The SBI PPF Scheme 2026 has entered the new year without major changes, as the government retained the existing interest rate and framework, reinforcing the Public Provident Fund’s role as a stable, tax-efficient savings instrument for millions of Indian households navigating economic uncertainty.

A Scheme Built on Stability

For more than five decades, the Public Provident Fund (PPF) has been one of India’s most trusted long-term savings schemes. Introduced in 1968, the programme was designed to encourage disciplined savings while offering protection from market volatility.

In 2026, that philosophy remains intact.

The SBI PPF Scheme 2026, like all PPF accounts across banks and post offices, continues under rules notified by the Ministry of Finance. There have been no structural changes to tenure, contribution limits, or tax treatment, a decision analysts say reflects caution rather than inertia.

“PPF is not meant to chase returns,” said a senior public finance expert at a Delhi-based policy institute. “Its primary purpose is to provide certainty, especially for middle-income savers who prioritise capital protection over high growth.”

Interest Rate: Why 7.1% Still Matters

Under the SBI PPF Scheme 2026, the interest rate remains at approximately 7.1 percent per annum, compounded annually. The rate is reviewed quarterly but applies uniformly nationwide.

While the figure may appear modest compared with equity returns during strong market cycles, economists stress that the comparison is misleading.

PPF interest is:

- Risk-free, backed by the sovereign

- Fully tax-exempt, unlike most fixed-income alternatives

- Protected from market cycles, making returns predictable

When adjusted for tax and volatility, analysts note that PPF’s effective real return often compares favourably with other low-risk instruments.

How Interest Is Calculated—and Why Timing Matters

Interest under the SBI PPF Scheme 2026 is calculated on the lowest balance between the fifth and the last day of each month.

This technical detail has practical implications. Savers who deposit funds before the fifth day of a month earn interest for that month, while later deposits do not.

Financial planners often advise investors to:

- Deposit early in the financial year

- Or ensure monthly contributions are made before the fifth

“Small behavioural changes in deposit timing can compound into meaningful gains over 15 years,” said a certified financial planner based in Mumbai.

Core Features That Define the SBI PPF Scheme 2026

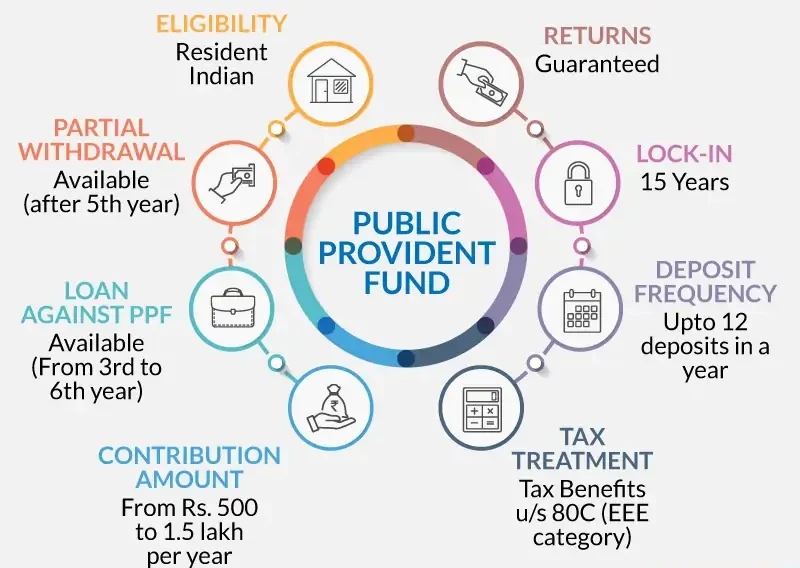

Despite frequent speculation about reforms, the SBI PPF Scheme 2026 preserves its foundational structure:

- Tenure: 15 years, extendable in blocks of five years

- Minimum contribution: ₹500 per financial year

- Maximum contribution: ₹1.5 lakh annually

- Eligibility: Resident Indian individuals only

- Account limit: One PPF account per person

A guardian may open an account on behalf of a minor, though the annual contribution cap applies jointly to the guardian’s own PPF account.

