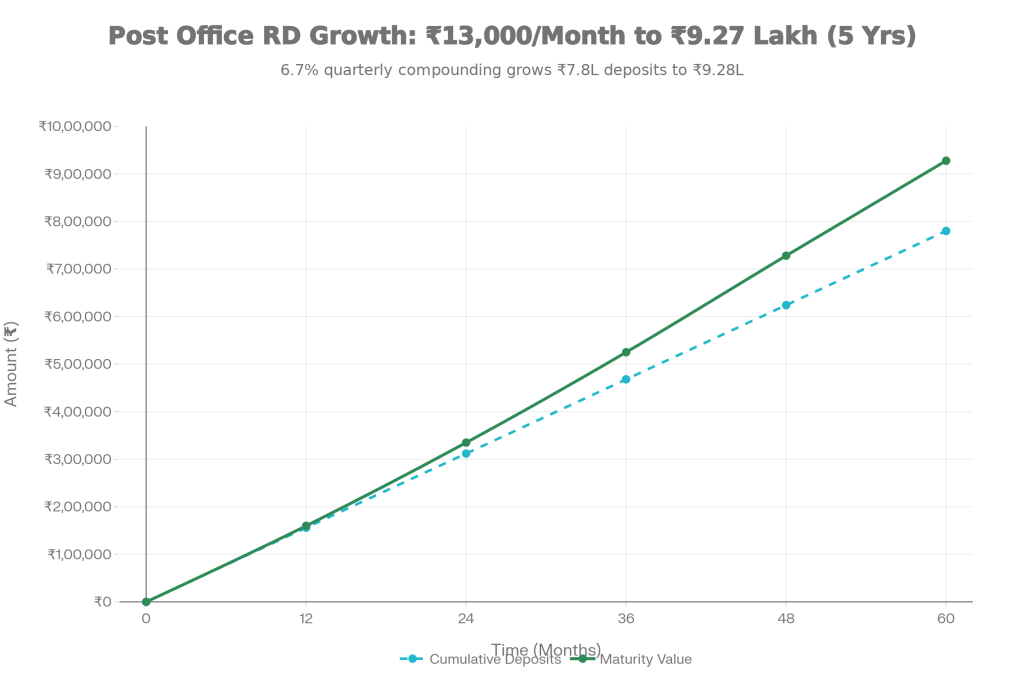

The Post Office RD Scheme shines for its accessibility and security, making it a top pick for anyone starting their savings journey. You can begin with as little as ₹100 per month but bumping it up to ₹13,000 like in this example shows real power. Over five years, you’ll pour in ₹7,80,000 total, and with interest compounding every quarter at 6.7%, it swells to that impressive ₹9,27,753. That’s about ₹1,47,753 in pure interest earnings, enough to cover a family vacation or boost your emergency fund.

What makes this scheme stand out in 2025? Government backing means zero worry about defaults, unlike some private banks. Rates stay steady through the quarter, reviewed by the Finance Ministry, so your planning stays on track. Families love the joint account option for up to three adults, or guardians handling minors’ accounts. It’s especially popular in smaller towns where post offices are everywhere, serving over 1.5 crore RD accounts nationwide.

Post Office RD Scheme

| Feature | Details |

|---|---|

| Interest Rate | 6.7% p.a. (compounded quarterly) |

| Tenure | 5 years |

| Minimum Monthly Deposit | ₹100 (multiples of ₹10) |

| Maximum Deposit | No upper limit |

| Maturity for ₹13,000/month | ₹9,27,753 (approx.) |

| Total Principal | ₹7,80,000 |

| Interest Earned | ₹1,47,753 (approx.) |

Diving deeper into the Post Office RD Scheme, you’ll find features tailored for real-life needs. Deposits come in multiples of ₹10, with no maximum, so scale as your income grows. Interest at 6.7% compounds quarterly, meaning your money earns on earnings, accelerating growth over time. For that ₹13,000 monthly plan, early deposits benefit most from compounding, pushing the final amount higher.

Joint accounts add teamwork husband, wife, and a sibling can pool efforts. Minors over 10 can operate their own with a guardian. Missed a month? A gentle ₹1 penalty per ₹100 nudges you back without breaking the bank. In 2025, with digital tracking via passbooks and apps, monitoring feels modern. No wonder rural savers flock here; it’s trusted, simple, and yields better than basic savings at 4%.

How To Calculate Post Office RD Scheme Maturity

- Calculating maturity in the Post Office RD Scheme doesn’t require a finance degree. The formula is M = R × [{(1 + i)^n} – 1] / [1 – (1 + i)^(-1/3)], where R is your monthly deposit (₹13,000), i is the quarterly rate (6.7%/4 = 1.675%), and n is total quarters (60 for five years). Punch it in, and you get exactly ₹9,27,753.

