If you have ever wished your savings behaved like a mini salary, landing in your account every month without stress, Post Office MIS 2025 is exactly that kind of product. Post Office MIS 2025 takes a one–time lump-sum deposit and converts it into a fixed monthly income, backed by the Government of India, with far less drama than the stock market or risky corporate bonds. In simple terms, Post Office MIS 2025 lets you park your money safely for five years and enjoy guaranteed interest every month. With smart planning and proper use of single and joint accounts in a family, this safe deposit can be structured to generate a monthly income that can come close to figures like ₹19,000, especially when combined with other steady-income products.

Post Office MIS 2025 is a small savings scheme designed for people who value peace of mind more than chasing high-risk returns. You deposit a fixed amount once, lock it for five years, and in return you receive interest every month directly into your savings account. The principal comes back to you in full at maturity, so you can decide again what to do with it. Because the scheme is run by India Post under the Government of India, it appeals strongly to retirees, homemakers, and conservative investors who are tired of market ups and downs. Instead of worrying about daily NAVs or stock prices, you know exactly how much you have invested, the rate you are earning, and roughly how much will arrive every month. That predictability is the real charm of Post Office MIS 2025.

Post Office MIS 2025 Overview

| Particulars | Details |

|---|---|

| Scheme Name | Post Office Monthly Income Scheme 2025 |

| Scheme Type | Government-backed small savings scheme |

| Organised By | India Post, Government of India |

| Minimum Deposit | ₹1,000 (in multiples of ₹1,000) |

| Maximum Deposit (Single Account) | ₹9 lakh |

| Maximum Deposit (Joint Account) | ₹15 lakh |

| Tenure / Lock-in Period | 5 years |

| Interest Payout | Monthly, credited to savings account |

| Principal Repayment | Returned in full at maturity |

| Eligible Investors | Resident individuals; single, joint, and minor accounts |

| Premature Closure | Allowed after 1 year with penalty on principal |

| Tax Treatment | No 80C benefit; interest is fully taxable |

Post Office MIS 2025

To understand how a safe deposit can generate a sizable monthly income, you need only one formula:

Monthly Interest = Amount Invested × Annual Interest Rate ÷ 12

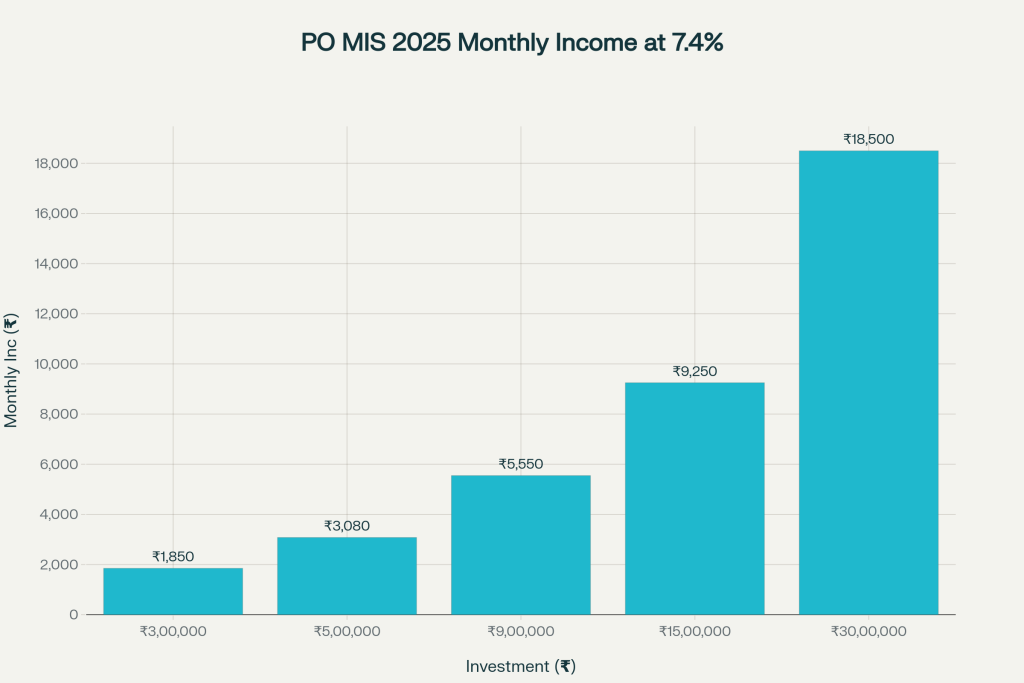

Suppose you invest ₹1,00,000. At a typical MIS rate like 7.4% per annum, your yearly interest is ₹7,400, which means your monthly payout is about ₹616. Scale this up and the picture becomes clearer:

- Around ₹3 lakh can give a modest side income every month.

- Around ₹5 lakh starts covering meaningful bills like school fees or groceries.

