Starting a small business in India is exciting, but let’s be honest, arranging money is often the hardest part. Most people don’t have assets to offer as collateral, and traditional banks can feel intimidating for first-time entrepreneurs. This is where PM Mudra Yojana has made a real difference.

Designed especially for micro and small business owners, PM Mudra Yojana helps turn business ideas into reality by providing collateral-free loans through banks and financial institutions. Over the years, PM Mudra Yojana has become a lifeline for shopkeepers, street vendors, artisans, service providers, and small manufacturers. Still, many applicants either misunderstand the scheme or make avoidable mistakes that lead to delays or rejection. This detailed guide explains the scheme in simple terms, clears common doubts, and helps you understand how to use PM Mudra Yojana the right way.

The PM Mudra Yojana is a flagship government scheme launched to promote entrepreneurship and self-employment among India’s small business owners. The scheme focuses on non-corporate, non-farm enterprises that usually struggle to access formal credit. These include businesses in manufacturing, trading, and the service sector. The core idea behind PM Mudra Yojana is financial inclusion. Many micro entrepreneurs depend on local moneylenders who charge extremely high interest. This scheme brings such businesses into the banking system and offers loans at reasonable rates, without asking for collateral. Loans are provided through public and private banks, regional rural banks, NBFCs, and microfinance institutions, making the scheme accessible across urban and rural India.

PM Mudra Yojana

| Particulars | Details |

|---|---|

| Scheme Name | Pradhan Mantri Mudra Yojana |

| Launch Year | 2015 |

| Maximum Loan Amount | ₹10 lakh |

| Collateral Required | No |

| Target Group | Micro and small entrepreneurs |

| Loan Categories | Shishu, Kishor, Tarun |

| Lending Institutions | Banks, NBFCs, MFIs |

| Eligible Sectors | Manufacturing, trading, services |

What Is Pradhan Mantri Mudra Yojana

- Pradhan Mantri Mudra Yojana was introduced to support income-generating activities at the grassroots level. The scheme does not fund personal expenses. Instead, it strictly supports business-related needs such as purchasing equipment, raw materials, tools, or expanding operations.

- The scheme is suitable for both new and existing businesses. Whether someone wants to start a small tailoring shop or expand an existing food processing unit, PM Mudra Yojana offers structured financial support based on the stage of the business.

Objectives Of Pradhan Mantri Mudra Yojana

- One of the main objectives of PM Mudra Yojana is to encourage entrepreneurship among people who have skills but lack capital. By offering collateral-free loans, the scheme reduces dependence on informal credit sources.

- Another important objective is employment generation. When small businesses grow, they create local jobs and strengthen the economy from the ground up. The scheme also aims to improve financial literacy and promote formal banking habits among small entrepreneurs.

Salient Features of Pradhan Mantri Mudra Yojana

- PM Mudra Yojana stands out because of its simple structure and borrower-friendly approach. The most important feature is that no collateral or security is required. This makes the scheme accessible to people who do not own property or assets.

- Loans are provided in stages, allowing businesses to grow gradually. Interest rates are regulated and vary depending on the lending institution. The documentation process is simpler than traditional business loans, and repayment periods are flexible, based on the borrower’s income flow.

Eligibility Criteria for PM Mudra Yojana

To apply under PM Mudra Yojana, the applicant must be an Indian citizen. The business should be non-corporate and non-farm in nature. Eligible businesses include proprietorships, partnerships, and small enterprises engaged in manufacturing, trading, or services. Applicants should have a viable business plan and should not be defaulters with any bank or financial institution. While the scheme does not demand collateral, banks still evaluate the repayment capacity of the borrower.

Types Of Loans Under PM Mudra Yojana

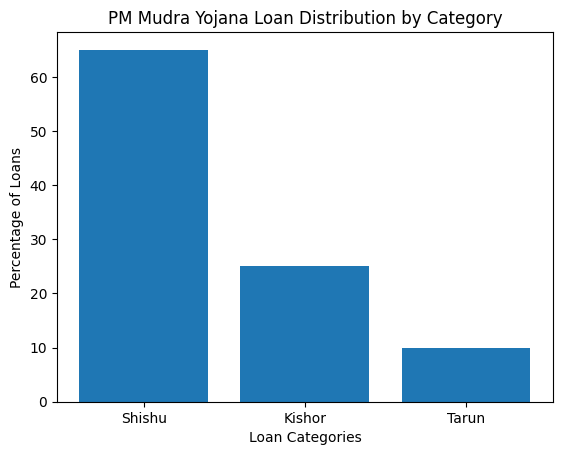

PM Mudra Yojana offers three categories of loans based on business size and funding requirements.

Shishu Loan

Shishu loans are meant for startups and very small businesses. The loan amount goes up to ₹50,000. This category is ideal for first-time entrepreneurs who need funds for basic setup, tools, or initial working capital.

Kishor Loan

Kishor loans range from ₹50,001 to ₹5 lakh. These loans are suitable for businesses that have started operations and are now looking to expand. Funds can be used for purchasing machinery, hiring staff, or increasing inventory.

Tarun Loan

Tarun loans range from ₹5 lakh to ₹10 lakh and are meant for well-established businesses. This category supports expansion, modernization, and scaling up operations.

Interest Rate Under PM Mudra Yojana

- The interest rate under PM Mudra Yojana is decided by the lending institution, following RBI guidelines. There is no fixed rate across all banks. The final rate depends on factors such as loan amount, business profile, and credit history.

- Compared to informal lending sources, interest rates under PM Mudra Yojana are generally affordable. This makes repayment easier and helps businesses manage cash flow more effectively.

Documents Required for PM Mudra Yojana

- Submitting complete and correct documents is critical for loan approval. Commonly required documents include identity proof such as Aadhaar or PAN, address proof, recent bank statements, and business-related documents like shop registration or trade license.

- For higher loan amounts, lenders may also ask for a basic business plan or quotations for equipment to be purchased. Requirements may vary slightly from one bank to another.

How To Apply for PM Mudra Yojana

- Applicants can apply for PM Mudra Yojana either by visiting a bank branch or through online portals provided by banks. The process starts with filling out the application form and submitting the required documents.

- After submission, the bank verifies the documents and assesses the business proposal. If approved, the loan amount is disbursed directly into the applicant’s bank account. The processing time depends on the lender and the completeness of the application.

Common Mistakes People Make While Applying

- Many applicants assume that PM Mudra Yojana guarantees automatic approval, which is not true. One common mistake is applying without a clear business plan. Banks want to know how the money will be used and how the business will generate income.

- Another frequent error is choosing the wrong loan category. Applying for a higher loan amount without business justification often leads to rejection. Incomplete documentation, ignoring credit history, and expecting instant disbursement are other common mistakes that applicants should avoid.

Benefits Of PM Mudra Yojana

The biggest benefit of PM Mudra Yojana is access to collateral-free credit. It empowers small entrepreneurs who were earlier excluded from formal banking. The scheme also helps build a credit history, which is useful for future loans. By supporting micro enterprises, PM Mudra Yojana contributes to local economic development, job creation, and financial inclusion. The structured loan categories encourage responsible borrowing and steady business growth.

FAQs On PM Mudra Yojana

Is PM Mudra Yojana only for new businesses

No, both new and existing micro enterprises can apply based on their funding needs.

Do I need collateral for a Mudra loan

No, PM Mudra Yojana offers loans without any collateral or security.

Can service-based businesses apply

Yes, service providers such as salons, repair shops, and small consultancies are eligible.

How long does loan approval take

Approval timelines vary by lender, but it usually takes a few weeks after document verification.