SBI PPF 2025 Update: Latest Interest Rate and Smart Tips to Maximize Returns is the safe, no-drama way to grow long-term wealth while keeping taxes out of the picture. If stability, government backing, and predictable compounding matter to you, this is a smart core holding for your fixed-income bucket. With disciplined deposits and a few timing hacks, you can squeeze more value from the same yearly contribution without taking market risk.

The Public Provident Fund continues at 7.1% per annum in 2025, reviewed quarterly by the government. Interest is calculated on the lowest balance between the 5th and the last day of each month and credited annually on March 31. You can invest from ₹500 to ₹1.5 lakh in a financial year in one go or in multiple installments. The account matures after 15 financial years and can be extended in blocks of five years, with or without further contributions. The scheme carries EEE tax treatment eligible for Section 80C deduction, and both interest and maturity proceeds are tax-free. Residents can open one account per person; a guardian can open one for a minor; joint accounts are not permitted.

SBI PPF 2025 Update

| Item | Details |

|---|---|

| Current Interest Rate | 7.1% per annum |

| Review Cycle | Quarterly by Government of India |

| Annual Deposit Limits | Minimum ₹500; Maximum ₹1.5 lakh |

| Deposit Mode | Lump sum or multiple installments |

| Interest Calculation | Lowest balance between the 5th and month-end; credited March 31 |

| Tenor | 15 years, extendable in 5-year blocks |

| Eligibility | Resident individuals; one account per person; minor account allowed |

| Withdrawals | From the 7th financial year; specific rules apply on extension |

| Loans | Available between the 3rd and 6th financial years, as per rules |

| Tax Treatment | EEE: 80C deduction; tax-free interest and maturity |

SBI PPF 2025 Update: Latest Interest Rate and Smart Tips to Maximize Returns remains a cornerstone for anyone seeking low-risk, tax-free compounding with government backing. The 7.1% rate may not sound flashy, but when combined with EEE tax status, early-in-the-month deposits, the full ₹1.5 lakh yearly contribution, and strategic extensions, it delivers strong, predictable outcomes over long horizons. Treat it as the steady base of your fixed income allocation and let compounding do the heavy lifting while you focus on growth elsewhere.

What Hasn’t Changed In 2025

The big story is consistency. The 7.1% rate has held steady across multiple quarters, maintaining predictability for savers who prefer guaranteed returns over market-linked volatility. Even with a formula linked to government security yields, policy has favored stability for household savings, keeping PPF a reliable anchor in a balanced portfolio.

Who Should Prioritize SBI PPF 2025

If you’re conservative, tax-aware, and prefer certainty, PPF deserves top billing. Salaried professionals optimizing Section 80C, self-employed individuals seeking a safe compounding base, and families planning for education or retirement all benefit from its EEE structure. It’s also a great counterweight to equities—especially when your aim is to secure a portion of your long-term corpus with sovereign-backed certainty.

