If you’re looking for safe, predictable growth on a small lump sum, the Post Office ₹50000 Fixed Deposit Scheme hits that sweet spot with government backing, transparent tenures, and quarterly compounding that steadily builds your corpus. The current slabs for the Post Office Time Deposit are 6.9% for 1 year, 7.0% for 2 years, 7.1% for 3 years, and 7.5% for 5 years, giving you clear options to match your goals. Because the interest is compounded quarterly and paid annually, your ₹50000 grows efficiently while keeping cash flows simple. And if you’re using the old tax regime, the 5-year deposit also qualifies for Section 80C handy for optimizing taxes while keeping risk near-zero.

The Post Office ₹50000 Fixed Deposit Scheme, Find Out How Much You’ll Earn and the Latest Interest Rate serves readers who want a quick, practical guide to today’s rates, real-world maturity estimates, tax angles, and booking steps without fluff. The structure is straightforward: choose from 1, 2, 3, or 5 years; rates are currently 6.9%, 7.0%, 7.1%, and 7.5%; interest is calculated quarterly and credited annually; and for the 5-year term, you can claim Section 80C under the old regime. The aim is simple show you exactly how a ₹50000 deposit can work for you, how to calculate maturity cleanly, and how to align tenure with your cash-flow plans.

Post Office ₹50000 Fixed Deposit Scheme

| Item | Details |

|---|---|

| Scheme | Post Office Time Deposit (National Savings Time Deposit) |

| Tenures | 1, 2, 3, and 5 years |

| Current Rates | 1Y: 6.9% |

| Compounding | Quarterly (interest credited annually) |

| Minimum Amount | ₹1,000; subsequent multiples of ₹100 |

| Maximum Amount | No upper limit |

| Tax Benefit | 5-year TD eligible under Section 80C (old regime) |

| Safety | Sovereign guarantee (Government of India) |

| Liquidity | Premature closure after 6 months with applicable rules |

| Payout | Interest paid annually; principal at maturity |

The Post Office ₹50000 Fixed Deposit Scheme, Find Out How Much You’ll Earn and the Latest Interest Rate is a straightforward, low-risk way to grow a small lump sum with total peace of mind. You get sovereign safety, quarterly compounding, and clean annual payouts. If you want the best rate plus a tax edge, the 5-year slab at 7.5% is the standout. Use a quarterly-compounding calculator to lock your maturity expectations before you book, ladder deposits if you need staggered liquidity, and keep an eye on the rate card each quarter to decide when to roll over. For conservative savers especially those optimizing the old regime this remains one of the most dependable fixed-income anchors available today.

Latest Interest Rate

For the current quarter, Post Office Time Deposit rates are unchanged at 6.9% for 1 year, 7.0% for 2 years, 7.1% for 3 years, and 7.5% for 5 years. These are published as part of the small savings schedule and apply to new accounts opened during the quarter. Once you open your TD, your rate is locked for the full tenure, so future revisions won’t impact your existing deposit. That stability is a big reason savers prefer the Post Office route in a falling or uncertain rate environment.

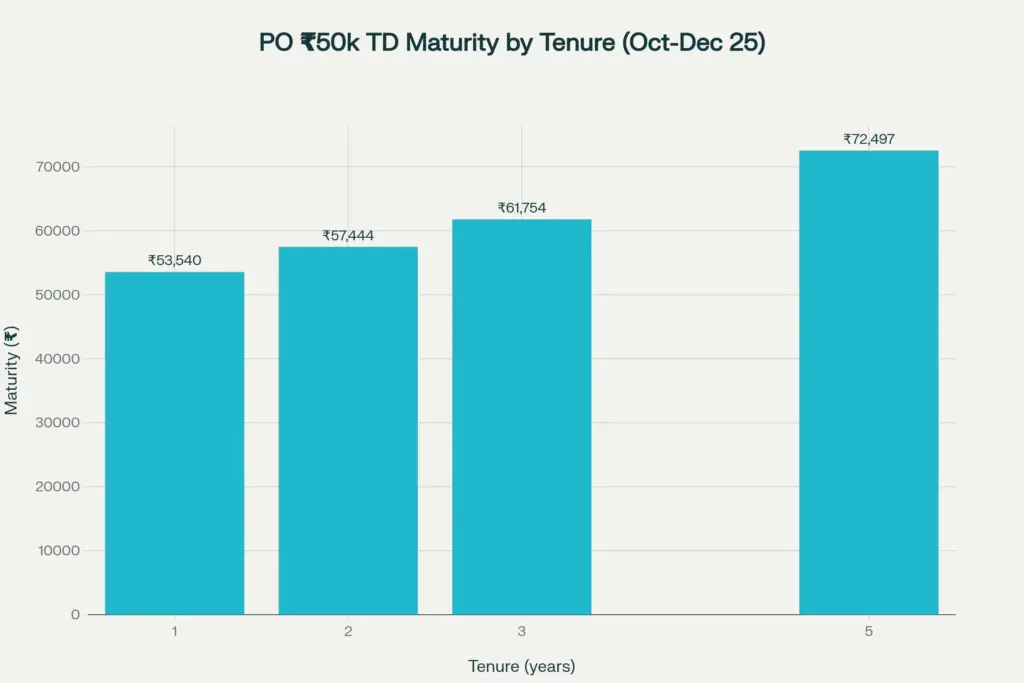

How Much You’ll Earn On ₹50000

The math is clean because interest is computed quarterly and credited once a year. To estimate maturity, use the compound interest model with quarterly frequency: M = P(1 + r/4)^(4t), where P is ₹50000, r is the annual rate (as a decimal), and t is the tenure in years. Subtract principal to get total interest.

