PM-Kisan 2026 Updated Rules, Eligibility and Payment Process Explained is something every beneficiary farmer now needs to understand clearly if they want their annual support of 6,000 rupees to keep coming on time without interruptions. By knowing the updated rules, eligibility norms, and the exact payment process, you can avoid common mistakes that lead to delayed or stopped installments and make sure your name stays in the active beneficiary list.

PM-Kisan 2026 Updated Rules, Eligibility and Payment Process Explained basically brings together all the key points you must know: how much money you get, who is eligible, who is excluded, what e-KYC rules apply, and how the money actually reaches your bank account. The focus has now shifted from just enrolling farmers to cleaning and verifying data at every step – even a small mismatch in land records, Aadhaar, bank details, or e-KYC can affect your payment status. The government wants to ensure that only genuine, landholding farmers receive the benefit, so by 2026 the system has become more strict and technology-driven, with tighter checks on duplicate and fake entries.

PM-Kisan 2026

| Point | Details |

|---|---|

| Scheme Name | Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) |

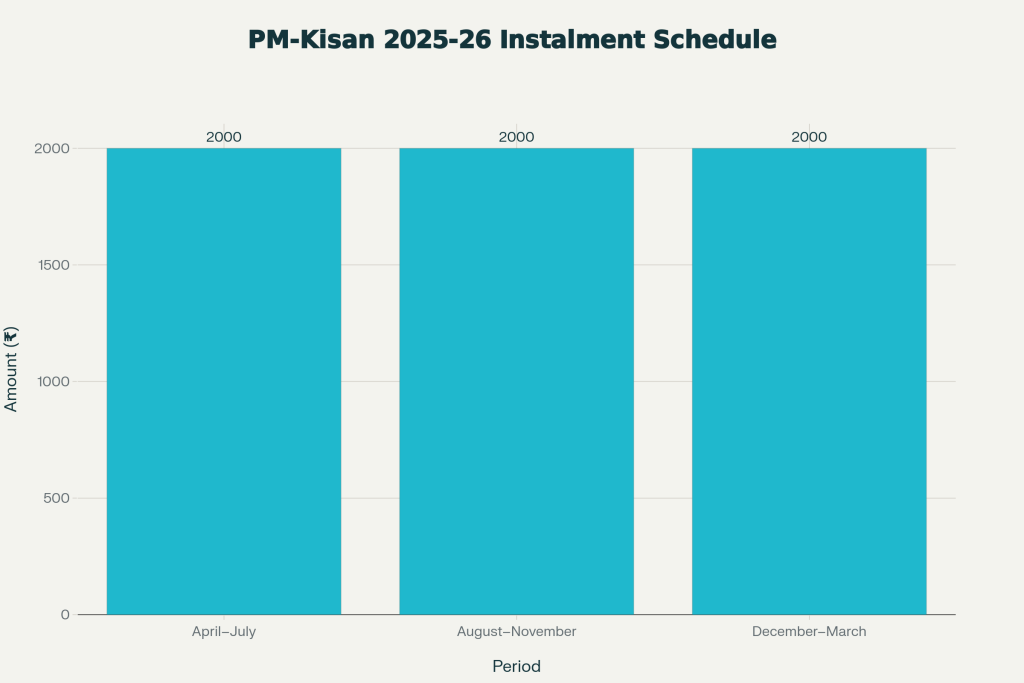

| Yearly Benefit | ₹6,000 per farmer family, paid as three installments of ₹2,000 each |

| Installment Cycle | April–July, August–November, December–March |

| Recent Trend | 21st installment released in November 2025; next installment expected in early 2026 |

| Payment Mode | Direct Benefit Transfer (DBT) into Aadhaar-seeded bank account |

| KYC Requirement | e-KYC mandatory; deadline extended up to March 2026 |

| Basic Eligibility | Landholding farmer families with cultivable land in their own name |

| Excluded Groups | Income-tax payers, many categories of government employees, institutional landholders |

| Official Portal | pmkisan.gov.in for registration, beneficiary status, list, and e-KYC |

What Is PM-Kisan And Why It Matters

PM-Kisan is a central government income-support scheme under which eligible farmer families receive 6,000 rupees per year directly in their bank account to help with routine agricultural expenses like seeds, fertilizers, pesticides and fuel. The amount may look modest, but three installments spread across the year provide timely cash flow right when farmers usually need working capital for seasonal operations.

