Starting a business is exciting, but arranging funds without property or assets to pledge can feel like hitting a wall. That is exactly why Pradhan Mantri Mudra Yojana has become such an important support system for small entrepreneurs across India. If you want to launch or grow a small business and need a loan without collateral, Pradhan Mantri Mudra Yojana is built for that purpose.

It focuses on helping micro and small businesses get formal credit through banks and financial institutions. Instead of depending on private lenders or high interest borrowing, small business owners can now approach recognized lenders and apply under a structured government backed model. From shop owners and repair services to home based businesses and small manufacturers, this scheme opens the door to organized funding.

Pradhan Mantri Mudra Yojana is a dedicated small business loan program that provides collateral free credit to micro and small non farm enterprises. It is structured to support startups, self employed individuals, and growing small units through formal lenders like banks, NBFCs, and microfinance institutions. Under Pradhan Mantri Mudra Yojana, loans are divided into three stages based on the size and maturity of the business, which helps borrowers choose the right funding level. The scheme encourages entrepreneurship, improves financial inclusion, and helps small businesses build a credit history while accessing capital in a practical and simplified way.

Pradhan Mantri Mudra Yojana

| Feature | Details |

|---|---|

| Scheme Name | Pradhan Mantri Mudra Yojana |

| Loan Type | Collateral Free Business Loan |

| Target Group | Micro And Small Non Farm Businesses |

| Maximum Loan Amount | Up To 10 Lakh Rupees |

| Loan Segments | Shishu Kishor Tarun |

| Collateral Requirement | Not Required |

| Lending Channels | Banks NBFCs MFIs Small Finance Banks |

| Main Purpose | Startup Expansion Working Capital |

| Government Support | Credit Guarantee Backing |

| Suitable For | First Time And Small Entrepreneurs |

What Is Pradhan Mantri Mudra Yojana

- Pradhan Mantri Mudra Yojana is a government supported financing framework created to make business loans accessible to very small enterprises. These are businesses that usually operate outside large corporate structures and often struggle to get traditional bank loans due to lack of collateral.

- The system works by supporting lenders rather than lending directly to individuals. Financial institutions receive backing and refinance support so they can safely lend to small business borrowers. Because of this safety net, lenders are more comfortable approving small ticket business loans without security.

- The scheme mainly serves micro manufacturers, traders, service providers, artisans, transport operators, and local business units. It is especially useful for people starting their first venture or running a small operation that needs additional working capital.

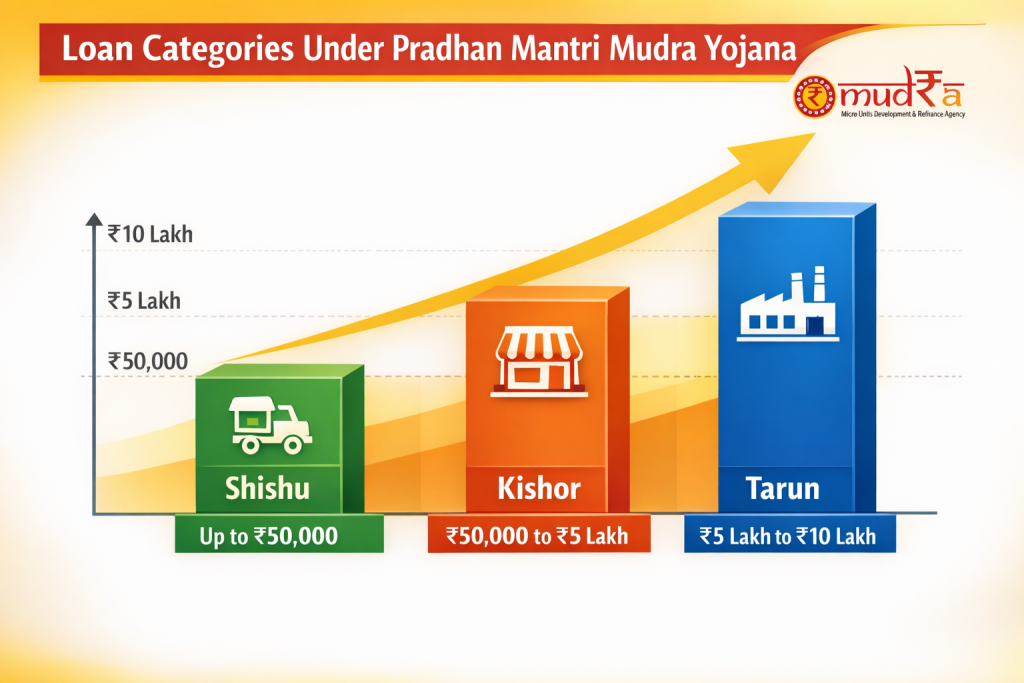

Loan Categories Under Pradhan Mantri Mudra Yojana

To make funding more practical, loans are grouped into three categories based on how much money the business needs and how developed it is.

