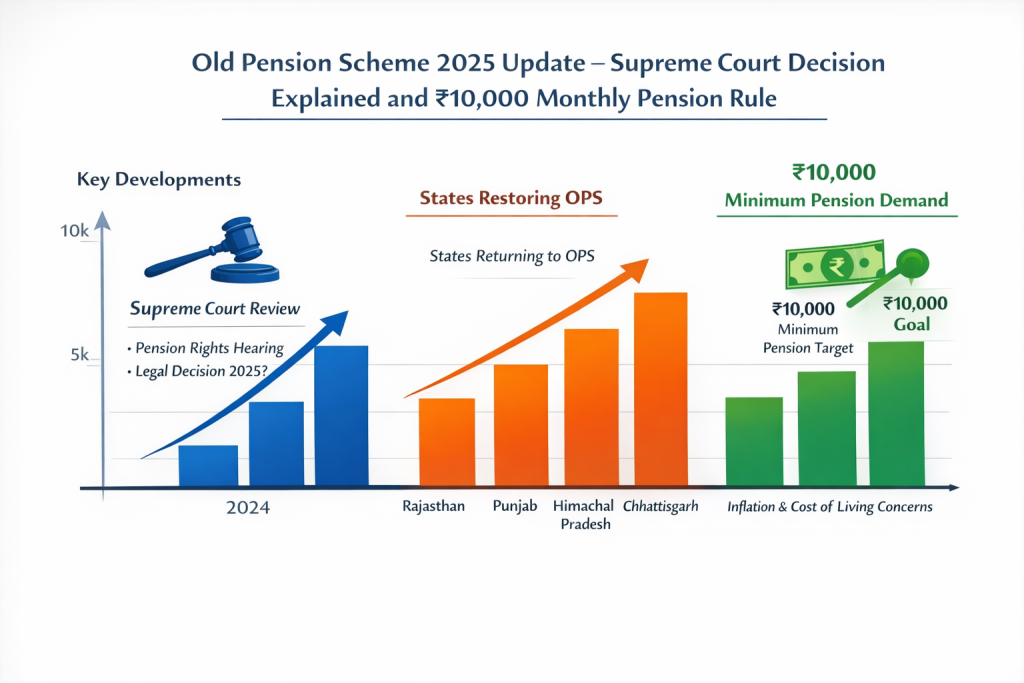

The Old Pension Scheme 2025 Update has emerged as one of the most talked-about issues among government employees, pensioners, and policymakers in India. Retirement planning, which was once considered predictable for government staff, has now become a topic of uncertainty and debate. With inflation rising and life expectancy increasing, employees are demanding stronger financial protection after retirement. This is where the Old Pension Scheme 2025 Update becomes critically important, as it directly affects income security for lakhs of families. In recent months, discussions around pension reforms, court hearings, and state government decisions have intensified. The Old Pension Scheme 2025 Update is not just about restoring an old system; it represents a broader demand for dignity, stability, and fairness for employees who dedicate their working lives to public service. From Supreme Court observations to the ₹10000 minimum monthly pension proposal, every development is being watched closely.

The Old Pension Scheme 2025 Update is expected to be a defining moment in India’s pension landscape. Government employees covered under the National Pension System have been raising concerns about uncertainty in post-retirement income. Market-linked returns, lack of a guaranteed pension, and rising living costs have pushed employees to demand reforms or a return to OPS-like benefits. This update focuses on two major expectations. First, clarity from the Supreme Court regarding pension rights. Second, the proposal for a ₹10000 minimum monthly pension to ensure basic financial security. The Old Pension Scheme 2025 Update is therefore being seen as a potential turning point that could reshape retirement benefits for current and future government employees.

Old Pension Scheme 2025 Update

| Aspect | Details |

|---|---|

| Scheme Name | Old Pension Scheme |

| Update Year | 2025 |

| Pension Type | Defined benefit |

| Nature Of Pension | Fixed and guaranteed |

| Supreme Court Role | Hearing pension related matters |

| Minimum Pension Demand | ₹10000 per month |

| Market Risk | None |

| Financial Responsibility | Government funded |

| Key Concern | Post-retirement income security |

The Old Pension Scheme 2025 Update represents a crucial phase in India’s pension journey. With Supreme Court observations, growing employee demands, and the proposal for a ₹10000 minimum monthly pension, the coming year could redefine retirement security for millions. While challenges remain, the debate itself reflects a broader recognition that pension systems must evolve to meet the realities of modern life. As 2025 approaches, all eyes remain on the decisions that will shape the future of government pensions in India.

