The concept being promoted under the name “LIC FD Scheme 2025” is not a simple, traditional bank fixed deposit. It is more like a combination of LIC Housing Finance’s Sanchay Fixed Deposit and LIC’s guaranteed income or annuity plans. The idea being sold is that you invest ₹1,50,000 once, and in return you receive a fixed monthly income that feels like a pension or rental cash flow. Many websites label it as a “new FD scheme” to keep it familiar and easy to understand, even though the actual product design is more layered than a normal FD.

The headline “LIC Rolls Out New FD Scheme: Invest ₹1.5 Lakh and Receive ₹9,750 Monthly Income” usually rests on a best‑case or theoretical illustration, not a standard, universally available FD. These figures often assume a particular age, a specific annuity option, possibly a long lock‑in, and sometimes even a structure where your principal is slowly returned to you, not just interest. In practical terms, if you put the same amount into a regular FD or a typical annuity, the monthly payout is much lower. That is why the headline should be treated as a marketing hook, not as a guaranteed promise for every investor.

LIC Rolls Out New FD Scheme

| Point | Detail |

|---|---|

| Scheme Title | LIC Rolls Out New FD Scheme: Invest ₹1.5 Lakh and Receive ₹9,750 Monthly Income |

| Basic Idea | Invest a lump sum (around ₹1.5 lakh) and receive fixed monthly income through an FD‑like or annuity‑style structure |

| Product Nature | Combination‑type concept linking LIC Housing Finance Sanchay FD and LIC guaranteed income/annuity plans |

| Claimed Monthly Income | Around ₹9,500 – ₹9,750 per month shown in some projections or marketing examples |

| Realistic Return Range | In safe, regulated products, realistic annual returns are usually around 5 – 7%, so actual monthly payouts are much lower than the claim |

| Likely Target Investors | Retirees, homemakers, small business owners, and conservative investors who prefer stable monthly cash flow |

| Risk Level | Principal is relatively safe; no market risk, but future rates for new investments can change |

| Tax Treatment | Monthly income is taxable as per your income‑tax slab; TDS may apply, which reduces the net in‑hand return |

What Exactly Is LIC FD Scheme 2025

The product circulating under the name “LIC FD Scheme 2025” is not a straight government‑backed bank FD. In practice, it usually refers either to LIC Housing Finance’s Sanchay Public Deposit with a monthly interest option or to LIC annuity/guaranteed income plans where you pay a one‑time premium and receive a pension‑like income. In the FD‑type variant, your principal is returned at maturity and you receive only interest as monthly income during the tenure. In several annuity options, the principal is not returned; instead, you get a fixed pension for life or for a fixed period.

That means the statement “LIC Rolls Out New FD Scheme: Invest ₹1.5 Lakh and Receive ₹9,750 Monthly Income” can only be remotely possible if the structure is such that your own principal is being paid back to you over time along with any earnings. In that case, the high monthly payout is not pure profit; part of it is your original capital coming back. In FD‑style or principal‑protected formats, where your capital remains intact, it is simply not realistic for such a small amount to generate such a large monthly payout in a safe, regulated product.

Can ₹1.5 Lakh Really Give ₹9,750 Monthly

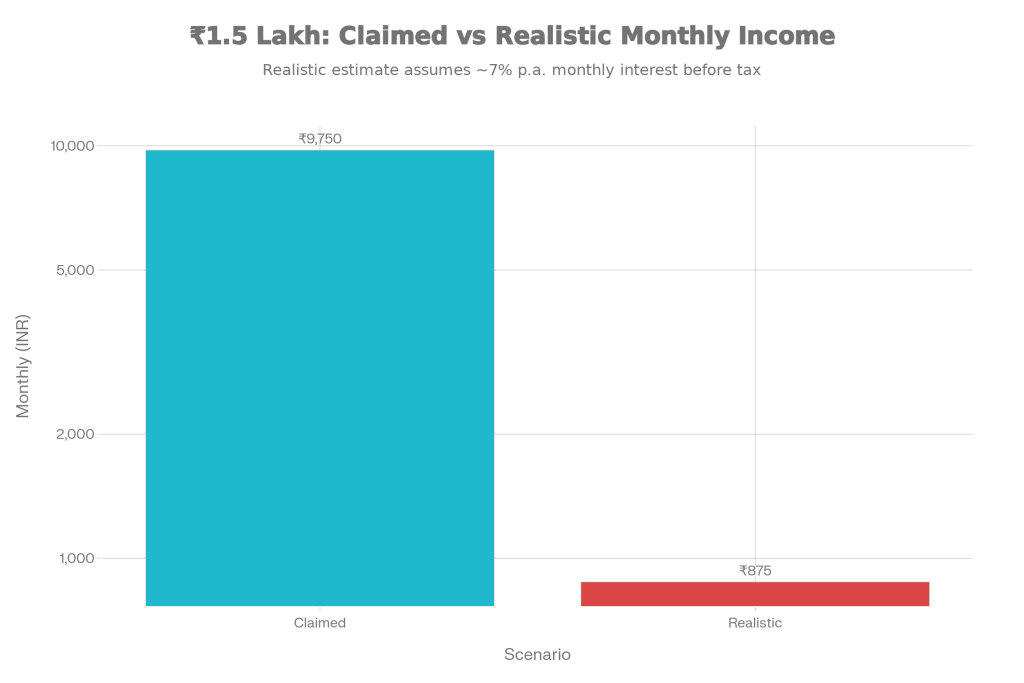

Let’s break this down with simple maths. If you invest ₹1,50,000 and receive ₹9,750 every month, your total yearly income from that investment is ₹1,17,000. That works out to an effective annual return of roughly 78%. No normal FD or standard annuity product that is regulated and considered safe offers anything even close to this. In real life, FD and traditional annuity plans generally deliver around 5–8% per year, not 50–80%.

