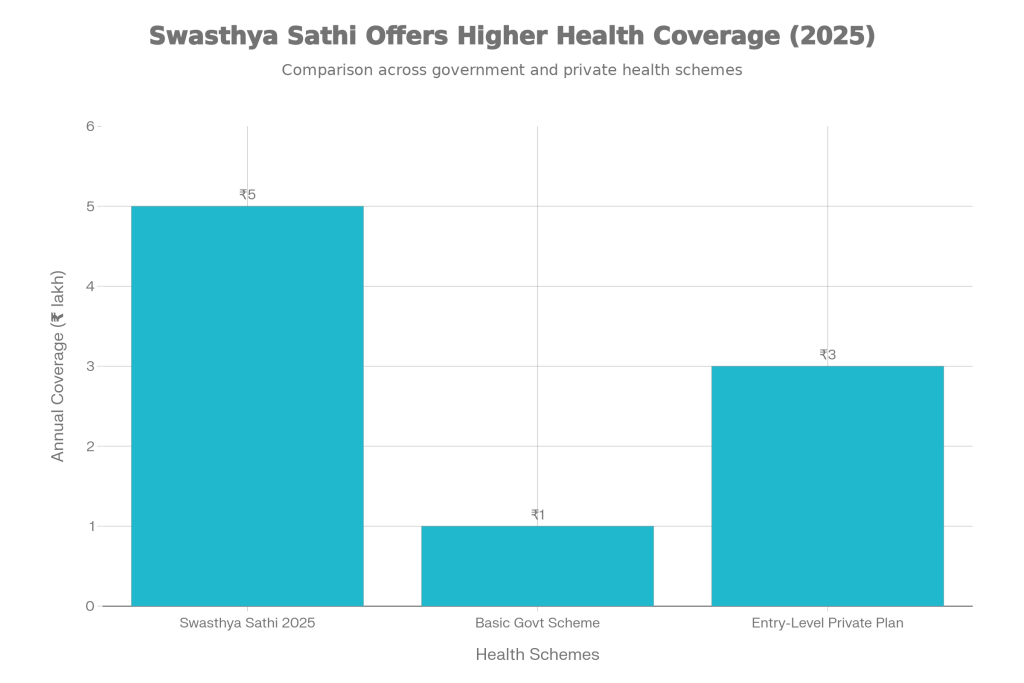

Swasthya Sathi 2025 is a government-funded health insurance-cum-assurance programme for residents of West Bengal, designed to protect families from expensive hospital bills. Each enrolled family gets an annual cover of up to ₹5 lakh that can be used for secondary and tertiary care treatments. This includes operations, ICU care, serious disease management, and a wide range of treatment packages that have pre-fixed rates.

The entire system runs on a smart card that carries the biometric and demographic details of all covered family members. This card is usually issued in the name of the eldest female member or head of the family, symbolising women-centric empowerment as well as practicality. Once issued, the card can be used at empanelled hospitals across the state and in some cases outside West Bengal, for completely cashless admission and discharge under approved packages.

Swasthya Sathi 2025

| Feature | Details |

|---|---|

| Scheme Name | Swasthya Sathi Health Insurance Scheme |

| Implementing Authority | Government of West Bengal, Health & Family Welfare Department |

| Annual Coverage | Up to ₹5 lakh per family per year |

| Premium Cost | Zero; full premium paid by the West Bengal government |

| Family Size Limit | No cap; parents of both spouses and dependent members included |

| Card Type | Smart card with biometric and demographic data |

| Card Issued To | Generally the eldest female or head of the family |

| Network Hospitals | Government and empanelled private hospitals across and beyond the state |

| Pre-existing Diseases | Covered from day one |

| Mode Of Treatment | Fully paperless and cashless hospitalisation |

What Is the Swastha Sathi Scheme?

The Swastha Sathi scheme is West Bengal’s flagship health protection programme aimed at providing universal health coverage to households that are often left out of private health insurance. It began with specific categories like self-help group members and certain government-linked workers, and has gradually evolved into a broader scheme that covers almost all residents not receiving separate medical allowances or covered under overlapping government schemes.

The model used is a mix of insurance and direct government assurance. A part of the risk is handled by insurance companies selected by the state, while the rest is backed directly by the government to ensure continuity of benefits. For the average family, this hybrid backend is invisible; what they experience is a hassle-free cashless system where the hospital raises the claim and the scheme settles it.

Benefits of the Swasthya Sathi Health Scheme

The core benefit of Swasthya Sathi 2025 is the high coverage limit: free cashless treatment up to ₹5 lakh per family per year. This is substantial, especially when a single major surgery or critical illness can easily run into lakhs of rupees. Hospitalisation expenses such as room charges (within approved category), nursing, doctor’s fees, operation theatre charges, ICU, and in-patient medicines generally fall under package rates.

