The headline sounds tempting, but here is the straightforward truth no genuine Post Office product can turn a ₹10,000 deposit into ₹5,000 monthly interest under current government-notified rates, and Post Office FD pays interest annually, not monthly, while monthly payouts are available only through the Monthly Income Scheme at the current quarter’s rate of 7.4 percent. If your goal is steady monthly income from the Post Office, the right product is MIS, and at 7.4 percent, ₹10,000 yields about ₹62 per month, which shows why the viral claim is unrealistic and mathematically impossible in regulated schemes.

Post Office FD Scheme 2025 refers to the National Savings Time Deposit Account, a sovereign-backed fixed deposit offering tenures of 1, 2, 3, and 5 years with interest compounded quarterly but credited annually, making it a safe, predictable option for conservative savers seeking assured returns without market risk. For the October to December 2025 quarter, rates remain unchanged at 6.9 percent for 1 year, 7.0 percent for 2 years, 7.1 percent for 3 years, and 7.5 percent for 5 years, and only the 5-year TD qualifies for Section 80C tax deduction up to ₹1.5 lakh under the Income Tax Act. If monthly cash flow is what you want, pair your planning with the Post Office Monthly Income Scheme at 7.4 percent, which credits interest every month to your linked account, while using the 5-year Time Deposit for annual credit and the added tax benefit.

Post Office FD Scheme 2025

Why The ₹10,000 To ₹5,000 Claim Fails

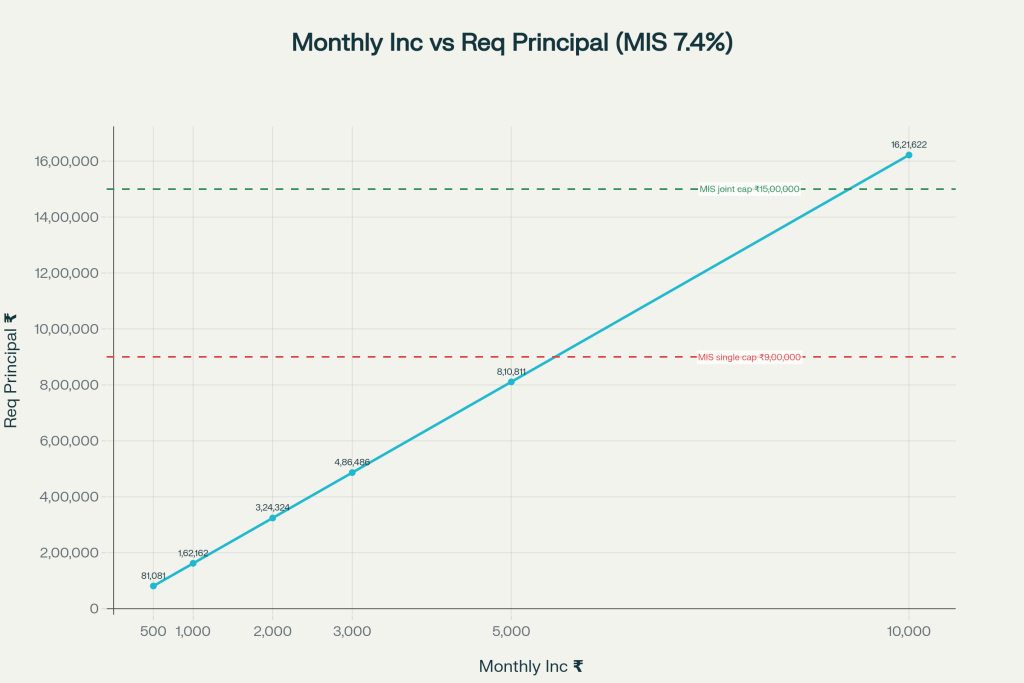

To generate ₹5,000 per month at the MIS rate of 7.4 percent, the required principal is about ₹8.11 lakh using the simple income formula P=Monthly Income×12rP=r Monthly Income×12, which shows why a ₹10,000 principal cannot deliver such a large monthly payout in any official scheme. The government has kept small savings rates unchanged for the quarter, and none of the India Post products pay anywhere near 50 percent per month, confirming the claim is outside regulated reality.

What You Actually Earn On ₹10,000

In MIS at 7.4 percent, monthly interest on ₹10,000 is 10,000×0.07412≈₹61.671210,000×0.074≈₹61.67, which is a fair, rule-based benchmark for monthly payouts on this principal under the current quarter. In the Post Office FD Scheme 2025 framework, interest is credited annually, so at 7.5 percent for the 5-year deposit, the annual interest on ₹10,000 is ₹750, not a monthly stream, because payouts are not monthly under Time Deposits.

