If predictable cash flow and capital safety are your top priorities, the Post Office Monthly Income Scheme 2025 is built for you. It offers a fixed interest rate credited every month for five years, making it a steady way to fund essentials without worrying about market volatility. For retirees, homemakers, and conservative savers, it’s a clean, rules-based product with sovereign backing, simple operations, and clear exit provisions. The big question most readers have is simple: can this plan actually deliver ₹19,000 every month, and if yes, how should you structure your deposits?

You invest a lump sum once, lock it for five years, and receive interest every month straight into your linked account. The current rate is 7.4% per annum (subject to quarterly review), paid out monthly, while your full principal is returned at maturity. You can open single or joint accounts, follow deposit caps, nominate a beneficiary, and even transfer the account between post offices if you relocate. Because the interest is taxable, net-in-hand depends on your slab, but there’s no TDS deduction at source. Most importantly, there are strict maximum deposit limits so hitting big monthly targets (like ₹19,000) requires smart planning and, often, layering with other safe instruments.

Post Office Monthly Income Scheme 2025

| Feature | Details |

|---|---|

| Interest Rate | 7.4% per annum, paid monthly |

| Tenure | 5 years (principal repaid at maturity) |

| Minimum Deposit | ₹1,000 (in multiples of ₹1,000) |

| Maximum Per Single | ₹9,00,000 (aggregate across single holdings) |

| Maximum Per Joint | ₹15,00,000 (equal shares among holders) |

| Eligibility | Resident Indians; minors via guardian; NRIs not eligible |

| Premature Closure | Not allowed in first year; 2% penalty if closed between 1–3 years; 1% if closed between 3–5 years |

| Tax Treatment | Interest taxable as per slab; typically no 80C on principal; no TDS deduction |

Interest Rate For 2025

The scheme currently pays 7.4% per annum with monthly credits to your linked post office savings account or via ECS to a bank account. Rates are reviewed by the government quarterly, but in practice they tend to move gradually. The appeal here isn’t chasing the highest yield; it’s the stability of a fixed rate for five years, the predictability of monthly payouts, and the comfort of government backing. For households building a low-risk income ladder, that combination often matters more than squeezing a few extra basis points elsewhere.

Maximum And Minimum Investment Limits of Post Office Monthly Income Scheme 2025

You can begin with just ₹1,000 and add only in multiples of ₹1,000 when opening a fresh account. The upper cap is critical: ₹9 lakh per individual in single accounts (including aggregate across multiple single accounts) and ₹15 lakh for a joint account (2–3 adults, equal shares). These caps apply regardless of how many post offices or accounts you use so planning for a large target income must respect these ceilings. Families often use one joint account plus individual accounts for each spouse (and sometimes a minor’s account via a guardian, within its own lower limit) to optimize total household income.

