If you want to build a big, tax-free fund just by saving a reasonable amount every month, the Post Office PPF Plan can be a perfect fit. This scheme is not only safe but also helps you create a solid corpus for goals like retirement, children’s education, or a house down payment. With a disciplined monthly saving of just ₹7,000, you can end up with more than ₹22 lakh after 15 years.

Today, the Post Office PPF Plan is especially useful for those who want guaranteed and tax-free returns without worrying about stock market volatility. Since it is backed by the Government of India, the risk is extremely low, while the combination of tax benefits and compounding significantly boosts its return power.

Post Office PPF Plan

| Detail | Information |

|---|---|

| Scheme name | Post Office PPF Plan / Public Provident Fund |

| Scheme type | Long-term government small savings scheme |

| Minimum annual investment | ₹500 per year |

| Maximum annual investment | ₹1,50,000 per year |

| Example monthly investment | ₹7,000 per month (₹84,000 per year) |

| Current indicative interest rate | Around 7.1% per annum, compounded yearly |

| Mandatory lock-in period | 15 years |

| Extension option | Can be extended in 5-year blocks after 15 years |

| Estimated maturity amount (₹7,000 per month, 15 years) | Around ₹22–23 lakh |

| Tax status | Tax benefits on investment, interest and maturity (EEE) |

| Risk level | Very low, as it is government-backed |

What Is Post Office PPF Plan And How Does It Work

- The Post Office PPF Plan, or Public Provident Fund, is a long-term small savings scheme run by the central government. Its main purpose is to help individuals build strong financial security for their future and retirement. You can open this account at a post office as well as several major banks, but the post office version is particularly popular among investors in smaller towns and rural areas.

- The minimum annual deposit allowed in this scheme is ₹500 and the maximum is ₹1.5 lakh. You can invest in one lump sum or spread it across up to 12 instalments throughout the year. That means depositing ₹7,000 every month in the Post Office PPF Plan is fully within the rules, as it works out to around ₹84,000 per year.

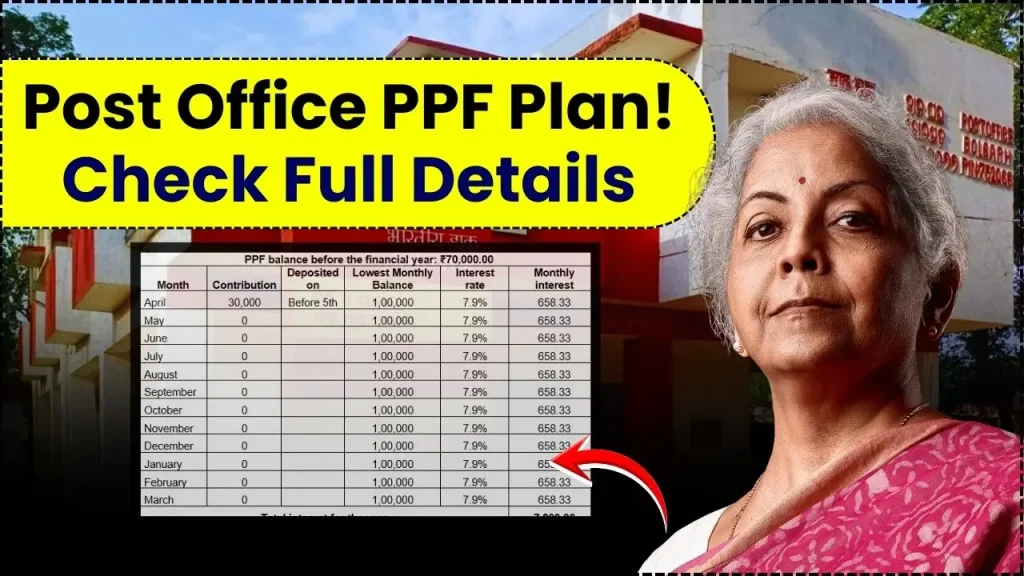

- The interest rate on PPF is decided by the government and reviewed every quarter. At present, it hovers around 7.1% per annum, compounded yearly. This compounding effect is what turns small regular contributions into a large amount over the long term and is the key reason the Post Office PPF Plan stands out compared to other traditional savings products.

Monthly Investment Of ₹7,000 In Post Office PPF Plan

When you deposit ₹7,000 every month into the Post Office PPF Plan, your total yearly investment becomes ₹84,000. If you keep investing this amount consistently for the full 15-year tenure, your total principal will be around ₹12.60 lakh. Now the real power comes from compound interest. At an annual interest rate of about 7.1%, your total investment can grow to roughly ₹22–23 lakh in 15 years. In other words, the ₹12.60 lakh you put in can almost double by maturity. The best part is that this entire maturity amount, including the interest, is completely tax-free, so whatever you receive at the end is your full, clear amount with no tax deduction. If you wish, you can also extend the account in blocks of 5 years after the initial 15-year period. If you continue contributing ₹7,000 per month for a few more years, or even if you simply keep the account open and let the interest compound, your corpus can grow well beyond ₹22 lakh.

Logic Behind The ₹7,000 PPF Calculation

- To understand the maturity calculation of the Post Office PPF Plan, you need to look at two main things total yearly investment and the compound interest rate. Here, the annual investment is about ₹84,000, and the assumed interest rate is around 7.1% per year.

