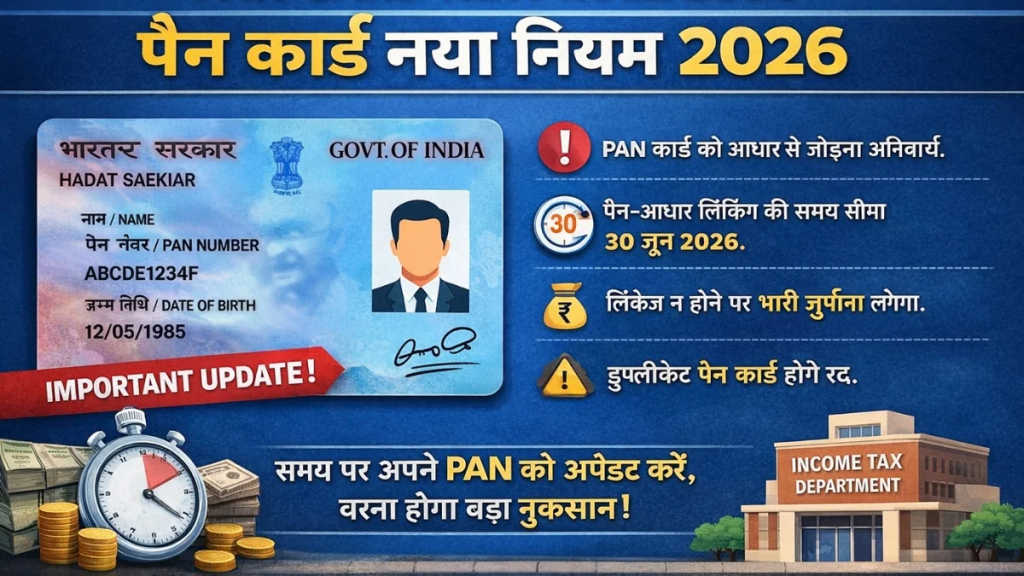

The government has introduced PAN Card New Rules 2026, and these updates are far more serious than many people realize. For decades, the PAN card has quietly worked in the background of our financial lives. From filing income tax returns to opening bank accounts, investing, and even buying property, PAN is everywhere.

But with the new rules coming into effect in 2026, treating PAN compliance casually could land you in real trouble. The authorities are clearly tightening the system, and anyone who ignores these changes may face blocked services, higher taxes, or delayed refunds. What makes PAN Card New Rules 2026 especially important is that they affect almost everyone, salaried employees, business owners, freelancers, students, and retirees alike. These rules are designed to clean up the system, remove fake or duplicate PAN cards, and ensure that every financial identity is properly verified. If you depend on smooth banking and tax related processes, understanding these changes is no longer optional.

The PAN Card New Rules 2026 focus on stronger identity verification, tighter compliance, and increased use of digital systems. Under these rules, PAN is no longer just a static document you apply for once and forget. It must stay active, verified, and correctly linked with other identity records. The biggest changes include mandatory Aadhaar linking, stricter action against duplicate PAN cards, increased importance of digital PAN, and tougher KYC checks by banks and financial institutions. Together, these updates aim to make financial transactions more transparent and prevent misuse of the PAN system.

PAN Card New Rules 2026

| Area Of Change | Key Update |

|---|---|

| Aadhaar Linking | PAN must be linked with Aadhaar to remain active |

| PAN Status | Unlinked PAN can become inoperative |

| Digital PAN | e PAN encouraged for faster verification |

| Duplicate PAN | Penalties for holding more than one PAN |

| KYC Verification | PAN details must match Aadhaar and bank records |

| Tax Filing | Inoperative PAN can block returns and refunds |

The PAN Card New Rules 2026 mark a significant shift in how financial identity is managed in India. These changes are not meant to trouble honest citizens but to strengthen transparency and trust in the system. Ignoring them, however, can lead to serious financial disruptions. Taking a few proactive steps today can ensure that your PAN remains active, verified, and problem free in the years ahead.

Mandatory Aadhaar Linking

- One of the most crucial updates under PAN Card New Rules 2026 is mandatory Aadhaar linking. This step is no longer a suggestion or optional compliance task. If your PAN is not linked with Aadhaar within the prescribed timeline, it may be marked as inoperative. An inoperative PAN cannot be freely used for tax filing, banking, or high value transactions.

- The reason behind this move is simple. Aadhaar based verification ensures that each PAN belongs to one genuine individual. This helps eliminate fake identities and multiple PAN cards issued to the same person. While linking PAN with Aadhaar takes only a few minutes online, failing to do so can create long term financial inconvenience.

