The world of Indian banking is about to witness a major regulatory shake-up. The Reserve Bank of India (RBI) has released a much-awaited update announcing the discontinuation of three distinct bank account types, effective from November 2025. It’s a move poised to affect millions of account holders nationwide. Whether you’re a student, a salaried professional, a senior citizen, or a small business owner, this RBI update is relevant to you. Banking norms have become tighter in recent years, and this step signals a renewed push by RBI toward transparent and secure financial operations across the country. The RBI update on three bank account types will be discontinued in November 2025 and understanding what it means is not just necessary, it’s essential if you want to retain seamless access to your money.

The RBI update on three bank account types will be discontinued in November 2025 is more than an administrative overhaul. It’s a consequential policy move aiming to minimize fraud, shut down loopholes for inactive and bogus accounts, and keep the Indian banking system safe for genuine customers. This directive from the RBI is crystal clear: banks must close accounts lacking latest KYC updates, those dormant for extended periods, and accounts with mismatched or suspicious details. If you fall into these categories, immediate attention is required.

RBI Update

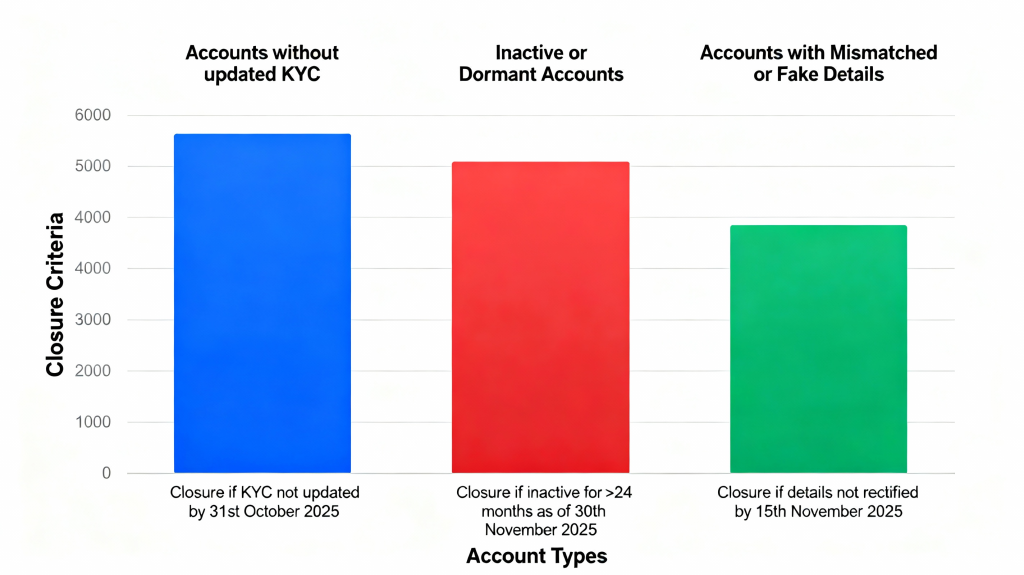

| Bank Account Type | Description | Closure Criteria | Customer Action Required |

|---|---|---|---|

| Accounts Without Updated KYC | Missing updated Aadhaar, PAN, or address proofs | KYC not updated after reminders | Update KYC documents promptly |

| Inactive Or Dormant Accounts | No transaction activity for over two years | Inactivity for more than two years | Make at least one transaction |

| Accounts With Mismatched/Fake Info | Incorrect/suspicious personal details or fake proofs | Verification or document mismatch | Correct details and verify identity |

This RBI update marks an important milestone in India’s banking modernization journey. By taking timely action, updating your records, and keeping accounts active, you ensure continued, safe access to your money. Whether your account is for daily transactions, savings, government subsidies, or business, compliance with the RBI guidelines is the key to hassle-free banking in 2025 and beyond. Stay alert, stay compliant, and safeguard your financial future.

Which Accounts Will Be Closed

Three categories have been marked for discontinuation in this RBI update:

- Accounts Without Updated KYC: The RBI has mandated that banks close accounts without updated Know Your Customer (KYC) records. This includes any account with missing or outdated Aadhaar, PAN, or address proofs. If you receive reminders and still don’t update your KYC, the risk of closure is high.

- Inactive Or Dormant Accounts: Accounts that have not seen any transaction for more than two years are termed dormant. These unused accounts are attractive targets for fraudulent activities, which is why the RBI is calling for their closure unless they’re activated with at least one transaction.

