If you write or receive cheques, this is the moment to tighten your processes. From October 2025, India’s cheque ecosystem has moved to faster, continuous clearing with strict confirmation windows, same‑day outcomes, and tougher consequences when a cheque bounces due to faults like insufficient funds or mismatched details. For issuers, that means less float time and far less room for error; for payees, it means quicker credit and quicker recourse if a cheque is dishonoured. Cheque bounce alert is not just a warning it’s a shift in how quickly a dishonour surfaces and how promptly the legal clock starts. Cheque bounce alert now effectively compresses the window from deposit to decision into hours, not days, so balances, Positive Pay confirmations (where applicable), and error-free cheque details are essential to avoid penalties and legal exposure.

RBI Releases Tough New Guidelines

| Item | Details |

|---|---|

| Rollout Phases | Phase 1: Same‑day confirmation by evening; Phase 2: Rolling three‑hour confirmation tied to presentation time |

| Clearing Model | Continuous clearing with settlement on realisation; faster credits, faster returns |

| Presentation Window | Single daytime session for scanning and continuous flow to drawee bank |

| Confirmation Window | Phase 1: By evening same day; Phase 2: Within three clear hours of presentation |

| Deemed Approval | If a drawee bank does not confirm within the window, item may be treated as approved for settlement |

| Positive Pay | Reinforced for higher-value cheques as per bank thresholds; non‑compliance can trigger returns |

| Legal Route | Section 138 NI Act: fine up to twice the cheque amount and/or imprisonment up to two years |

| Notice Timelines | Payee notice within 30 days; drawer gets 15 days to pay; complaint can follow if unpaid |

Continuous clearing has made cheque outcomes faster and more final. That’s great for genuine transactions but unforgiving of sloppy issuance or under‑funded accounts. Treat the confirmation window as non‑negotiable, align balances and Positive Pay actions ahead of presentation, and move quickly on any bounce either to settle dues or to protect your legal rights. This is the cheque bounce alert that changes everyday banking habits: discipline now saves charges, reputational damage, and potential courtroom trouble later.

What Exactly Changed In Clearing

Cheques are no longer queued for end‑of‑day batch decisions. They’re scanned and pushed through the clearing house continuously, and the drawee bank must issue a positive (honour) or negative (return) confirmation within a strict, time‑boxed window. In Phase 1, items presented during the designated window receive a decision by evening; in Phase 2, the rule tightens to a rolling three‑hour response linked to the time of presentation, which substantially shrinks uncertainty for both parties.

Why This Is A Cheque Bounce Alert

Because dishonour can now surface within hours, the legal and operational consequences arrive sooner. If a cheque bounces due to insufficient funds, signature mismatch, overwriting, stale or post‑dated issues, or Positive Pay lapses, the return memo is generated quickly. That memo starts the statutory timeline for the payee’s demand notice and, if unresolved, enables filings under Section 138 much earlier than before. For drawers, casual “I’ll fund it tomorrow” approaches no longer work.

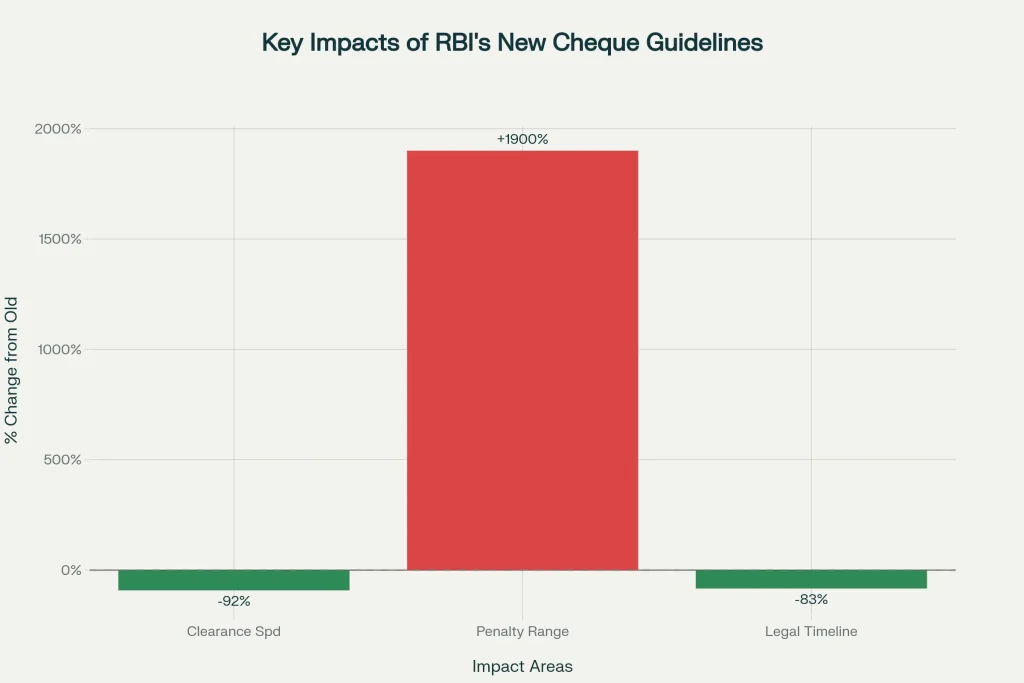

Penalties, Charges, And Legal Exposure

- Bank Charges: Banks levy cheque return charges when the customer is at fault typically for insufficiency, stop payment without valid cause, or signature mismatches. Schedules vary by bank and may differ for drawer and payee.