What Is The Old Pension Scheme

- The Old Pension Scheme is a traditional retirement system designed for government employees. Under this scheme, an employee receives a fixed monthly pension after retirement. The pension amount is generally calculated as 50 percent of the last drawn basic salary, along with applicable dearness relief.

- One of the biggest strengths of OPS is predictability. Employees know in advance what their pension will be, allowing them to plan their retirement without fear of income fluctuations. There is no market exposure, and the government takes full responsibility for pension payments. The renewed interest driven by the Old Pension Scheme 2025 Update highlights how important financial certainty is for retirees.

Difference Between OPS And NPS

- The transition from OPS to the National Pension System marked a major shift in retirement policy. NPS is a contribution-based system where both employees and the government invest money in market-linked funds. The final pension depends on market performance, which introduces uncertainty.

- OPS, on the other hand, offers a guaranteed pension for life, along with family pension benefits. Under NPS, there is no assured minimum pension unless additional safeguards are introduced. This fundamental difference has fueled dissatisfaction among employees and is a key reason behind the growing attention on the Old Pension Scheme 2025 Update.

Supreme Court Decision on Pension Matters

- The Supreme Court has repeatedly emphasized that pension is not a gift or charity, but a right earned through years of service. Several petitions related to pension equality, minimum pension guarantees, and protection for NPS employees are currently under consideration.

- While no blanket order restoring OPS nationwide has been issued so far, the court’s observations have strengthened employee demands. Many believe the Old Pension Scheme 2025 Update may include important judicial guidance that could influence future pension reforms and government decisions.

₹10000 Monthly Pension Rule Explained

- The demand for a ₹10000 monthly pension has gained strong momentum due to economic realities. Retirees argue that rising costs of healthcare, housing, and daily necessities make lower pension amounts inadequate.

- The proposed ₹10000 minimum monthly pension is seen as a safety net rather than a luxury. If implemented, it could ensure that retirees are able to meet basic expenses without financial stress. This proposal is closely linked to the Old Pension Scheme 2025 Update and is one of the most closely watched aspects of the ongoing debate.

States That Have Restored Old Pension Scheme

- Several state governments have already taken the step of restoring OPS for their employees. These decisions were driven by employee protests, political promises, and concerns about retirement security.

- States that have brought back OPS have set an example for others and increased pressure on the central government. Their decisions are often cited in discussions related to the Old Pension Scheme 2025 Update, as they demonstrate that alternative pension models are still possible.

Financial Impact of OPS On Government

- One of the strongest arguments against OPS is its long-term financial impact. Since pensions are paid directly from government revenue, critics argue that OPS increases fiscal pressure and reduces funds available for development.

- Supporters counter this by stating that pension expenditure is a social responsibility. They argue that government employees often accept lower salaries during service in exchange for retirement security. Balancing fiscal discipline with social welfare remains a key challenge in the Old Pension Scheme 2025 Update debate.

Employee Expectations from the Old Pension Scheme 2025 Update

- Government employees have clear expectations from the Old Pension Scheme 2025 Update. They want certainty, transparency, and fairness in retirement benefits. Many employees nearing retirement are particularly anxious, as policy changes directly affect their future income.

- Key expectations include a guaranteed minimum pension, reduced dependence on market performance, and equal treatment across states and departments. These expectations reflect the emotional and financial importance of the issue.

Possible Outcomes In 2025

- The year 2025 could bring several possible outcomes. The government may introduce a minimum pension guarantee, reform NPS to include stronger safeguards, or adopt a hybrid model combining elements of OPS and NPS.

- While a full nationwide restoration of OPS may be challenging, partial reforms could address employee concerns. Whatever the outcome, the Old Pension Scheme 2025 Update is expected to leave a lasting impact on pension policy in India.

BOB Savings Account Update 2026 – New Benefits Announced for Bank of Baroda Customers

Why The Old Pension Scheme Debate Matters

- The discussion around pensions is not just about financial figures. It is about dignity, independence, and peace of mind after retirement. A secure pension allows retirees to live without fear of financial hardship and reduces dependence on family members.

- The Old Pension Scheme 2025 Update has brought these issues into the public spotlight, forcing policymakers to reconsider how retirement security should be ensured in a changing economic environment.

FAQs on Old Pension Scheme 2025 Update

Is the Old Pension Scheme fully restored in 2025

No final nationwide decision has been announced yet. The Old Pension Scheme 2025 Update is still under discussion.

What is the ₹10000 monthly pension rule

It is a proposed minimum pension amount aimed at ensuring basic financial security for retirees.

Who benefits from the Old Pension Scheme

Government employees covered under OPS or working in states that have restored the scheme benefit directly.

Is NPS being scrapped under the 2025 update

There is no confirmation. Discussions are focused on reforms and safeguards rather than complete removal.