Another major benefit is that there is no waiting period for pre-existing diseases. Many private health insurance policies either exclude existing illnesses for a few years or restrict coverage in the initial period. Under this scheme, long-standing conditions like diabetes, hypertension, heart disease, kidney problems or cancer can be treated from day one, as long as the required procedure is part of the approved package list. For families with elderly parents or members with chronic diseases, this makes a big difference.

Swasthya Sathi 2025 Eligibility Criteria

Swasthya Sathi 2025 is meant primarily for residents of West Bengal. The state has expanded the scheme over time to include almost all families living within its borders, with some exceptions. Generally, those already receiving a separate medical allowance from their government employer or covered under another major public health insurance scheme are not included, to avoid double benefits.

The definition of “family” is quite generous under Swasthya Sathi 2025. It usually includes the main beneficiary, spouse, parents of both husband and wife, sons up to a certain age limit, unmarried daughters up to a defined age, and dependent persons with disabilities without strict age caps. Importantly, there is no numerical cap on the number of members that can be added under one family unit. This is especially beneficial for joint families and households where several generations live together.

How To Apply for the Swasthya Sathi Card

To join Swasthya Sathi 2025, families typically have to go through an enrollment process which may happen via government-organised camps, local offices, or online platforms as notified by the state. Basic documents often include Aadhaar card, ration card or other identity and address proofs, and details of all family members who are to be covered. Local authorities verify the data and ensure there is no duplication with other schemes.

Once the verification is complete, a Unique Registration Number (URN) is generated for the family. Based on this URN, a smart card is printed and delivered or distributed at the designated center. This card, once activated, becomes the key to using Swasthya Sathi 2025 benefits. It is important for families to keep the card safe, updated in case of any change in family details, and to carry it whenever they visit any empanelled hospital.

How Cashless Treatment Works Under the Scheme

The cashless process under Swasthya Sathi 2025 is designed to be simple for the patient. In case of a planned procedure or emergency, the family can go to any hospital that is part of the scheme’s network. At the hospital’s Swasthya Sathi help desk or registration counter, the smart card is presented. The staff then checks the validity and details online through the scheme’s portal.

If the case requires admission and falls under an approved treatment package, the hospital raises a pre-authorisation request with relevant medical details. Once authorised, the hospital proceeds with treatment without demanding a deposit from the patient for covered services. After the patient is discharged, the hospital submits the final bill to the scheme’s system. The payment is then processed directly between the hospital and the scheme administrator or insurer, while the family walks out without paying for the approved bill amount.

Exclusions And Limitations You Should Know

Although Swasthya Sathi 2025 is generous, it does not cover every single type of medical expense. Outpatient consultations that do not involve admission, routine health check-ups, purely cosmetic or beauty-enhancing procedures, weight-loss surgeries done for cosmetic reasons, fertility or IVF treatments, and experimental or unapproved therapies are generally not included. Illnesses directly linked to substance abuse or self-harm, as well as war or nuclear-related incidents, are common exclusions.

Another important limitation is the overall financial cap. While ₹5 lakh per family per year is a strong shield, very prolonged or multiple high-cost treatments in the same year can still exhaust this limit. Once the cap is reached, any additional expenses might have to be paid from the family’s own pocket. For families with the capacity to pay an additional premium, combining Swasthya Sathi 2025 with a separate private health insurance policy can offer an extra layer of security.

Deposit ₹12,000 for Your Daughter and Get ₹66 Lakh Later — Post Office SSY Returns Explained

Why Swasthya Sathi 2025 Matters for WB Families

Healthcare costs have been rising steadily, and a single medical emergency can push a middle-class family into debt. Swasthya Sathi 2025 directly attacks this problem by offering free cashless treatment up to ₹5 lakh without any premium burden on the family. This makes quality healthcare more accessible and encourages people to seek timely treatment instead of delaying it out of financial fear.

The scheme’s broad definition of family, its inclusion of elderly parents and dependents with disabilities, and its digital, paperless workflow make it particularly suited for the ground realities of West Bengal. For a large section of the population that never considered buying private health insurance, Swasthya Sathi 2025 serves as their first real safety net against catastrophic health expenses. In practical terms, it can mean the difference between “we can’t afford this surgery” and “let’s admit immediately and get it done.”

FAQs on Swasthya Sathi 2025

1. Who can apply for Swasthya Sathi 2025?

Residents of West Bengal who are not already covered under specific government medical allowance schemes or overlapping health insurance programmes are generally eligible.

2. Is Swasthya Sathi 2025 completely free?

Yes, for beneficiaries the scheme is completely free. There is no premium, no enrollment fee, and no annual renewal cost charged to the family.

3. What is the maximum coverage available under the scheme?

Each enrolled family gets an annual coverage of up to ₹5 lakh, which can be used for approved secondary and tertiary care treatments in empanelled hospitals.

4. Does Swasthya Sathi 2025 cover pre-existing diseases?

Yes, pre-existing diseases are covered from day one. Chronic or long-term conditions that existed before enrollment can still be treated under the scheme if the required procedure or treatment falls under the approved package list.