire normally, you become eligible for an assured pension of 50% of your average basic pay over the last 12 months, with a guaranteed minimum pension of ₹10,000 per month for anyone who has at least 10 years of service. On top of this, dearness relief is added in the same way as DA for serving employees, which means your pension and family pension rise periodically with inflation instead of staying flat for life.

Unified Pension Scheme 2025

| Point | Details |

|---|---|

| Scheme type | Contributory, defined-benefit style pension under the NPS framework with assured payouts for eligible Central Government employees |

| Employee contribution | 10% of basic pay and dearness allowance deducted monthly and invested in your UPS account |

| Government contribution | 18.5% of basic pay and dearness allowance (10% to your individual corpus, 8.5% to a pooled corpus), higher than 14% under NPS |

| Full pension condition | 50% of 12-month average basic pay before retirement, available if you have at least 25 years of qualifying service |

| Minimum pension | At least ₹10,000 per month on superannuation if you have 10–24 years of qualifying service, even if your 50% formula works out lower |

| Service range 10–25 years | Proportionate pension: assured payout is scaled as years of service divided by 25, subject to the minimum pension guarantee |

| Family pension | 60% of the pension that the employee was drawing immediately before death, payable to the surviving spouse |

| Inflation protection | Dearness Relief on pension and family pension, calculated using the AICPI-IW index like DA for serving staff |

| Implementation date | Effective from April 1, 2025, for eligible Central Government NPS subscribers who opt into UPS |

| Last date to switch | Current deadline to move from NPS to UPS was September 30, 2025, after which you stay with NPS by default |

The Unified Pension Scheme represents a deliberate middle ground between the Old Pension Scheme (which gave 50% pension with zero employee contribution but became fiscally unsustainable) and the National Pension System (which offers market-driven returns but no guaranteed pension floor). What makes Unified Pension Scheme 2025 distinctive is that the government is betting on a pooled corpus mechanism to sustainably deliver those assured payouts without reverting to a fully unfunded model. When you contribute your 10% and the government contributes 18.5%, part of the government’s share goes into a centralized pool that essentially acts as a buffer to guarantee pension payments, especially for employees who retire with shorter service tenures or lower accumulated corpus.

The scheme became operational on April 1, 2025, and existing Central Government NPS subscribers had until September 30, 2025, to opt into Unified Pension Scheme 2025. This one-time switch window was critical because, under the current rules, you cannot easily move back to NPS once you commit to UPS. For new government recruits hired after April 1, 2025, the default option is NPS, but they can opt for Unified Pension Scheme within 30 days of joining if they prefer the assured pension approach from day one.

Eligibility Criteria for Unified Pension Scheme 2025

Unified Pension Scheme 2025 is meant primarily for Central Government employees who joined service on or after January 1, 2004, and are currently under NPS, giving them a one-time option to move into an assured pension structure. This eligibility window covers approximately 23 lakh Central Government employees, many of whom joined after the NPS rollout and have spent years accumulating contributions without a guaranteed pension floor. New recruits joining on or after the UPS implementation date can also opt for Unified Pension Scheme within a fixed window after joining; if they do nothing, NPS remains the default.

From a practical standpoint, Unified Pension Scheme eligibility strongly favours employees who expect to stay in government service for the long haul, because the benefit curve becomes most attractive once you cross the 20–25-year mark. If you are already close to retirement with limited remaining years, you need to carefully compare the projected NPS corpus and Unified Pension Scheme assured pension using an online UPS versus NPS calculator before locking in your choice, because the switch is currently designed as a one-time, irreversible move. Some employees in their late 50s, for example, might find that staying with their accumulated NPS corpus and taking an annuity produces a higher income than switching to a proportionate Unified Pension Scheme benefit with just a few years left to contribute.

How The 50 Percent Pension Actually Works

Under Unified Pension Scheme 2025, the headline promise is clear: for a normal superannuation with at least 25 years of qualifying service, you get 50% of your average basic pay from the last 12 months as an assured, lifelong pension. So if your average basic pay in the final year is ₹80,000, your base pension would be ₹40,000 per month before Dearness Relief, which can push the actual in-hand pension much higher over time as DR rates move up with inflation.

If you retire with, say, 15 years of qualifying service instead of 25, the formula scales your benefit as 15 divided by 25 of the full pension, but still ensures a minimum of ₹10,000 per month as long as you meet the 10-year threshold. This proportionate structure is fair because it reflects your actual contribution history while preserving a safety net so that even employees with interrupted service or shorter tenures do not retire into poverty.

Contributions, Returns And Inflation Protection

On the contribution side, UPS keeps your share the same as NPS—10% of basic plus DA—but significantly boosts the government share to 18.5%, which directly strengthens your retirement funding every single month. Together, this 28.5% total contribution is invested through the NPS infrastructure, typically with conservative equity caps and a higher allocation to government securities, so that your corpus growth can support the guaranteed formulas in the Unified Pension Scheme 2025.