Tax Benefits: Why PPF Retains Its Appeal

The scheme continues to enjoy Exempt-Exempt-Exempt (EEE) tax status:

- Contributions qualify under Section 80C

- Interest earned is tax-free

- Maturity proceeds are fully exempt

Tax professionals argue that this feature alone ensures PPF’s relevance, even as newer savings products enter the market.

“In a post-tax comparison, very few instruments match PPF’s certainty,” said a chartered accountant advising high-salary professionals. “For conservative allocation, it remains indispensable.”

Liquidity in SBI PPF Scheme 2026: Loans and Withdrawals Explained

Liquidity constraints remain a common criticism of PPF. However, the SBI PPF Scheme 2026 provides structured access to funds:

Loans

- Available between the third and sixth financial year

- Loan amount capped at a percentage of the balance

Partial Withdrawals

- Permitted from the seventh year onward

- Subject to limits based on historical balances

Premature Closure

- Allowed only under specific conditions such as serious illness or higher education

SBI’s Role and Digital Expansion

As India’s largest public sector bank, SBI plays a central role in administering PPF accounts. Through its YONO app and internet banking services, customers can:

- Open new PPF accounts

- Make online contributions

- Monitor balances and interest credits

Bank officials say digital access has reduced paperwork and increased adoption among younger savers.

“The average age of new PPF account holders has fallen over the last five years,” an SBI official said, pointing to growing digital literacy.

PPF in the Context of India’s Household Savings

India’s household savings have undergone a structural shift, with greater exposure to equities and mutual funds. Yet policymakers continue to protect small savings schemes like PPF.

Economists view this as a balancing act.

“Not every household can tolerate market risk,” said a senior economist at a national research institute. “PPF acts as an anchor, especially during economic shocks.”

This was evident during periods of market stress, when inflows into PPF accounts increased even as equity investments slowed.

Historical Perspective: How PPF Has Evolved

Over the decades, PPF interest rates have ranged from double digits in the 1980s to single digits in recent years. Contribution limits, once modest, have gradually increased to reflect income growth.

Yet the scheme’s philosophy has not changed.

Policy documents consistently describe PPF as a social savings instrument, not a yield-maximisation tool.

Myths and Misconceptions Around SBI PPF Scheme 2026

Myth 1: SBI Offers a Higher PPF Rate

False. The interest rate is identical across all banks and post offices.

Myth 2: PPF Is Obsolete

While returns are not market-linked, PPF remains relevant due to tax efficiency and risk protection.

Myth 3: One Can Open Multiple Accounts

Only one PPF account per individual is permitted.

How Savers Use PPF Strategically

Financial planners increasingly recommend PPF as part of a diversified portfolio rather than a standalone solution.

Common strategies include:

- Using PPF as the debt component in long-term portfolios

- Extending accounts beyond 15 years to maximise compounding

- Pairing PPF with equity mutual funds for balanced growth

“When used correctly, PPF complements riskier assets,” said a Bengaluru-based investment advisor.

PM Kisan Yojana Update 2025 – ₹6,000 or ₹12,000? Government Clears the Confusion for Farmers

Looking Ahead: What Could Change

Although the SBI PPF Scheme 2026 shows no immediate reforms, experts highlight areas under policy discussion:

- Gradual alignment of rates with government bond yields

- Further digitisation and process simplification

- Enhanced awareness campaigns for young earners

Any changes, however, are expected to be incremental rather than disruptive.

Conclusion

The SBI PPF Scheme 2026 stands as a reminder that in an era of financial innovation and volatility, stability still has value. By retaining its structure and interest rate, policymakers have reaffirmed PPF’s role as a cornerstone of India’s household savings architecture.

For savers seeking certainty, tax efficiency, and long-term discipline, the scheme continues to offer exactly what it was designed to deliver—no more, no less.