Poultry Farm Loan Yojana 2025 has emerged as a big opportunity for young people, farmers, and small entrepreneurs who want to start a poultry farming business with limited capital. This scheme is especially useful for those who wish to create an additional, steady income source alongside farming or want to move towards a full-time poultry business. Run in coordination with banks, the scheme aims to help more rural families start organised poultry units so that employment grows and the rising demand for eggs and chicken can be met smoothly. Under Poultry Farm Loan Yojana 2025, applicants get access to loans, subsidy support, reasonable interest rates, and a longer repayment period, so the initial business risk and financial pressure stay under control. For first-time poultry farmers, this scheme can work as an easy door to startup capital because a major part of the project cost can be financed by banks, while a sizeable share is supported in the form of government subsidy.

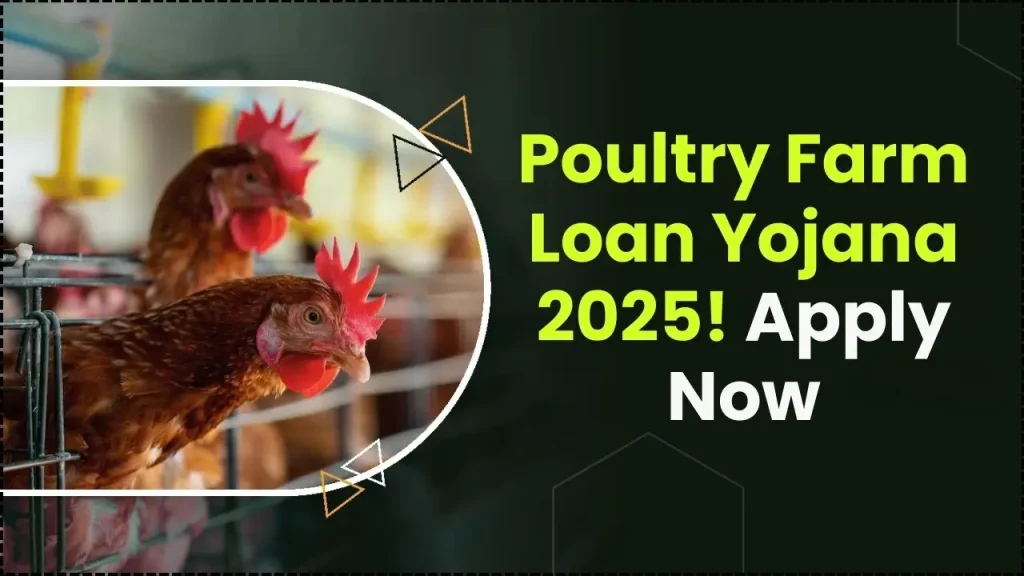

If you have been thinking for a long time about how to earn a good profit from poultry farming but lack of funds is stopping you, Poultry Farm Loan Yojana 2025 is designed exactly to solve this problem. Under this scheme, banks can offer loans typically from about ₹2 lakh up to ₹9 lakh, and in some cases even up to ₹10 lakh, which can be used for shed construction, buying chicks, feed, medicines, water and electricity arrangements, and other basic infrastructure. The biggest strength of this scheme is that you do not get only a loan, but also a capital subsidy of around 25% to 33% of the project cost, depending on your category and the exact scheme rules. This subsidy is later adjusted directly into your loan account, effectively reducing your outstanding amount and lowering your EMI burden. With a repayment period of around 5 years and an initial grace period in many cases, Poultry Farm Loan Yojana 2025 gives your poultry business enough time to stabilise and start generating consistent cash flow.

Poultry Farm Loan Yojana 2025

What Poultry Farm Loan Yojana 2025 Is And Why It Matters

Poultry Farm Loan Yojana 2025 is essentially a structured financial support mechanism in which the government does not pay money directly to individuals but routes support through banks in the form of loans and capital subsidies. This means you can set up your poultry farm as a properly planned business project, where the major portion of investment is funded by a bank loan while the subsidy reduces your effective project cost over time.

In recent years, the demand for eggs and chicken has grown steadily across both urban and rural areas, due to rising awareness about protein-rich diets and changing food habits. In this situation, Poultry Farm Loan Yojana 2025 is not just a support programme for entrepreneurs, but also a way to strengthen the entire value chain – including feed manufacturing, transport, local markets, cold storage, and processing units. That is why many state governments as well as central programmes highlight poultry as a key sector for rural employment, self-reliance and nutritional security.

Key Benefits Of Poultry Farm Loan Yojana 2025

One of the biggest advantages of Poultry Farm Loan Yojana 2025 is that you do not need to arrange the entire project cost from your own pocket. Major expenses such as shed construction, equipment, feeder and drinker systems, chicks, feed stock, vaccines and medicines can be covered largely through bank finance under this scheme.

Another major benefit is the nature of cash flow in poultry farming. Once your batches start coming into production and you maintain regular sales of live birds or eggs, monthly income becomes fairly consistent. If your unit size, cost structure, and loan amount have been chosen wisely under Poultry Farm Loan Yojana 2025, you can manage EMIs without too much strain and gradually build a profitable, scalable business.

