Starting a small business in India is no longer just a dream limited by lack of funds. With growing government support and easier access to credit, entrepreneurs today have far better opportunities than a decade ago. One such initiative that has transformed the small business landscape is PM Mudra Yojana.

This scheme was created to help micro and small entrepreneurs who struggle to get loans from traditional banking channels due to lack of collateral or credit history. If you are planning to start a business or expand an existing one, PM Mudra Yojana can be a practical financing solution. It offers collateral-free loans, flexible repayment options, and an easy application process. In this guide, we will walk you through the online application process, eligibility rules, loan types, benefits, and the most common mistakes applicants make so you can avoid delays or rejection.

PM Mudra Yojana is a government-backed loan scheme designed specifically for micro, small, and non-corporate businesses. The main goal of the scheme is to promote self-employment and entrepreneurship across India, especially in rural and semi-urban areas. Under this scheme, financial institutions provide loans to individuals who want to start or grow income-generating activities without asking for collateral. The scheme operates through banks, non-banking financial companies, microfinance institutions, and regional rural banks. It supports businesses involved in manufacturing, trading, and service activities. What makes PM Mudra Yojana unique is its structured loan categories, which align funding with the growth stage of the business. With online application facilities now available, accessing these loans has become simpler and more transparent.

PM Mudra Yojana Overview Table

| Feature | Details |

|---|---|

| Scheme Name | Pradhan Mantri Mudra Yojana |

| Maximum Loan Amount | Up to ₹10 lakh |

| Loan Categories | Shishu, Kishore, Tarun |

| Collateral Requirement | None |

| Interest Rate | As per lender guidelines |

| Repayment Period | Up to 5 years |

| Eligible Borrowers | Individuals, MSMEs, traders, service providers |

| Application Mode | Online and Offline |

| Implementing Institutions | Banks, NBFCs, MFIs, RRBs |

What Is Pradhan Mantri Mudra Yojana

- Pradhan Mantri Mudra Yojana is aimed at strengthening the backbone of India’s economy, which is made up of small businesses and self-employed individuals. The scheme provides financial assistance to enterprises that are not covered under large corporate lending frameworks. This includes shopkeepers, artisans, vendors, small manufacturers, and service providers.

- The loans can be used for a variety of business purposes such as purchasing equipment, buying raw materials, meeting working capital needs, or expanding operations. Since the loans are collateral-free, they reduce the financial risk for new entrepreneurs. Lenders assess the business idea, cash flow potential, and repayment ability rather than property or asset ownership.

Types Of Loans Under PM Mudra Yojana

PM Mudra Yojana offers three distinct loan categories based on the funding needs and growth stage of the business.

Shishu Loan

Shishu loans are designed for startups and very small businesses. The maximum loan amount under this category is ₹50,000. It is ideal for individuals who are just beginning their entrepreneurial journey and need basic funding to start operations.

Kishore Loan

Kishore loans range from ₹50,001 to ₹5 lakh. These loans are suitable for businesses that are already operational and need additional funds for expansion, inventory purchase, or working capital.

Tarun Loan

Tarun loans offer funding from ₹5 lakh to ₹10 lakh. This category is meant for established businesses with a proven track record that are looking to scale up, modernize equipment, or expand into new markets.

Eligibility Criteria for PM Mudra Yojana

- To apply for PM Mudra Yojana, the applicant must be an Indian citizen. The business should be involved in non-farm income-generating activities such as manufacturing, trading, or services. Both new and existing businesses are eligible under the scheme.

- The enterprise must fall under the micro or small business category. While there is no strict income requirement, lenders evaluate the applicant’s repayment capacity. Maintaining basic financial records and having a clear business plan improves the chances of approval.

Documents Required for PM Mudra Yojana

Although document requirements may vary slightly depending on the lender, most institutions ask for the following:

- Identity proof such as Aadhaar card or PAN card

- Address proof

- Passport-size photographs

- Business proof or project report

- Bank account details

- Income proof or bank statements, if required

Ensuring that all documents are accurate and up to date helps avoid unnecessary delays during verification.