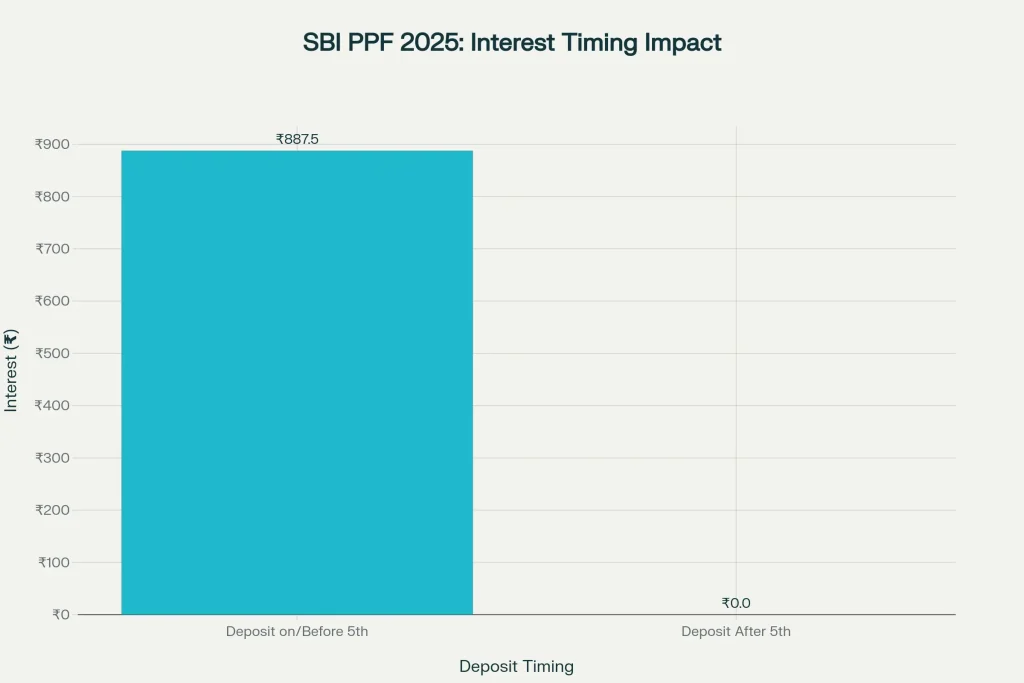

How Interest Is Actually Credited

Interest accrues monthly but is credited once a year on March 31. Each month’s calculation is based on the lowest balance between the 5th and the last day. That makes timing crucial. Deposit on or before the 5th to ensure that month’s accrual counts; deposit after the 5th and you lose a month’s interest on that addition. A lump sum in April maximizes compounding for the entire financial year.

Smart Tips To Maximize Returns

- Deposit before the 5th or invest a lump sum in April to capture interest every month on your full balance.

- Use the full ₹1.5 lakh Section 80C limit strategically account for EPF, ELSS, and insurance first, then allocate the rest to PPF depending on your risk appetite.

- At maturity, extend in 5-year blocks with contributions if you’re still building wealth; extend without contributions if you want passive, tax-free compounding with flexible withdrawals.

- Plan liquidity: partial withdrawals start from the 7th financial year; understand the caps under different extension modes to avoid surprises.

- Keep contributions within ₹1.5 lakh in a financial year excess deposits won’t earn interest and can complicate processing.

- Use reliable calculators to compare lump sum vs monthly deposits and to project maturity values at 7.1%.

- Set calendar reminders for early-month funding to avoid missing the accrual window.

- Align PPF with specific goals (e.g., a 15–20-year education or retirement timeline) to stay consistent through market cycles.

Rules And Eligibility Criteria for SBI PPF 2025

Any resident individual can open one PPF account; a guardian may open one for a minor. HUFs cannot open PPF accounts. NRIs cannot open new PPF accounts, but if an account was opened while resident, it may be continued until maturity (extension is not permitted thereafter). There is no maximum age to open an account, which helps late starters build a tax-efficient fixed-income core. Nomination is available and should be completed at account opening or updated promptly after life events.

Account Opening and Access Via SBI

State Bank of India supports PPF through branches and digital channels, making it straightforward to open, fund, and manage the account. You can deposit via internet banking or mobile banking, set up reminders, update nominations, and process extensions within timelines. Keep your KYC in order and track your contribution history to avoid breaching the annual cap.

Rate Context and Policy Linkage

The indicative framework links small savings rates to government securities, but the administered rate can be held to balance saver confidence and policy objectives. Over recent years, 7.1% has offered consistent, policy-backed returns with no tax drag. Compared with typical fixed deposits especially for those in higher tax brackets the post-tax advantage of PPF is compelling.

Checked Numbers For 2025

- Interest rate: 7.1% per annum.

- Deposit window: any number of deposits per year, ₹500 minimum, ₹1.5 lakh maximum.

- Interest credit: calculated monthly; credited on March 31; deposit by the 5th to count for that month.

- Maturity and extension: 15 years; extensions in 5-year blocks with/without contributions.

- Withdrawals: allowed from the 7th financial year; rules vary based on whether you extend with or without contributions.

- Loans: available typically between the 3rd and 6th years, subject to limits and repayment rules.

- Tax: contributions eligible under Section 80C; interest and maturity proceeds are tax-free.

FAQs on SBI PPF 2025 Update

Can an NRI open a new PPF account in 2025?

No. NRIs cannot open new PPF accounts. They can continue an existing account opened when they were a resident until maturity but cannot extend it after maturity.

When can partial withdrawals start in PPF?

From the 7th financial year, subject to calculation rules and limits. If you extend with contributions, aggregate withdrawal during the 5-year block is capped relative to the balance at the time of extension.

What’s the best time to deposit to maximize PPF interest?

On or before the 5th of each month or as a lump sum in April to ensure all months’ interest accrues on the highest balance.

Can PPF be extended multiple times?

Yes, you can extend in successive 5-year blocks, either with fresh contributions or without contributions, each with different withdrawal allowances.