The Post Office Monthly Income Scheme continues to serve as one of India’s most trusted fixed-income savings instruments, offering predictable monthly payouts backed by the Government of India. Administered through India Post, the scheme provides stable returns over a five-year tenure and remains particularly popular among retirees and conservative investors seeking capital protection.

What Is the Post Office Monthly Income Scheme?

The Post Office Monthly Income Scheme (POMIS) is a small savings instrument operated under the supervision of the Ministry of Finance and delivered through India Post. It allows individuals to deposit a lump sum and receive monthly interest payments at a rate declared quarterly by the government.

According to official notifications issued by the Department of Economic Affairs, small savings rates are reviewed every quarter based on yields of government securities of comparable maturity. As of FY 2025–26, the interest rate for the Post Office Monthly Income Scheme stands at 7.4% per annum, payable monthly.

The tenure is fixed at five years, after which the principal is repaid to the investor.

Post Office Monthly Income Scheme at a Glance

| Feature | Details |

|---|---|

| Scheme Name | Post Office Monthly Income Scheme (POMIS) |

| Governing Authority | Ministry of Finance, Government of India |

| Implementing Agency | India Post |

| Tenure | 5 years |

| Interest Rate (FY 2025–26) | 7.4% per annum (reviewed quarterly) |

| Interest Payout | Monthly |

| Minimum Investment | ₹1,000 |

| Maximum Investment | ₹9 lakh (single), ₹15 lakh (joint) |

| Risk Level | Sovereign-backed (very low default risk) |

| Tax Benefit | No Section 80C benefit |

| Taxation | Interest fully taxable |

| Premature Withdrawal | Allowed after 1 year (penalty applicable) |

How Monthly Returns Are Calculated

Interest under the Post Office Monthly Income Scheme is calculated annually but paid out every month. The formula is straightforward:

Monthly Interest = (Investment × Annual Interest Rate) ÷ 12

For instance:

- Investment: ₹5,00,000

- Annual interest: 7.4%

- Annual interest earned: ₹37,000

- Monthly payout: Approximately ₹3,083

These payouts continue for the entire five-year tenure, provided the account remains active.

Who Can Invest?

Eligibility is restricted to resident Indian citizens. Individuals aged 18 years and above can open single or joint accounts. A guardian may open an account on behalf of a minor aged 10 years or above.

Non-Resident Indians (NRIs) are not permitted to invest in the scheme.

Joint accounts may include up to three adults, and the maximum permissible limit applies collectively to all holders.

Safety and Sovereign Backing

One of the defining features of the Post Office Monthly Income Scheme is its sovereign guarantee. Since it is backed by the Government of India, investors face minimal credit risk.

Financial planners frequently categorise it alongside other low-risk instruments such as Public Provident Fund (PPF) and Senior Citizens Savings Scheme (SCSS).

According to the Reserve Bank of India’s financial stability assessments, household financial savings in India remain concentrated in low-risk instruments, including bank deposits and small savings schemes, reflecting a strong preference for safety over higher but volatile returns.

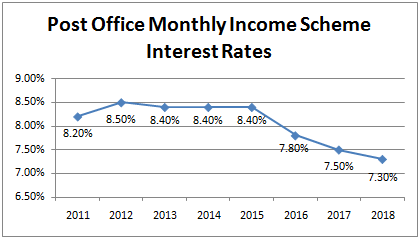

How Interest Rates Are Determined

The government reviews small savings scheme rates every quarter. These rates are broadly aligned with government bond yields of similar maturity, though adjustments may be moderated for policy considerations.

Economists note that small savings rates influence bank deposit pricing. When POMIS rates are higher than comparable bank deposits, banks may raise deposit rates to remain competitive.

Dr. Radhika Rao, senior economist at DBS Bank, has observed in policy commentary that small savings schemes “act as a floor for retail deposit pricing and play an important role in shaping domestic liquidity.”

This linkage makes the Post Office Monthly Income Scheme significant beyond retail investing.

Premature Withdrawal Rules

Liquidity is limited during the first year. Withdrawals are allowed only after one year from the date of deposit.

- Between 1 and 3 years: 2% deduction on principal

- Between 3 and 5 years: 1% deduction

These penalties are deducted from the invested amount before repayment.

This structure encourages investors to commit for the full tenure while still offering partial flexibility.

Tax Treatment and Real Returns

Interest earned under the Post Office Monthly Income Scheme is fully taxable under the investor’s income tax slab.

There is no deduction under Section 80C of the Income Tax Act for investment in this scheme. Additionally, no Tax Deducted at Source (TDS) is applied, placing the responsibility of disclosure on the investor.

Financial advisors stress the importance of considering post-tax returns. For investors in higher tax brackets, effective returns may reduce significantly after taxation.

Inflation also affects real returns. If inflation averages 6% annually, the real return margin narrows considerably.

Comparison With Alternative Investment Options

Investors often compare POMIS with other fixed-income options.

Bank Fixed Deposits

Bank deposits offer flexible tenures and liquidity but carry credit risk based on the issuing bank. Interest rates may vary widely.

Senior Citizens Savings Scheme (SCSS)

SCSS often provides higher interest but is available only to individuals aged 60 and above. It also offers tax benefits under Section 80C.

Monthly Income Plans (Mutual Funds)

Market-linked monthly income plans may offer higher returns but expose investors to capital volatility.

Demographic Trends and Regional Reach

India Post operates more than 1.5 lakh post offices, according to official government data, making it one of the largest postal networks globally.

This reach allows the Post Office Monthly Income Scheme to penetrate rural and semi-urban areas where access to formal banking may be limited.

Post office officials report consistent enrolment among pensioners, widows, and individuals who receive retirement benefits in lump sums.

Policy Role in Government Borrowing

Small savings collections contribute to the government’s borrowing programme. According to the Controller General of Accounts, funds mobilised through these schemes form part of the National Small Savings Fund (NSSF).

Economists say that higher collections in schemes like POMIS can reduce reliance on market borrowings.

However, elevated small savings rates may also raise the government’s interest burden if they significantly exceed market rates.

Risks and Limitations

While the Post Office Monthly Income Scheme offers strong safety, it has limitations:

- Fixed returns may underperform during high inflation periods

- Taxable interest reduces effective yield

- No capital growth component

- Limited liquidity during early years

Financial planners recommend diversifying across asset classes rather than relying solely on fixed-income instruments.

Expert View: When Is POMIS Suitable?

Certified financial planners suggest the scheme is most appropriate for:

- Retirees seeking predictable monthly income

- Risk-averse individuals with surplus funds

- Investors looking for capital preservation

It may not suit young investors seeking long-term wealth creation, where equities historically deliver higher returns.

Conclusion

The Post Office Monthly Income Scheme remains a cornerstone of India’s small savings ecosystem. With sovereign backing, fixed monthly payouts, and nationwide accessibility, it continues to appeal to conservative investors prioritising stability over growth.

However, taxation, inflation, and opportunity costs must be carefully evaluated. As financial markets evolve, the scheme’s attractiveness will depend largely on interest rate revisions and broader economic conditions.

For many households, it remains a dependable income source. But as experts emphasise, informed decision-making requires comparing returns, liquidity, and long-term financial goals.