Where Unified Pension Scheme really stands out is inflation protection: both your assured pension and your spouse’s family pension receive Dearness Relief linked to the AICPI-IW index, calculated in the same way as DA for serving government staff. That means if inflation spikes over the next 10–20 years, your pension is periodically revised upward instead of staying fixed, which is a huge structural advantage over standard annuity-based NPS payouts that usually don’t rise at the same pace. As of November 2025, the DR stands at approximately 55%, and while this rate will fluctuate based on the cost of living index, the point is that retirees under Unified Pension Scheme 2025 automatically get the benefit of inflation adjustments tied to official government indices.

Lump Sum Payouts and Gratuity Benefits

Beyond the monthly pension, Unified Pension Scheme 2025 includes a generous lump sum payment at retirement. You receive one-tenth of your monthly emoluments (basic pay plus DA on the date of superannuation) for every six-month period of completed service. So if you retire after 30 years with a monthly emolument of ₹90,000, you would get one-tenth of ₹90,000 (which is ₹9,000) multiplied by 60 six-month periods, totaling ₹5.4 lakh as a one-time lump sum. This payment is separate from your monthly pension and is designed to help cover immediate retirement expenses, house repairs, medical costs, or investment opportunities.

Additionally, you become eligible for gratuity under the Central Civil Services (Payment of Gratuity under NPS) Rules. Retirement gratuity is calculated as one-fourth of your emoluments multiplied by the number of completed six-month periods of service, capped at a maximum of 16.5 times your emoluments or ₹25 lakh, whichever is lower. The ₹25 lakh ceiling was raised in early 2024 to account for inflation, and it applies to both retirement gratuity and death gratuity if you pass away while in service. For a 30-year government employee retiring with substantial emoluments, the gratuity benefit can easily exceed ₹15–20 lakh, representing a significant capital injection to supplement the lump sum and your monthly pension setup.

Family Pension And Survivor Protection

One of the most valuable aspects of Unified Pension Scheme 2025 is the family pension provision, which protects your surviving spouse after you pass away. If you pass away after retiring and drawing pension under Unified Pension Scheme, your legally wedded spouse becomes eligible to receive 60% of the pension you were drawing immediately before death. So if your monthly pension (including DR) was ₹70,000, your spouse would receive ₹42,000 per month for life, also adjusted by Dearness Relief periodically.

If you die before retiring (while still in service), different gratuity rules apply. Death gratuity scales based on years of service: for less than one year of service you get two times your emoluments, for one to five years you get six times, for five to eleven years you get twelve times, and for eleven to twenty years you get twenty times. For twenty or more years of service, death gratuity equals one-half of your emoluments for every completed six-month period of service, capped at ₹25 lakh. These substantial death gratuity payouts ensure that even if an employee dies unexpectedly, their family receives meaningful financial support rather than just a nominal severance amount.

Delhi Coaching Scheme for Talented Students — Free Preparation for Competitive Exams

Making Your Decision

Choosing between Unified Pension Scheme 2025 and continuing with NPS is a significant decision that deserves careful analysis of your specific situation. If you have substantial years of service remaining, prefer income certainty, and want inflation protection built into your retirement plan, Unified Pension Scheme 2025 is a compelling option. The enhanced government contribution, guaranteed pension formula, and dearness relief indexation create a robust retirement income stream that frees you from worrying about market volatility or unfavorable annuity rates in your 60s or 70s.

FAQs on Unified Pension Scheme 2025

Who should seriously consider opting for Unified Pension Scheme 2025 instead of staying with NPS?

UPS is particularly suitable if you are a Central Government employee with at least 10–15 years of service already completed and a strong likelihood of reaching or nearing 25 years, because the assured 50% salary pension plus inflation indexation materially de-risks your retirement income.

Can I still get a good payout if I have less than 25 years of service?

Yes, as long as you complete at least 10 years of qualifying service, you are guaranteed a minimum pension of ₹10,000 per month, and for 10–24 years your benefit is calculated proportionately as years of service divided by 25 of the full 50% formula.

How does Unified Pension Scheme 2025 compare with NPS for long-term planning?

NPS can potentially deliver higher or lower income depending on market performance and annuity rates, while Unified Pension Scheme 2025 trades some upside for predictability by giving you a formula-based, inflation-linked pension plus a stronger government contribution of 18.5% instead of 14%.

What happens to my family if I die after retiring under UPS?

Your legally wedded spouse is entitled to a family pension equal to 60% of the pension you were drawing immediately before death, and that family pension also receives Dearness Relief, giving your household continued, inflation-linked income.