Owning a home is one of the most important financial and emotional goals for Indian families. A permanent house brings stability, safety, and a sense of belonging. However, for many people, especially those from low- and middle-income groups, rising property prices and high home loan interest rates make this dream difficult to achieve.

To address this challenge, the Government of India introduced Pradhan Mantri Awas Yojana, a housing scheme designed to make homeownership affordable and accessible. Pradhan Mantri Awas Yojana focuses on helping first time homebuyers by offering interest subsidies on housing loans. The scheme reduces the financial burden on families who otherwise struggle to afford monthly EMIs. Beyond financial support, it also promotes better living standards, planned urban growth, and social inclusion. Understanding who is eligible and how the scheme works is essential before applying, as the benefits depend on income category, property type, and ownership status.

Pradhan Mantri Awas Yojana is a flagship housing initiative aimed at achieving the vision of Housing for All. It is designed for individuals and families who do not own a permanent house and fall under defined income groups. The scheme provides interest subsidies on home loans taken from approved financial institutions, which directly lowers the cost of borrowing. One of the key features of the scheme is its focus on affordability rather than luxury housing. By setting limits on property size and loan amounts, the scheme ensures that benefits reach genuine home seekers. It also gives preference to women, senior citizens, and vulnerable sections, making it an inclusive and socially balanced housing program.

Pradhan Mantri Awas Yojana

| Aspect | Details |

|---|---|

| Scheme Name | Pradhan Mantri Awas Yojana |

| Primary Objective | Affordable housing for eligible citizens |

| Target Beneficiaries | EWS LIG MIG categories |

| Type Of Assistance | Interest subsidy on home loans |

| Property Usage | Residential purpose only |

| Ownership Condition | Applicant or spouse must not own a pucca house |

| Priority Groups | Women senior citizens differently abled |

Pradhan Mantri Awas Yojana has emerged as one of the most impactful housing initiatives in India. By clearly defining eligibility criteria, income categories, and benefits, the scheme ensures that financial support reaches deserving families. For anyone planning to buy their first home, understanding how Pradhan Mantri Awas Yojana works can lead to significant savings and long term financial security. With the right planning and awareness, the dream of owning a home can become a reality.

Objectives Of Pradhan Mantri Awas Yojana

The main objective of the scheme is to reduce the housing shortage in urban areas by enabling affordable homeownership. It aims to provide safe and permanent housing to families living in temporary or inadequate conditions. Another important goal is to promote financial inclusion by helping low-income households access formal housing finance. The scheme also encourages planned urban development, better infrastructure, and improved quality of life through access to basic amenities such as clean water, sanitation, and electricity. By supporting home construction and purchase, the scheme contributes to employment generation and economic growth as well.

Income Categories Under Pradhan Mantri Awas Yojana

- Eligibility under Pradhan Mantri Awas Yojana is primarily based on annual household income. The government has divided applicants into specific income groups to ensure fair distribution of benefits.

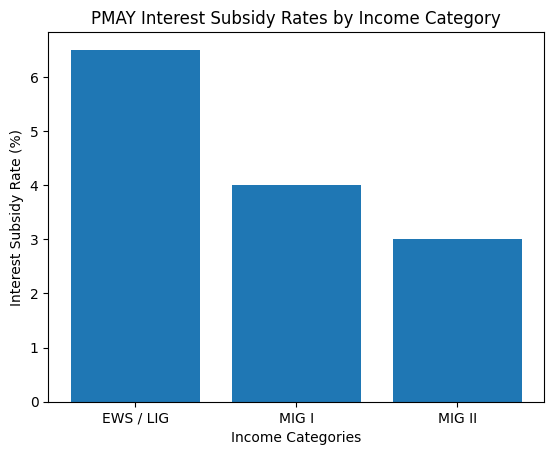

- The Economically Weaker Section includes families with the lowest income levels and receives the highest subsidy support. The Low Income Group consists of households with slightly higher income but limited financial capacity. The Middle Income Group is further divided into MIG I and MIG II, covering salaried and self employed individuals with moderate income. Each category has defined income limits, and the subsidy benefits vary accordingly.