- Criminal Liability: Under Section 138 of the Negotiable Instruments Act, courts may impose fines up to twice the cheque amount and/or imprisonment up to two years if statutory notice and payment windows are missed.

- Faster Cycle, Faster Costs: With accelerated clearing, charges and legal exposure manifest within the same day or within hours, so monitoring alerts is critical.

Positive Pay And Threshold Compliance

Many banks mandate Positive Pay for cheques above specified thresholds. You must reconfirm key details cheque number, date, amount, and payee via mobile/net banking or branch channels before the cheque is presented. A mismatch or missing Positive Pay instruction can result in a quick technical return under the compressed clearing regime, causing delays, fees, or worse, a missed deadline on critical payments.

Practical Steps To Avoid A Bounce

- Maintain Same‑Day Liquidity: Hold sufficient balance not only at issuance but during the exact presentation window; factor in other scheduled debits that could reduce available funds just before confirmation.

- Use Positive Pay Proactively: For high‑value cheques, submit Positive Pay details before deposit time to eliminate avoidable mismatches.

- Check Instrument Hygiene: Ensure clean writing, matching words and figures, correct date, legible signature, and no overwriting; avoid stale or post‑dated cheques unless intentional.

- Monitor Alerts In Real Time: Keep an eye on SMS, email, and app notifications during the confirmation window and respond immediately to any issues.

- Prefer Real‑Time Rails For Urgent Payments: For payments with tight deadlines, consider UPI, NEFT, or RTGS to avoid cheque‑timing risk.

- Set Internal Cut‑offs: Businesses should define deposit and funding cut‑offs aligned to the confirmation windows and train staff accordingly.

What Happens If Your Cheque Bounces

You’ll receive (or your counterparty will receive) a return memo detailing the reason for dishonour. If you are the payee, serve a statutory demand notice within 30 days of receiving the memo. The drawer then has 15 days to make the payment. If payment isn’t made within that period, a complaint under Section 138 can be filed within the prescribed time. Document everything return memo, notice, courier/email proof to preserve your rights and timelines.

Impact On Businesses and MSMEs

- Collections Become Predictable: Same‑day or within‑hours outcomes tighten receivables cycles, enabling faster follow‑ups, earlier escalations, and clearer cash‑flow projections.

- Process Discipline Is Mandatory: Adopt intra‑day reconciliation, pre‑funding for issued cheques, Positive Pay routines for high‑value instruments, and maker-checker controls for issuance and deposits.

- Vendor Relationships Improve: Quick clarity on honour or return reduces disputes and helps both parties resolve issues while the transaction is still fresh.

Drawer’s Checklist Before Issuing A Cheque

- Confirm available balance including holds, liens, and pending debits.

- Verify payee name spelling and match it exactly with records if Positive Pay applies.

- Write the amount clearly in words and figures; avoid overwriting.

- Date the cheque correctly; avoid stale‑dating or long post‑dating.

- Sign as per bank records; if multiple signatories are required, ensure all are available.

- If high‑value, submit Positive Pay details before the cheque is presented.

Payee’s Checklist Before Depositing a Cheque

- Check the date, signature, overwriting, and mismatch risks.

- If your bank requires Positive Pay for incoming cheques above a threshold, ensure the drawer has submitted it.

- Deposit within the designated window to be included in the day’s clearing flow.

- Track notifications until confirmation or credit; if returned, act the same day to maintain legal timelines.

Common Reasons for Dishonour Under the New Regime

- Insufficient funds or breach of arrangement.

- Signature mismatch or missing mandatory signatories.

- Cheque altered/overwritten without countersignature.

- Stale or post‑dated beyond acceptable limits when presented.

- Positive Pay not submitted or details mismatched for high‑value cheques.

- Stop payment without valid underlying dispute or cause.

FAQs on RBI Releases Tough New Guidelines

What’s the new confirmation timeline for cheques?

Phase 1 provides same‑day confirmation by evening for items presented during the daytime window; Phase 2 compresses this to a three‑hour response tied to the exact presentation time.

What does “deemed approval” mean?

If a drawee bank doesn’t confirm honour or return within the stipulated window, the cheque may be treated as approved and included in settlement, prompting faster credit unless later reversed under strict conditions.

What legal consequences apply if a cheque bounces?

Dishonour for insufficiency of funds can lead to proceedings under Section 138 of the Negotiable Instruments Act, with potential fines up to twice the cheque amount and/or imprisonment up to two years, once statutory notice and payment windows lapse.

How can I reduce bounce risk now?

Keep adequate balances during the presentation window, use Positive Pay for high‑value cheques, avoid errors on the instrument, monitor alerts closely, and use real‑time digital payment rails for time‑critical transactions.