RBI Issues New Guidelines for ₹10, ₹20, ₹100, and ₹500 notes is one of the biggest currency updates of 2025 for everyday users who still rely heavily on cash in their daily life. These changes are not about demonetisation or banning notes, but about making cash transactions smoother, safer, and more transparent for common people, traders, and small businesses. If you regularly use cash for groceries, local travel, tuition payments, or small business dealings, understanding these guidelines will help you stay calm, avoid rumours, and handle your money smartly. RBI Issues New Guidelines for ₹10, ₹20, ₹100, and ₹500 notes also aims to clear the confusion created by viral messages and half-baked social media posts that often mislead people about which notes are valid and which are not. The focus is on three big areas: the validity of existing notes, how banks must handle damaged or soiled notes, and how ATMs and branches should improve the supply of smaller denominations and cleaner currency.

This latest update on RBI Issues New Guidelines for ₹10, ₹20, ₹100, and ₹500 notes is essentially a package of clarifications and operational instructions meant for banks, but its impact is directly felt by the public. All currently circulating notes of these denominations remain legal tender, and there is no hidden deadline to exchange them, which is a crucial point to reduce panic and rumours. Alongside this, the central bank has pushed banks to follow stricter standards on accepting, sorting, and exchanging notes so that customers get better quality currency and fewer unusable or badly damaged notes over the counter or through ATMs.

RBI Issues New Guidelines for ₹100 and ₹500 Notes

| Point | What Has Changed Or Been Clarified | What It Means For You |

|---|---|---|

| Validity of notes | Existing ₹10, ₹20, ₹100 and ₹500 notes remain legal tender. | You can continue using these notes without fear of sudden invalidation. |

| Old vs new designs | Older designs are still valid as long as they are genuine and not excessively damaged. | You do not need to rush to exchange older-looking notes. |

| Damaged or soiled notes | Banks must accept and exchange eligible damaged notes under defined rules. | Torn or soiled notes can be replaced at bank branches. |

| Counterfeit detection | Banks must use machines and follow strict reporting procedures for suspected fakes. | Better filtering of fake ₹100 and ₹500 notes in the system. |

| ATM note mix | Stronger emphasis on availability of smaller denominations like ₹100 and ₹200. | Easier access to change for daily spending from ATMs. |

| Service standards | Clearer responsibilities for branches and currency chests in handling notes. | You can expect more consistent treatment across different bank branches. |

| Rumour control | Official clarifications issued to counter fake news about bans or cut-off dates. | You can safely ignore unverified social media forwards about note bans. |

Old Notes Will Continue To Be Valid

One of the most important messages behind these guidelines is that existing ₹10, ₹20, ₹100 and ₹500 notes will continue to be valid and usable in daily transactions. Design changes over the years do not automatically cancel older series, so long as the note is genuine and in acceptable physical condition. This means you do not need to panic if you still have older style notes in your wallet, cash box, or savings at home. There is no requirement to stand in long queues or rush to the bank simply because a note looks slightly different from the newer ones in circulation. If any denomination is ever officially withdrawn in the future, it would be clearly announced through official channels, not just through forwarded messages or rumours.

Clean Notes and Better-Quality Currency

A major theme behind RBI Issues New Guidelines for ₹10, ₹20, ₹100, and ₹500 notes is the long running “clean note” effort, which aims to improve the physical quality of notes in circulation. Banks are expected to stop recirculating very dirty, brittle, or badly scribbled notes, and instead send them for processing and destruction while giving cleaner notes to the public. For you, this means fewer experiences of receiving badly torn or nearly disintegrating notes at counters or ATMs. Over time, the rules push banks to rely more on note-sorting machines and quality checks, so surplus soiled notes are retired faster and replaced with fresh ones, especially in high-use denominations like ₹100 and ₹500.

Stricter Rules on Damaged and Mutilated Notes

- Damaged or mutilated notes have always been a concern for the public, especially for shopkeepers, small traders, and people who handle a lot of cash every day. Under the latest approach, banks must follow a clear framework to assess damaged notes and decide whether they qualify for full value, partial value, or no refund at all.

- If you have a torn or partly missing note, you can present it at a bank branch, where staff will check how much of the original note is intact and whether key portions and features are still visible. If the note fits the defined criteria, you receive value in exchange; if not, the bank will explain why it cannot be refunded as per the rules. This system ensures fair and uniform treatment across branches, rather than leaving it to individual discretion.

Tightening The Net Around Counterfeit Notes

Counterfeit currency has always been a risk in high‑value and widely used denominations like ₹100 and ₹500. With RBI Issues New Guidelines for ₹10, ₹20, ₹100, and ₹500 notes, banks are under even greater pressure to use proper authentication and sorting equipment to catch fakes before they reach the customer. If a note is suspected to be counterfeit at a bank counter, the staff cannot simply hand it back and pretend nothing happened. There is a prescribed process to record the details, retain the note, and send it to the appropriate authorities or testing facilities, and in some cases inform law enforcement as required. This may feel inconvenient to the person who unknowingly brought the note, but it is essential to protect the wider system from a steady inflow of fake currency.

