PM Awas Yojana 2.0: New Applications Open for Affordable Housing Who Can Apply and How It Works is a fresh opportunity for lakhs of families who were either stuck due to limited savings or scared of long-term loan pressure. In this phase, the focus is on Economically Weaker Section (EWS), Lower Income Group (LIG) and Middle-Income Group (MIG) families living in urban areas. The core idea is simple: make decent housing affordable through a mix of direct financial support and interest subsidy on home loans so that tenants, slum dwellers and families in kutcha houses can move into safe, permanent homes.

It has set an ambitious target of supporting around 1 crore urban low and middle income families over the next few years. The scheme works through four main channels: direct support for families building on their own plots, affordable flats in partnership projects, rental housing for tenants at reasonable rates, and heavy interest subsidy on eligible home loans. If you are a first-time homebuyer or planning to replace an old kutcha house with a pucca one, this scheme can reduce your upfront cost as well as your monthly EMI over the long term.

PM Awas Yojana 2.0

| Point | Details |

|---|---|

| Scheme Name | Pradhan Mantri Awas Yojana – Urban 2.0 (PMAY-U 2.0) |

| Focus | Affordable pucca houses for urban low and middle income families |

| Target | Around 1 crore families to be covered with housing or housing support |

| Main Verticals | Beneficiary Led Construction, Affordable Housing In Partnership, Affordable Rental Housing, Interest Subsidy Scheme |

| Eligible Categories | EWS, LIG, MIG-I, MIG-II urban families |

| Core Condition | The family must not own a pucca house anywhere in India |

| Form Of Support | Direct financial assistance on house cost + interest subsidy on home loans |

| Indicative Benefit | Net saving of roughly 1.5–1.8 lakh rupees possible (depending on house price and loan) |

| Application Channels | Online portals/apps or through nearby urban local bodies/CSC centres |

| Priority Groups | Widows/single women, persons with disabilities, SC/ST, minorities, sanitation workers, street vendors, urban workers and others |

Who Can Apply Under Pm Awas Yojana 2.0

The most important eligibility condition under this scheme is that the applicant’s family should not own any pucca house anywhere in the country. The husband, wife and unmarried children together are counted as one “family”. This means if even one of them already owns a pucca house, the others cannot claim separate benefits under the scheme. The programme is primarily meant for those who are currently living in rented homes, slums, informal settlements, chawls or semi-permanent structures and want to own a home for the first time.

The second key filter is annual family income. EWS usually covers families with the lowest annual income (up to a defined limit), LIG includes slightly higher but still modest-income households and MIG categories cover middle-income families within prescribed ranges. Based on these income brackets, the allowable carpet area of the house, the loan limits and subsidy structure are decided. Many states also encourage registration of the house in a woman’s name or in joint ownership, so that women get a stronger legal stake in the family home.