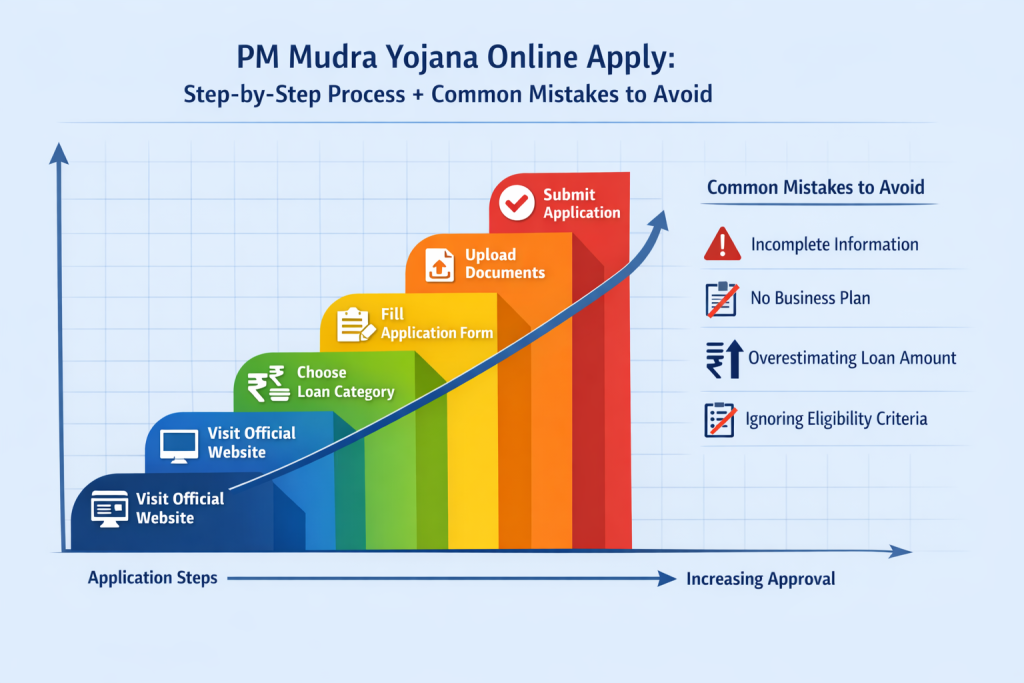

PM Mudra Yojana Online Apply Step by Step Process

Applying for PM Mudra Yojana online is convenient and time-saving when done correctly. Below is the step-by-step process:

- Visit the official Mudra portal or the website of a participating bank

- Choose the loan category that matches your funding requirement

- Fill in the online application form carefully

- Provide personal, business, and financial details accurately

- Upload the required documents

- Submit the application

After submission, the lender reviews the application and verifies the documents. If approved, the loan amount is credited directly to the applicant’s bank account.

Common Mistakes to Avoid

- Many applicants face delays or rejection due to avoidable errors. One common mistake is submitting incomplete or incorrect information. Even small mismatches in personal or business details can slow down the approval process.

- Another mistake is applying for a loan amount that does not match actual business needs. Requesting a higher amount without justification can raise concerns about repayment ability. Lack of a basic business plan is also a major issue. Even a simple outline of expected income and expenses can significantly improve credibility.

- Applicants should also check eligibility criteria before applying. Applying through multiple lenders simultaneously without proper planning can negatively affect approval chances.

Benefits Of PM Mudra Yojana

- PM Mudra Yojana offers several benefits that make it attractive to small entrepreneurs. The biggest advantage is collateral-free financing, which removes a major barrier for first-time borrowers. Flexible repayment periods help manage cash flow effectively.

- The scheme encourages formalization of small businesses and promotes financial inclusion. By providing easy access to credit, it supports employment generation and contributes to local economic growth.

FAQs on PM Mudra Yojana

1. What Is the Maximum Loan Amount Under PM Mudra Yojanaa

The maximum loan amount available under PM Mudra Yojana is ₹10 lakh under the Tarun category.

2. Is Collateral Required for PM Mudra Yojana Loans

No, all loans under PM Mudra Yojana are completely collateral-free.

3. Can I Apply for PM Mudra Yojana Online

Yes, most banks and financial institutions allow online applications through their official websites.

4. Who Can Apply for PM Mudra Yojana

Small business owners, traders, vendors, artisans, and self-employed individuals engaged in non-farm activities can apply.