Starting a small business in India is no longer just a dream limited by lack of funds. With government backed financial support, aspiring entrepreneurs now have easier access to credit than ever before. One such powerful initiative is the Mudra Loan Subsidy 2026, which continues to play a crucial role in supporting small businesses, startups, and self employed individuals.

This scheme is specifically designed for people who want to grow on their own terms without depending on large investors or risking personal assets. The biggest strength of Mudra Loan Subsidy 2026 lies in its simplicity. The process is straightforward, the eligibility is practical, and the financial burden is kept low. From street vendors and shop owners to service providers and micro manufacturers, the scheme targets real people with real business needs. If you are looking for a low cost business loan with government support, this initiative deserves your attention.

Mudra Loan Subsidy 2026 focuses on strengthening India’s micro and small business ecosystem by offering affordable credit through banks and financial institutions. The objective is to reduce dependency on informal lenders and encourage structured financial growth. Under this scheme, loans are provided without collateral, making it accessible even for first time borrowers. The subsidy component under Mudra Loan Subsidy 2026 helps reduce the overall cost of borrowing, especially for eligible categories and priority sectors. This means lower interest burden and manageable repayments. The scheme supports business expansion, working capital needs, equipment purchase, and operational growth, ensuring that lack of funds does not hold back capable entrepreneurs.

Mudra Loan Subsidy 2026 Overview Table

| Feature | Details |

|---|---|

| Scheme Name | Pradhan Mantri Mudra Yojana |

| Applicable Year | 2026 |

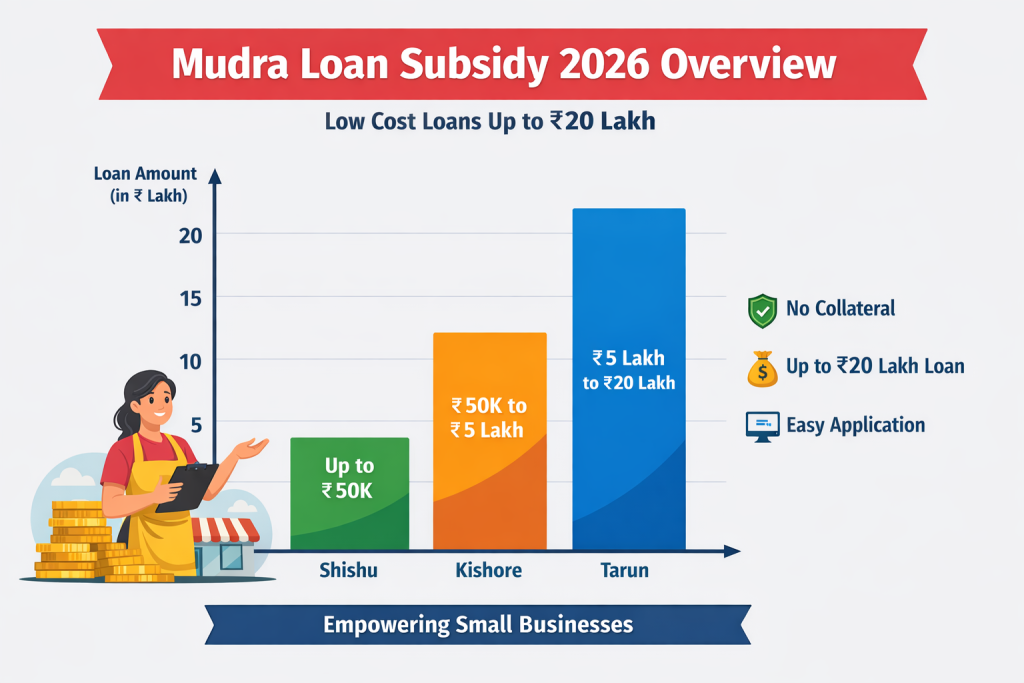

| Maximum Loan Amount | Up to ₹20 Lakh |

| Loan Type | Business Loan |

| Collateral | Not Required |

| Beneficiaries | Small Businesses, MSMEs, Self Employed |

| Application Mode | Online And Offline |

| Repayment Period | As Per Bank Policy |

Mudra Loan Subsidy 2026 is more than just a loan scheme it is a growth opportunity for India’s small business community. With affordable credit, government backing, and easy access, it empowers entrepreneurs to build sustainable ventures without unnecessary financial pressure. If you are planning to start or expand a business in 2026, this scheme offers a reliable and practical path forward. With the right preparation and financial discipline, Mudra Loan Subsidy 2026 can be the stepping stone to long term business success.

