The MNSSBY Bihar Student Credit Card scheme has genuinely saved the education plans of thousands of students in Bihar. If you are stuck after Class 12 or graduation because of tuition fees, hostel charges or the cost of books, this scheme can be a lifeline. Under it, you can get financial support of up to ₹4 lakh for your education, without running around middlemen, simply by applying online and going through a structured counselling and bank process. This guide walks you through everything step by step so you can manage the entire process confidently on your own. MNSSBY Bihar Student Credit Card is designed for young people who want to study further but are forced to step back due to financial constraints. The core idea of the scheme is simple – money should not be the reason your education stops. The government has used the education loan model in a more student-friendly way so that during your course you can focus on studies first and worry less about funds. In the sections below, you will understand who is eligible, which documents are needed, how to fill the online form, and how to track your loan status later.

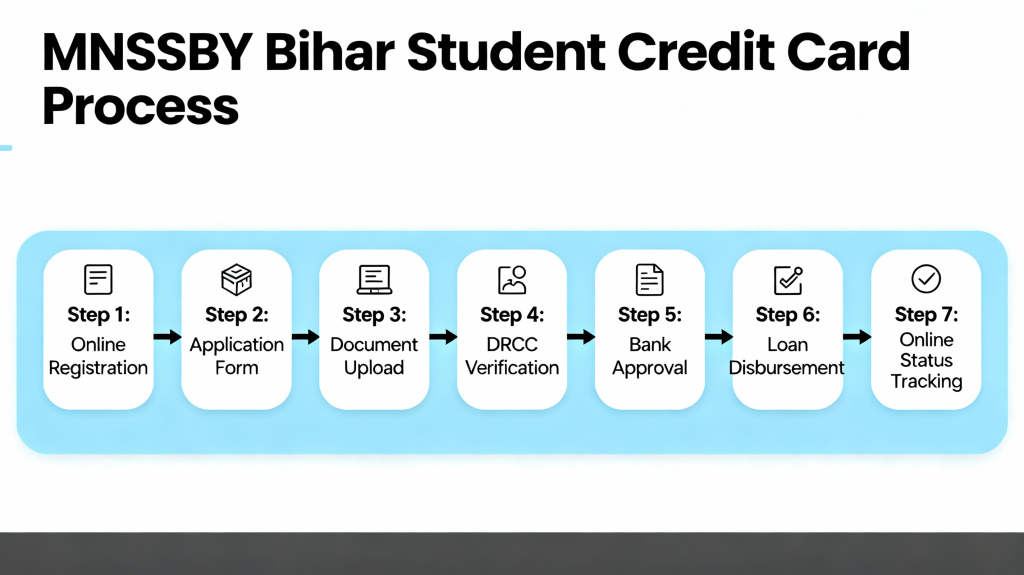

The most important thing about MNSSBY Bihar Student Credit Card is understanding the complete procedure so that you do not miss any step in between. Many students make the common mistake of completing registration but taking the DRCC counselling, bank process or status tracking lightly. Because of this, files remain pending for a long time or get rejected due to small errors. If you are applying for the first time, you need to follow every step carefully and on time. The purpose of this guide is to ensure you do not feel lost at any stage of the MNSSBY Bihar Student Credit Card journey. From online registration and document upload to DRCC visit, bank approval and online status tracking, everything is explained in simple, practical language. If you follow the flow from start to finish, you can move your file forward yourself without paying any agent or extra charges and get the loan sanctioned within a reasonable time.

MNSSBY Bihar Student Credit Card

| Point | Detail |

|---|---|

| Scheme Name | Bihar Student Credit Card Scheme (BSCC) under MNSSBY |

| Maximum Loan | Education loan facility up to ₹4 lakh |

| Objective | To provide financial support for tuition, books, hostel and other study-related expenses |

| Mode | Fully online application, counselling and bank processing |

| Main Steps | Registration, application, document upload, DRCC verification, bank sanction, disbursement |

| Usage Of Loan | Tuition fees, exam fees, books, laptop, hostel/rent and other academic expenses |

Objectives Of the Bihar Student Credit Card (BSCC) Application Portal

The biggest objective of the Bihar Student Credit Card portal is to bring the entire process onto a single platform. Earlier, students had to visit multiple offices, banks and departments, wasting both time and money. Now, the same work can be done from one online portal – where you register, fill the application, upload documents and later check the status of your loan.

The portal is designed to be student-friendly so that even someone applying for MNSSBY Bihar Student Credit Card for the first time can manage it. Once you log in, you will see clear sections like Application Form, Document Upload, Application Status, Loan Request Status and Account Summary. With the help of these, you keep full control over your loan journey and can see at any moment where exactly your file stands.

Eligibility Criteria of The MNSSBY Bihar Student Credit Card

- To benefit from the MNSSBY Bihar Student Credit Card scheme, you need to meet some basic eligibility conditions. First, the applicant must be a permanent resident of Bihar. For this, a valid domicile or other accepted residence proof is generally required. Second, the student must have passed Class 12 or an equivalent examination from a recognised board.

