The Government of India has introduced significant reforms to the Student Credit Card Scheme 2025, aimed at expanding access to education loans and shortening approval timelines. The revised policy allows eligible students to secure up to ₹10 lakh with simplified documentation, digital verification, and broader institutional coverage. Officials said the changes are designed to remove financial barriers to higher education for millions of students across the country.

Key Changes Introduced Under the Student Credit Card Scheme 2025

According to the Ministry of Education’s updated policy document, the 2025 revision focuses on improving efficiency, widening loan eligibility, and making the scheme uniform across states participating in the programme. The move follows months of consultations with banks, state governments, education experts, and student groups.

A senior official from the Ministry’s Higher Education Bureau said the objective is to “ensure consistent access, predictable timelines, and fair treatment for every applicant, regardless of geography or income background.”

Higher Loan Limit and Strengthened Subsidy Provision

The revised guidelines maintain the ₹10 lakh loan cap available without collateral but introduce a graded interest support structure for disadvantaged families. According to the Ministry circular, students from low-income households will receive additional interest relief during the study period.

Several state governments have already announced complementary subsidies. For example, officials in West Bengal, which pioneered the Student Credit Card model in 2021, said they will continue to offer interest concessions under state policy frameworks.

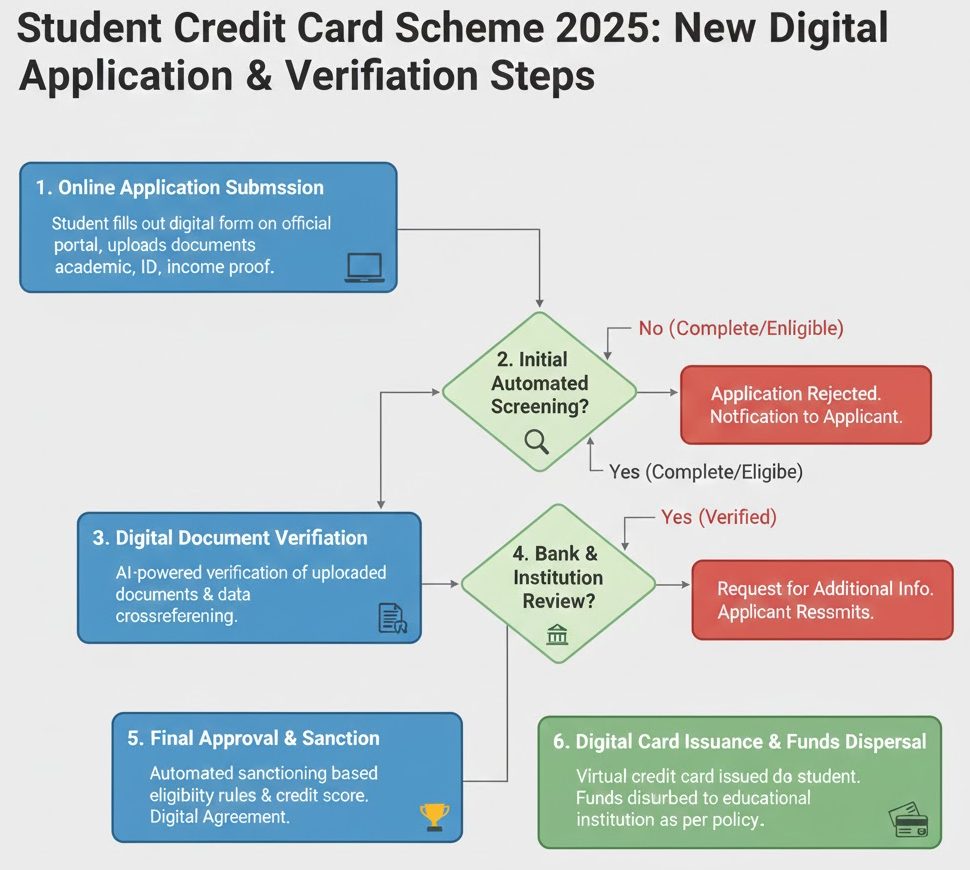

Simplified Application Process Designed for Faster Approvals

A central feature of the 2025 update is the introduction of a unified digital application portal. The platform provides a single interface where students can apply, upload documents, verify details, and track progress in real time.

Digital Verification to Reduce Administrative Delays

The Ministry of Finance has directed banks to incorporate national digital identity tools, including Aadhaar-based e-KYC and e-verification of income certificates. According to the Ministry’s statement, this is expected to reduce the processing time for most applications from several weeks to approximately seven to ten days.

Dr. Anita Iyer, a higher education policy specialist at the National Institute of Public Finance and Policy, said the digital shift “could significantly address structural delays that have historically prevented students from receiving financial support before academic deadlines.”

The application portal will also provide direct messaging between students and bank officials, reducing reliance on in-person branch visits.

Eligibility Criteria and Expanded Institutional Coverage

The Student Credit Card Scheme 2025 remains open to Indian citizens aged 18 to 40 enrolled in recognised institutions. For the first time, the policy explicitly includes a wide range of professional training institutes, competitive exam preparatory centres, and skill development academies approved by national accreditation bodies.