What Does Inoperative PAN Really Mean

- Many people misunderstand the term inoperative and assume it means PAN is cancelled forever. That is not exactly the case, but the impact is still severe. Under PAN Card New Rules 2026, an inoperative PAN loses its functionality for most practical purposes.

- If your PAN becomes inoperative, you may not be able to file income tax returns on time. Refunds could get stuck. Employers and banks may deduct tax at a higher rate. Investment platforms might restrict transactions. Even basic services like updating bank details or applying for loans can become difficult. While reactivating PAN is possible after Aadhaar linking, the process can take time and cause unnecessary stress.

Increased Focus on Digital PAN

Another major shift introduced by PAN Card New Rules 2026 is the push toward digital PAN or e PAN. The government is encouraging citizens to use digital PAN because it is easier to verify, store, and share securely. Unlike physical cards, e PAN can be accessed instantly and used for online KYC and verification processes. Digital PAN fits well with the growing digital financial ecosystem. Banks, stockbrokers, and fintech platforms increasingly prefer e PAN for faster onboarding and compliance checks. While physical PAN cards will continue to exist, digital PAN is becoming the preferred option for most transactions.

Strict Action Against Duplicate PAN Cards

Holding more than one PAN card has always been illegal, but enforcement is becoming much stricter under the new rules. With improved data matching and Aadhaar integration, identifying duplicate PANs is now easier than ever. Under PAN Card New Rules 2026, individuals found holding multiple PAN cards may face penalties, cancellation of PAN, or legal consequences. Even if duplicate PANs were issued unintentionally years ago, they still need to be addressed. Anyone who suspects they have more than one PAN should surrender the extra card immediately to avoid future problems.

Tighter KYC And Data Matching

- The new rules also introduce stricter Know Your Customer checks. PAN details must now match exactly with Aadhaar and other financial records. Even small mismatches in name spelling, date of birth, or mobile number can lead to verification failures.

- Banks, insurance companies, and investment platforms are required to periodically re verify PAN details. If inconsistencies are found, services may be restricted until corrections are made. These tighter KYC rules under PAN Card New Rules 2026 are meant to reduce fraud but require individuals to keep their records accurate and updated.

Impact On Income Tax Filing

- Income tax filing is one of the areas most affected by these new rules. An active and verified PAN is essential for filing returns, claiming refunds, and responding to tax notices. If your PAN is inoperative, filing returns can become complicated or even impossible.

- Additionally, incorrect PAN details can delay refunds or trigger compliance notices. Under PAN Card New Rules 2026, maintaining a clean and active PAN record is essential for hassle free tax compliance.

How These Rules Affect Every day Financial Activities

The effects of PAN Card New Rules 2026 go beyond taxes. PAN is required for opening bank accounts, applying for loans, investing in mutual funds, trading stocks, purchasing property, and even certain high value purchases. If your PAN is inactive or mismatched, these activities may be delayed or denied altogether. Financial institutions are now legally required to verify PAN status before processing transactions. This makes early compliance more important than ever.

How To Stay Compliant And Avoid Trouble

- Staying compliant with PAN Card New Rules 2026 is simple if you take timely action. First, check whether your PAN is linked with Aadhaar. Second, ensure your personal details match across PAN, Aadhaar, and bank records. Third, confirm that you hold only one PAN card. Lastly, consider downloading and using your digital PAN for convenience.

- Regularly reviewing your PAN status can save you from last minute issues, penalties, and service disruptions. The system is becoming stricter, but compliance is straightforward if handled early.

Ladka Bhau Yojana 2026: How to Apply, Eligibility, and All the Benefits You Need to Know!

Common Mistakes People Should Avoid

- One common mistake is assuming that old PAN cards are automatically compliant. Another is ignoring mismatch warnings from banks or tax portals. Some people also believe that Aadhaar linking can be done anytime, which is risky under the new rules.

- Avoiding these mistakes ensures that PAN Card New Rules 2026 do not create unnecessary complications in your financial life.

FAQs on PAN Card New Rules 2026

Is Aadhaar Linking Mandatory Under PAN Card New Rules 2026

Yes, Aadhaar linking is mandatory to keep PAN active and usable.

Can An Inoperative PAN Be Reactivated

Yes, PAN can usually be reactivated after Aadhaar linking, but delays can cause inconvenience.

Is Digital PAN Accepted Everywhere

Digital PAN is legally valid and widely accepted for banking, tax, and investment purposes.

What Happens If I Have Two PAN Cards

Holding multiple PAN cards can attract penalties, and extra PANs should be surrendered immediately.