- Another important condition is that you must have taken admission in a recognised college, university or technical institute. Whether you are doing a graduation degree, a professional course, management, engineering or another approved programme, both the course and institution should be valid as per the scheme. There is usually an upper age limit, commonly in the mid-20s for undergraduate courses. Exact age and course-related rules are mentioned in the latest guidelines, so it is wise to read them carefully before applying.

Features Of The Bihar Student Credit Card Loan

- One of the biggest advantages of the Bihar Student Credit Card loan is that it covers almost all major education-related expenses. Often, the burden is not only tuition fees but also hostel charges, rent, books, lab fees, laptop and other learning materials. The loan structure under this scheme has been created keeping all these practical needs in mind. For many students, the maximum limit of ₹4 lakh is enough to cover a large part of the entire course cost.

- Another strong feature is that, compared to regular education loans, the interest and repayment terms under MNSSBY Bihar Student Credit Card are usually more comfortable. During your course and for a certain period after you finish, there is generally a moratorium in which repayment does not start immediately. This gives you time to complete your degree, find a job or stabilise your career. Later, the loan is repaid through EMIs. In short, the scheme offers you both time and flexibility along with financial support.

Required Documents for The MNSSBY Bihar Student Credit Card

Before you start filling the online form for MNSSBY Bihar Student Credit Card, it is smart to prepare all your documents in advance. Usually, you will need Aadhaar card, recent passport-size photographs, a scanned signature, Class 10 and Class 12-mark sheets, the admission letter from your college/institute, institute details and a valid address proof. Keeping clear scanned copies ready makes the upload process much smoother. In some cases, an income certificate or affidavit may also be required, especially if the family’s financial condition is weak or you are availing benefits under a specific category. While arranging your documents, make sure that your name, date of birth and other personal details are consistent across all papers. Even small mismatches can slow down verification. Once your documents are correct and clearly uploaded, the further stages of the process generally move faster.

Step-By-Step Application Process of The MNSSBY Bihar Student Credit Card

- To begin with, go to the official portal and start with New Applicant Registration. Here, you provide basic information like your name, mobile number, email address and Aadhaar number. After this, you will receive OTPs on your mobile and email. Enter these to complete the verification, and you will get a user ID or registration number. This is important, as it is used later for login and status tracking.

- After registration, log in with your credentials and open the application form linked to the Bihar Student Credit Card scheme. In this form, you have to fill personal details, address, family information, academic qualifications, course details, name of the college/institute, fee structure and the amount of loan you are seeking. Once all details are filled, upload the required documents in the mentioned format. Finally, review the form carefully and submit it. After submission, your application is automatically forwarded to your district’s DRCC (District Registration and Counselling Centre) for the next stage.

Process Of Tracking Your Application

- Once you have submitted the application, the next important task is to regularly track the MNSSBY Bihar Student Credit Card status. For this, go back to the same portal and log in using your applicant credentials. After logging in, visit the Application Status section. Here, you will be able to see whether your file is marked as Received, Under Process, pending at DRCC, sent to the bank, Approved or Rejected.

- To view details like the sanctioned amount, approved limit, date of disbursement and instalment-related information, you can check the Loan Request Status or Account Summary section. If you feel that the status has not changed for a long time, you can contact the DRCC or use the helpline to get clarity. By doing this, you stay fully updated on your MNSSBY Bihar Student Credit Card file and can plan your next move accordingly.

Alternative Methods To Check BSCC Loan Status

Sometimes, due to technical issues, the portal may not open properly, or you may face login problems. Even in such cases, you are not completely stuck. You can call the official helpline with your registration number or Aadhaar-linked details and ask for the current status of your MNSSBY Bihar Student Credit Card application. In most cases, they can tell you at which stage your file is and whether any action is pending from your side. Similarly, you can send an email to the official support address with your name, registration ID and mobile number clearly mentioned, requesting an update on your application. Some students also prefer visiting the DRCC office directly, especially if a counselling session, document clarification or bank meeting is pending. Whichever method you choose, always provide complete and correct information related to your Bihar Student Credit Card application so that your query is resolved quickly.

FAQs on MNSSBY Bihar Student Credit Card

1. Where can I use the money received under MNSSBY Bihar Student Credit Card?

The amount can be used mainly for your tuition fees, examination fees, books, hostel charges, rented accommodation, laptop and other direct education-related expenses. As long as you stay within the scheme guidelines and bank norms, you can plan the usage to match your academic needs.

2. Is a guarantor or security mandatory for this scheme?

In many cases, the rules around guarantee and security are more relaxed compared to standard education loans. Generally, parents or a guardian are added as co-applicant, and heavy collateral is not demanded.

3. How long does it usually take to get the loan sanctioned?

If your documents are complete and DRCC verification happens on time, a decision from the bank is often made within a few weeks. During peak admission season, it may take a little longer because of higher application volume, so it is always better to apply for MNSSBY Bihar Student Credit Card soon after your admission is confirmed.

4. When do EMIs start for this loan?

Generally, EMIs do not start while you are studying. There is usually a moratorium period that covers your course duration and some additional time after completion, so that you can focus on studies and then search for a job.