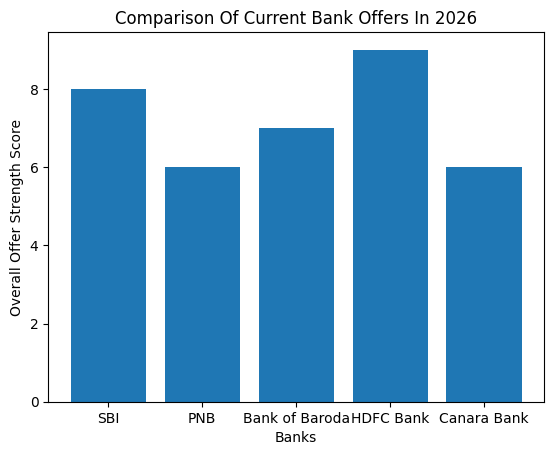

If you hold an account with a major Indian bank, this is one of those moments where staying informed can actually save you money. New Bank Offers for SBI, PNB, BOB, HDFC & Canara Account Holders are currently focused on digital usage, reduced charges, better interest rates, and everyday rewards. Banks are no longer limiting benefits to premium customers only. Regular savings account holders, salary account users, senior citizens, and even students are seeing meaningful perks. What’s interesting is how practical these offers have become. Instead of complicated reward structures, banks are rewarding things people already do pay bills online, use UPI, maintain fixed deposits, or swipe debit cards. These New Bank Offers for SBI, PNB, BOB, HDFC & Canara Account Holders are not just promotional gimmicks; they reflect how banking habits are changing in 2026.

The latest New Bank Offers for SBI, PNB, BOB, HDFC & Canara Account Holders are designed to encourage digital banking while reducing the cost of everyday financial services. Public and private sector banks are both competing aggressively, which works in the customer’s favor. These offers are mostly available to existing customers and often require nothing more than using your account regularly through official banking channels. Banks are especially pushing UPI payments, mobile banking apps, online fixed deposits, and debit card usage. In return, customers receive cashback, interest rate bonuses, fee waivers, and lifestyle discounts. Some offers run for limited periods, while others are ongoing. Checking your bank’s app regularly is now almost as important as checking your balance.

New Bank Offers

| Bank Name | Key Benefits Offered | Best For | Availability |

|---|---|---|---|

| SBI | Debit card cashback, FD interest bonus, app-based offers | Digital banking users, senior citizens | Limited period |

| PNB | Zero balance accounts, loan fee discounts | Students, borrowers, salaried users | Ongoing |

| Bank Of Baroda | UPI cashback, higher FD rates | UPI users, senior citizens | Limited period |

| HDFC Bank | Shopping, travel, and card rewards | Lifestyle-focused users | Ongoing |

| Canara Bank | Reduced locker charges, digital incentives | Traditional and digital users | Limited period |

The current wave of New Bank Offers for SBI, PNB, BOB, HDFC & Canara Account Holders shows how customer-centric banking has become. These offers are practical, easy to access, and designed for everyday use. Whether you prefer digital banking, value lower charges, or enjoy lifestyle rewards, there is something available for nearly everyone. Staying informed and proactive is key. A few small changes in how you use your bank account can unlock meaningful financial benefits without switching banks or opening new accounts.

SBI Cashback Digital Banking and FD Benefits

- State Bank of India continues to expand its digital ecosystem, and customers who use online services are the biggest beneficiaries. SBI debit card users can earn cashback on eligible transactions such as online shopping, utility bill payments, and mobile recharges. While these offers usually come with minimum spending conditions, regular users can accumulate savings over time.

- Fixed deposit customers are also seeing benefits. SBI has introduced higher interest rates for specific tenures, especially for senior citizens. Customers opening or renewing FDs through online channels may receive additional interest. These New Bank Offers for SBI, PNB, BOB, HDFC & Canara Account Holders make SBI’s digital banking ecosystem more rewarding while reducing reliance on branch visits.

PNB Zero Balance Accounts And Loan Fee Waivers

- Punjab National Bank is focusing on simplicity and affordability. One of its biggest advantages is the availability of zero balance or low minimum balance savings accounts. These accounts are ideal for students, pensioners, and individuals who prefer flexibility without worrying about penalties.