Eligibility Criteria For Pradhan Mantri Awas Yojana

To qualify for benefits under Pradhan Mantri Awas Yojana, applicants must meet certain eligibility conditions. The applicant or their spouse should not own a pucca house anywhere in India. The home loan must be taken from a recognized bank or housing finance company. The property should be used strictly for residential purposes and must fall within the prescribed carpet area limits. Female ownership is encouraged, and preference is given to applications where a woman is listed as the owner or co owner. These conditions ensure that the scheme benefits first time homebuyers who genuinely need financial assistance.

Benefits Of Pradhan Mantri Awas Yojana

The most significant benefit of Pradhan Mantri Awas Yojana is the interest subsidy on home loans. This subsidy reduces the effective interest rate, leading to lower EMIs or shorter loan tenure. Over the life of the loan, beneficiaries can save a substantial amount on interest payments. The scheme also improves access to housing finance for people who were previously excluded due to income limitations. In addition, it promotes women empowerment by encouraging female ownership of property and supports social inclusion by prioritizing disadvantaged groups.

Interest Subsidy Structure Explained

Under Pradhan Mantri Awas Yojana, the interest subsidy is calculated on a specified portion of the home loan. The subsidy amount is credited directly to the loan account, reducing the principal outstanding. This results in immediate EMI relief for the borrower. The subsidy rate and eligible loan amount vary based on income category. Loans exceeding the prescribed limit do not receive subsidy benefits, even if the applicant qualifies under other criteria. This structure ensures controlled and targeted financial assistance.

Property Size And Loan Limits

- The scheme defines maximum carpet area limits for houses eligible for subsidy. These limits are different for each income category and are intended to support affordable housing.

- Larger or luxury properties are excluded to prevent misuse of benefits. Similarly, there is a cap on the loan amount eligible for interest subsidy. Applicants should carefully check these limits before finalizing a property to ensure they receive the full benefit under Pradhan Mantri Awas Yojana.

Priority Beneficiaries Under The Scheme

Certain sections of society are given priority under Pradhan Mantri Awas Yojana. These include women, senior citizens, differently abled individuals, scheduled castes, scheduled tribes, and minority communities. The focus on priority groups helps promote social equality and ensures that vulnerable populations are not left behind in the process of urban development and housing growth.

Documents Required For Pradhan Mantri Awas Yojana

Applicants need to submit a set of standard documents to verify eligibility and identity. These typically include Aadhaar card, income proof, bank statements, property documents, and a loan sanction letter. An affidavit stating that the applicant does not own a pucca house is also required. Accurate and complete documentation is crucial for smooth processing and timely approval of subsidy benefits.

Application Process For Pradhan Mantri Awas Yojana

The application process usually starts at the bank or housing finance institution from which the home loan is availed. The lender verifies the applicant’s eligibility and submits the required details for subsidy approval. Once approved, the subsidy amount is credited directly to the home loan account. Applicants should ensure that all information provided is accurate, as discrepancies can cause delays or rejection.

Common Mistakes to Avoid While Applying

Many applicants miss out on benefits due to small errors. Providing incorrect income details, choosing properties outside the carpet area limits, or failing to meet ownership conditions are common mistakes. It is important to review eligibility criteria carefully and consult with the lending institution before applying under Pradhan Mantri Awas Yojana.

Soil Health Card Scheme — How It Helps Farmers Use Fertilizers More Effectively

Long Term Impact of Pradhan Mantri Awas Yojana

The scheme has had a significant impact on India’s housing sector. It has increased homeownership among low- and middle-income families and encouraged affordable housing development. By reducing the cost of borrowing, Pradhan Mantri Awas Yojana has helped families achieve financial stability while improving living conditions. Over time, the scheme contributes to sustainable urban growth and economic development.

FAQs on Pradhan Mantri Awas Yojana

Who Can Apply for Pradhan Mantri Awas Yojana

Any Indian citizen who does not own a pucca house and meets the income criteria can apply.

Is Pradhan Mantri Awas Yojana Only for First Time Homebuyers

Yes the scheme is mainly intended for first time homebuyers.

Can Self Employed Individuals Apply For Pradhan Mantri Awas Yojana

Yes, both salaried and self-employed individuals are eligible.

Is The Subsidy Paid Directly to the Applicant

No the subsidy amount is credited directly to the home loan account.