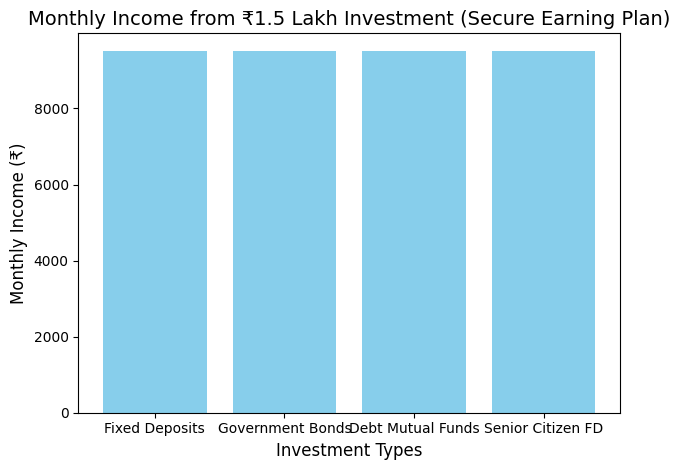

In today’s world, many people are constantly searching for ways to earn a steady, predictable income without taking on too much risk. If you’re in a position where you can invest ₹1.5 Lakh and are looking for a secure earning plan that provides consistent returns, this is the article for you. A secure earning plan is an excellent way to generate passive income, and with the right investment strategies, you could earn up to ₹9,500 per month. By making the right investment choices, you can create a steady cash flow that will help you meet your financial goals.

A secure earning plan is designed for those who want to invest their money and earn a fixed income over time with minimal risk. The goal of this strategy is to ensure that your hard-earned money works for you while offering stability and reliability. By investing ₹1.5 Lakh, you can easily generate a consistent income of ₹9,500 per month. Whether you prefer low-risk fixed deposits, government bonds, or mutual funds, there are several options that cater to a secure earning plan. These investment vehicles help you safeguard your capital while earning a stable return.

Secure Earning Plan

| Investment Type | Required Capital | Expected Monthly Income | Risk Level | Investment Duration | Key Benefits |

|---|---|---|---|---|---|

| Fixed Deposits | ₹1.5 Lakh | ₹9,500 | Low | 1-5 years | Guaranteed returns, safety |

| Government Bonds | ₹1.5 Lakh | ₹9,500 | Low | 1-5 years | Low risk, steady income |

| Mutual Funds (Debt) | ₹1.5 Lakh | ₹9,500 | Low to Medium | 3-5 years | Higher returns than FD |

| Senior Citizen FD | ₹1.5 Lakh | ₹9,500 | Low | 5 years | Higher interest rate |

A secure earning plan is an excellent way to generate steady monthly income with an investment of ₹1.5 Lakh. Whether you choose fixed deposits, government bonds, or debt mutual funds, the key is to ensure your investment strategy aligns with your goals and risk tolerance. By following the right steps and staying informed, you can easily earn ₹9,500 per month while minimizing risk. Start today, and with the right plan, you’ll be on your way to achieving financial stability and peace of mind.

Fixed Deposits: A Reliable Choice

- Fixed deposits (FDs) are among the most reliable investment options in India. Banks and financial institutions offer FD schemes where you invest a lump sum amount for a fixed tenure, earning a guaranteed interest. Typically, the interest rates for FDs range from 5% to 7% per annum, depending on the bank and the duration of the investment.

- For instance, investing ₹1.5 Lakh in an FD with a 6% interest rate would yield ₹9,000 annually. Dividing this by 12 months, you will receive ₹7500 per month, which is quite close to your target of ₹9,500. FDs are considered low-risk investments, ensuring your capital remains safe, making them ideal for conservative investors. Though the return may not be extremely high, the predictability and safety make FDs a popular choice for generating steady monthly income.

- One of the advantages of fixed deposits is the flexibility they offer in terms of tenure. Banks typically offer tenures ranging from 1 year to 5 years, and you can choose the duration that best aligns with your investment goals. If you’re looking for a long-term investment with a steady return, FDs are an excellent option.

Government Bonds: Safe and Steady Income

- Government bonds are another safe investment option that can provide a stable income. These bonds are backed by the government, meaning they are very low-risk investments. The returns on government bonds usually range between 6% and 7% annually, with the interest paid periodically or at the end of the bond term.

- For example, investing ₹1.5 Lakh in government bonds with a 6% interest rate would give you ₹9,000 in annual returns, which translates to ₹750 per month. While this may fall slightly short of the ₹9,500 target, government bonds are a secure way to grow your money with minimal risk, making them an ideal choice for long-term investors seeking stability.