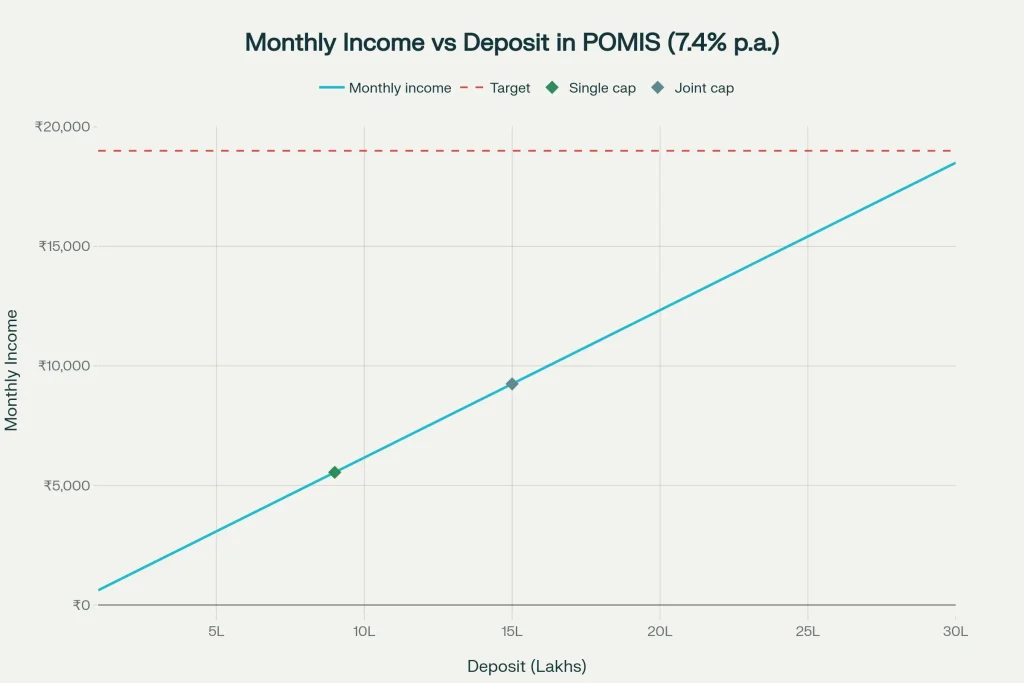

How To Generate ₹19,000 Every Month

Use this simple formula for the Post Office Monthly Income Scheme 2025: Monthly income = Principal × 0.074 ÷ 12. To receive ₹19,000 per month, the required principal is roughly ₹19,000 × 12 ÷ 0.074 ≈ ₹30.8 lakh. This exceeds both the single cap (₹9 lakh) and the joint cap (₹15 lakh). In other words, POMIS alone cannot legally host the full corpus needed for a ₹19,000 monthly payout under current limits. For context:

- ₹9,00,000 (single cap) generates about ₹5,550 per month.

- ₹15,00,000 (joint cap) generates about ₹9,250 per month.

Even using both a joint account (₹15 lakh) and one full single account (₹9 lakh) within a household totals ₹24 lakh—still short of the ~₹30.8 lakh needed. The practical approach is to anchor a portion in POMIS and complement the rest with other safe, fixed-income options (for example, Senior Citizens’ Savings Scheme for eligible investors, NSC, or time deposits) to close the gap.

Eligibility Criteria And Account Types for Post Office Monthly Income Scheme 2025

Resident Indian adults can open single or joint accounts, and a guardian can open on behalf of a minor; a minor above ten can operate the account subject to rules. Each joint holder has equal share by default in a joint account, and an individual’s aggregate limit across single accounts remains capped at ₹9 lakh. NRIs are not eligible to open a POMIS account. The scheme supports nomination, enabling smooth transfer to a nominee in the event of the holder’s demise, and accounts are transferable between post offices if you move.

Premature Closure And Liquidity

There’s no exit in the first year plan your emergency fund outside POMIS. After one year, you can close with a penalty on principal: 2% if closed after one year and before three years, and 1% if closed after three years and before five years. The entire principal (minus penalty if applicable) is returned on premature closure, and monthly interest stops thereafter. If you prefer more liquidity, consider staggering multiple POMIS accounts opened on different dates. That way, if you need to close one, only part of your principal attracts the penalty, keeping the rest intact.

Tax Treatment And TDS

Interest from the Post Office Monthly Income Scheme 2025 is fully taxable as income according to your slab. Typically, there is no TDS deduction at source on POMIS interest, which means you must factor the tax into your advance tax or year-end self-assessment. The principal invested in POMIS generally does not qualify under Section 80C. For many investors, pairing POMIS with tax-efficient instruments where suitable and within limits can improve after-tax outcomes without sacrificing safety.

Worked Examples and Calculator Logic

The calculator logic is straightforward. For any deposit D, monthly payout M = D × 0.074 ÷ 12.

- Example 1: D = ₹2,00,000 → M ≈ ₹1,233 per month.

- Example 2: D = ₹9,00,000 → M ≈ ₹5,550 per month.