Since its launch in 2019, crores of farmers have received multiple installments and the scheme has become a stable support system for small and marginal farmers in particular. By 2026, the objective is not just to send money, but also to ensure transparency and accuracy so that farmers themselves can track every installment online instead of depending on middlemen or rumors.

Eligibility, Exclusions, And Updated Rules For PM-Kisan 2026

- Eligibility starts with land ownership. To qualify for PM-Kisan, you must be part of a farmer family that owns cultivable land recorded in the state revenue records in your or your family’s name. For the scheme, a “family” usually means husband, wife and minor children together, and the entire family is treated as a single unit eligible for only one benefit, regardless of how much land they hold.

- In the case of jointly owned land, eligibility and family count are usually decided on the basis of the share mentioned in revenue records, and the same updated records are uploaded to the PM-Kisan portal by the state. If there are errors in your name, your father’s name, survey numbers, or other land details, it is important to correct them at the local revenue office; otherwise, the system can easily mark your record as ineligible or “on hold.”

- Now, who is excluded? Institutional landholders, most regular government employees and officers, retired employees drawing higher pensions, and individuals who pay income tax are generally not allowed to receive PM-Kisan benefits even if they own agricultural land. If someone from these excluded categories has received installments due to wrong or incomplete information, recovery and further action are possible, so voluntarily opting out is usually the safer route.

- For 2026, some of the most important updated rules relate to e-KYC and database verification. e-KYC has been made fully mandatory for all beneficiaries, and the deadline has been extended to March 2026 to give farmers more time to complete the process. Under the updated system, any mismatch between Aadhaar, bank account and land records – or multiple applications from members of the same family – can mark a case as “duplicate” or “suspect,” which may immediately stop future installments until corrected.

Payment Process, e-KYC, And Online Status Check for PM-Kisan 2026

- The PM-Kisan payment process is fully digital and functions through Direct Benefit Transfer into your Aadhaar-linked bank account. First, state governments prepare and verify the list of eligible farmers and upload it onto the scheme’s central portal, where the data is then cross-checked with Aadhaar, bank databases and land records.

- Once the central government approves a particular installment, funds are released through the national payment system to crores of accounts in a single go, as was done for the 21st installment in November 2025. If your bank account is closed, the IFSC code is wrong, or the bank raises any technical objection, the transaction may show as “failed” or “returned,” and the amount will not reach you until the issues are resolved.

- That is why e-KYC is now at the heart of the scheme. Under PM-Kisan 2026 Updated Rules, Eligibility and Payment Process Explained, no beneficiary is considered fully valid until e-KYC is completed successfully. You can complete e-KYC online using OTP authentication on the official portal, or offline through the nearest Common Service Centre using biometric or face authentication.

- Checking your status online is equally important. By entering your registered mobile number, Aadhaar number or bank account number on the official portal, you can see your Beneficiary Status in detail. This page usually shows whether your installment has been credited, is pending, on hold, failed, or rejected, and may also show brief reasons or response codes that help you decide whether to visit the bank, revenue office, or a service centre.

- It is a good habit to check your status at least once before and once after every installment cycle. Doing this regularly allows you to catch and fix issues like KYC pending, bank mismatch or land record errors before they affect more than one installment. Timely correction can make the difference between a smooth payment experience and months of delay.

Practical Tips To Stay Eligible In 2026

- If you want to stay safely on the active list in 2026, start by treating your records like an important asset. Make sure your Aadhaar is correctly linked to both your bank account and your mobile number, and keep your passbook and SMS alerts handy around installment dates. Complete your e-KYC well before the deadline instead of waiting for the last week, when service centres and portals usually get overloaded.

- Next, keep your land documents updated. If there has been any change – such as inheritance, sale, partition or correction in your name – get it properly recorded in the revenue records and ensure that this updated information reaches the PM-Kisan database through your state authorities. This step is especially important for families with joint land or complex ownership patterns, where mistakes commonly occur.

Finally, in families where more than one member owns land or has applied separately, sit together and check that only one valid application exists for the entire family unit as defined under PM-Kisan. Removing duplicates proactively can prevent your payments from getting flagged or blocked later under the tightened verification rules for 2026.