When it comes to long-term, low-risk investments in India, very few options have earned as much trust as the Post Office PPF Scheme. It is one of those financial tools that quietly helps investors build wealth without exposing them to market volatility. The scheme is backed by the Government of India, which means your money stays safe while steadily growing over time.

This is exactly why millions of Indians continue to rely on the Post Office PPF Scheme for retirement planning, tax savings, and future financial security. What truly sets this scheme apart is its simplicity. You do not need to track stock markets, follow economic news daily, or worry about sudden losses. All you need is consistency. Even a modest annual contribution, such as ₹25,000, can grow into a meaningful amount over the years thanks to the power of compounding. For anyone looking to balance safety, returns, and tax benefits, this scheme deserves serious attention.

The Post Office PPF Scheme is a government-backed savings plan designed to encourage long-term investing among individuals. It is available through post offices across the country, making it easily accessible to people in both urban and rural areas. The scheme offers a fixed investment tenure of 15 years and allows investors to contribute a small amount every year to build a sizeable, tax-free corpus. This scheme is particularly suitable for people who prefer guaranteed returns over high-risk investments. With annual compounding, tax exemptions, and complete capital protection, it provides a rare combination of stability and growth. Whether you are planning for retirement, your child’s education, or simply want a secure savings option, this scheme fits well into most financial plans.

Post Office PPF Scheme

| Feature | Details |

|---|---|

| Scheme Name | Public Provident Fund |

| Minimum Investment | ₹500 per year |

| Maximum Investment | ₹1.5 lakh per year |

| Tenure | 15 years |

| Interest Rate | Government notified quarterly |

| Risk Level | Very low |

| Tax Benefits | Section 80C and tax-free returns |

| Compounding | Annual |

| Account Location | Post Office |

The Post Office PPF Scheme continues to be one of the most reliable and effective long-term investment options in India. Whether you invest ₹25,000 annually or aim for the maximum limit, consistency and patience are what truly matter. With guaranteed returns, strong tax benefits, and government backing, this scheme offers a rare combination of safety and growth. For anyone looking to build a secure financial future without taking unnecessary risks, this scheme remains a smart and time-tested choice.

What Is the Post Office PPF Scheme

- The Post Office PPF Scheme is a long-term savings instrument that helps individuals develop disciplined investing habits. Once you open an account, you are required to make at least one deposit every financial year to keep it active. The account matures after 15 years, but it can also be extended in blocks of five years if you wish to continue earning interest.

- Since the scheme is supported by the central government, there is virtually no risk involved. Your principal amount is secure, and the interest earned is credited every year. This makes it an ideal choice for conservative investors who want predictable growth without worrying about capital loss.

Investment Rules And Contribution Limits

- The investment rules under this scheme are simple and flexible. You can start with a minimum deposit of ₹500 in a financial year. The maximum amount you can invest is ₹1.5 lakh per year. You can deposit the money in a single lump sum or spread it across multiple installments during the year.

- Many investors choose to invest smaller amounts, such as ₹25,000 annually, especially in the early years. While the amount may seem modest, regular contributions combined with compounding can create impressive results over time. Missing a year is not ideal, but the account can be revived by paying a small penalty along with the minimum deposit.

Interest Rate and Compounding Benefit

- The interest rate for the Post Office PPF Scheme is set by the government and reviewed every quarter. Although the rate may change, it has historically remained competitive compared to traditional savings accounts and fixed deposits. More importantly, the interest is compounded annually.

- Compounding plays a crucial role in long-term wealth creation. In the early years, the growth may appear slow, but as interest starts earning interest, the pace accelerates. This is why staying invested for the full tenure is essential to maximize returns.

