If you have been putting off small corrections in your Aadhaar or haven’t checked your PAN status in a while, act now because the PAN Card Rule Changed and even a minor mismatch can make your PAN inoperative for taxes and daily banking workflows starting this compliance cycle. The PAN Card Rule Changed also means Aadhaar–PAN linking deadlines and real-time Aadhaar checks now decide whether your PAN works for refunds, KYC, and investments, so getting your details aligned before year end is the smartest move.

The PAN Card Rule Changed puts data accuracy at the center: Aadhaar details must match PAN, your Aadhaar must be active, and your mobile should be linked for OTP because banks and the tax portal increasingly rely on instant Aadhaar validation to allow KYC and PAN linkage. From July 1, 2025, new PAN applications require Aadhaar OTP verification, so an inactive Aadhaar, a mismatched name or DOB, or an unlinked mobile can cause immediate rejection. Alongside that, UIDAI’s digital update flow and revised fee structure from November 1, 2025 make it easier to correct Aadhaar details online, which is the fastest way to avoid linkage failures and inoperative PAN status.

PAN Card Rule Changed

Aadhaar–PAN Linking Deadline

Under the updated framework, Aadhaar–PAN linking remains compulsory for taxpayers, with a focused extension that allows those who received PAN using an Aadhaar enrolment ID to link by December 31, 2025, failing which the PAN becomes inoperative from January 1, 2026. For others who missed earlier deadlines, the linkage still requires completion with applicable late fee norms under current guidance to restore normal operability. Inoperative PAN disrupts filings, refunds, and can trigger higher TDS or TCS until the linkage is completed and reflected as operative in systems.

Revised Fees and Simplified Digital KYC

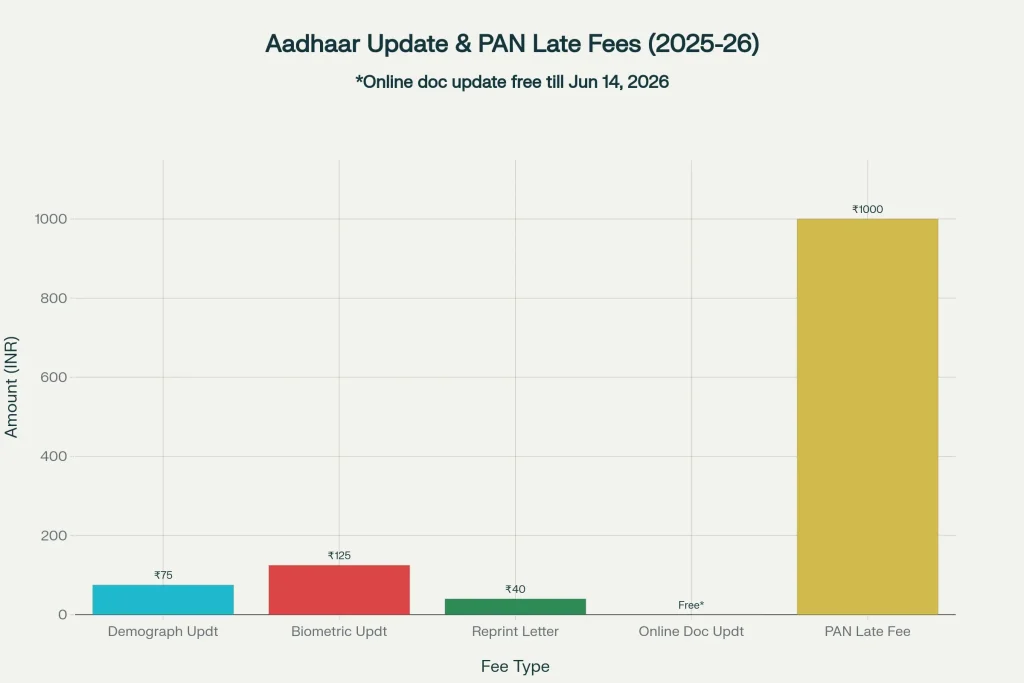

UIDAI has enabled a paperless path for demographic updates through myAadhaar, letting you fix name, address, date of birth, and mobile entirely online to prevent Aadhaar–PAN mismatches that usually derail linkage. The fee is ₹75 for demographic edits and ₹125 for biometric updates, while online document updates are free till June 14, 2026, helping taxpayers clean up data before critical tax deadlines. Banks and financial institutions can proceed with Aadhaar-based KYC only if the Aadhaar is active and non-duplicate, so correcting Aadhaar first is the most reliable way to avoid repeated KYC failures.

Why A Small Error Can Inactivate Your PAN

Most linkage failures come down to minor discrepancies in name spelling, date of birth formats, or an Aadhaar that isn’t linked to the right mobile number for OTP, and the PAN Card Rule Changed pushes these validations to the front of every application or KYC. If the system cannot match or authenticate in real time, your linkage request fails or your PAN remains inoperative, which then cascades into blocked refunds and higher TDS/TCS under the operative rules. That is why updating Aadhaar first and confirming OTP readiness cuts down on errors and speeds up PAN reactivation or new PAN issuance.

How To Complete Linking Without Roadblocks

Start by checking Aadhaar status and ensuring the mobile number is current, then use the free online document update window to make any demographic corrections needed to match your PAN precisely. After that, submit the Aadhaar–PAN link request on the income-tax e-filing portal and recheck status before major payout dates to avoid higher TDS/TCS on interest, dividends, or other receipts. If your PAN was inoperative and higher rates applied in the interim, use CBDT Circular 9/2025 with your deductor to regularize rates after operability is restored.

Aadhaar Based Verification for New PAN

From July 1, 2025, Aadhaar OTP verification is a must for new PAN applications, which eliminates paper back-and-forth but demands that your Aadhaar be active, accurate, and OTP-ready at the time of application. A mismatch in personal details or a dormant mobile link can stop issuance in its tracks, so clear Aadhaar corrections first and then apply to reduce rejections. The PAN Card Rule Changed makes this sequence essential for first-time applicants and responsible persons seeking PAN for firms or entities.

What Changes for Everyday Banking And KYC

Banks and NBFCs lean on Aadhaar-based KYC to onboard and service customers, but only if UIDAI confirms the Aadhaar is active and non-duplicate under the revised rules. That means a stale Aadhaar record can block video KYC, demat opening, mutual fund onboarding, or even routine updates until the record is cleaned up and revalidated. Fixing Aadhaar first and then running KYC keeps your PAN linkage and account services smooth and avoids surprise declines.

Action Plan to Stay Compliant

- Verify Aadhaar demographics and update online through myAadhaar so your PAN details match exactly.

- Confirm your Aadhaar-linked mobile number is active because OTP is central to linkage and KYC.

- Link Aadhaar–PAN on the e-filing portal and check status before payout cycles to avoid higher TDS/TCS.

- If PAN was inoperative and higher rates applied, ask the deductor to rectify using CBDT Circular 9/2025 once your PAN turns operative.

- For new PAN, complete Aadhaar corrections first, then apply so the real-time OTP step succeeds on the first attempt.