Starting a poultry business in India has moved far beyond being a small side activity. Today, it is a full-fledged agribusiness opportunity with consistent demand, fast returns, and government support. Eggs and chicken are among the most consumed protein sources in the country, and this demand continues to rise every year.

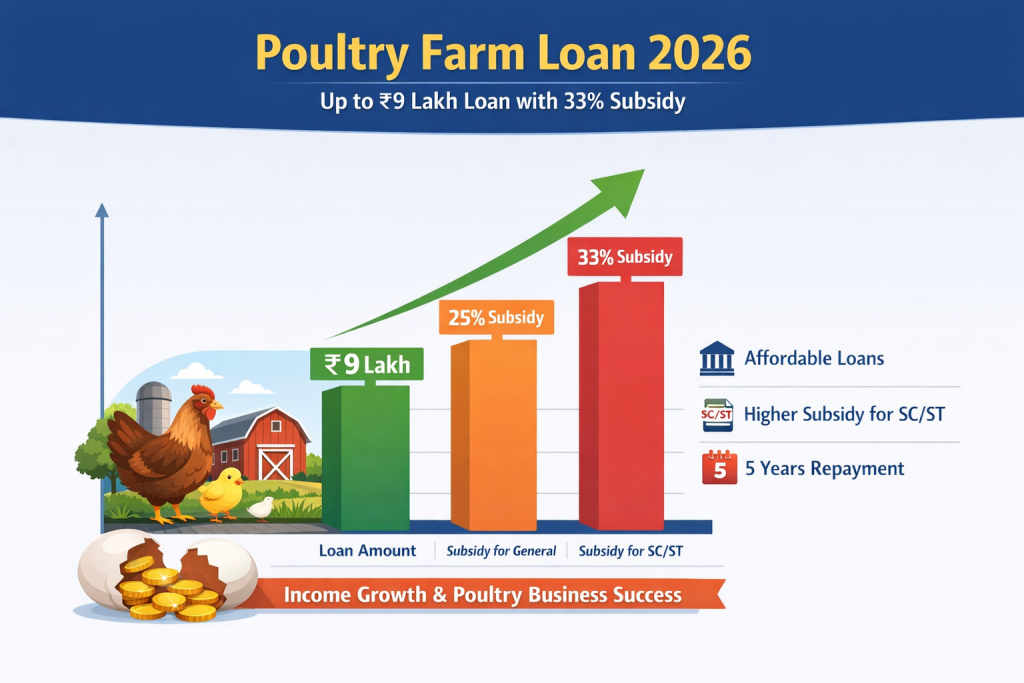

To help people take advantage of this opportunity, the government has introduced the Poultry Farm Loan 2026, a scheme that makes it easier to start or expand a poultry farm with proper financial backing. The Poultry Farm Loan 2026 is designed for farmers, rural youth, and entrepreneurs who want to build a stable income source through poultry farming. With a loan amount of up to ₹9 lakh and a subsidy of up to 33 percent, the scheme reduces the initial financial burden and encourages more people to enter this sector with confidence.

The Poultry Farm Loan 2026 is a government-supported financial assistance scheme aimed at promoting poultry farming as a sustainable and profitable business. Under this scheme, eligible applicants can receive a loan of up to ₹9 lakh to start a new poultry farm or expand an existing one. The loan covers major setup and operational costs such as poultry shed construction, purchase of chicks, feed, medicines, equipment, and other essential requirements. What makes this scheme especially attractive is the subsidy component. A significant portion of the project cost is subsidized, which lowers the overall loan liability. This support helps first-time farmers and small entrepreneurs manage risk while establishing their poultry business. The loan is provided through banks, and approval depends on eligibility criteria and the quality of the project report.

Poultry Farm Loan 2026

| Particular | Details |

|---|---|

| Scheme Name | Poultry Farm Loan Yojana 2026 |

| Maximum Loan Amount | Up to ₹9,00,000 |

| Subsidy | 25% for General Category, 33% for SC/ST |

| Repayment Period | Up to 5 Years |

| Moratorium Period | Up to 6 Months |

| Purpose Of Loan | Shed construction, chicks, feed, medicines, equipment |

| Application Mode | Online or Bank Branch |

The Poultry Farm Loan 2026 is a strong opportunity for anyone looking to enter or expand in the poultry sector. With a loan of up to ₹9 lakh, subsidy benefits, and flexible repayment terms, the scheme reduces the biggest challenges faced by new farmers. For those seeking a stable income source with long-term growth potential, poultry farming supported by this loan scheme can be a smart and sustainable choice.