Income Categories And Eligibility Criteria for PM Awas Yojana 2.0

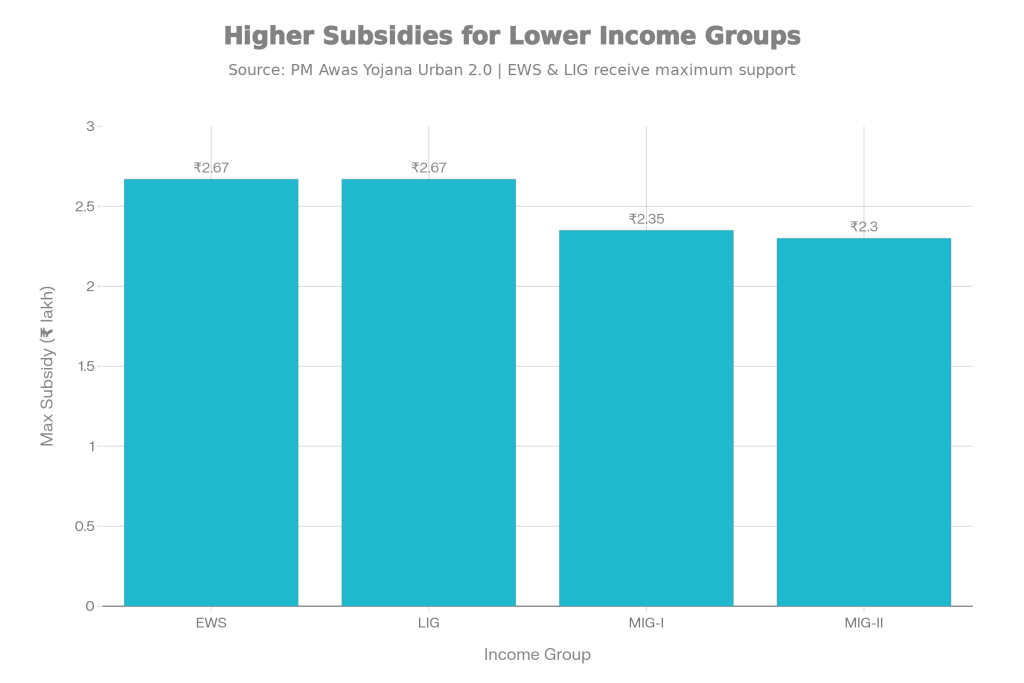

If you want to benefit from Pm Awas Yojana 2.0, you must first understand which income category your family falls into. EWS covers families with the lowest annual income and these households generally receive the highest focus and relief. For them, smaller, compact units or 1 BHK type homes with limited carpet area are planned so that costs stay low and more families can be covered under the available budget.

LIG families, whose income is higher than EWS but still tight, are allowed slightly bigger units so that the family can live comfortably without stretching the budget too far. For MIG-I and MIG-II, both the house size and loan ceilings are higher, but the interest subsidy structure is adjusted accordingly. Overall, the objective is to keep the price and EMI within the paying capacity of different income brackets, while still giving them a decent, livable home.

Types Of Benefits Available Under The PM Awas Yojana 2.0

Pm Awas Yojana 2.0 offers two major types of relief – it lowers your house cost and it brings down your loan cost. Families who are building a house on their own plot or reconstructing a kutcha or dilapidated house into a pucca one can get direct financial assistance released in stages. This means a part of the construction cost is effectively shared by the government, reducing how much you need to arrange from savings or loans.

For those taking a home loan from a bank or housing finance company, the scheme gives interest subsidy. This subsidy is not paid as cash in your hand; instead, it is credited directly into your loan account. That reduces the outstanding principal and your EMI drops accordingly. Over the full tenure of the loan, this can translate into substantial savings in interest – sometimes running into lakhs of rupees depending on the loan amount and duration. That is why Pm Awas Yojana 2.0 is seen as a strong support system even for middle income families.

How Pm Awas Yojana 2.0 Works Step By Step

Once you submit your application and it is approved after verification, your case is tagged under one of the scheme’s verticals. For example, if you own a small plot and want to construct your own house, you will typically fall under the Beneficiary Led Construction category. Here, the grant is released in multiple instalments linked to construction stages – foundation, structure and finishing – so that the money is used for actual building progress.

If you are buying a flat in an approved project, you might be covered under Affordable Housing In Partnership or the Interest Subsidy vertical. In such cases, the government and states work together to keep project prices affordable and at the same time provide interest subsidy on your home loan. The whole system is increasingly being digitised to make the process transparent, traceable and less dependent on middlemen. As a beneficiary, you should be able to see the impact either in the instalments you receive or in the reduction in your loan balance and EMI.

Online Application Process For Pm Awas Yojana 2.0

To apply online, you need to visit the official PMAY Urban portals or authorised platforms and start a new application. Initially, you will be asked for basic details such as your state, city and category (EWS, LIG, MIG etc.) so that the system can quickly check whether you fall within the core eligibility framework. If you pass this preliminary check, you proceed to Aadhaar-based verification, where you enter your Aadhaar number and name and confirm it through an OTP sent to your registered mobile number.