- Free online calculators from India Post or financial sites make it effortless just enter amount, rate, and tenure for instant breakdowns. Want to tweak? Try ₹10,000 monthly: it matures at around ₹7.13 lakh. Or stretch to 10 years for double the impact. Always use the latest Q4 2025 rate for spot-on post office recurring deposit projections, helping you compare with bank RDs or other schemes.

Benefits Of Post Office RD Scheme

- The perks of the Post Office RD Scheme go beyond numbers. Sovereign guarantee eliminates risk, a big win when bank failures make headlines. Liquidity shines with loans up to 50% of your balance after one year and 12 deposits, at just 2% above RD rate. Need money for a medical bill? Borrow without closing the account.

- Advance deposits sweeten the deal pay six months early for a ₹10 rebate per ₹100 installment, or ₹40 for 12 months. That’s like free interest boosts. In today’s 5% inflation world, 6.7% delivers real 1.7% gains yearly. Tax planning fits too; pair it with PPF for 80C benefits. For women or seniors, it’s a safe harbor building corpora for weddings, education, or retirement.

Eligibility Criteria For Post Office RD Scheme

- Jumping into the Post Office RD Scheme? Resident Indians qualify easily individuals, joint up to three adults, or guardians for kids over 10. No upper age limit, perfect for retirees. NRIs and HUFs miss out, but that’s minor. KYC is straightforward: Aadhaar, PAN, passport, or voter ID.

- One account per person per post office keeps it simple, though transfers and extensions are allowed. This broad eligibility pulls in everyone from fresh graduates to pensioners, making post office RD interest rates accessible nationwide.

How To Open an Account

- Opening your Post Office RD Scheme account takes minutes. Swing by any of 1.3 lakh post offices with ID proof, address proof, photo, and first deposit (cash, cheque, or transfer). Fill the form, pay ₹13,000 initial, and get a passbook on the spot.

- Go digital via India Post Payments Bank app or eBanking if you have a savings link. Select ‘New RD’, input details, and fund it. Deposits start from the first payment date, with reminders built in. In 2025’s app-savvy era, this hybrid approach suits all.

Deposit Rules For Post Office RD Scheme

- Rules in the Post Office RD Scheme promote steady saving. Pay by the 5th each month (or chosen date) in ₹10 multiples. Miss one? Add penalty next time; up to four quarters tolerated before closure notice. Advances reward foresight: six months ahead shaves ₹10 per ₹100, 12 months ₹40 plus extras.

- No partial withdrawals mid-run, but loans fill gaps. Track via passbook or DOP app for peace of mind. Discipline here turns ₹13,000 habits into that ₹9.27 lakh windfall.

Premature Withdrawal Rules

- Life happens, so Post Office RD Scheme allows early closure with caveats. After three years (36 deposits), withdraw at savings rate (4%), losing RD interest. Before? Only extreme cases like illness, with heavy penalties. Plan maturity to avoid this; extensions keep momentum.

- Post-three years, full access minus adjustment. Better to loan against it for flexibility.

Loan Facility

Craving cash without ditching your Post Office RD Scheme? After 12 deposits and one year, borrow 50% of balance at 8.7% (RD rate +2%), repay over 24-36 months. Ideal for emergencies or opportunities. At maturity, unpaid loans deduct automatically. This feature makes RD more than savings it’s a safety net.

Advance Deposit Rebate

Maximize the Post Office RD Scheme with rebates. Deposit six installments early: ₹10 off per ₹100. Full year ahead: ₹40 per ₹100, plus ₹10 on additional. Time it with salary bonuses for effortless savings. Combined with compounding, it supercharges your ₹9,27,753 goal.

Taxation Aspects

Interest from Post Office RD Scheme taxes as ‘income from other sources’ per slab. TDS applies over ₹40,000 yearly (₹50,000 seniors) at 10% with PAN; Form 15G/15H skips it if eligible. No standalone 80C but complements ELSS or NSC. Net calculator: after 20% tax, your ₹1.47 lakh interest shrinks to ₹1.18 lakh still solid.

Free Dish TV Scheme Explained: Watch 800 Channels Without Recharge — Who Can Get It

Renewal Options

- Maturity at ₹9,27,753? Renew Post Office RD Scheme for another five years at new rates or shift to savings. Transfer to any post office free. Keeps compounding alive indefinitely.

- Why dive in now? Late 2025’s stable 6.7% amid rate cuts elsewhere makes Post Office RD Scheme a steal. Start with ₹13,000 monthly your future self will thank you.

FAQs on Post Office RD Scheme

What is the current Post Office RD Scheme interest rate?

6.7% p.a. compounded quarterly, steady for Q4 2025.

Can I open multiple Post Office RD Scheme accounts?

One per post office per person joint or minors expand options.

Is premature withdrawal allowed in Post Office RD Scheme?

Yes, after three years at lower rate; penalties earlier.

How does advance deposit rebate work in Post Office RD Scheme?

₹10 per ₹100 for six months; ₹40 for 12 months.