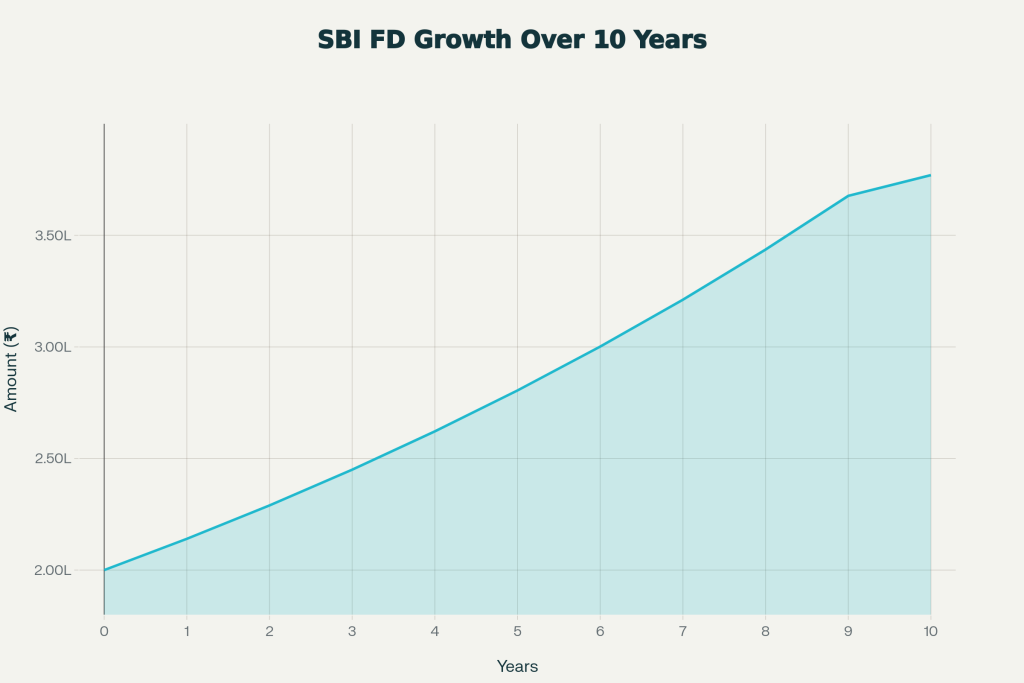

If you want to grow your savings without taking stock market risk, SBI’s new FD plan is one of the most practical options to consider. This fixed deposit is structured so that a one-time investment of ₹2 lakh can grow to around ₹3.77 lakh over a long-term tenure, while your capital stays fully protected under the umbrella of a large public sector bank. The idea is simple: combine a decent interest rate with the power of compounding over time, and let your money quietly work in the background for your future goals. This plan is especially appealing for people who are planning ahead for things like children’s education, a retirement corpus, or any long-term financial milestone. Because the interest rate is locked in at the time of opening the FD, you can estimate your maturity amount in advance and make clear financial plans. That predictability and stability are the main reasons this long-term SBI FD is being seen as a solid choice for middle-class families and senior citizens who prefer guaranteed returns over volatility.

The core promise of SBI’s new FD plan is long-term growth with a high level of safety. You deposit ₹2 lakh once, choose a suitable long tenure, and opt for a cumulative FD. In a cumulative FD, the interest that you earn is not paid out periodically but is added back to the principal at regular intervals, typically every quarter. That larger principal then earns interest in the next period, creating a compounding effect. Over the years, this compounding becomes the real engine of growth. Even if the headline interest rate looks similar to other deposits, the fact that you leave the money untouched for a long period makes a big difference to the final amount. This is how a modest-looking deposit of ₹2 lakh can reasonably grow towards ₹3.77 lakh over a suitable tenure, provided you stay invested for the full term and do not break the FD midway.

SBI’s New FD Plan Turns ₹2 Lakh Into ₹3.77 Lakh

| Detail | Information (Illustrative) |

|---|---|

| Bank | State Bank of India (SBI) |

| Product Type | Long-term Fixed Deposit (Special / High Return) |

| Example Investment | ₹2,00,000 (one-time lump sum) |

| Tenure (Example) | Around 10 years |

| Interest Type | Cumulative (compounded quarterly) |

| Indicative Interest – Public | Around 7% per annum (long-tenure slab) |

| Indicative Interest – Senior | Around 0.50% higher than public rate |

| Example Maturity – Public | About ₹3.77 lakh on ₹2 lakh (illustrative) |

| Example Maturity – Senior | Higher than public, can approach ~₹3.9 lakh+ |

| Minimum Deposit | Typically from ₹1,000 as per FD rules |

| Maximum Deposit | As per standard SBI term deposit norms |

| Risk Level | Very low; principal-protected bank deposit |

| Best Suited For | Long-term, low-risk, goal-based investors |

How SBI’s New FD Plan Grows ₹2 Lakh To ₹3.77 Lakh

The key to turning ₹2 lakh into about ₹3.77 lakh lies in the combination of interest rate, tenure, and compounding. When you choose a long tenure (for example, around 10 years) and a competitive interest rate in the 7% range, the FD quietly accumulates value year after year. Since this is a cumulative deposit, you are not withdrawing the interest; instead, every rupee of interest earned is reinvested automatically.

In simple terms, during the first year, you earn interest on your original ₹2 lakh. In the next year, you earn interest on ₹2 lakh plus the interest from year one. As this continues over the full tenure, the growth gradually accelerates. That is why long-term cumulative FDs often show surprisingly higher maturity amounts compared with what many people expect just by looking at the annual rate. The example of 2 lakh becoming around 3.77 lakh is a clear illustration of compound interest in action.

