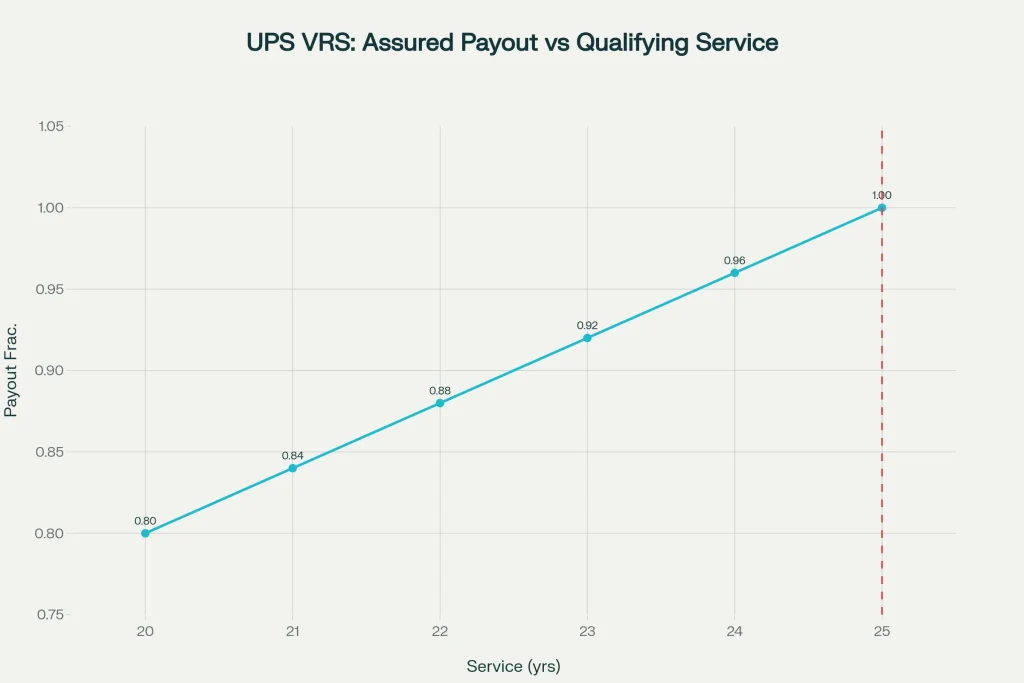

The Unified Pension Scheme — Government Issues Clarification and Makes New Rules Mandatory for Voluntary Retirement has set out a clear, structured path for central government employees who are planning to exit through voluntary retirement under UPS. In simple terms, employees can opt for voluntary retirement after completing 20 years of regular service, but they must serve a minimum three-month written notice to the appointing authority. If no refusal is issued before the notice period ends, the retirement becomes effective automatically on the expiry date. The entitlement is tied to qualifying service: before 25 years, benefits are paid on a pro‑rata basis; at 25 years or more, the full assured payout applies as per the operational regulations.

If you are evaluating your options under the Unified Pension Scheme Government Issues Clarification and Makes New Rules Mandatory for Voluntary Retirement, the rules are now straightforward and predictable. You become eligible to submit voluntary retirement after 20 years of regular service by giving a written three‑month notice, with the option to request a shorter notice if it does not cause administrative inconvenience. Your assured payout depends entirely on your qualifying service at the time of exit: below 25 years means pro‑rata benefits, while completing 25 or more years unlocks the full assured payout. Importantly, withdrawal of a VRS notice is not automatic—you need specific approval, and the request must reach the authority at least 15 days before the intended retirement date.