- In compound interest, the interest earned each year gets added back to the principal, and then in the next year you earn interest on this higher amount. This means growth looks slow in the initial years but speeds up sharply as time passes. After around 10 years, the curve becomes noticeably steep. That is why, in long-term schemes like the Post Office PPF Plan, breaking the investment in the first 5–7 years is usually a bad idea; staying invested till the end is what creates real wealth.

- Put simply, someone who deposits ₹7,000 every month in the Post Office PPF Plan is building a kind of “forced saving” habit. The money doesn’t get spent, it stays locked in, keeps compounding, and then returns as a sizeable, tax-free lump sum after 15 years.

PPF Rules: Lock-In, Partial Withdrawal And Loan Facility

- The lock-in period of the Post Office PPF Plan is 15 years. This means you cannot normally withdraw the entire amount before 15 years are completed. While some people find this strict at first, this lock-in actually helps you avoid breaking your savings and supports long-term wealth creation.

- Even then, the rules are not completely rigid. From the 7th financial year onwards, you are allowed partial withdrawals under certain conditions. For example, you can withdraw a portion of the balance for needs like higher education of children, serious medical issues or other specific emergencies. The amount you can withdraw is limited by a prescribed formula so that the account does not get emptied completely.

- In addition to this, the Post Office PPF Plan allows you to take a loan against the balance from the 3rd year onward. You can borrow up to a certain percentage of your PPF balance and repay it with interest. This feature is very useful for middle-class families because it gives access to funds in times of need without closing the account and without losing the long-term saving habit.

Tax Benefits and Safety: Why PPF Is So Popular

From a tax perspective, the Post Office PPF Plan is one of the strongest options available. It falls under the EEE category Exempt on investment, Exempt on interest, and Exempt on maturity. That means:

- The amount you invest in PPF is eligible for deduction under Section 80C of the Income Tax Act up to ₹1.5 lakh per financial year.

- The interest that gets credited to your PPF account every year is completely tax-free.

- The entire maturity amount you receive at the end of the tenure is also tax-free.

On the other hand, interest earned on bank fixed deposits is fully taxable as per your income tax slab. Many debt funds and other fixed-income products also do not enjoy the same tax-free status as PPF. This is why a lot of salaried and self-employed individuals treat the Post Office PPF Plan as the backbone of their tax planning. In terms of safety, your money in PPF is backed by the Government of India. There is virtually no market risk, credit risk, or default risk. If you are uncomfortable with stock market volatility or mutual fund fluctuations, the Post Office PPF Plan can become a very stable and secure part of your portfolio.

How To Open a Post Office PPF Account

Starting a Post Office PPF Plan is quite simple. You just need to visit your nearest post office or an authorised bank branch and fill out the PPF account opening form. Typically, you will need:

- Identity proof (such as Aadhaar card, PAN card, etc.)

- Address proof

- Passport-sized photographs

- Initial deposit amount (often ₹500 or more)

Once you submit the form and KYC documents, your account is opened and you receive a passbook or statement showing all deposits and interest details.

Nowadays, many banks and some post offices also allow PPF contributions through online modes. You can set up auto-debit via net banking or mobile banking so that ₹7,000 is automatically transferred every month into your Post Office PPF Plan. This removes the risk of forgetting and also saves you the hassle of doing each transaction manually.

LIC Amrit Bal Policy Explained: Why Many Are Choosing It Over FD and RD Options

Who Should Choose The Post Office PPF Plan

If you want to build a safe, tax-free and guaranteed long-term fund without getting stressed about market swings, the Post Office PPF Plan is an excellent choice. It is especially suitable for:

- Salaried employees who want to park a fixed portion of their monthly income into a disciplined savings plan

- Small business owners who need a long-term, low-risk retirement strategy

- Middle-class families looking to build a corpus for children’s education, marriage or home purchase

- Investors who want to combine tax planning with stable returns

An amount like ₹7,000 per month is manageable for many working individuals. If you channel this money into the Post Office PPF Plan instead of letting it get spent, the same habit can turn into a tax-free corpus of about ₹22 lakh or more after 15 years.

FAQs on Post Office PPF Plan

1. Can I really get over ₹22 lakh by depositing ₹7,000 per month in the Post Office PPF Plan?

Yes, assuming an interest rate around 7.1% per annum and a continuous investment of ₹7,000 per month for 15 years, your total principal of about ₹12.60 lakh can grow to roughly ₹22–23 lakh due to compound interest and tax-free growth.

2. Is the PPF interest rate fixed?

No. The interest rate of the Post Office PPF Plan is reviewed by the government every quarter. Once declared, it usually applies for that quarter or financial year, but over the long term, the rate can move up or down slightly.

3. Can I withdraw my entire money before 15 years?

Generally, no. The PPF account is locked in for 15 years, and you cannot withdraw the full amount before maturity. However, from the 7th year onwards, partial withdrawals are allowed under certain conditions, and loans are available from the 3rd year.

4. Which is better PPF or bank fixed deposit?

In most cases, after accounting for tax, the Post Office PPF Plan offers better real returns than bank FDs because PPF interest and maturity are tax-free, while FD interest is taxable.