That is why most serious and realistic calculations connected to something called “LIC FD Scheme 2025” show that for ₹1.5 lakh, the true monthly income tends to be in the range of a few hundred rupees to about one thousand rupees, depending on the rate and structure not nearly ₹9,750. If you come across a chart or video confidently showing exactly “LIC Rolls Out New FD Scheme: Invest ₹1.5 Lakh and Receive ₹9,750 Monthly Income” for everyone, it is either mixing in principal repayment, using extremely selective examples, or simply over‑hyping the numbers.

How The Monthly Income Structure Actually Works

In an FD‑like structure, you choose a fixed tenure say 3 or 5 years and opt for a non‑cumulative plan where interest is paid out to you regularly instead of being reinvested. Your principal stays locked in until maturity, and only the interest hits your bank account every month. For example, at roughly 7% annual interest, ₹1,50,000 would generate around ₹10,500 per year in interest, which is about ₹875 per month before tax not ₹9–10,000 per month.

In annuity or pension‑style plans, the model is different. You pay a one‑time premium, and in exchange you receive a pension every month, quarter, or year for life or for a fixed number of years. The payout may look promising on paper, but often either the principal is not returned, or the income is not inflation‑adjusted, or both. Many people see such annuity illustrations and directly assume that the same logic applies to what they think is an “FD scheme” like LIC FD Scheme 2025. In reality, the headline “LIC Rolls Out New FD Scheme: Invest ₹1.5 Lakh and Receive ₹9,750 Monthly Income” usually represents a very specific, non‑standard scenario and does not apply as a general rule.

Key Features You Should Focus On

When you try to understand this type of scheme, do not look only at the monthly figure. You should focus on:

- Whether the principal is returned at the end or only the monthly income is paid

- Whether the payout is for life or only for a fixed duration

- Whether the income is fixed or can change in the future

- What happens if you want to surrender or close early are their penalties

- What your post‑tax return looks like after including income tax and TDS

Once you evaluate any scheme whether marketed as LIC FD Scheme 2025 or otherwise on these parameters, it becomes much easier to see the true benefit and separate genuine value from marketing language. The headline may promise, but the fine print will tell you what you actually get.

Who Should Consider This Type of LIC FD Scheme

This kind of monthly income‑oriented scheme is more suitable for investors who value steady cash flow over high growth. If you are retired, approaching retirement, or running a household where regular monthly cash inflow matters more than capital appreciation, a stable LIC‑linked monthly income product can give you peace of mind. The same is true for conservative investors who do not want to deal with stock‑market volatility and complicated products.

However, if your primary goal is long‑term wealth creation or beating inflation by a wide margin, relying only on low‑to‑moderate return instruments like these is not enough. In that case, you need a balanced approach that includes mutual funds, equities, or other growth‑oriented options along with safe income products. The headline “LIC Rolls Out New FD Scheme: Invest ₹1.5 Lakh and Receive ₹9,750 Monthly Income” may tempt you, but a smart long‑term plan combines safety with growth through proper diversification.

Starlink Internet Pricing Revealed: Monthly Cost and Service Details Explained

Things To Check Before Investing

Before putting your money into any such scheme, make sure you:

- Verify the latest interest rates, annuity options, and minimum investment details from official or trusted sources

- Ask for a written benefit illustration showing exactly how much monthly income you will get for ₹1.5 lakh at your present age and chosen option

- Read the terms and conditions carefully to understand whether and when the principal will be returned

- Understand the tax impact, because monthly income from FD‑like and annuity products is usually fully taxable as per your slab

- Treat viral messages, forwarded videos, and aggressive blog headlines as rough information only, never as the final decision‑making base

When you go through these checks, the LIC FD Scheme 2025 or any “new LIC FD scheme” stops being just an exciting line like “LIC Rolls Out New FD Scheme: Invest ₹1.5 Lakh and Receive ₹9,750 Monthly Income” and becomes a clear, informed financial decision. That is the difference between reacting to marketing and acting like a smart investor.

FAQs on LIC Rolls Out New FD Scheme

1. Can ₹1.5 lakh really give ₹9,750 per month?

No typical FD or standard annuity can provide such a high monthly payout on such a small principal in a safe, regulated environment.

2. Is LIC FD Scheme 2025 a normal FD or an annuity?

In many explanations, it is presented as if it were a simple FD, but structurally it can be a mix of FD‑like monthly interest payout and annuity‑style pension.

3. Is the principal safe in this kind of scheme?

In pure FD‑type Sanchay deposits, the principal is normally returned at maturity. In annuity plans, several options are designed so that the principal is not returned and only the pension is paid out over time.

4. Which is better LIC FD‑type scheme or bank FD?

Some LIC‑group or housing‑finance FDs may offer slightly better interest rates than certain bank FDs, but their liquidity, lock‑in, and conditions can differ.