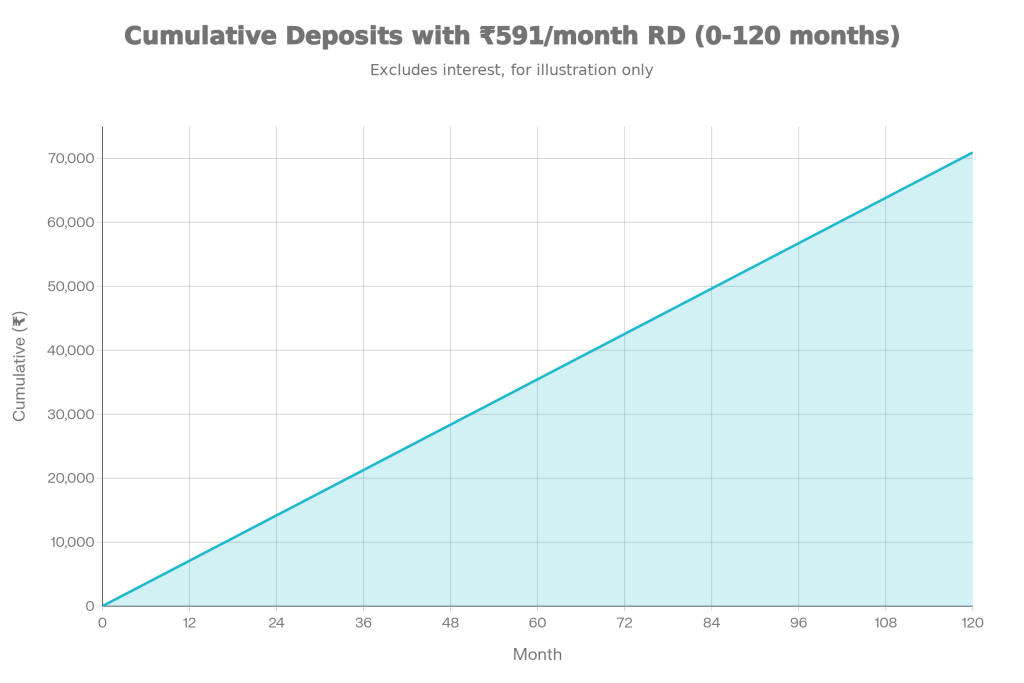

Planning a ₹1 lakh corpus doesn’t always need a big salary or risky bets. Sometimes, the smartest move is simply committing to a small monthly habit and letting time do the heavy lifting. That’s exactly why SBI RD Scheme Deposit ₹591 Monthly and Build ₹1 Lakh with This Popular Plan is getting so much attention lately. It speaks to everyday savers who want a clear target, a structured plan, and the comfort of doing it with a trusted bank. If you’re here because you searched SBI RD Scheme Deposit ₹591 Monthly and Build ₹1 Lakh with This Popular Plan, here’s the real deal: ₹591 is an example that becomes possible when the tenure is longer and the interest environment supports it. In goal-based recurring deposits, the monthly installment isn’t “one fixed number for everyone” it shifts based on tenure, rate changes, and your chosen maturity target. The good news is that the idea behind SBI RD Scheme Deposit ₹591 Monthly and Build ₹1 Lakh with This Popular Plan is simple and practical: fix a goal, pick a tenure you can stick with, and automate the deposit.

SBI RD Scheme Deposit ₹591 Monthly and Build ₹1 Lakh with This Popular Plan is commonly linked with SBI’s goal-oriented recurring deposit approach where you invest a fixed amount every month to reach a specific maturity value like ₹1,00,000. Instead of guessing how much you’ll end up with, you start with the end goal and work backwards to decide the monthly installment. That’s why the same plan can show different monthly numbers for different tenures. Think of it like this: if you want to reach ₹1 lakh faster, the monthly installment rises. If you are comfortable staying invested longer, the monthly installment falls and numbers like ₹591 become realistic in certain scenarios. This is also why people who want a low-pressure saving plan often to prefer recurring deposits over “lump sum” options. Most importantly, with This Popular Plan works best when it’s treated like a discipline tool. The RD product is not designed for frequent withdrawals or irregular deposits. It rewards consistency.

SBI RD Scheme Overview Table

| Overview Point | Details |

|---|---|

| Scheme Type | Goal-oriented Recurring Deposit plan designed to help build ₹1 lakh (or more) through monthly savings |

| Popular Example | ₹591 monthly deposit can be an illustrative case depending on tenure and applicable rate |

| Best Suited For | Salaried individuals, first-time savers, parents saving for kids, anyone who wants a fixed goal |

| Deposit Pattern | Fixed monthly installment for chosen tenure |

| If You Delay Payments | A delay penalty can apply, calculated on the installment amount and month of delay |

| If You Exit Early | Premature withdrawal may reduce returns and can include a penalty as per bank rules |

| Key Success Factor | Auto-debit + consistency + avoiding missed installments |

New Variant of Recurring Deposit Scheme

- SBI’s Har Ghar Lakhpati style RD positioning is basically a “goal-first” recurring deposit concept. The intent is clear: help regular families create a meaningful savings milestone, like ₹1 lakh, using manageable monthly deposits. This kind of plan feels relatable because it doesn’t demand a high monthly commitment from day one. Instead, it motivates you to start small and stay steady.

