Higher education is a dream for many students in Bihar, but financial limitations often turn that dream into a struggle. After completing Class 12, students who wish to pursue professional or technical courses face rising tuition fees, accommodation costs, and other academic expenses. For families with limited income, arranging such funds at once becomes extremely difficult.

This is where MNSSBY Bihar Student Credit Card Yojana plays a crucial role in supporting deserving students. The MNSSBY Bihar Student Credit Card Yojana is a government-backed initiative created to ensure that financial issues do not force students to abandon higher education. Instead of depending on high-interest private loans or giving up their career goals, students can now access affordable education loans with simple terms, low interest rates, and an easy application process.

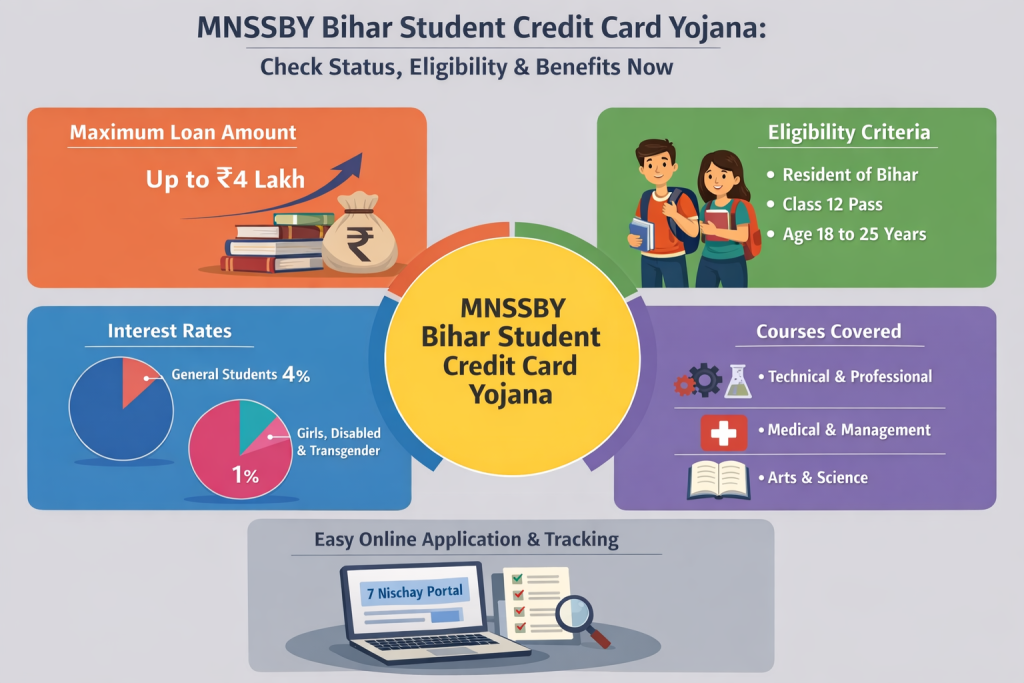

MNSSBY Bihar Student Credit Card Yojana is one of the most student-friendly education loan schemes introduced by the Bihar government. It is designed specifically for students who have passed Class 12 and want to continue their education in higher studies. Under this scheme, eligible students can get an education loan of up to four lakh rupees to cover tuition fees and other academic expenses. The scheme focuses on equal opportunities, transparency, and long-term educational growth. With a digital application process and interest subsidy, it has become a reliable support system for thousands of students across the state.

MNSSBY Bihar Student Credit Card Yojana

| Details | Information |

|---|---|

| Scheme Name | MNSSBY Bihar Student Credit Card Yojana |

| State | Bihar |

| Maximum Loan Amount | ₹4,00,000 |

| Interest Rate | 4 percent and 1 percent for eligible categories |

| Minimum Qualification | Class 12 Pass |

| Beneficiaries | Students of Bihar |

| Courses Covered | General, technical, professional |

| Application Mode | Online |

| Official Platform | 7 Nischay Portal |

MNSSBY Bihar Student Credit Card Yojana has become a powerful tool in transforming the educational landscape of Bihar. By offering affordable education loans with flexible terms, the scheme ensures that financial limitations do not stop students from achieving their academic and career goals. For students planning higher education after Class 12, this initiative provides not just financial support but also confidence to dream bigger and aim higher.