Shishu

- This is the entry level category meant for very small or newly starting businesses. Loan amount goes up to 50000 rupees.

- It suits street vendors, home based producers, small service providers, and first time entrepreneurs testing a business idea. Documentation and scale expectations are usually simpler here.

Kishor

- This category is for businesses that are already running but want to grow. Loan amount ranges from 50000 to 5 lakh rupees.

- It helps with buying tools, small machines, additional stock, or boosting working capital. Many small shops and service units apply under this segment.

Tarun

- This is meant for more established small businesses planning expansion. Loan amount ranges from 5 lakh to 10 lakh rupees.

- It is typically used for capacity expansion, new equipment, business vehicles, or scaling operations to a higher level.

Eligibility Process for Pradhan Mantri Mudra Yojana

Eligibility under Pradhan Mantri Mudra Yojana is based more on business activity and repayment ability than on assets. That makes it different from traditional secured loans.

You are generally eligible if you are:

- Running or planning a micro or small business

- Operating in manufacturing trading or service sector

- A non corporate and non farm enterprise

- An individual proprietor or small unit operator

Common eligible applicants include shopkeepers, food processing units, repair workshops, tailors, artisans, beauty salons, small transport operators, and local service providers. Lenders review whether the business idea is workable and whether expected income can support repayment. A clear use of funds plan helps a lot during assessment.

Documents Required for Pradhan Mantri Mudra Yojana

The paperwork is lighter compared to large business loans, but accuracy still matters. Most lenders typically ask for:

- Identity proof

- Address proof

- Recent photographs

- Business activity details or plan

- Existing business proof if already operating

- Bank account statements

- Cost estimates for equipment or assets if being purchased

Some lenders may ask for additional forms depending on loan size and category. Submitting clean and consistent documents speeds up processing.

How To Apply For Pradhan Mantri Mudra Yojana

Applying is straightforward and follows regular loan application flow through approved lenders.

- You can visit a nearby bank branch, small finance bank, NBFC, or microfinance institution that offers Mudra category loans. Ask for the relevant application form and category guidance. Fill in your business details, funding requirement, and submit documents.

- The lender will review your application, check your repayment capacity, and evaluate your business purpose. If everything is in order, the loan is approved and disbursed through your bank account.

- Many lenders now support digital applications, which means you can begin the process online and complete verification later. Choosing the correct loan category instead of applying for the maximum amount improves approval chances.

Interest Rates and Repayment

- Interest rates are decided by the lending institution, not fixed under one universal number. Rates depend on borrower profile, loan size, and lender policy. Still, these rates are usually more reasonable than informal borrowing options.

- Repayment terms are also flexible and linked to business cash flow. Tenure can vary from short to medium term depending on the purpose of the loan. Some lenders allow structured EMI plans that match business income cycles.

- Timely repayment under Pradhan Mantri Mudra Yojana helps borrowers build a strong credit record, which improves chances of getting larger loans later.

Collateral and Guarantee Support

One of the biggest advantages of Pradhan Mantri Mudra Yojana is that no collateral is required from the borrower. You do not need to pledge land, property, or gold. Instead, loans are supported through a credit guarantee framework that reduces the lender’s risk. This is what enables collateral free lending at scale. However, collateral free does not mean rule free. Lenders still check repayment capacity, business intent, and document authenticity carefully.

Key Benefits of the Pradhan Mantri Mudra Yojana

This scheme has gained wide adoption because it addresses real small business funding gaps.

- No collateral needed

- Designed for micro and small enterprises

- Three level loan structure

- Wide network of participating lenders

- Supports new entrepreneurs

- Encourages formal banking access

- Helps build credit history

- Useful for startup and expansion both

For many borrowers, Pradhan Mantri Mudra Yojana acts as the first formal step into business finance.

Practical Tips Before You Apply

- Before applying, prepare a simple business note explaining what you do, how you earn, and how the loan will be used. Keep your bank transactions clean and regular for a few months before application.

- Do not apply randomly at multiple lenders at the same time. Select the correct Mudra category based on actual need. Borrowing realistically improves approval odds and repayment comfort.

- If you are already running a small business, keep basic income and expense records ready. Even simple records build lender confidence.

FAQs on Pradhan Mantri Mudra Yojana

Who Should Apply Under Pradhan Mantri Mudra Yojana

Anyone running or planning a micro or small non farm business such as trading, services, or small manufacturing can apply through participating lenders.

Is Collateral Ever Asked In Practice

The scheme is designed as collateral free. Normally no security is taken, though lenders still perform credit and business checks.

What Is The Maximum Loan Limit

The upper limit is 10 lakh rupees under the Tarun category, depending on eligibility and repayment capacity.

Can A First Time Entrepreneur Get Approval

Yes. Many first-time entrepreneurs apply under the Shishu category with a small loan size and basic business plan.