Planning a steady monthly income is no longer just a retirement concern. With rising expenses, uncertain markets, and increasing life expectancy, many people today are actively searching for safe investment options that can provide predictable cash flow. This is where the Post Office Monthly Income Scheme 2026 comes into focus. It is one of the most trusted government-backed schemes in India, known for stability, safety, and regular monthly returns. The Post Office Monthly Income Scheme 2026 is especially appealing to individuals who want peace of mind along with monthly income credited directly to their bank account. Whether you are a retiree, a senior citizen, or someone looking to supplement your regular earnings, this scheme offers a reliable way to generate fixed monthly returns without exposure to market risks.

The Post Office Monthly Income Scheme 2026 is a small savings scheme offered through post offices across India. It allows investors to deposit a lump sum amount once and receive interest every month for a fixed tenure of five years. The scheme is backed by the Government of India, which makes it one of the safest investment options available for conservative investors. The main objective of this scheme is to provide regular income rather than long-term capital growth. The interest earned is paid monthly and directly transferred to the investor’s linked savings bank account. Since the returns are fixed at the time of investment, investors can plan their monthly expenses with confidence.

Post Office Monthly Income Scheme 2026

| Feature | Details |

|---|---|

| Scheme Name | Post Office Monthly Income Scheme |

| Investment Type | One time lump sum |

| Tenure | 5 years |

| Monthly Payout | Fixed interest income |

| Risk Level | Very low |

| Account Options | Single and joint |

| Minimum Investment | ₹1,000 |

| Interest Payment | Monthly |

| Capital Safety | Fully protected |

The Post Office Monthly Income Scheme 2026 remains a dependable choice for investors who value safety, predictability, and regular income. While it may not deliver high returns, it offers something equally important: financial peace of mind. With careful planning and the right investment amount, this scheme can provide steady monthly income and support long-term financial stability.

How The Post Office Monthly Income Scheme Works

- The working of the Post Office Monthly Income Scheme 2026 is simple and transparent. An investor deposits a lump sum amount at a post office. Based on the prevailing interest rate, the post office calculates the monthly interest on the invested amount.

- This interest is credited every month directly into the investor’s savings account. The principal amount remains locked in for five years and is returned at maturity. Since the interest rate is fixed at the time of investment, monthly income remains stable throughout the tenure.

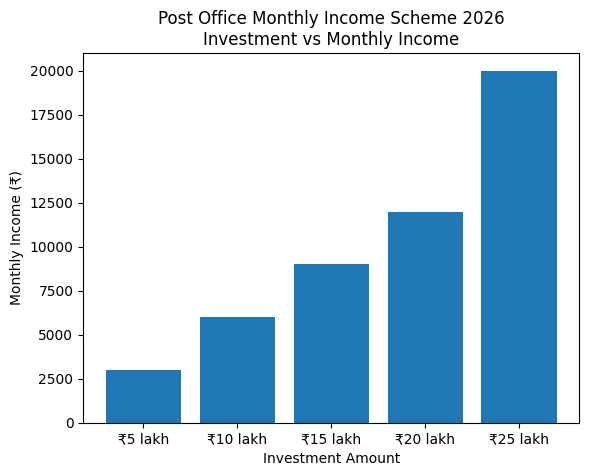

How To Get ₹20,000 Every Month From This Scheme

- Many investors are curious whether it is realistically possible to earn ₹20,000 per month through the Post Office Monthly Income Scheme 2026. The answer depends on two factors: the interest rate and the total investment amount.

- To reach a monthly income close to ₹20,000, investors usually need to invest near the maximum permissible limit. Joint accounts are commonly used for this purpose. A joint account allows multiple adults to invest together, increasing the total deposit amount and, in turn, the monthly interest payout.

- With proper planning and maximum utilization of the allowed limits, this scheme can generate a substantial monthly income that supports household expenses, medical costs, or retirement needs.

Interest Rate and Monthly Income Calculation

- The interest rate under the Post Office Monthly Income Scheme is announced by the government and reviewed periodically. Once an investor opens an account, the interest rate applicable at that time remains fixed for the entire five-year tenure.

