If you hold a PAN, the new compliance push for the current year tightens what you must do right now, especially around PAN Aadhaar linking, inoperative PAN consequences, and time bound relief windows for deductors and collectors under the latest circulars, so it is wise to get ahead of the curve today. The PAN card new guidelines are not cosmetic tweaks but concrete rules that decide whether your refunds flow on time, whether higher TDS or TCS hits your payouts, and whether your day-to-day financial transactions move smoothly or get stuck due to an inoperative PAN status.

The PAN card new guidelines for the current year revolve around two pillars that every taxpayer and payor needs to understand at once, first, if your PAN is not linked with Aadhaar where required, it goes inoperative and stays that way until you complete linkage, and second, relief windows under CBDT Circular 9 2025 protect deductors and collectors from higher rate demands if the PAN is made operative within specific timelines tied to the date of payment or credit. For those who got a PAN using an Aadhaar enrolment ID before October two thousand twenty four, there is a dedicated window through December thirty one two thousand twenty five to update with the final Aadhaar number, after which the PAN can turn inoperative from January one two thousand twenty six if you still do not comply, so do not wait until the last week of December to act under the PAN card new guidelines.

PAN Card Holders Beware

PAN Aadhaar Linking 2025

PAN Aadhaar linking remains mandatory for eligible individuals who were allotted PAN and are eligible to obtain Aadhaar, and any non linking pushes the PAN into inoperative status until the Aadhaar number is duly intimated and validated on the portal. If your PAN was allotted against an Aadhaar enrolment ID, you should now update to the final Aadhaar number within the dedicated two thousand twenty five window so that your PAN does not lapse into inoperative status as the year turns under the PAN card new guidelines.

Consequences For Not Linking PAN With Aadhaar Number

Once a PAN becomes inoperative, the department does not issue refunds and does not pay interest for the entire period during which the PAN stays inoperative, which can add up to real money if you typically receive a refund each year. During the inoperative window, the higher TDS or TCS rate rules under Sections 206AA and 206CC apply until the PAN is restored by successful Aadhaar linkage, which directly increases cash outflows for many routine transactions.

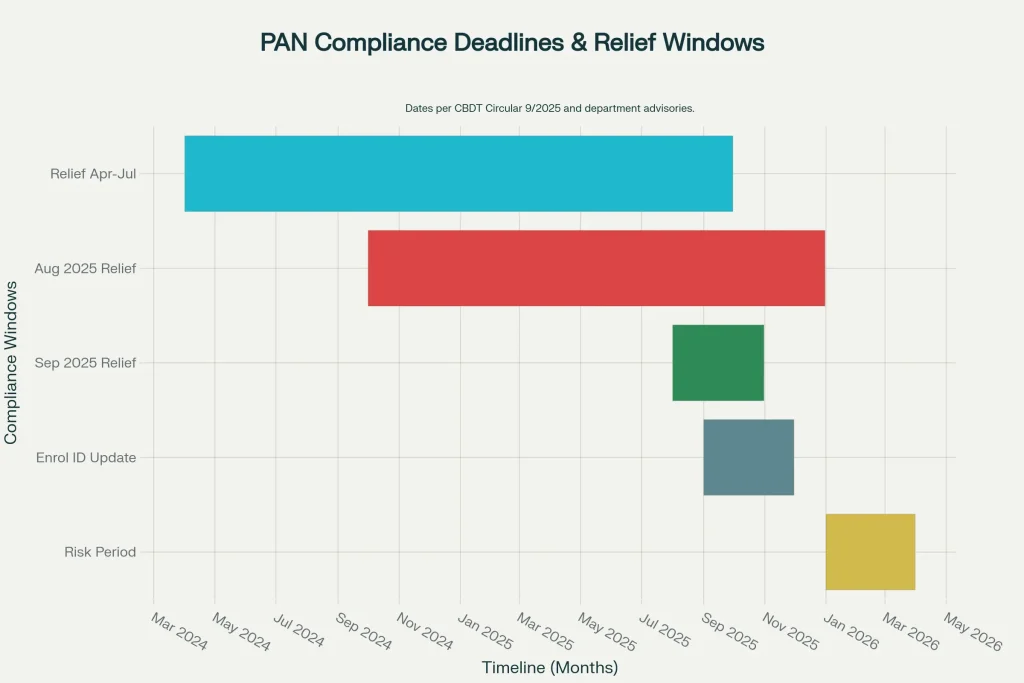

CBDT Circular No. 9 2025 Relief On Higher TDS TCS

Circular 9 two thousand twenty five recognizes the practical challenge faced by many deductors and collectors who handled inoperative PANs, and it provides that no higher rate demand will stand for payments from April one two thousand twenty four to July thirty one two thousand twenty five if the PAN became operative by September thirty two thousand twenty five. For payments on or after August one two thousand twenty five, the same relief principle applies when the PAN is made operative within two months from the end of the month in which the payment or credit was made, subject to the usual Chapter seventeen framework under the PAN card new guidelines.