Unified Pension Scheme

| Key Aspect | What It Means |

|---|---|

| Coverage | Central Government civil employees who opted for UPS under NPS; service matters governed by CCS (Implementation of UPS under NPS) Rules, 2025 and aligned regulations. |

| Eligibility For VRS | May seek voluntary retirement after 20 years of regular service with a written notice of not less than three months. |

| Deemed Acceptance | If no refusal is issued before the notice period expires, retirement takes effect automatically on the expiry date. |

| Shorter Notice Option | Appointing authority may relax the three‑month notice if curtailment does not cause administrative inconvenience. |

| Withdrawal Of Notice | Allowed only with specific approval and must be requested at least 15 days before the intended retirement date. |

| Entitlement Below 25 Years | Pro‑rata assured payout, proportionate to qualifying service as per operational regulations. |

| Entitlement At 25+ Years | Full assured payout as defined under the operational regulations for UPS. |

| Exclusions | Not applicable to DoPT’s special VRS for surplus staff or to retirements for absorption in autonomous bodies/PSUs. |

| Departmental Directions | Ministries and departments instructed to disseminate and strictly implement these provisions. |

The Unified Pension Scheme Government Issues Clarification and Makes New Rules Mandatory for Voluntary Retirement gives central government employees a rule-bound, predictable route to exit after 20 years, with strong incentives to complete 25 years for full assured payout. The three-month notice standard deemed acceptance safeguard, and narrowly tailored exceptions create clarity and lower friction. If you are weighing your options, align your timeline with the 20‑ and 25‑year gates, lock in the notice mechanics, and coordinate your post-retirement benefits for a smooth, financially sound transition.

Employees’ Entitlement On Voluntary Retirement Under UPS

The entitlement structure is now service-linked and clear. If you retire voluntarily after 20 years but before 25 years of qualifying service, your assured payout is paid on a pro‑rata basis. Practically, that means the benefit scales according to the fraction of 25 years you have completed. If you complete 25 years or more, you are entitled to the full assured payout under the Unified Pension Scheme as per the notified operational framework. This bifurcation encourages careful timing: crossing the 25‑year mark substantially changes the benefit quantum.

What Happens If the Notice Is Not Accepted by the Appointing Authority

The process recognizes a principle of deemed acceptance. After you submit a notice of voluntary retirement meeting the requirements, the appointing authority must issue a refusal before the notice period ends if it intends to block the retirement. If no refusal is communicated within that period, the retirement becomes effective automatically on the date your notice expires. This reduces uncertainty and empowers employees to plan transitions, travel, financial commitments, and post-retirement arrangements with dependable timelines.

What If the Employee Wants to Serve a Notice Period of Less Than 3 Months

The rules provide a practical flexibility window. You can submit a written request asking the appointing authority to shorten the three-month notice, explaining the reasons. The authority has discretion to curtail the period if doing so will not cause administrative inconvenience. This gives room for urgent exits health, family exigencies, or mission-critical transitions without undermining institutional continuity.

Who Is Covered and Who Is Not Under This Rule

These voluntary retirement clarifications apply to central civil employees who opted for UPS within the National Pension System framework, and whose service conditions fall under the CCS (Implementation of UPS under NPS) Rules, 2025. The rules explicitly exclude two categories: employees taking the DoPT special VRS designed for surplus staff and employees retiring for absorption in autonomous bodies or public sector undertakings. Those scenarios continue to be governed by their own specialized frameworks and orders.

1. Entitled To Pro‑Rata Assured Payout Admissible Under the PFRDA Regulations

For voluntary retirement taken any time from 20 years up to, but not including, 25 years of qualifying service, the assured payout is proportionate. The pro‑rata method ensures employees receive benefits aligned with the percentage of 25 years completed at exit. Though the detailed formula is part of the operational regulations, the intent is straightforward: if you exit before 25 years, your assured payout fractionally reflects your years served.

2. The Subscriber on Voluntary Retirement from Service on or After Completion of Twenty-Five Years of Qualifying Service Is Entitled to Full Assured Payout

Completing 25 years is the pivotal threshold. From that point onward, a subscriber who opts for voluntary retirement is eligible for the full assured payout under the Unified Pension Scheme. Computation, start date of the payout, and interaction with other retirement benefits are guided by the notified regulations and FAQs, but the headline point is unambiguous: reaching 25 years maximizes the assured payout entitlement.

