PM Mudra Loan Yojana 2025 is one of the most searched options for small business owners who want funding without getting stuck in long, complicated loan formalities. PM Mudra Loan Yojana 2025 is built for micro and small entrepreneurs who need money for inventory, tools, setup costs, or day-to-day working capital and want to apply through trusted lenders like banks and other eligible institutions. If you’re planning to start a new business or expand an existing one, PM Mudra Loan Yojana 2025 can be a practical route because it offers structured categories that match different business stages. PM Mudra Loan Yojana 2025 is also popular because it focuses on enabling credit access for small units that often struggle to meet typical “big loan” requirements.

PM Mudra Loan Yojana 2025 works under the Pradhan Mantri Mudra Yojana framework, where loans are offered in three clear categories so borrowers can choose based on business stage and funding requirement. The idea is simple: start small if your business is at the beginning, then move to the next level as you grow and stabilize. That “growth ladder” approach is what makes PM Mudra Loan Yojana 2025 feel more realistic than a one-size-fits-all business loan.

PM Mudra Loan Yojana 2025

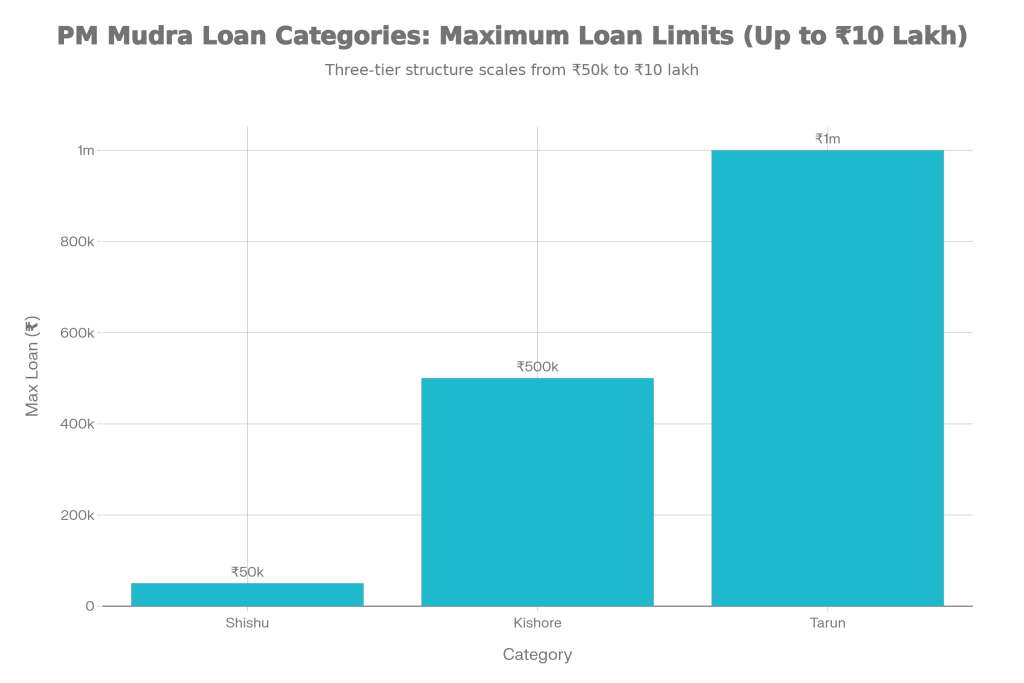

Under the MUDRA framework, the offerings are structured into Shishu, Kishore, and Tarun to reflect where a business stands in its journey. This structure matters because it helps the lender and the borrower stay aligned: a first-time entrepreneur usually needs smaller money with a simple plan, while an established shop or service unit may need higher funds for expansion.

Shishu, Kishore And Tarun

This is the most important part to understand before applying, because your category should match your genuine requirement.

- Shishu: early-stage funding needs (typically the smallest ticket size).

- Kishore: for businesses that have started operations and now need more money to build momentum.

- Tarun: for larger needs, commonly discussed up to ₹10 lakh, usually aimed at stronger expansion requirements.

A smart way to choose: don’t pick Tarun just because it sounds bigger. Pick the slab your business can actually absorb and repay comfortably. That one decision can save you from both rejection and repayment stress.

Types Of Lending Support

PM Mudra Loan Yojana 2025 is delivered through multiple kinds of eligible lenders, not only a single bank. This matters because different lenders may have different comfort levels with different business types, and their internal processes can vary even if the loan is under the same PMMY umbrella.

In practical terms, this means:

- You can approach a bank branch where you already have an account and transaction history.

- You can also check other eligible lending institutions if your business model fits their appetite better.

So if one place delays, it doesn’t automatically mean “Mudra loan is not possible.” Often it’s just a lender-level process issue, not a scheme issue.

Eligible Criteria for PM Mudra Loan Yojana 2025

PMMY is meant for non-farm income generating activities across manufacturing, trading, and services, which is why it fits everything from a kirana store to a repair shop to a small service business. The framework also includes “activities allied to agriculture” such as dairy, fishery, poultry, bee keeping, food/agro-processing, while clearly excluding crop loans and land improvement works.

Examples of activities that commonly align well:

- Small retail shop or wholesale trading

- Salon, tailoring, boutique, coaching/service center

- Mobile/electronics repair, small workshop

- Food cart, tiffin service, small bakery-type unit

- Dairy/poultry/fishery-type allied activities (where applicable)

When applying, the more clearly you explain “what the money is for,” the smoother the appraisal tends to be.

How To Apply For PM Mudra Loan Yojana 2025

Here’s the clean, no-confusion path that works for most applicants.

- Decide your category (Shishu/Kishore/Tarun) based on business stage and amount actually needed.

- Prepare a short business note: what you do, what you sell, expected monthly sales, and where the loan amount will be used.

- Approach a bank or eligible lending institution that offers PMMY loans and submit your request under PM Mudra Loan Yojana 2025.

- If your requirement includes working capital, ask about working capital handling and the MUDRA Card concept (where offered/eligible).

- Respond quickly to any document or clarification request from the lender to avoid file delays.

Small tip that genuinely helps: walk in with numbers. Even basic estimates (rent, inventory, raw material, expected profit margin) make you look serious and “fundable.”

Documents You Should Keep Ready

Exact documentation varies by lender, but your goal should be to keep a complete, clean file so your application doesn’t get stuck for avoidable reasons.

Commonly asked items include:

- ID proof and address proof

- Passport-size photographs

- Business proof (as applicable)

- Bank statements and basic income/transaction visibility (especially if business is running)

If the business is brand new, lenders may rely more on your profile, background, and clarity of plan. If it’s existing, they’ll typically look closely at cash flow signals.

PM Subhadra Yojana Odisha 2025: Massive Benefits for Women – Application, Eligibility & Big Updates!

Important Warning No Agents

This is a critical safety point. The official MUDRA framework clearly highlights that no agents or middlemen are engaged for availing Mudra loans. So if anyone claims “100% guaranteed Mudra loan” and asks for money upfront, treat it as a red flag.

Do this instead:

- Apply directly through a lender.

- Pay only legitimate, lender-issued charges (if any) through official channels.

- Never share OTPs, card details, or passwords with anyone.