What is the Poultry Farm Loan Yojana 2026?

The Poultry Farm Loan Yojana 2026 is a focused initiative to encourage poultry farming as a source of employment and income generation. Many people hesitate to start poultry farming due to high initial investment costs. This scheme addresses that problem by offering affordable loans with government backing. The loan can be used for both broiler and layer poultry farming. Depending on the project size, the bank evaluates the total cost and approves the loan accordingly. By supporting structured poultry projects, the scheme ensures that farms are planned properly, making them more likely to succeed in the long run.

Loan Amount And Subsidy Details

- Under the Poultry Farm Loan 2026, the maximum loan amount can go up to ₹9 lakh. However, the exact amount depends on factors such as farm capacity, infrastructure cost, and operational expenses mentioned in the project report.

- The subsidy is one of the biggest advantages of this scheme. Applicants from the general category can receive a subsidy of up to 25 percent of the total project cost. Applicants belonging to Scheduled Caste and Scheduled Tribe categories can receive a higher subsidy of up to 33 percent. This subsidy is adjusted directly against the loan amount, reducing the total repayment burden.

Benefits Of the Poultry Farm Loan Yojana

The Poultry Farm Loan Yojana offers several benefits that make it appealing for new and existing farmers.

- One major benefit is reduced financial pressure. Since part of the project cost is subsidized, borrowers need to repay a smaller amount. Another benefit is easier access to credit compared to regular commercial loans. Banks are more willing to support poultry projects under government-backed schemes.

- Poultry farming also provides steady income. Eggs and chicken have year-round demand, which means farmers can generate regular cash flow. In addition, the scheme helps create employment opportunities in rural areas, contributing to overall economic development.

Loan Repayment and Moratorium

Repayment under this scheme is designed to be flexible and farmer friendly. The loan repayment period can extend up to five years, allowing borrowers to pay in manageable installments. Many banks also offer a moratorium period of up to six months. During the moratorium period, the borrower is not required to pay monthly installments. This gives the poultry farm enough time to start production and generate income before repayment begins. This feature is especially helpful for new farmers who need time to stabilize operations.

Eligibility Criteria for Poultry Farm Loan 2026

To apply for the Poultry Farm Loan 2026, applicants must meet certain basic eligibility conditions. The applicant must be an Indian citizen and at least 18 years old. Having suitable land or space for setting up a poultry farm is essential. Applicants should also have basic knowledge of poultry farming. While prior experience is not always mandatory, it increases the chances of loan approval. Some banks may also prefer applicants who have completed short training programs related to poultry management.

Required Documents for Poultry Farm Loan 2026

- Applicants need to submit a set of documents during the loan application process. These usually include identity proof, address proof, bank account details, income proof, and passport size photographs.

- If the applicant is applying under the SC or ST category, a valid caste certificate is required to claim the higher subsidy. A detailed project report is also mandatory. This report should include information about farm size, number of birds, estimated costs, and expected income.

Application Process

- The application process for the Poultry Farm Loan Yojana 2026 is simple and accessible. Applicants can apply online through the bank’s official portal or visit the nearest bank branch.

- After submitting the application and documents, the bank reviews the project report and verifies the applicant’s details. In some cases, a site visit may be conducted. Once approved, the loan amount is sanctioned and released as per the project requirements.

PM Scholarship Scheme 2026 — Who Can Apply and How to Submit the Form Quickly

Income Potential in Poultry Farming

- Poultry farming has strong income potential when managed properly. Broiler farming provides quick returns, while layer farming offers steady income through egg sales. With proper feed management, hygiene, and disease control, farmers can maintain healthy production levels.

- Many poultry farmers recover their initial investment within a few years. As the business grows, profits increase, making poultry farming a reliable long-term income source. Government support through schemes like the Poultry Farm Loan 2026 further improves profitability by reducing financial risk.

FAQs on Poultry Farm Loan 2026

1. Who Is Eligible for Poultry Farm Loan 2026

Any Indian citizen above 18 years with suitable land and interest in poultry farming can apply.

2. How Much Subsidy Is Available Under This Scheme

General category applicants can get up to 25 percent subsidy, while SC and ST applicants can get up to 33 percent.

3. Is Prior Experience Required To Apply

Prior experience is not mandatory, but basic knowledge or training in poultry farming is beneficial.

4. How Long Is the Repayment Period

The repayment period can be up to five years, with a possible moratorium of six months.