3. All Ministries Departments Are Requested That the Above Provisions Regarding Entitlement on Voluntary Retirement Be Brought to the Notice of Personnel for Strict Implementation

The government has asked ministries, attached offices, and subordinate units to actively communicate these provisions to all personnel handling service matters, UPS/NPS records, and retirement cases. The objective is uniform, timely implementation and to avoid inconsistent interpretations that could delay processing or create disputes. For employees, this means smoother filing, consistent scrutiny, and predictable outcomes.

How This Impacts Your Decision Making

- Time Your Exit: If your qualifying service is approaching 25 years, consider whether waiting to cross the threshold is beneficial for your long-term payout. The Unified Pension Scheme Government Issues Clarification and Makes New Rules Mandatory for Voluntary Retirement effectively rewards completion of 25 years with full assured payout.

- Manage The Notice: The standard is three months’ written notice. If you need to exit faster, prepare a clear justification for curtailment that demonstrates no administrative inconvenience, and submit it alongside your notice.

- Track The Clock: Mark your calendar from the date of notice. If no refusal lands before the expiry, your retirement is effective automatically on the expiry date plan your final handover, leave encashment processing, and documentation accordingly.

- Don’t Assume Withdrawal: If you change your mind, you cannot unilaterally retract the notice. You must apply for withdrawal at least 15 days before the intended retirement date, and it will require explicit approval. Build in that buffer if there’s a realistic chance your plans may change.

- Know The Exclusions: If you are proceeding under the surplus staff special VRS or retiring for absorption in an autonomous body or PSU, these UPS VRS entitlements and mechanics do not apply. Refer to the specific scheme or absorption rules that govern your case.

Timelines, Windows, And Readiness

In 2025, multiple departments have aligned their internal processes to the UPS framework, including timelines for options and migration where applicable. Employees should watch for department-level circulars and FAQs that clarify when assured payouts start for various retirement scenarios, especially for those completing 25 years. This administrative readiness is designed to minimize delays between the effective date of retirement and the commencement or sanctioning of associated benefits.

Berojgari Bhatta Yojana 2025 — Apply to Receive ₹2,500 Monthly Assistance from the Government

Practical Tips to Optimize Outcomes

- Document Everything: Keep copies of your notice, any request for curtailment, reminders, and acknowledgments. This helps if there are questions about deemed acceptance.

- Consult Your Establishment Section Early: Get clarity on your qualifying service calculation, pending leave, last pay drawn, and any recoveries. Accurate numbers will speed up benefit processing.

- Coordinate Benefits: Understand how assured payout timing interacts with retirement gratuity, leave encashment, CGEGIS, and any corpus withdrawals permissible under the broader framework. A cohesive plan avoids liquidity gaps post-retirement.

- Plan For Post-Notice Period: Align your handover, conclusions of ongoing tasks, and personal arrangements to the exact expiry date of your notice or the approved curtailed date. Avoid last-minute changes that may complicate approvals.

- Evaluate Tax And Cash Flow: While the assured payout framework is defined, your overall tax and cash flow picture depends on combining multiple benefits. A quick run-through with a financial planner can help smooth the transition.

FAQs on Unified Pension Scheme

Can I take voluntary retirement under UPS after 20 years?

Yes. After completing 20 years of regular service, you may retire voluntarily by giving at least three months’ written notice to the appointing authority. If no refusal is issued before the notice ends, retirement becomes effective on the expiry date.

Will I get full assured payout if I retire at 22 years?

No. Before completing 25 years of qualifying service, the assured payout is pro‑rata. Full assured payout applies only when you retire on or after completing 25 years.

What happens if my authority does not respond to my VRS notice?

Your retirement takes effect automatically on the expiry of the notice period if the authority does not refuse permission before that date. This deemed‑acceptance principle ensures you are not left in limbo.

Can the three‑month notice be reduced?

Yes, but only at the discretion of the appointing authority. You must make a written request showing that curtailment will not cause administrative inconvenience; if satisfied, the authority may approve a shorter notice.