- Accounts With Mismatched Or Fake Details: Any account with conflicting, unverifiable, or fake personal details, whether PAN, Aadhaar, address, or name, will be closed if not immediately rectified. This is crucial for maintaining the security and transparency of India’s banking network.

Why Is RBI Implementing These Changes

The surge in banking fraud and misuse of inactive or fake accounts has sounded alarms across the sector. The RBI update on three bank account types will be discontinued in November 2025 comes as a relief for many, but also a warning to those who haven’t maintained compliance.

The Aim is Clear:

- Root out dormant accounts that can harbor and hide fraudulent transfers.

- Ensure every bank account is linked to a verified individual.

- Keep all banking documentation especially KYC details up to date.

- Stop the misuse of banking services for illegal activities.

By forcing compliance, RBI hopes to provide added protection to both customers and institutions.

What Should Customers Do Now

If you want to avoid the consequences of the RBI update, take these steps today:

- Log in to your online banking or visit your bank branch and update all relevant KYC documents (Aadhaar, PAN, address).

- If your account is dormant, make a small transaction deposit, withdrawal, or transfer to reactivate it.

- Double-check all personal information and rectify any mismatches immediately. This includes your mobile number, email address, PAN, and Aadhaar.

- Respond to every communication from your bank regarding account status, KYC requirements, or warnings about inactivity.

Consequences Of Non-Compliance

Should you fail to follow the RBI’s new guidelines, you may face:

- Temporary freezing of your account, making withdrawals and deposits impossible.

- Permanent account closure, with funds transferred to a special RBI account accessible only after following formal reactivation procedures.

- Time-consuming, bureaucratic claim processes when trying to recover your balance.

Compliance brings peace of mind. Inaction could lead to needless hassles, especially if you rely on your bank account for daily financial operations.

Impact On Common People

- A large section of the population students, elderly citizens, migrant workers, and people with multiple small or zero-balance accounts is at risk. Many have opened accounts for specific government schemes or subsidies but never updated records or used them actively.

- So, if your account exists for subsidy transfers or infrequent transactions, the RBI update on three bank account types will be discontinued in November 2025 could impact you the most. Banks are sending out reminders pay attention to SMS, emails, or letters and follow instructions.

How Banks Are Notifying Customers

Banks have started comprehensive customer notification drives. Expect texts, emails, physical letters, calls, and digital messages warning you about possible closure and urging you to update KYC and activate your account. The RBI update on three bank account types will be discontinued in November 2025 is being broadcast widely by major banks, so don’t ignore those updates.

Tips To Keep Your Account Active

- Set a calendar reminder to conduct a transaction every year.

- Promptly update personal details whenever there’s a change especially after moving or changing your phone number.

- Open communication lines with your bank. Respond to their queries, requests for documents, and compliance needs.

- Avoid letting zero-balance or subsidy-linked accounts sit idle for too long.

Practical Benefits of RBI’s Update

This move brings several benefits to genuine account holders, such as:

- Enhanced safety of financial assets.

- Reduced risk of fraud targeting your savings.

- Smooth operation of government schemes and direct benefit transfers.

- Efficient claim processes in case of account closure.

300 Units of Free Power in 2025 — How Households Can Join the Updated Beneficiary List

What To Expect Going Forward

This RBI update on three bank account types will be discontinued in November 2025 reflects larger trends in Indian banking: increased digitization, heightened compliance, and customer-centric security measures. Regulators are stepping up to protect your money and make banking authentic and convenient. Keep your documents ready, maintain regular banking activity, and stay aware of official communications to ensure you’re not caught off-guard.

FAQs on RBI Update

Q1: What happens if I don’t update my KYC by the November 2025 deadline?

Your bank account risks closure. Update KYC documents before the cutoff to avoid losing access to your funds.

Q2: How do I reactivate a dormant bank account?

A single transaction (deposit, withdrawal, or transfer) will reactivate your account.

Q3: Will I lose my money if my account is closed?

No, but it will be transferred to a special account. You’ll have to follow reinstatement procedures to reclaim it.

Q4: Are zero-balance accounts affected by this update?

Yes. If they lack updated KYC or remain inactive, they’re subject to closure.

Q5: How will I be notified if my account is at risk?

Banks will send texts, emails, letters, and digital alerts regarding your account’s status and required actions.