Comprehensive Coverage of Academic Expenses

The loan can be used for tuition fees, hostel charges, examination fees, laboratory and library charges, laptops, books, educational software, and other certified learning materials.

According to officials from the Indian Banks’ Association (IBA), the revised guidelines instruct banks to avoid questioning legitimate academic costs unless irregularities appear in institutional records.

Funds intended for tuition and institutional charges will be deposited directly into the institution’s account, while personal study-related expenses will be transferred to the student’s bank account in regulated instalments.

Stakeholder Reactions to the Updated Scheme

Experts, banks, and student organisations have expressed broad support for the reforms, though several groups have highlighted areas where further improvements may be needed.

Positive Reception from Academia

Dr. Mahesh Kulkarni of Delhi University said the updated policy “creates a more predictable financing environment that can help students pursue higher education without fear of excessive financial strain.” He emphasised the importance of building awareness among rural families, where loan uptake remains comparatively low.

Bank Readiness and Operational Considerations

Banks have indicated that they are ready to adopt the necessary digital tools but have requested additional guidance on uniform documentation standards. A spokesperson from the State Bank of India (SBI) said the updated scheme “provides a clearer compliance framework,” but banks will need several weeks to fully align technical systems with the central portal.

Student Groups Call for Transparency

Several national student organisations have welcomed the changes but have urged the government to strengthen grievance-redressal mechanisms. A representative from the All India Students’ Federation said that prompt complaint resolution is essential to prevent delays in disbursals, especially during university admission cycles.

Historical Context Behind the 2025 Reforms

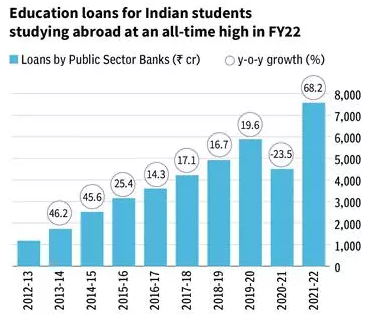

India’s education loan ecosystem has undergone multiple policy shifts over the last two decades. The original model relied heavily on commercial bank education loans, which often required collateral and extensive documentation.

The earlier Student Credit Card models introduced by West Bengal and Bihar demonstrated strong demand for simplified, collateral-free financing.

The 2025 reforms consolidate lessons from these state programmes and integrate technology frameworks adopted during the expansion of digital public infrastructure. According to policy analysts, the harmonisation of rules across states marks a significant step toward a national approach to student financing.

How India’s Scheme Compares Globally

Internationally, countries such as Australia, the United Kingdom, and New Zealand operate income-contingent repayment systems linked to post-graduation earnings. In contrast, India’s model relies on low-interest lending rather than income-based repayment.

Dr. Rupa Fernandes, an economist at the Centre for Global Development, said India’s approach “prioritises upfront access rather than long-term repayment flexibility.” She added that the digital enhancements in the 2025 scheme “move India closer to global standards of transparent, technology-enabled student support.”

Impact on Students and Families

The government estimates that the updated scheme could benefit more than three million students over the next five years.

The availability of a collateral-free, interest-subsidised loan provides families with an alternative to informal borrowing, which often carries higher interest rates and limited repayment flexibility.

Increased Access for Rural and First-Generation Learners

Data from the All India Survey on Higher Education (AISHE) shows that students in rural districts face greater financial and administrative challenges when accessing higher education loans. Experts say the digital verification mechanisms and standardised documentation under the 2025 scheme could reduce disparities between rural and urban applicants.

Potential Risks and Safeguards

Analysts warn that increased access must be balanced with strong oversight. Concerns include the possibility of over-borrowing or aggressive recovery practices by some institutions.

The Ministry said annual audits will be conducted to monitor compliance, and institutions found violating guidelines may face penalties or removal from the approved list.

Step-by-Step Guide for Students Applying in 2025

To help students navigate the revised system, policymakers have released a streamlined checklist.

Required Documents

- Aadhaar card or government-approved ID

- Admission letter from a recognised institution

- Income certificate issued by a competent authority

- Recent passport-size photograph

- Academic records from the previous course

- Bank account details of the applicant

Application Steps

- Register on the central Student Credit Card portal.

- Complete the online form with personal and academic details.

- Upload required documents.

- Verify email and mobile number.

- Institution confirms academic details digitally.

- Bank reviews application using e-verification tools.

- Sanction letter issued online.

- Loan disbursal begins in scheduled instalments.

Future Outlook and Policy Developments to Watch

The government is considering additional features, including optional income-linked repayment plans, interest support for foreign education, and integration with national career services platforms.

Economists say that as India works to increase its gross enrolment ratio in higher education to 50 percent by 2035, financing programmes such as the Student Credit Card Scheme will play a critical role.

LPG Price Update — Latest Cylinder Rates and What Households Will Pay Now

Conclusion

The Student Credit Card Scheme 2025 represents a major shift in India’s education financing framework. With simplified application processes, a digital verification system, and access to ₹10 lakh loans, the scheme seeks to reduce financial barriers and improve student mobility.

Analysts caution, however, that the long-term success of the programme will depend on transparent implementation, strong oversight, and continued collaboration between banks, institutions, and government agencies.