Eligibility Criteria For Poultry Farm Loan Yojana 2025

To avail benefits under Poultry Farm Loan Yojana 2025, the applicant must be an Indian citizen and at least 18 years of age. Individual banks may have their own internal norms related to maximum age, income profile, or credit history, but generally, farmers, rural youth, and small business owners are actively encouraged to apply.

Eligible categories typically include farmers, unemployed rural youth, women, self-help groups (SHGs), farmer producer organisations (FPOs), and cooperative societies engaged in livestock or allied activities. You also need access to suitable land – in most schemes around 3 acres or so, either owned or on a valid long-term lease – where the poultry shed can be constructed with proper safety and hygiene norms. Some banks treat prior experience or basic training in poultry farming as an added advantage, though it may not always be mandatory.

Required Documents for Poultry Farm Loan Yojana 2025

To keep your application process smooth, it is wise to organise the required documents before visiting the bank. Typically you will need basic KYC proofs such as Aadhaar card, PAN card, passport-size photographs, and address proof. In addition, banks usually ask for your bank passbook or recent account statement, income proof, and caste certificate if you are claiming benefits under a reserved or priority category.

One of the most important documents is the Detailed Project Report (DPR). This report should clearly explain how the Poultry Farm Loan Yojana 2025 funds will be used the number of birds, type of farming (broiler or layer), estimated cost of construction and equipment, feed cost, mortality assumptions, sale price, expected revenue, and net profit projections. Many banks, district animal husbandry offices, or industry centres provide standard DPR formats and guidance, which is very helpful for first-time entrepreneurs.

Where To Get a Loan Under Poultry Farm Loan Yojana 2025

Almost all major public sector and private sector banks today offer some form of poultry or agri-business loan that can be aligned with Poultry Farm Loan Yojana 2025 benefits. You can approach banks such as State Bank of India, Punjab National Bank, Central Bank, regional rural banks, cooperative banks, or reputed NBFCs that operate in your area.

Many institutions now allow you to initiate the process online by filling a basic application or callback form, especially under agriculture/MSME loan sections. After this, you are usually called to the branch for detailed discussion, document submission, and further processing. For smaller-ticket projects, microfinance institutions or specialised rural finance companies also provide funding which can complement formal schemes linked to Poultry Farm Loan Yojana 2025.

Step-By-Step Application Process Under Poultry Farm Loan Yojana 2025

The first step is to clearly define your business plan – decide whether you want to start with broilers or layers, what unit size is manageable (for example, 1,000, 2,000, or 5,000 birds), where your local market is, and how you will arrange feed and other inputs. Based on this, prepare a realistic project report that reflects ground-level costs and income expectations rather than overly optimistic numbers.

Next, visit the nearest branch of the bank or financial institution of your choice and ask for details about poultry farm loans under current schemes. Collect and fill in the loan application form, attach your KYC documents, land/lease documents, DPR, income proof, and any other required papers. The bank will then assess your credit profile, check your CIBIL score, evaluate the feasibility of the project, and may conduct a site visit. Once the loan is sanctioned, the amount is disbursed as per the approved plan, and any eligible subsidy under Poultry Farm Loan Yojana 2025 is later adjusted into your loan account through the concerned implementing agency.

PM Vishwakarma: पैसा आया या नहीं? आधार नंबर से पीएम विश्वकर्मा योजना का पेमेंट चेक करें

Important Tips Before Applying Under Poultry Farm Loan Yojana 2025

Before applying, remember that taking a loan is only one part of success – thoughtful planning and execution matter even more. Start with a unit size you can practically manage with your current knowledge, local support, and market network. An oversized project in the beginning can create management challenges and strain cash flow.

Build your market connections in advance. Talk to existing poultry farmers, feed suppliers, traders, and wholesalers to understand realistic purchase and sale prices, seasonal demand patterns, and common risks like diseases or price drops. It is also wise to calculate your EMIs beforehand and ensure that even with conservative profit estimates, you can comfortably service the loan taken under Poultry Farm Loan Yojana 2025. Having a small emergency buffer for unexpected issues such as disease outbreaks or feed price spikes can protect your business during tough phases.

FAQs on Poultry Farm Loan Yojana 2025

1. What Is the Maximum Loan Available Under Poultry Farm Loan Yojana 2025?

In most cases, banks provide loans from about ₹2 lakh up to ₹9 lakh, while some banks and state-linked schemes may allow limits up to around ₹10 lakh or more depending on your project size and repayment capacity.

2. Is Subsidy Available Under Poultry Farm Loan Yojana 2025?

Yes, subsidy is one of the key highlights of this scheme. Generally, beneficiaries in the general category can get around 25% capital subsidy on eligible project cost, while SC/ST, women and other priority groups may get around 33% or higher, as per the respective scheme’s guidelines.

3. How Can I Apply Online for Poultry Farm Loan Yojana 2025?

Many banks allow you to start the process online via their official websites in the agriculture or business loan section. You can submit basic details and contact information, after which a bank representative will reach out to guide you through documentation and branch-level formalities.

4. Is Collateral Mandatory for Loans Under This Scheme?

Collateral requirements depend on the loan amount and the bank’s internal policies. Smaller loans may be sanctioned against hypothecation of project assets alone or even under collateral-free norms in some cases, while larger amounts often require land, property, or other acceptable security.