- Example 3: D = ₹15,00,000 → M ≈ ₹9,250 per month.

These are useful for quick mental math when designing your income stack. If your household target is ₹19,000, POMIS can shoulder roughly half with a full joint allocation, and the balance can be sourced from other government-backed or bank fixed-income products, depending on eligibility and tenure preferences.

Who Should Consider POMIS

Choose POMIS if you value stability over chasing higher but uncertain returns. It fits retirees needing a dependable monthly stream, conservative savers planning near-term goals, and families looking to build a secure baseline income. If you anticipate cash needs before five years, stagger your accounts to create rolling access windows after the first year. Also, if you are in a higher tax bracket, map the post-tax income to avoid overestimating your monthly take-home.

How To Open and Operate Post Office Monthly Income Scheme 2025

Walk into any core banking–enabled post office or use supported digital channels where available. Complete KYC, choose single or joint mode, nominate a beneficiary, and deposit within the prescribed limits. Link a post office savings account (or ECS to a bank account) for monthly credits. Keep records of account numbers, opening dates (for penalty calculation), and nomination acknowledgments. If you relocate, request an account transfer to your new post office your tenure and payout schedule continue seamlessly.

Key Pros and Trade-Offs

Pros

- Sovereign-backed safety with fixed monthly income.

- Clear, rules-based structure with a defined 5-year term.

- Reasonable flexibility via premature closure after one year.

- Simple math for planning, easy to monitor, and transferable across post offices.

Trade-Offs

- Deposit caps limit how much income you can generate solely through POMIS.

- First-year lock-in; penalties apply for early exit thereafter.

- Interest is fully taxable, affecting net monthly income for higher slab investors.

- Rate is fixed at entry; you forgo upside if interest rates rise substantially later.

Practical Roadmap To ₹19,000 Per Month

- Step 1: Max the Post Office Monthly Income Scheme 2025 joint account at ₹15,00,000 to lock in about ₹9,250 per month.

- Step 2: If possible, add a single account at ₹9,00,000 for about ₹5,550 per month, reaching ~₹14,800.

- Step 3: Close the gap of ~₹4,200 per month with an eligible mix of safe alternatives:

- Senior Citizens’ Savings Scheme for those 60+ (or as per early retirement rules) to secure higher fixed payouts.

- National Savings Certificate to compound and later annuitize or ladder redemptions as income.

- Bank fixed deposits with monthly interest payout mandates, selecting tenures to suit liquidity needs.

- Step 4: Reassess annually for tax impact and rate changes; rebalance maturities to maintain the target.

The Post Office Monthly Income Scheme 2025 is a rock-solid way to secure monthly income with minimal fuss. It won’t single-handedly deliver ₹19,000 per month due to deposit caps, but it’s an ideal core layer in a conservative income strategy. Use the simple payout formula to size deposits, fill the remaining gap with compatible fixed-income instruments, and stagger accounts for flexibility. Keep taxes in view, respect the first-year lock-in, and review your plan annually to stay aligned with your cash flow needs.

FAQs on Post Office Monthly Income Scheme 2025

What is the current interest rate and tenure?

The Post Office Monthly Income Scheme 2025 currently offers 7.4% per annum with a fixed 5-year tenure. Interest is credited monthly to your linked account, and the principal is repaid at maturity.

How much do I need to get ₹19,000 per month?

About ₹30.8 lakh at 7.4%. Because POMIS caps are ₹9 lakh (single) and ₹15 lakh (joint), you cannot place the entire required corpus into POMIS alone. Use POMIS as an anchor and complement it with other safe fixed-income instruments.

Can I close the account early if I need the money?

Not in the first year. After one year, you can close with a penalty on principal: 2% between the first and third year, and 1% between the third and fifth year. Staggering multiple accounts on different dates can improve flexibility.

Is the interest taxable? Is there TDS?

Interest is fully taxable as per your slab. Typically, there is no TDS deduction on POMIS interest, so plan for advance tax or self-assessment to avoid surprises at year-end.