Illustrative outcomes for ₹50000:

- 1 year at 6.9%: You earn interest aligned to the 6.9% slab with a modest quarterly compounding lift. This suits ultra-short goals and capital protection.

- 2 years at 7.0%: Slightly higher rate plus more compounding periods; good for medium-term targets without committing too long.

- 3 years at 7.1%: A practical midpoint with better compounding impact and still reasonable liquidity timing.

- 5 years at 7.5%: The highest rate and Section 80C eligibility typically the best cumulative growth on ₹50000, especially if you’re optimizing taxes under the old regime.

Pro tip: Always compute with quarterly compounding for accuracy. If you prefer quick projections, use a reliable FD calculator set to quarterly compounding and annual payout to mirror Post Office behavior. Check your annual interest credit expectation as well as the final maturity figure for clean planning.

Key Features You’ll Appreciate

- Simple Tenure Choices: Four standard tenures 1, 2, 3, and 5 years make selection easy without overthinking niche variants.

- Annual Interest Credit: Interest is added once a year, which works well if you want a scheduled payout for expenses like premiums or school fees.

- Sovereign Backing: This is as safe as it gets for a fixed-income option, ideal for first-time savers and retirees.

- Flexible Ticket Size: Start with ₹1,000 and add in multiples of ₹100, with no upper cap great for scaling beyond ₹50000 when you’re ready.

- Liquidity Levers: Premature closure is allowed after 6 months, subject to scheme rules useful if plans change.

- 5-Year Tax Edge: If you’re under the old regime, the 5-year term qualifies under Section 80C, though remember interest remains taxable.

Who Should Choose the Post Office FD

- Conservative Savers: If safety and predictability rank above chasing top yields, the Post Office ₹50000 Fixed Deposit Scheme fits like a glove.

- Retirees And First-Time Investors: The clarity of rates, sovereign guarantee, and simple payout logic reduce anxiety.

- Tax Planners (Old Regime): The 5-year option at 7.5% with Section 80C is a straightforward way to combine guaranteed returns with a tax deduction.

- Short-To-Medium Goals: For goals within 1–3 years, locking in the current slab with annual interest payout keeps things tidy and low maintenance.

Post Office Fixed Deposit Vs Rate Changes

A frequent question is whether your rate changes mid-way. It doesn’t. Once booked, your TD rate is locked until maturity. Only new deposits opened after a rate change get the revised slab. That rate certainty helps in two ways: it protects you from adverse moves if rates drop later, and it lets you plan annual interest credits against upcoming obligations with confidence.

How To Open, Documents, And Steps

- Where To Open: Any post office with counter service; many locations support digital-friendly processes alongside paper forms.

- What To Carry: Basic KYC, PAN, Aadhaar, a recent photograph, and your initial deposit channel (cash or cheque as allowed).

- Steps: Choose your tenure, fill the TD form, nominate a beneficiary, and receive your passbook/acknowledgment. You can also transfer your TD between post offices if you relocate.

- For Families: Minors over 10 years can open accounts in their name, which is a useful tool for building early, safe savings habits.

Practical Strategies to Maximize Returns

- Prefer 5-Year For The Best Rate: At 7.5%, the 5-year slab generally produces the highest maturity value on ₹50000 and adds the Section 80C benefit under the old tax regime.

- Build A Ladder: Instead of one large deposit, split into multiple TDs across tenures. You’ll unlock periodic liquidity while averaging rate opportunities over time.

- Align Payouts To Bills: Because interest is paid annually, map your credit date to big expenses insurance, school fees, or loan prepayments so the interest works harder for you.

- Reinvest Smartly: On maturity, review prevailing rates. If the 5-year slab is still attractive and you don’t need liquidity roll into the fresh 5-year bucket to keep compounding at the top rate.

How To Calculate Maturity Quickly

If you want quick, credible numbers without doing the algebra each time, use a calculator configured as follows:

- Principal: ₹50000

- Tenure: 1, 2, 3, or 5 years

- Rate: 6.9%, 7.0%, 7.1%, or 7.5%

- Compounding: Quarterly

- Payout: Annual

You’ll see two useful outputs: the annual interest credit projection and the final maturity amount—both vital for cash-flow planning.

Common Mistakes to Avoid

- Ignoring Tax On Interest: Only the 5-year principal is eligible under Section 80C (old regime). Interest itself is taxable as “Income from Other Sources.”

- Assuming Senior Citizen Uplift: Unlike many banks, the Post Office FD does not offer a higher rate for seniors. If you want a senior-friendly rate bump, consider Senior Citizen Savings Scheme instead.

- Overlooking Premature Closure Rules: You can break the FD after six months, but the applied interest may be lower than the contracted rate and subject to scheme rules. Set your tenure realistically.

FAQs on Post Office ₹50000 Fixed Deposit Scheme

Do Post Office FD Rates Change For Existing Accounts?

No. Your booked rate remains fixed till maturity. Only new deposits opened after a revision get the updated slab.

What Is the Current 5-Year Post Office FD Rate?

The 5-year slab is 7.5% per annum this quarter, which is the highest among the four available tenures.

How Is Interest Calculated and Paid?

Interest is calculated using quarterly compounding but credited annually to your linked account or as per the scheme’s annual payout rules. The principal is returned at maturity.

Is The 5-Year Post Office FD Eligible For Tax Benefits?

Yes. Under the old tax regime, the 5-year Time Deposit qualifies for Section 80C. Interest remains taxable, so plan your taxes accordingly.