What These Rules Mean For Your Daily Cash Use

In practical terms, RBI Issues New Guidelines for ₹10, ₹20, ₹100, and ₹500 notes is meant to simplify your life, not complicate it. You can continue to use these denominations as usual for shopping, bills, local services, and business payments, without worrying that they will suddenly stop being accepted. You should, however, become more mindful when accepting cash—check basic security features, look for extreme damage, and avoid taking obviously suspicious notes. At the same time, you can be more confident about approaching your bank branch to exchange damaged notes, knowing that there is a defined policy the staff must follow, rather than ad‑hoc decisions.

ATM Rules and the Push for Smaller Denominations

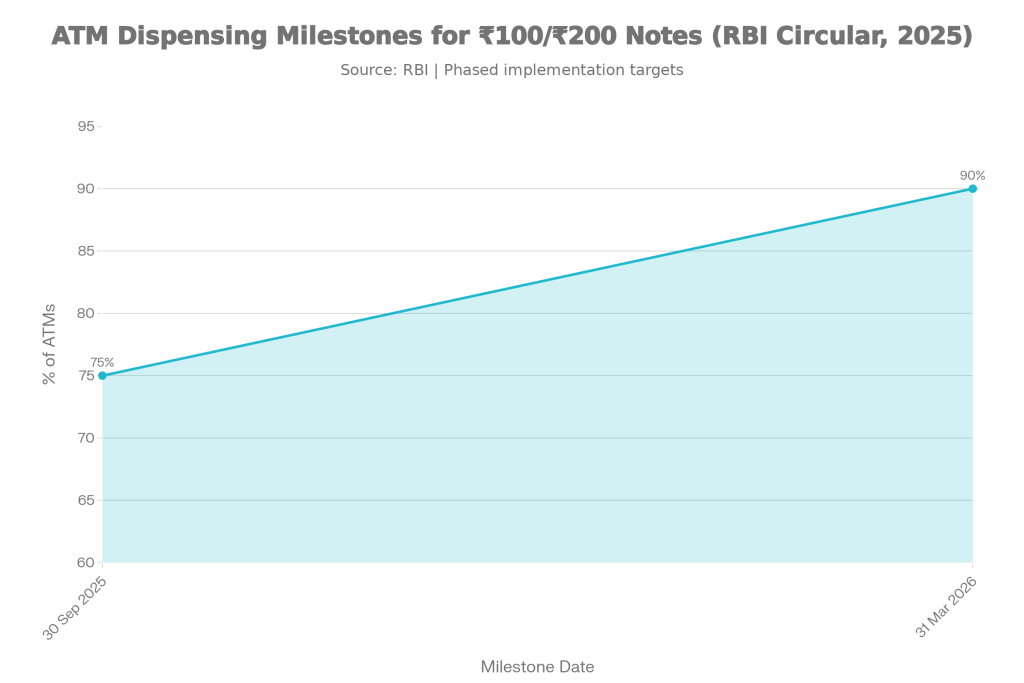

Even though the main headline is that RBI Issues New Guidelines for ₹10, ₹20, ₹100, and ₹500 notes, there is a related push to improve the availability of smaller denominations through ATMs. For years, customers have complained about machines that dispense only high‑value notes, making it hard to get change for everyday expenses. The current direction encourages banks and ATM operators to ensure that a significant share of machines dispense ₹100 and ₹200 notes along with higher denominations. The result should be a more user‑friendly cash experience, especially for people in smaller towns, semi‑urban areas, and cash‑heavy markets where digital payments are still catching up.

How To Handle Rumours And Viral Messages

Every time there is a change or clarification around currency, social media and messaging apps fill up with alarming forwards. Many of these claim that certain notes will stop working after a particular date, or that people must immediately deposit all their cash to avoid losses. The safest approach is simple: treat any such message as untrue unless it matches what you see on official government or central bank channels, or in reliable news outlets. RBI Issues New Guidelines for ₹10, ₹20, ₹100, and ₹500 notes precisely to reduce confusion and make rules transparent, so if something as important as a ban or cut‑off date existed, it would be clearly visible in official announcements, not just in screenshots and forwards.

Krishak Bandhu Scheme 2025: Farmers Can Now Earn ₹10,000/Yr—Here’s How to Register Today

Practical Tips for Everyday Users

- Keep your notes flat and avoid unnecessarily folding, stapling, or writing on them; this helps them stay “fit” longer.

- If you receive a badly damaged note, set it aside and plan a visit to your bank to exchange it.

- Do basic visual checks on high‑value notes, especially ₹100 and ₹500, before accepting them in large transactions.

- Do not panic‑sell or rush to deposit notes just because of an unverified rumour.

- Use official websites or trusted news sources whenever you want to confirm any claim related to currency.