The Reserve Bank of India (RBI) has confirmed that minimum balance rules for savings accounts are not regulated centrally, leaving individual banks free to set thresholds based on customer segments and operational strategy. This clarification comes amid public confusion over reports suggesting a nationwide rule would take effect on 10 November 2025.

Understanding Minimum Balance Rules

What Are Minimum Balance Rules?

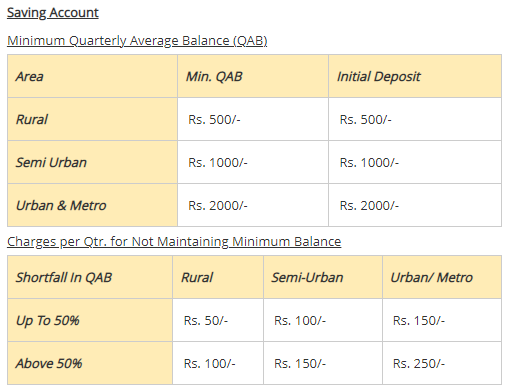

Minimum balance rules refer to the requirement that account-holders maintain a certain amount of money in their savings accounts at all times or as an average across a month. Failure to meet this threshold may result in bank charges or restrictions on services. Banks often define the minimum average balance (MAB) separately for metro, urban, semi-urban, and rural branches.

Regulatory Context

The RBI has stated clearly that setting minimum balance thresholds falls outside its regulatory purview. According to statements from RBI officials, the decision to impose, adjust, or waive these balances lies solely with individual banks. Special account types, such as Basic Savings Bank Deposit Accounts (BSBDA) or accounts under the Pradhan Mantri Jan Dhan Yojana (PMJDY), are exempt from such requirements, ensuring low-income and first-time account holders face no barriers to access.

Current Landscape of Minimum Balance Rules

Divergent Bank Policies

Banks across India follow diverse policies:

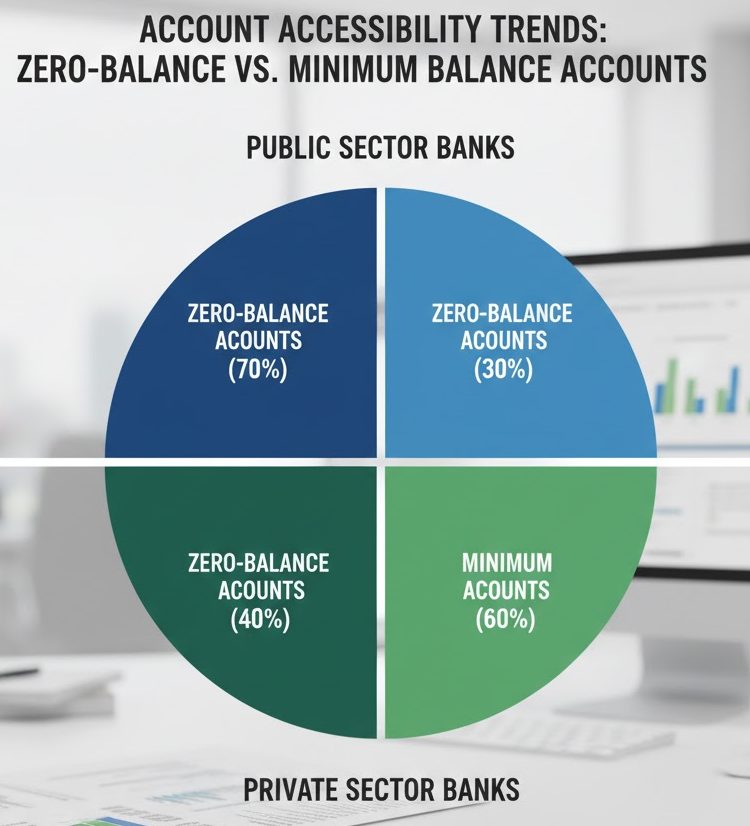

- Some public sector banks have waived minimum balance requirements entirely to encourage financial inclusion.