Why This FD Is Attractive In 2025

In the current environment, interest rates are neither extremely high nor extremely low. For conservative investors, it is not easy to find products that offer both safety and a reasonably high fixed return. That is where SBI’s new FD plan stands out: it uses the upper range of fixed deposit rates on longer tenures and turns them into meaningful long-term growth.

Being a leading public sector bank, SBI also brings a strong trust factor. Deposits up to a certain limit are covered by deposit insurance as per regulatory rules, which adds an extra layer of comfort for small and medium investors. When people know their principal is safe and the return is guaranteed, they are more comfortable locking in money for a longer period, which is exactly what this plan is built around.

Benefits For Senior Citizens

Senior citizens are among the biggest beneficiaries of this kind of FD plan. Banks usually offer them an additional interest premium over the regular customer rate, often around 0.50% per year. That may not look huge at first glance, but over 8–10 years, this extra half percent can translate into a noticeably larger maturity amount. For retirees who depend on interest income and cannot afford to take big risks with their savings, this structure is highly valuable. They can use such long-term deposits to build a stable base of funds for medical needs, living expenses, or future emergencies. The comfort of dealing with a large, established bank like SBI further reduces anxiety about where their money is parked.

How This Plan Compares To Regular FDs And Savings Accounts

If that same ₹2 lakh were left in a standard savings account, the return over a decade would be much lower because savings interest rates are significantly below long-term FD rates. Savings accounts are suitable for liquidity, not for serious long-term wealth building. Even regular short- or medium-term FDs may not match the maturity value of a long-term, higher-rate, cumulative FD. Shorter tenures mean compounding has less time to work its magic. In contrast, the new SBI FD plan is designed with a long tenure and cumulative interest, so the gap in maturity value compared with short-term deposits can be quite large. That is why, for long-term goals, parking money in a savings account or rolling over short FDs often proves less efficient than choosing a well-structured long-term FD upfront.

Who Should Consider This SBI’s New FD Plan

This FD plan is particularly suitable for:

- Risk-averse investors who want guaranteed returns instead of market-linked volatility

- Salaried individuals who want to lock in a portion of their savings for future life events

- Senior citizens and retirees looking for stable long-term growth with high safety

- Families planning for major goals like higher education, a home down payment, or children’s marriage

If you know you will not need this ₹2 lakh for several years, and your priority is safety plus steady growth, this plan can serve as a core building block in your financial strategy. You can always complement it with other products, but a strong fixed-income base gives peace of mind.

Important Points To Check Before Investing

- Like any financial product, this FD plan also comes with a few conditions you must review carefully. First, interest from fixed deposits is fully taxable as per your income slab. That means your post-tax return will be lower than the headline rate if you fall in a higher tax bracket. You may also face tax deduction at source (TDS) once your total annual interest crosses the prescribed threshold.

- Second, premature withdrawal is usually allowed but comes with penalties and a reduced interest rate. If you break the FD before maturity, you will not receive the illustrated amount like ₹3.77 lakh. So, it is wise to align the FD tenure with your real time horizon and keep some separate emergency funds in more liquid options like savings accounts or short-term FDs.

School Holiday: सर्दियों की 12 दिनों की छुट्टी घोषित! स्कूल कब बंद होंगे और कब खुलेंगे, तुरंत देखें

Can This FD Replace Market Investments?

- This SBI FD is a pure fixed-income product. It offers capital protection and guaranteed, but limited, upside. Equity mutual funds and stocks, on the other hand, have the potential to deliver higher returns over very long periods, but they also carry the risk of sharp corrections and periods of poor performance.

- For critical, non-negotiable financial goals—where losing money is not an option—a product like this FD can make a lot of sense. You can use it to create a stable base and then, depending on your risk appetite, add equity or other growth assets on top. The idea is not necessarily to replace market investments, but to balance them with something dependable, like SBI’s long-term FD.

Overall, SBI’s new FD plan is a strong option for anyone who wants to grow money steadily while sleeping peacefully at night. The example of ₹2 lakh turning into around ₹3.77 lakh clearly shows what patient, long-term compounding can do, even at modest interest rates. Instead of chasing quick gains, this approach rewards discipline and time. If you are serious about building a secure financial cushion for the next decade, it is worth checking the latest rates and exact terms for this FD with SBI either through internet banking or by visiting your nearest branch. Once you understand the tenure, interest rate, tax impact, and withdrawal rules, you can decide how much of your savings to allocate here. A well-chosen FD today can become a solid financial anchor for your tomorrow.

FAQs on SBI’s New FD Plan Turns ₹2 Lakh Into ₹3.77 Lakh

1. How does SBI’s new FD plan turn ₹2 lakh into ₹3.77 lakh?

SBI’s new FD plan uses a competitive long-term interest rate and quarterly compounding on a cumulative fixed deposit. When you keep ₹2 lakh invested for around 10 years without withdrawing interest, the compounding effect gradually increases the principal, allowing the amount to grow towards approximately ₹3.77 lakh at maturity.

2. Is this SBI FD plan completely risk-free?

This FD is considered very low risk because it is a bank deposit with a fixed interest rate and guaranteed principal repayment, subject to SBI’s standard terms.

3. Who should consider investing in this SBI FD scheme?

This plan suits conservative investors, salaried individuals, and senior citizens who want assured long-term returns without stock market volatility. It is ideal for those saving for future goals such as education, retirement, or a house down payment.

4. Can I withdraw my money before maturity from this FD?

Yes, SBI generally allows premature withdrawal of fixed deposits, but doing so usually attracts a penalty and a lower applicable interest rate for the period the deposit actually remained with the bank.