- What makes this style of RD popular is the psychological clarity. You don’t keep wondering “am I saving enough?” because you are saving toward a visible target. And because it’s structured as a recurring deposit, the saving happens automatically, like a bill payment.

- If you’re trying SBI RD Scheme Deposit ₹591 Monthly and Build ₹1 Lakh with This Popular Plan specifically, the biggest win is that it turns a vague intention (“I should save more”) into a fixed action (“₹ goes out every month”). That shift is where most people finally start building real money.

- Also, recurring deposits are generally easier for beginners than market-linked products because you aren’t exposed to daily ups and downs. The trade-off is that you must stay disciplined for the full term to get the best outcome.

Premature Withdrawal

One thing many people ignore at the start is what happens if you need money in the middle. In most RD products, withdrawing before maturity is allowed, but it can come with conditions that reduce your overall benefit. That’s why premature withdrawal should be treated as a backup option, not a planned feature.

If you break an RD early, two things usually happen:

- Your interest gets recalculated based on rules applicable for premature closure.

- A penalty may apply depending on the bank’s policy and the deposit size.

So if your main goal is to make SBI RD Scheme – Deposit ₹591 Monthly and Build ₹1 Lakh With This Popular Plan actually deliver the ₹1 lakh target smoothly, try to choose a tenure you can realistically complete. A smarter approach is to keep a separate emergency fund (even a small one) so your RD stays untouched.

Practical tip: if your income is seasonal or unpredictable, don’t pick the minimum monthly installment just to “start.” Pick a number that you can pay even in a slow month. That one decision prevents most premature closures.

Delay In Payment

Delaying installments is where RD plans start leaking money quietly. Even if the penalty looks small per month, repeated delays can add up and spoil the maturity benefit. The bigger risk is the habit: once you start missing installments, the plan stops feeling automatic and becomes a burden. To make SBI RD Scheme Deposit ₹591 Monthly and Build ₹1 Lakh with This Popular Plan work, treat it like a compulsory monthly commitment. The best way is:

- Set auto-debit from your SBI savings account.

- Keep a buffer balance so the debit never fails.

- Align the debit date with your salary date or predictable cash-flow date.

If you’re self-employed, set the debit date a few days after your usual payment cycle. That reduces bounce risk. Also, avoid the “I’ll pay two installments next month” mindset unless you are sure the bank allows and processes it smoothly within RD rules. The cleanest method is always: one installment, on time, every month.

How To Choose The Right Tenure For ₹1 Lakh

This is the step where most readers get confused, so keep it simple. You have three levers:

- Target amount (₹1,00,000)

- Tenure (how long you’ll invest)

- Monthly installment (how much you’ll deposit)

When tenure increases, the monthly installment typically decreases. That’s how amounts like ₹591 become possible in certain longer-tenure illustrations. If you want to finish faster, your monthly number will naturally be higher.

A simple decision framework:

- Want the lowest monthly burden? Choose a longer tenure.

- Want to reach ₹1 lakh quickly? Choose a shorter tenure and pay more monthly.

- Want a balanced plan? Choose a mid-tenure that doesn’t strain your budget.

If you’re creating a goal for something like education, a bike down payment, or a wedding buffer, choose a tenure that matches your timeline. Don’t pick a tenure so long that the goal becomes irrelevant, and don’t pick a tenure so short that you start missing installments.

Who Should Consider This Plan

- You want a predictable, goal-based saving plan.

- You struggle to save unless it’s automated.

- You prefer stable saving over market-linked ups and downs.

- You want a clear maturity milestone such as ₹1 lakh.

It can be especially useful for:

- Parents starting a small child fund.

- Young earners building their first savings discipline.

- People who want a “festival or yearly expense” buffer.

- Anyone who wants a safe habit-building product.

However, if you may need the money frequently or your income is highly uncertain, consider building an emergency fund first. An RD works best when you can stay consistent.

DA Hike December 2025: Big Salary Boost & Arrears Update — Govt Employees, Check the Latest Buzz!

Smart Tips To Get The Best Results

Here are practical habits that make this plan actually successful:

- Start with an amount you can continue without stress.

- Use auto-debit and keep a buffer balance.

- Don’t treat RD as emergency money.

- Track your goal yearly: if income rises, consider starting a second RD rather than disturbing the first.

- If you get a bonus, avoid the temptation to close the RD early; use the bonus to strengthen your emergency fund.

Also, remember that “small” amounts feel small only in the beginning. Over time, that steady discipline becomes a strong financial identity. That is the hidden benefit this Scheme, it trains you to stay consistent.

FAQs on SBI RD Scheme

1) Is ₹591 per month fixed for everyone in this plan?

No. The monthly installment depends on tenure and the rate applicable at the time, so ₹591 is best treated as an example that can vary.

2) What if I miss an installment?

Delays can attract penalties and repeated misses can affect the continuity of your RD. It’s best to use auto-debit and keep enough balance.

3) Can I withdraw the money before maturity?

Premature withdrawal is generally possible in RD products, but it can reduce returns and may involve a penalty or revised interest calculation.

4) Is this better than keeping money in a savings account?

For most people, RD is better for goal-based saving because it forces discipline and prevents casual spending, while a savings account is easier to dip into.