- Certain private banks have increased thresholds for premium accounts, sometimes as high as ₹50,000 in metro branches, while offering lower thresholds in semi-urban and rural areas.

- Zero-balance savings accounts remain widely available but may carry restrictions, such as limited cheque leaves or transaction counts.

Why the Variation Exists

Banks’ choices are influenced by multiple factors:

- Customer Segment: Low-balance accounts often incur higher servicing costs, so banks may waive fees to attract and retain customers.

- Profitability and Deposit Mix: Banks prefer higher CASA (Current Account + Savings Account) ratios for lower-cost deposits. Setting higher minimums can improve the average balance per account but may reduce the number of accounts.

- Competitive Positioning: Some banks market zero-balance accounts to attract young or digitally savvy customers, while others use higher minimums to position premium services.

Impact on Account-Holders

- Customers in rural or low-income segments benefit from waivers that prevent penalties for failing to maintain balances.

- Those unable to meet higher thresholds may be excluded from certain accounts unless they opt for zero-balance alternatives.

- Comparing accounts across banks is now more important than ever due to non-standardized rules.

Expert Analysis

Regulatory Perspective

Experts note that the RBI’s statement eliminates confusion about a hypothetical nationwide minimum balance requirement. By allowing banks autonomy, the regulator encourages transparency and innovation in savings products. However, complete discretion may widen disparities in account accessibility, requiring banks to maintain suitable low-balance options.

Consumer and Financial Implications

Financial analysts emphasize a balance between inclusion and profitability:

- Excessively high minimums may discourage low-income customers and reduce account activity.

- Waiving minimums entirely can attract high-volume, low-balance accounts, increasing operational costs for banks.

- Clear disclosure of charges and conditions remains critical to ensure consumer awareness.

Practical Guidance for Customers

- Check Your Bank’s Terms: Understand your account’s specific MAB and any penalties for non-maintenance.

- Consider Zero-Balance Accounts: BSBDA and PMJDY accounts offer financial access without minimum balance requirements.

- Evaluate Service Trade-Offs: Zero-balance accounts may restrict cheque usage or withdrawal frequency.

- Maintain a Cushion: For accounts with MAB requirements, keeping slightly more than the minimum balance can prevent accidental charges.

- Compare Banks: Public sector banks may provide lower minimums or more inclusive accounts compared to private banks.

- Stay Updated: Banks can revise their policies; new account holders may be subject to different thresholds than existing customers.

Broader Implications

Financial Inclusion

Minimum balance waivers for low-income and first-time account holders support the government’s financial-inclusion goals. Zero-balance accounts enable wider access to banking services, including digital payments, insurance, and small savings instruments.

Bank Profitability

Banks must balance profitability with inclusivity. Low-balance accounts may incur higher servicing costs, while higher minimums may restrict account growth. This tension is reflected in varied strategies across institutions.

Consumer Choice and Transparency

The lack of a standardized national minimum balance rule increases the need for consumers to compare account features. Transparency about fees, interest rates, and service restrictions is essential for informed decision-making.

What to Watch Next

- Bank Announcements: Watch for updates from individual banks regarding minimum balance rules, penalties, or zero-balance options.

- Digital Banking Trends: Banks may offer lower thresholds for digital-only accounts compared to traditional branch accounts.

- Financial Literacy Initiatives: Educating consumers on account requirements, penalties, and alternatives will remain critical.

- Policy Signals: While the RBI allows discretion, regulatory oversight may still ensure fairness, transparency, and protection against discriminatory practices.

Conclusion

The Reserve Bank of India has clarified that minimum balance rules are a matter of bank policy, not central regulation. Consumers now have the responsibility to choose accounts that match their financial habits, while banks must balance profitability with accessibility. As the banking landscape evolves, transparency, education, and careful comparison will guide account-holders in navigating these diverse savings options.