Modi Government Launches and Expanded Benefits

- The Mudra Loan Yojana was launched with a clear vision of empowering the backbone of India’s economy small and micro businesses. Over time, the government has expanded the scope of the scheme to meet changing economic needs. The increase in loan limits and relaxed eligibility norms reflect the government’s commitment to entrepreneurship and job creation.

- Under Mudra Loan Subsidy 2026, borrowers with a good repayment history may qualify for higher loan amounts. This encourages financial discipline and long-term engagement with the formal banking system. The government’s continued focus on digital banking has also made applications faster and more transparent.

Benefits Of the PM Mudra Loan Scheme

- One of the standout features of this scheme is its affordability. Interest rates are generally lower compared to traditional unsecured business loans. With Mudra Loan Subsidy 2026, the financial load during the initial business phase becomes easier to handle.

- Another major benefit is zero collateral requirement. Entrepreneurs do not need to pledge property or assets, which removes a major barrier for small business owners. Flexible repayment options, wide lender participation, and government support make this scheme one of the most reliable funding options for MSMEs.

Loan Categories Under Mudra Scheme

- The Mudra Loan scheme is structured into different categories based on the stage of the business. This ensures that borrowers receive funding aligned with their actual needs.

- Shishu loans are ideal for startups and small ventures requiring minimal capital. Kishore loans cater to growing businesses that need funds to scale operations. Tarun loans are meant for established enterprises looking for higher investment to expand or modernize.

- Mudra Loan Subsidy 2026 applies across these categories, allowing businesses to progress naturally without financial stress.

Eligibility Criteria for Mudra Loan Subsidy

Eligibility under Mudra Loan Subsidy 2026 is practical and inclusive. Applicants must be Indian citizens within the specified age range and should be involved in non-farm income generating activities. Manufacturing units, traders, service providers, and small vendors are all covered. A viable business plan and basic financial discipline improve approval chances. Both new and existing businesses can apply, making the scheme suitable for a wide range of entrepreneurs.

Required Documents For Mudra Loan Subsidy 2026

The documentation process is simple and borrower friendly. Applicants usually need identity proof, address proof, business details, bank statements, and photographs. Depending on the lender, additional documents such as quotations for machinery or equipment may be required. Mudra Loan Subsidy 2026 minimizes paperwork to ensure that small business owners are not discouraged by complex procedures.

How To Apply Online For Mudra Loan Subsidy 2026

Applying for Mudra Loan Subsidy 2026 is easy and accessible. Applicants can visit the official website of participating banks or approach a nearby branch. After filling out the application form and submitting required documents, the bank evaluates the proposal. With digital tracking systems, applicants can monitor the status of their application. Once approved, funds are disbursed directly to the borrower’s bank account, ensuring transparency and speed.

Repayment Structure And Interest Rates

- Repayment terms under Mudra Loan Subsidy 2026 vary depending on the loan amount and lender policy. Typically, repayment periods range from one to several years. Interest rates are competitive and designed to be affordable for small businesses.

- Timely repayment not only improves credit score but also opens doors for higher loan eligibility in the future.

Gargi Puraskar Yojana 2026: ₹3,000 and ₹5,000 Reward on Basant Panchami, Check List and Payment Date

Common Mistakes to Avoid While Applying

- Many applicants make errors such as submitting incomplete documents, unclear business plans, or incorrect financial details. These mistakes can delay approval or lead to rejection. It is important to prepare documents carefully and provide accurate information.

- Understanding the loan category suitable for your business stage also plays a crucial role in approval under Mudra Loan Subsidy 2026.

FAQs on Mudra Loan Subsidy 2026

What Is Mudra Loan Subsidy 2026?

Mudra Loan Subsidy 2026 refers to government supported benefits under the Mudra Loan scheme aimed at reducing borrowing costs for small businesses.

Who Can Apply for Mudra Loan Subsidy 2026?

Any Indian citizen involved in a non-farm business activity such as trading, manufacturing, or services can apply.

What Is The Maximum Loan Amount Available?

Eligible borrowers can avail loans up to ₹20 lakh depending on category and repayment history.

How Long Does Loan Approval Take?

Approval timelines vary by bank, but most applications are processed within a few working days.