- Monthly income is calculated by applying the fixed interest rate to the invested amount and dividing it into monthly payouts. Even if interest rates change in the future, existing investors continue to receive income at the original rate, ensuring consistency and predictability.

Eligibility Criteria For Post Office Monthly Income Scheme 2026

- The Post Office Monthly Income Scheme 2026 is available to resident Indian individuals. Adults can open single or joint accounts. Parents or guardians can also open an account on behalf of a minor.

- There is no maximum age limit for investment, making this scheme especially attractive to senior citizens. However, non-resident Indians are not eligible to invest in this scheme.

Investment Limits and Account Types

- Investors can choose between single and joint accounts depending on their financial goals. Single accounts are suitable for individual investors, while joint accounts allow up to three adults to invest together.

- Joint accounts are particularly useful for couples or family members who want to maximize the total investment amount and earn higher monthly income. Each account holder has equal ownership, and the monthly interest is shared equally unless specified otherwise.

Taxation Rules

The interest earned from the Post Office Monthly Income Scheme 2026 is taxable as per the investor’s income tax slab. The scheme does not offer tax deductions under Section 80C. No tax is deducted at source on the monthly interest payments. This means investors must declare the interest income while filing their income tax returns. Those in higher tax brackets should consider the tax impact while calculating their net monthly income.

Premature Withdrawal Rules

Although the scheme has a fixed tenure of five years, premature withdrawal is allowed after a specific lock-in period. If the account is closed before maturity, a small penalty is deducted from the principal amount. This feature provides liquidity in case of emergencies. However, to get the full benefit of the scheme and avoid penalties, it is advisable to stay invested until maturity.

Benefits Of Post Office Monthly Income Scheme 2026

- The biggest benefit of the Post Office Monthly Income Scheme 2026 is capital safety. Since the scheme is government-backed, the risk of losing the invested amount is almost negligible.

- Other key benefits include guaranteed monthly income, fixed returns, simple account management, and direct bank credit of interest. The scheme is easy to understand and does not require constant monitoring, unlike market-linked investments.

Limitations of the Scheme

While the scheme offers safety and stability, it also has some limitations. The returns may be lower compared to equity-based or market-linked investment options. Additionally, the interest earned is taxable, which reduces the effective return for investors in higher tax brackets. The investment amount is also subject to maximum limits, which may restrict high-net-worth individuals from investing large sums in a single account.

Who Should Invest In This Scheme

The Post Office Monthly Income Scheme 2026 is ideal for retirees, senior citizens, and individuals who depend on monthly income for living expenses. It is also suitable for conservative investors who prefer guaranteed returns over higher but uncertain gains. People looking for a secondary income source to supplement salary or pension can also benefit from this scheme.

Comparison With Other Monthly Income Options

- Compared to bank fixed deposits, this scheme offers similar safety with the advantage of monthly payouts. Unlike mutual fund-based monthly income plans, it does not carry market risk.

- While returns may not be the highest, the assurance of regular income and capital protection makes it a preferred option for risk-averse investors.

Free Silai Machine Yojana 2026 – How Women Can Get Government Support to Earn from Home

Important Points to Remember Before Investing

- Before investing in the Post Office Monthly Income Scheme 2026, it is important to check the current interest rate and investment limits. Investors should also assess their monthly income needs and tax liability.

- Proper financial planning ensures that the scheme aligns with long-term goals and cash flow requirements.

FAQs on Post Office Monthly Income Scheme 2026

1. Is the Post Office Monthly Income Scheme 2026 safe for long-term investment

Yes, it is one of the safest investment options as it is backed by the Government of India.

2. Can I earn ₹20,000 per month from this scheme

Yes, with a high investment amount and use of joint accounts, earning close to ₹20,000 per month is achievable.

3. Is the monthly interest guaranteed

Yes, the interest rate is fixed at the time of investment and remains unchanged for five years.

4. Can senior citizens invest in this scheme

Yes, there is no age limit, making it suitable for senior citizens.