- A full ₹9 lakh (single account cap) can provide a noticeably useful monthly inflow for many households.

The real trick is not to get carried away by viral claims on social media showing unrealistic monthly figures from small deposits. Instead, do your own math using the simple formula and treat MIS as a serious part of your income plan, not a magic trick.

How Post Office MIS 2025 Interest Calculated

Now, how do we connect this to the famous “₹19,000 monthly income” idea? On paper, to generate ₹19,000 purely from one fixed-income product at a mid–single-digit interest rate, you would need a fairly large capital base. Under Post Office MIS 2025, you are also limited by the maximum deposit allowed per account and per individual.

That is why, in practice, families use a combination of accounts and products. One common pattern is:

- One or more single MIS accounts in the names of family members, respecting the individual limit.

- One or more joint MIS accounts (often husband–wife, or parent–adult child) up to the joint limit.

- Side-by-side use of other guaranteed-income schemes such as Senior Citizen Savings Scheme or bank FDs.

When you add the monthly payouts from all these together, you can reach or come close to targets like ₹15,000–₹19,000 per month in a legal and sensible way, without crossing any official investment caps.

What You Should Know About Post Office MIS 2025

Beyond returns, Post Office MIS 2025 stands out for its accessibility and ease of use. Almost anyone who is a resident individual can open an account: working professionals, pensioners, homemakers, and even minors through a guardian. Once a child turns 10, they can often operate the account themselves with proper documentation, which is a neat way to start their financial education early.

Opening the account is a very offline-friendly process, suiting people who are not comfortable with apps and trading platforms. You visit the nearest post office, fill out the MIS application form, attach PAN, Aadhaar, photographs and basic address proof, deposit your amount via cash or cheque, and the staff will issue you a passbook. From there, your only “job” is to keep an eye on monthly credits and plan how you want to spend or reinvest them.

Pros And Cons You Should Know

No product is perfect, and Post Office MIS 2025 is no exception. The biggest strengths are:

- Safety of capital because it is a government-backed small savings scheme.

- Predictable, fixed monthly income for five years, ideal for budgeting and household cash-flow planning.

- Simple structure, low entry point, and option to open single, joint, or minor accounts.

On the flip side, you must also be realistic about the limitations:

- Interest is fully taxable in your hands and can push you into a higher tax bracket if the amount is large.

- The five-year lock-in means your money is not fully liquid; premature closure is possible, but only with a penalty on principal.

- Returns, while steady, may not beat long-term inflation the way a diversified equity portfolio can. So MIS is better as a “stability layer” rather than the only investment in your life.

How To Use Post Office MIS 2025 Smartly

The smartest way to use Post Office MIS 2025 is to link it directly to specific monthly expenses. For example, you might dedicate the MIS income to your parents’ medicines, basic groceries, or a portion of house rent. That way, you know these non-negotiable costs are taken care of, regardless of what markets do.

Another powerful strategy is to “ladder” your MIS deposits. Instead of dumping everything in one account on one date, open smaller MIS accounts over several months or years. Their maturities will then be staggered, giving you flexibility to reinvest at new interest rates or redirect the corpus towards bigger goals like children’s education or home renovation. This approach also avoids the shock of all your MIS money stopping on a single maturity date.

Unified Pension Scheme 2025 — How Employees Can Lock in Half Their Salary as Lifetime Income

If your dream is to reach or approach ₹19,000 in monthly income, treat MIS 2025 as one pillar of a broader income portfolio. Combine it with:

- Senior Citizen Savings Scheme, if you or your parents are eligible.

- High-quality bank FDs or corporate deposits for additional fixed income.

- A conservative debt mutual fund, if you are comfortable with basic market risk.

By blending these products, you can balance safety, liquidity and return, rather than leaning entirely on one scheme. Always double-check the latest interest rates with official or trusted sources before investing, because these rates are reviewed periodically and can change with economic conditions.

FAQs on Post Office MIS 2025

1. Can a single deposit really give me ₹19,000 per month from MIS?

Not realistically within the official investment limits and typical interest rates. To generate ₹19,000 purely from one fixed-income product at these rates, you would need more capital than the scheme allows for a single account.

2. Is Post Office MIS 2025 better than a bank FD for monthly income?

For very conservative investors, MIS often compares well with regular bank FDs because it offers a stable, government-backed structure and a clearly defined tenure.

3. Who is Post Office MIS 2025 best suited for?

This scheme is best for retirees, pensioners, homemakers, and salaried people who want an additional guaranteed income stream without tracking markets daily.

4. What happens after the five-year tenure is over?

When the five-year period ends, your principal is returned to you, and monthly interest stops. At that point, you can either open a fresh MIS account at the then-current interest rate, shift the money into another scheme like SCSS or an FD, or use it for any financial goal.