How ₹25000 Investment Grows Over Time

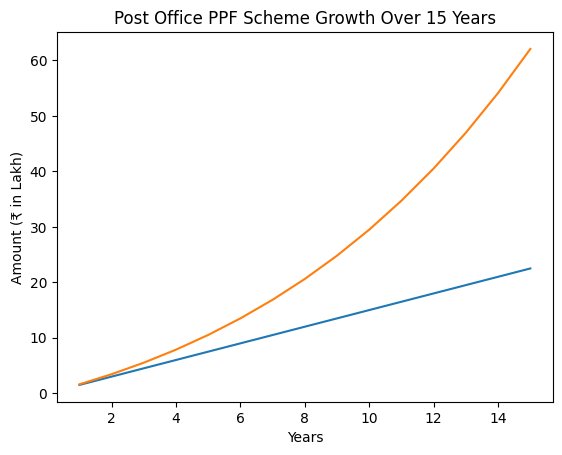

- Let us consider an investor who deposits ₹25,000 every year under the Post Office PPF Scheme. Over 15 years, the total investment amounts to ₹3.75 lakh. Thanks to annual compounding and a stable interest rate, the maturity value can be significantly higher than the total contribution.

- Now imagine increasing your yearly contribution gradually as your income grows. Investors who invest closer to the maximum limit each year can build a tax-free corpus worth several lakhs by maturity. The key takeaway here is consistency rather than the size of the investment in the beginning.

Tax Benefits Under The Scheme

- One of the biggest reasons behind the popularity of this scheme is its tax efficiency. It follows the EEE model, which means exempt at all three stages. The amount you invest qualifies for deduction under Section 80C of the Income Tax Act. The interest earned every year is completely tax-free. The maturity amount is also exempt from tax.

- These benefits make the Post Office PPF Scheme far more attractive than many other fixed-income investment options, especially for individuals in higher tax brackets.

Lock In Period And Withdrawal Rules

- The scheme comes with a mandatory lock-in period of 15 years. However, partial withdrawals are allowed after the completion of seven financial years, subject to specific conditions. Loans against the PPF balance are also permitted between the third and sixth year.

- These features add flexibility to the scheme, allowing investors to manage emergencies without breaking the account entirely. After maturity, you can withdraw the full amount or extend the account to continue earning interest.

Eligibility And Account Opening Process

- Any Indian resident can open an account under the Post Office PPF Scheme. Parents or guardians can also open an account on behalf of a minor. Only one account per individual is allowed, except for minor accounts.

- Opening an account is straightforward. You need to visit a post office with basic KYC documents such as identity proof, address proof, and photographs. Once the account is active, deposits can be made easily at the post office.

Why The Post Office PPF Scheme Is Still Relevant Today

- In today’s fast-changing financial environment, many investment options promise high returns but come with equally high risks. The Post Office PPF Scheme stands out because it offers stability and predictability. It may not generate quick wealth, but it ensures steady, tax-free growth over time.

- For investors who already take risks through equity or mutual funds, this scheme acts as a solid foundation. It balances the overall portfolio by providing guaranteed returns and long-term security.

Role Of Discipline In Wealth Creation

- The success of the Post Office PPF Scheme largely depends on discipline. Regular yearly deposits, even small ones, can lead to impressive results over time. Skipping contributions or withdrawing early can reduce the benefits of compounding.

- This scheme teaches an important financial lesson that wealth creation is not about timing the market, but about time spent in the investment.

Savings Account Interest Update – RBI Decision May Push Rates Above 7% for Account Holders

Who Should Invest In This Scheme

- The Post Office PPF Scheme is ideal for salaried individuals, self-employed professionals, and anyone looking for a safe long-term investment. It is especially suitable for retirement planning, children’s education funds, and tax-saving purposes.

- If you prefer peace of mind over aggressive returns, this scheme fits perfectly into your financial strategy.

FAQs on Post Office PPF Scheme

Is the Post Office PPF Scheme completely safe

Yes, it is backed by the Government of India, making it one of the safest investment options available.

Can I invest different amounts every year

Yes, you can vary your yearly contribution as long as it stays within the minimum and maximum limits.

Can I extend my PPF account after maturity

Yes, you can extend the account in blocks of five years with or without making further contributions.

Is this scheme suitable for short-term goals

No, it is best suited for long-term goals due to its 15-year lock-in period.