- PNB is also offering reduced processing fees on select loan products, including home loans and personal loans. This directly lowers the initial cost of borrowing. Customers using PNB’s digital platforms may also receive transaction-based incentives. Among the New Bank Offers for SBI, PNB, BOB, HDFC & Canara Account Holders, PNB stands out for people seeking cost-effective banking.

Bank Of Baroda UPI Cashback and Senior Citizen Advantages

- Bank of Baroda has strengthened its digital payments strategy with cashback offers on UPI transactions. Customers who use UPI for merchant payments, grocery shopping, or bill settlements can earn rewards, subject to monthly limits. This is especially useful for people who rely on UPI for daily expenses.

- Senior citizens benefit from higher fixed deposit interest rates, particularly on longer tenures. Bank of Baroda also promotes online banking by reducing charges for digital fund transfers. These New Bank Offers for SBI, PNB, BOB, HDFC & Canara Account Holders reflect a clear shift toward rewarding cashless transactions.

HDFC Bank Lifestyle Shopping And Travel Offers

- HDFC Bank continues to dominate the lifestyle banking segment. Account holders using HDFC debit or credit cards can access instant discounts on e-commerce platforms, travel bookings, dining, and entertainment services. These benefits are frequently updated, making them relevant throughout the year.

- Salary account holders receive additional perks such as lower interest rates on loans, higher transaction limits, and complimentary insurance coverage. Digital banking users often receive exclusive app-based offers. For customers who value rewards and convenience, these New Bank Offers for SBI, PNB, BOB, HDFC & Canara Account Holders position HDFC Bank as a premium yet practical choice.

Canara Bank Lower Charges and Digital Rewards

- Canara Bank has taken a balanced approach by offering benefits that appeal to both traditional and digital banking customers. Selected savings account holders can enjoy reduced locker charges and lower fees on routine banking services.

- To encourage digital adoption, Canara Bank offers rewards for UPI transactions and online payments. Customers who register for mobile and internet banking may qualify for additional concessions. These New Bank Offers for SBI, PNB, BOB, HDFC & Canara Account Holders make Canara Bank an attractive option for users seeking steady and affordable banking.

Why Banks Are Offering These Benefits In 2026

- The banking sector in 2026 is highly competitive. Customers now expect convenience, transparency, and rewards for loyalty. Banks are responding by shifting benefits toward digital usage, which also reduces their operational costs.

- By offering cashback, fee waivers, and better interest rates, banks encourage customers to stay within their ecosystem. This strategy benefits both sides. Customers save money, while banks improve engagement and reduce branch dependency. The rise of New Bank Offers for SBI, PNB, BOB, HDFC & Canara Account Holders is a direct result of this shift.

How To Maximize These Bank Offers

- To get the most value, customers should actively use their bank’s mobile app and online services. Many offers are automatically applied when transactions meet eligibility criteria.

- It’s also important to read the terms carefully. Cashback limits, transaction caps, and offer validity periods can vary. Setting reminders to review offers monthly can help ensure you don’t miss out. Smart usage of these New Bank Offers for SBI, PNB, BOB, HDFC & Canara Account Holders can lead to consistent savings over time.

Things To Keep in Mind Before Using Bank Offers

- Not all offers apply to every account type. Some benefits are limited to salary accounts, senior citizens, or digital-only users. Maintaining eligibility, such as minimum balances or transaction thresholds, is essential.

- Avoid unnecessary spending just to qualify for rewards. The best approach is to align offers with your existing financial habits. This ensures genuine savings rather than impulsive expenses.

FAQs on New Bank Offers

Are these bank offers available for existing customers?

Yes, most offers are designed for existing account holders and activate automatically when eligibility conditions are met.

Do these offers require manual activation?

Some offers apply automatically, while others may require registration through the bank’s app or website.

Are UPI cashback offers unlimited?

No, most UPI cashback offers come with monthly caps and specific transaction requirements.

Do senior citizens receive special benefits?

Yes, senior citizens often get higher fixed deposit interest rates and reduced service charges.