Objective of the MNSSBY Bihar Student Credit Card Yojana

The primary objective of this scheme is to encourage students in Bihar to pursue higher education without worrying about financial barriers. Many students discontinue their studies after Class 12 due to lack of funds, even when they have strong academic potential. This scheme aims to reduce dropout rates and increase enrollment in professional, technical, and higher education courses. It also supports skill development and employability by enabling students to choose quality institutions and courses that align with their career goals.

Eligibility Criteria For MNSSBY Bihar Student Credit Card Yojana

- To apply for the MNSSBY Bihar Student Credit Card Yojana, students must fulfill specific eligibility conditions set by the government. These criteria ensure that the benefits reach genuine and deserving candidates.

- The applicant must be a permanent resident of Bihar and should have passed Class 12 from a recognized board. Admission must be confirmed in a recognized higher education institution. The age of the applicant is generally between 18 and 25 years at the time of application. The selected course should fall under the approved categories such as general, technical, or professional education.

Courses Covered Under The Scheme

- One of the biggest strengths of this scheme is its wide coverage of courses. Students from different academic streams can benefit equally.

- The scheme supports engineering and technical courses, medical and paramedical programs, management and law degrees, arts, science, and commerce courses, as well as polytechnic and other professional diploma programs. This broad course coverage ensures that students are not limited in their career choices due to financial constraints.

Loan Amount And Interest Rate

- Under the MNSSBY Bihar Student Credit Card Yojana, students can avail an education loan of up to four lakh rupees. This amount can be used to pay tuition fees, examination fees, and other education-related expenses.

- The interest rate is highly subsidized to make repayment affordable. General category students are charged an interest rate of four percent per year. Female students, differently-abled students, and transgender applicants receive a special concession and are charged only one percent interest. This low-interest structure makes the scheme far more attractive compared to regular education loans.

Repayment Process For MNSSBY Bihar Student Credit Card Yojana

- The repayment process under this scheme is designed to be student-friendly. Students are not required to start repaying the loan while studying. Repayment begins only after the completion of the course, following a moratorium period.

- This grace period allows students to find employment or establish a stable source of income before repayment starts. The loan can be repaid in easy monthly installments over a flexible tenure, reducing financial pressure during the early stages of a student’s career.

Documents Required For MNSSBY Bihar Student Credit Card Yojana

- Applicants need to submit certain documents to complete the application process successfully. These documents help verify identity, residence, and educational qualifications.

- Required documents include Aadhaar card, Bihar residence certificate, Class 10 and Class 12 mark sheets, admission letter from the institution, income certificate, bank account details, and passport-size photographs. All documents must be uploaded online in the prescribed format.

How To Apply Online For MNSSBY Bihar Student Credit Card Yojana

- The application process for the MNSSBY Bihar Student Credit Card Yojana is fully online and user-friendly.

- Students need to visit the 7 Nischay Portal and register using their Aadhaar number and basic personal details. After registration, they must fill in educational information, course details, and upload the required documents. Once the application is submitted, a reference number is generated for future tracking. The application then goes through verification before being forwarded to the bank for loan approval.

How To Check Application Status

Checking the application status is simple and transparent. Applicants can log in to the portal using their registration details and enter the application reference number. The portal displays the current status, whether it is under verification, approved, or pending with the bank. This system ensures students remain informed throughout the process.

Antyodaya Anna Yojana 2026 – Full Application Process, Eligibility, Status & Beneficiary List

Benefits Of MNSSBY Bihar Student Credit Card Yojana

- The scheme offers several advantages that make it highly beneficial for students.

- It provides easy access to education loans without requiring collateral. Interest rates are low and subsidized, reducing the overall repayment burden. A wide range of courses and institutions are covered under the scheme. The digital application and tracking system saves time and effort. Most importantly, it empowers students to pursue higher education with confidence and financial security.

FAQs on MNSSBY Bihar Student Credit Card Yojana

Who Can Apply for MNSSBY Bihar Student Credit Card Yojana

Any student who is a permanent resident of Bihar, has passed Class 12, and has taken admission in a recognized higher education institution can apply for this scheme.

What Is the Maximum Loan Amount Available

Students can avail an education loan of up to four lakh rupees under this scheme.

Is There Any Interest Concession for Female Students

Yes, female students, along with disabled and transgender applicants, are eligible for a reduced interest rate of one percent.

When Does Loan Repayment Start

Repayment starts after course completion, following a moratorium period that allows students time to secure employment.