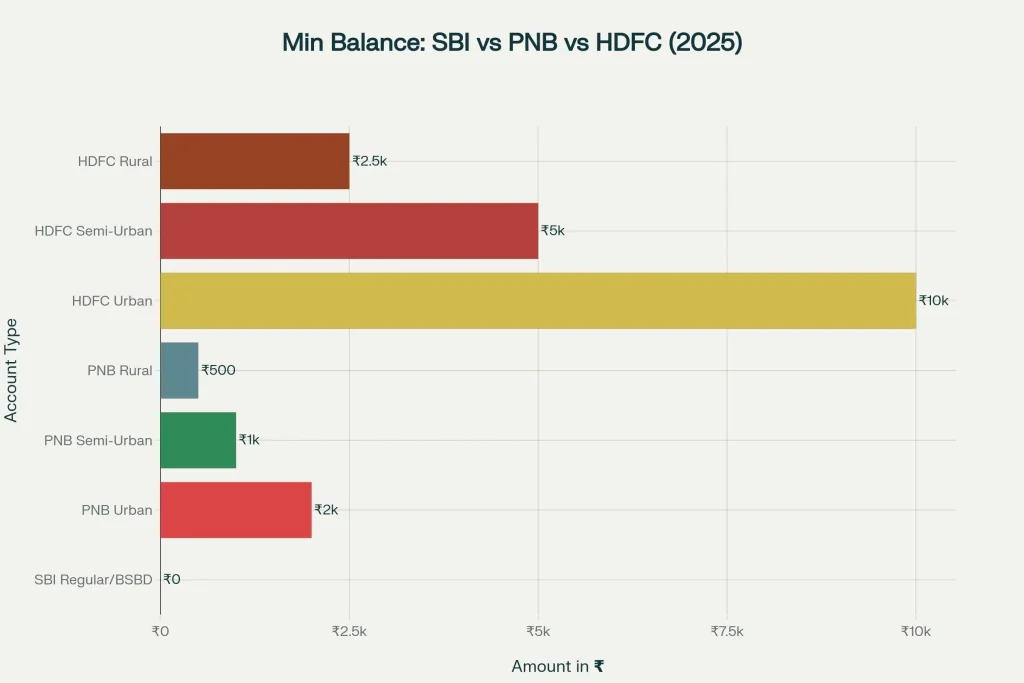

There is no single RBI-fixed minimum balance for every savings account in India; banks set their own Average Monthly/Quarterly Balance rules and charges based on account variant and branch location. What has changed recently is the compliance hygiene around your account especially nominations which you should update right away to avoid friction in future claims. For SBI and many public sector variants, zero-balance operation is widely available on standard or BSBD-style accounts, while HDFC’s Regular Savings Account still expects ₹10,000 AMB in urban areas, with lower thresholds in semi-urban and rural branches.

The practical view of the minimum balance rule for SBI, PNB and HDFC: banks not RBI decide your threshold and penalties, and the rule depends on your exact product and branch category. SBI and several PSBs allow zero-balance on popular or BSBD variants, while HDFC’s Regular Savings Account continues with ₹10,000 AMB in urban/metro, typically ₹5,000 in semi-urban and ₹2,500 in rural, unless your specific variant allows an FD-based alternative to maintain compliance.

RBI Issues New Rule

| Item | What’s New/Now | Why It Matters |

|---|---|---|

| RBI Position on Minimum Balance | No uniform RBI-fixed minimum; banks decide AMB/AQB per product and branch category | Compliance depends on your bank and account type, not a central fixed limit |

| SBI Savings Accounts | NIL Monthly Average Balance for standard SBI Savings and zero-balance BSBD/Small variants (as per current public materials) | Most retail users can avoid AMB penalties by being on the right product |

| PNB Savings Trend | Public-sector style relaxed or zero-balance options on many variants; confirm your account’s schedule of charges | Variant rules differ; check whether your product is truly zero-balance |

| HDFC Regular Savings AMB | ₹10,000 urban/metro; ~₹5,000 semi-urban; ~₹2,500 rural; FD alternative may apply on some variants | Keep the average, not just month-end balance; verify variant-specific terms |

| Nomination Rules (Current) | Multiple nominees permitted; clearer, standardized nomination process and disclosures | Faster claim settlement, fewer disputes; update nominees now |

There isn’t a new RBI-fixed minimum balance to “comply with.” Compliance is simply about matching your account type to your banking behavior and keeping the average above the bank-set threshold or choosing a zero-balance product so penalties never apply. Do a quick once-over today: confirm your variant and branch category, set up alerts, consider zero-balance if your cash flow is lumpy, and update nominations so your family never faces avoidable hurdles. That combination keeps you compliant, penalty-free, and future-ready.

What Did RBI Actually Change?

The essential update is around nominations and customer disclosures, not a blanket minimum-balance figure. Banks are expected to clearly offer and process nominations with standard forms and timelines, allowing multiple nominees and improving claim settlement. This does not alter each bank’s freedom to set AMB/AQB on savings accounts, which remains a product-level, bank-level policy.