- Additionally, government bonds offer tax advantages, particularly for long-term investors. The interest earned on government bonds may be subject to tax, but certain bonds, like tax-free bonds, can provide you with tax-exempt income, which makes them a great choice for those looking to minimize their tax liabilities. As a result, government bonds offer a secure investment avenue while providing steady returns over time.

Mutual Funds (Debt Funds): Potential for Higher Returns

- Debt mutual funds are another option that combines the benefits of fixed-income securities and the potential for slightly higher returns. These funds invest in government securities, corporate bonds, and other low-risk debt instruments. While they carry slightly more risk than fixed deposits and government bonds, they often offer higher returns over time.

- Investing ₹1.5 Lakh in a good debt mutual fund can provide annual returns ranging between 7% and 8%. This means that you could potentially earn ₹9,500 to ₹10,000 annually, which would generate a monthly income of ₹750 to ₹833. If you want to increase your monthly income slightly beyond ₹9,500, debt mutual funds could be a good choice. However, it’s important to remember that the value of your investment can fluctuate due to market conditions, though the risk remains relatively low.

- Debt mutual funds are often chosen by those looking for slightly higher returns with a low to medium level of risk. These funds typically invest in a diversified portfolio of bonds and other fixed-income instruments, which can help mitigate risks and offer better returns than traditional savings accounts or fixed deposits.

Senior Citizen Fixed Deposit: Special Benefits

- For senior citizens, banks offer special fixed deposit schemes that provide higher interest rates than standard FDs. These interest rates can be as high as 7% to 8%, depending on the bank and the duration of the deposit. Senior citizens enjoy additional benefits such as higher returns, which can make a significant difference in their monthly income.

- If you’re a senior citizen investing ₹1.5 Lakh in a senior citizen FD with a 7.5% interest rate, you can expect to earn ₹11,250 annually, or ₹9,375 per month. This surpasses your target of ₹9,500 per month and provides a comfortable, secure income with minimal risk.

- Senior citizen fixed deposits also offer other perks, such as higher interest rates and additional tax benefits. In many cases, senior citizens are exempt from tax on interest earned up to a certain limit. This makes senior citizen FDs a great option for retirees who are looking to supplement their income with safe and reliable investments.

How to Get Started with the Secure Earning Plan

Now that you understand the various investment options, let’s explore how you can start your secure earning plan with ₹1.5 Lakh:

1. Assess Your Financial Goals

Before you invest, it’s crucial to understand your financial goals. Are you looking for a stable income for the long term? Are you open to some risk for higher returns? Answering these questions will guide you in selecting the right investment option. Knowing your risk tolerance and the amount of income you need will help you make an informed decision.

2. Choose Your Investment Method

Based on your goals and risk tolerance, you can choose from fixed deposits, government bonds, debt mutual funds, or senior citizen FD schemes. Each option offers a different level of risk and return, so pick the one that aligns with your needs. For a safer, more predictable return, fixed deposits and government bonds are the best options. For potentially higher returns with a bit more risk, debt mutual funds are a good choice.

3. Consult a Financial Advisor

If you’re unsure which option is best for you, consulting a financial advisor can help. They can provide personalized recommendations and help you navigate the world of investments to maximize your returns. A financial advisor can assess your financial situation and recommend a portfolio that suits your risk profile and income objectives.

Indira Gandhi Smartphone Yojana – Who Gets Free Smartphones and How the Scheme Works

4. Track Your Investments

Once you’ve made your investment, it’s important to keep an eye on your portfolio. Most banks and financial institutions provide regular updates, so stay informed about your returns and adjust your strategy if needed. If you’ve chosen a more dynamic option like mutual funds, you’ll want to monitor the market conditions and make adjustments accordingly to ensure that your investment continues to meet your income needs.

FAQs on Secure Earning Plan

1. What is a secure earning plan?

A secure earning plan is a low-risk investment strategy that provides a steady, predictable income over time. It typically involves investing in options like fixed deposits, government bonds, or debt mutual funds, which offer guaranteed or relatively safe returns.

2. Is ₹1.5 Lakh enough to generate ₹9,500 per month?

Yes, with a ₹1.5 Lakh investment, it is possible to generate ₹9,500 per month through safe and reliable investment options such as fixed deposits, government bonds, or mutual funds, depending on the interest rates and returns offered.

3. What are the best investment options for secure earning?

The best investment options for secure earning include fixed deposits, government bonds, debt mutual funds, and senior citizen FD schemes. These options offer a mix of guaranteed returns and low risk.

4. How long should I invest for to earn ₹9,500 per month?

The investment duration varies depending on the option you choose. Fixed deposits and government bonds typically have a term of 1-5 years, while mutual funds may require a 3-5 year commitment to see significant returns.