Transactions In Which Quoting Of PAN Is Mandatory

PAN must be quoted for a long list of specified transactions, including opening certain bank accounts, time deposits beyond notified thresholds, demat accounts, credit or debit card applications, purchase or sale of immovable property, and large value purchases of goods or services, so a working PAN is essential to everyday finance. Financial institutions report many of these transactions through the Statement of Financial Transactions system, so accurate PAN quoting and an operative PAN reduce the chance of compliance queries.

High Value Transactions and SFT Why It Matters

Banks, mutual funds, registrars, and other entities file Form 61A to report large deposits, big investments, and property deals, which the department cross checks against your declared income and TDS or TCS trail. If your PAN is inoperative or not quoted correctly, the mismatch risk rises sharply, and you may receive nudges or notices through the e campaign compliance portal asking for explanations, which are avoidable with timely linkage and accurate PAN usage under the PAN card new guidelines.

How To Link Aadhaar Number With PAN

You can link without logging in by using the Link Aadhaar feature on the e filing portal, entering PAN and Aadhaar and validating with a one time password, which takes only a few minutes if your data already matches. If there are name or date of birth mismatches, resolve them first through UIDAI or with assisted support at authorized centres, then submit the request and check your link status through the same portal or status checker for peace of mind under the PAN card new guidelines.

Penalty For Not Complying With Provisions Relating To PAN Or Aadhaar

The department may levy a penalty up to ten thousand rupees per default for failure to obtain, quote, or authenticate PAN where mandated, and this is distinct from the fee that applies when reactivating an inoperative PAN through Aadhaar linkage. Treat these as two different issues, one being a late fee to restore operability and the other being a penalty for failing to follow the quoting or authentication rules in the first place under the PAN card new guidelines.

Who Is Exempt From Aadhaar Requirement

Exemptions exist for residents of Assam, Jammu and Kashmir, and Meghalaya, for non residents under the Income Tax Act, for those aged eighty or more, and for non citizens, but general quoting obligations for specified transactions may still apply separately. Those in exempt categories may choose to link voluntarily for convenience, but they are not subject to inoperative consequences due to Aadhaar non linking under the current framework and the PAN card new guidelines.

Practical Compliance Checklist for PAN Holders

Verify your PAN Aadhaar link status today and complete linkage right away if pending, since doing so avoids higher TDS TCS exposure and refund delays that occur during an inoperative period under Rule 114 AAA and the PAN card new guidelines. If you deduct or collect tax and any counterparty had an inoperative PAN, map the transaction dates to the Circular 9 two thousand twenty five relief conditions and obtain proof that the PAN is now operative to close out potential higher rate queries under the PAN card new guidelines.

Why These PAN Card New Guidelines Matter Right Now

The PAN card new guidelines are designed to remove ambiguity for payors and payees by tying relief directly to the date of payment and by making operability status the central trigger that controls higher rate exposure, which is practical for businesses that manage vendor payments and reimbursements. For individuals, the PAN card new guidelines cut the number of surprises by clearly stating that refunds and refund interest will not move while the PAN is inoperative, which creates a strong incentive to link early and keep records clean.

How To Future Proof Your PAN Compliance Under PAN Card New Guidelines

- First, keep your PAN Aadhaar linkage confirmed and take a screenshot or acknowledgement for your files, because you will likely need that in future KYC refreshes or loan underwriting under the PAN card new guidelines.

- Second, standardize vendor onboarding and client intake to capture PAN along with a declaration of current operability, which is a simple one line addition that reduces disputes and keeps you aligned with Circular 9 two thousand twenty five protections.

Common Mistakes to Avoid Under PAN Card New Guidelines

Do not assume that payment processors or banks will validate your PAN operability in time for your refund or your payout, since the responsibility sits with you to ensure proper linkage and quoting across transactions under the PAN card new guidelines. Do not wait for the last week of December if you are in the enrolment ID cohort, because holiday season slowdowns at service centres and data mismatch corrections can easily spill your case into January and flip your PAN to inoperative under the PAN card new guidelines.

FAQs on PAN Card Holders Beware

What happens to my tax refund if my PAN is inoperative

Will higher TDS or TCS demands be waived if the PAN is later made operative

Yes, Circular 9 two thousand twenty-five provides that no higher rate demand stands for payments from April one two thousand twenty-four to July thirty-one two thousand twenty-five if the PAN became operative by September thirty-two thousand twenty-five.