SBI: Zero-Balance Path for Hassle-Free Compliance

If you prefer penalty-free usage and simple banking, SBI’s standard savings proposition and BSBD/small accounts provide a NIL Monthly Average Balance while retaining essential services. For users who frequently dip below a threshold, switching to the appropriate SBI zero-balance variant can remove non-maintenance charges entirely. Do check variant features like cheque book availability, ATM withdrawal limits, and transaction caps so your day-to-day usage matches the product design.

PNB: Public-Sector Leniency Confirm Your Variant

Punjab National Bank and several PSBs generally lean toward relaxed or zero-balance requirements across mainstream savings offerings, but the specifics depend on your product and whether it’s a standard or premium variant. If you’re unsure, pull your schedule of charges and verify the AMB/AQB line item. When in doubt, ask the branch to migrate you to a BSBD-style or zero-balance product that better fits your monthly cash flows and transaction volume.

HDFC: AMB Unchanged Know Your Thresholds

HDFC Bank’s Regular Savings Account continues to require ₹10,000 average monthly balance in urban/metropolitan centers, with lower levels in semi-urban and rural categories. Some variants allow an alternative such as maintaining a fixed deposit instead of AMB handy if you keep long-term funds anyway. Ensure you understand whether your account calculates an average monthly or quarterly figure and set low-balance alerts so periodic dips don’t trigger penalties at the end of the cycle.

New Nomination Rules You Should Act On

Don’t skip this. Add or update nominees on all your accounts and lockers, especially where family members might need access in an emergency. The current framework permits multiple nominees and requires clearer disclosures, cutting delays and disputes during claims. Review your existing nominations for accuracy, add relationships and percentages where applicable, and keep documents handy so your next of kin won’t face hurdles.

How To Check If You’re Compliant Today

- Identify Your Exact Variant: Find the precise product name on your statement or mobile app; AMB requirements differ for regular, premium, salary, and BSBD accounts.

- Confirm Branch Category: Urban, semi-urban, and rural thresholds are often different; make sure you know which category your branch falls into.

- Track The Average, Not Just Month-End: AMB/AQB is an average over the period. You can dip below for a few days if the rest of the period carries the balance.

- Set App Alerts: Low-balance and goal alerts help you stay above thresholds without constant manual checks.

- Consider Zero-Balance Migration: If you’re paying frequent penalties, move to a zero-balance variant at SBI/PNB or a basic deposit account that fits your usage.

- Update Nominees: Add multiple nominees where the bank supports it, and review across all accounts and lockers.

- Audit Fees Annually: Penalty slabs can change; take five minutes each year to review your schedule of charges.

Minimum Balance Rule For SBI, PNB And HDFC

Think of the minimum balance rule for SBI, PNB and HDFC as a product feature, not a regulator mandate. SBI and many PSBs simplify life with zero-balance options on mainstream or BSBD variants, making them attractive for households with variable cash flows. HDFC’s Regular Savings Account remains an AMB-driven product in urban centers, so plan a buffer above ₹10,000 and consider variants or FD alternatives if that better matches your profile.

Actionable Tips to Avoid Penalties and Friction

- Prefer Zero-Balance Where Possible: If your monthly balance swings, a zero-balance SBI/PNB or BSBD product eliminates AMB penalties.

- Use A Buffer: For AMB products, keep a cushion 10–20% above the threshold to absorb unexpected debits or ATM withdrawals.

- Automate With Sweeps: If available, auto-sweep from a linked FD or reserve sub-account to top up shortfalls before cycle end.

- Consolidate Funds: Instead of thinly spreading money across many accounts, keep the AMB account funded and move surplus elsewhere.

- Schedule A Mid-Cycle Check: Put a mid-month calendar reminder to check average balance; adjust deposits if you’re short.

- Keep A Charge Sheet Snapshot: Save or print the current “schedule of charges” for your account so you understand the exact penalty formula.

- Review Variant Fit Annually: If your usage changed more transactions, lower balances switch variants rather than paying recurring fees.

FAQs on RBI Issues New Rule

Is There An RBI-Fixed Minimum Balance For All Savings Accounts?

No. Each bank sets its own Average Monthly/Quarterly Balance rules and penalties by product and location. RBI has not fixed a uniform minimum for all banks.

Does SBI Require a Minimum Balance?

Most common SBI savings variants including BSBD operate with NIL minimum balance, making them ideal if you want penalty-free, basic services. Always confirm your exact product name to be sure.

What Is the HDFC Minimum Balance Right Now?

For the Regular Savings Account, the typical requirement remains ₹10,000 AMB in urban/metropolitan branches, with lower thresholds in semi-urban and rural categories. Some variants may permit an FD alternative; check your terms.

What Changed Recently in Banking Rules for Customers?

The most impactful, day-to-day change is around nominations: clearer, standardized processes and allowance for multiple nominees, which speeds up claims and reduces disputes. Update your nominations across all accounts and lockers.