Post Office FD Key Features

The Post Office FD Scheme 2025 offers four standard tenures 1, 2, 3, and 5 years with sovereign assurance and rates notified quarterly, providing certainty and safety for those avoiding market volatility. Interest accrues with quarterly compounding but arrives annually in your account or passbook, aligning the product with fixed-tenure accumulation and tax planning rather than month-to-month cash flow needs.

MIS The Monthly Payout Option

If you need regular cash credit to your account, the Post Office Monthly Income Scheme is the correct instrument, paying 7.4 percent per annum for the current quarter with monthly interest disbursal after the deposit is made. MIS allows deposits up to ₹9 lakh in a single account and ₹15 lakh jointly, with a minimum of ₹1,000, making it the go-to product for retirees and households that prioritize stable monthly income from a government-backed source.

Premature Closure Rules

FD premature closure is permitted after six months, but the payout is recalculated with reductions, such as earning the savings account rate for closures before one year or a rate cut for completed years on longer tenures, which investors should consider before locking in. MIS allows premature closure after one year, typically with a 2 percent deduction if closed between one and three years and 1 percent if closed between three and five years, discouraging short-horizon use.

Eligibility Documents And Opening

Resident individuals, including minors through guardians, can open both Post Office FD Scheme 2025 and MIS accounts singly or jointly at post office branches nationwide, with nomination facilities available at the time of opening. Accounts can be opened via cash or cheque, and the minimum deposit starts at ₹1,000, subject to standard KYC and account opening protocols followed by India Post.

Taxation Essentials

Only the 5-year Time Deposit qualifies for a Section 80C deduction up to ₹1.5 lakh, making it a useful tax-planning tool alongside other deductions, while interest from both FD and MIS is taxable at slab rates in the year of receipt or accrual as applicable. While TDS practices can vary and thresholds apply across instruments, investors should plan their cash flows and reinvestment on a post-tax basis to keep expectations realistic.

How To Target ₹5,000 Per Month

At a 7.4 percent MIS rate, the required principal to target ₹5,000 monthly is roughly ₹8.11 lakh, computed as P=5,000×120.074P=0.0745,000×12, which fits under the ₹9 lakh single-account cap for MIS in the current framework. Doubling the monthly target to ₹10,000 raises the required principal to around ₹16.22 lakh, which would require using a joint MIS account within the ₹15 lakh cap and possibly supplementing with a second account structure where eligible.

Where Post Office FD Scheme 2025 Fits Best

Post Office FD Scheme 2025 is ideal when the priority is guaranteed principal, sovereign backing, annual interest credit, and a clear tax angle on the 5-year deposit rather than frequent disbursals, which are better served by MIS. A blended approach allocating a portion to MIS for monthly needs and the balance to a 5-year TD for 80C can balance cash flow with long-horizon compounding in a government-backed ecosystem.

Verdict On The Claim

No official Post Office scheme pays ₹5,000 monthly on a ₹10,000 deposit, and FD interest is not paid monthly, so treating such claims as investment advice risks disappointment and misallocation of funds. Use MIS for monthly income at 7.4 percent within the ₹9 lakh or ₹15 lakh cap and use Post Office FD Scheme 2025 for annual interest and Section 80C benefits on the 5-year option for safer, smarter planning.

FAQs on Post Office FD Scheme 2025

What is the current Post Office FD interest rate for 2025

For the October to December 2025 quarter, Post Office Time Deposit rates are 6.9 percent for 1 year, 7.0 percent for 2 years, 7.1 percent for 3 years, and 7.5 percent for 5 years, as notified under the small savings schedule. These rates are implemented nationwide by India Post across branches and accounts opened during the period, with rate locking at the time of opening for the chosen tenure.

Does Post Office FD pay monthly interest

No, the Post Office FD Scheme 2025 credits interest annually while compounding quarterly, so it does not provide monthly payouts and is not suitable if a monthly income stream is mandatory. For monthly interest, the appropriate product is the Post Office Monthly Income Scheme with credits each month at the current quarter’s rate, which is 7.4 percent for this period.

What are MIS deposit limits and payout timing

MIS accepts a minimum of ₹1,000 and allows up to ₹9 lakh in a single account and ₹15 lakh in a joint account, with interest credited monthly to your linked account for reliable cash flow. This structure makes MIS a practical income ladder for retirees, homemakers, and conservative savers aiming to cover regular expenses from a sovereign-backed corpus.

Is the 5-year Post Office FD eligible for 80C

Yes, only the 5-year Time Deposit under the Post Office FD Scheme 2025 qualifies for a Section 80C deduction up to ₹1.5 lakh, while the interest earned remains taxable at the investor’s slab rate. Shorter tenures of 1, 2, or 3 years do not carry 80C benefits, so choose tenure based on both cash flow needs and tax planning goals.