After this, a detailed application form opens. Here you must provide information about family members, total income, current living conditions (rented, slum, kutcha house etc.), your housing requirement, bank account details and job or occupation details. You may also need to specify whether you plan to build on your own plot or buy a flat in a project and give an approximate idea of your expected loan amount. Once you submit the form, you receive a unique application or assessment ID. Keep this ID safe, because it is the key to tracking your application status and is often required when you coordinate with banks or housing finance companies.

Offline Route: Help From CSC And Local Bodies

Not everyone is comfortable filling out online forms or scanning and uploading documents. To address this, the scheme also allows you to apply through Common Service Centres (CSCs), municipal corporations, municipal councils and other urban local bodies. At these centres, trained operators fill your online application on your behalf, verify the Aadhaar details and upload the necessary documents. They may charge a small service fee for this assistance, but your application still goes into the same central digital system.

The advantage is that even those with limited digital skills or access can still benefit from Pm Awas Yojana 2.0 without depending on private agents. You will receive the same kind of application ID and can later check your status online or by returning to the centre. The key is to make sure you only use authorised government-linked centres or offices and avoid handing money to any middleman who claims to “guarantee” subsidy or fast approval. The scheme has defined rules and approvals, and no private agent can override those.

Documents Required For Smooth Approval

Proper documentation is critical in Pm Awas Yojana 2.0 because incomplete or incorrect papers are a common reason for delays or rejections. Aadhaar is the primary identity document for both the applicant and family members, helping the system avoid duplicate claims and maintain accurate records. Your bank account details, preferably a savings account linked to Aadhaar, are equally important, as grants and subsidy adjustments are linked directly to your bank or loan account.

To prove your income, you may be asked for an income certificate, salary slips, PAN and in some cases, income tax returns. For address and identity verification, documents like ration card, voter ID, electricity bill or water bill are usually accepted. If you have already been identified in any earlier urban housing or slum survey, the survey ID or reference number can also help speed up verification. The more accurate and consistent your documents are, the smoother your approval journey is likely to be.

Priority Groups And Special Focus

This is its strong focus on vulnerable groups. These include widows and single women heading households, people with disabilities, senior citizens, Scheduled Castes, Scheduled Tribes, other backward classes, minority communities, sanitation workers, street vendors and various categories of urban workers. During selection and approval, such families often receive higher priority so that those in the most difficult conditions are helped first.

In many cities, slum clusters have been identified for dedicated rehabilitation projects. In these, old and unsafe shacks or tin-roof structures are replaced by multi-storey pucca flats, and eligible families are allotted units within the same or nearby area. Even in these projects, beneficiaries must provide correct details of their family, income and identity, so that the final allotment list is fair and transparent. This way, the scheme combines physical redevelopment of the city with social protection for its poorest residents.

Kisan Subsidy: चारा कटाई मशीन पर सरकारी छूट! किसान तुरंत भरें फॉर्म, बड़ा फायदा

Smart Tips To Get Maximum Benefit

To truly benefit from this scheme, you need more than just a filled form. Start by comparing your current rent with a realistic EMI you can manage, keeping in mind your monthly income, existing liabilities and expected house price. Then estimate the likely loan amount and tenure. This basic homework will help you understand how much relief Pm Awas Yojana 2.0 can actually give you and whether a particular house or flat is really within your comfort zone.

Always provide honest and accurate information. Exaggerating income, hiding an existing property or giving a wrong address may seem tempting in the short term but can easily lead to rejection at the verification stage or even future recovery actions. Keep your application ID safe, check your status periodically and respond quickly if any additional documents are requested. With clear documentation, timely follow-up and a realistic choice of property and loan, Pm Awas Yojana 2.0: New Applications Open for Affordable Housing Who Can Apply and How It Works can genuinely become your steppingstone from a rented house to an owned, secure and stable home for your family.