The Life Insurance Corporation of India (LIC) has drawn national attention after online reports claimed that its Fixed Deposit Scheme offers ₹42,500 in interest on a ₹1 lakh investment. Official data, however, shows that the offer is part of the LIC Housing Finance Ltd. (LIC HFL) Sanchay Public Deposit Scheme, which provides market-aligned interest rates between 6.70% and 7.15% per annum—not the exaggerated figures circulating online.

LIC’s Entry Into Fixed Deposits

The LIC Fixed Deposit Scheme operates under LIC Housing Finance Ltd., a subsidiary of the Life Insurance Corporation of India. Established in 1989, LIC HFL is one of the country’s largest housing finance institutions and is registered with the National Housing Bank (NHB).

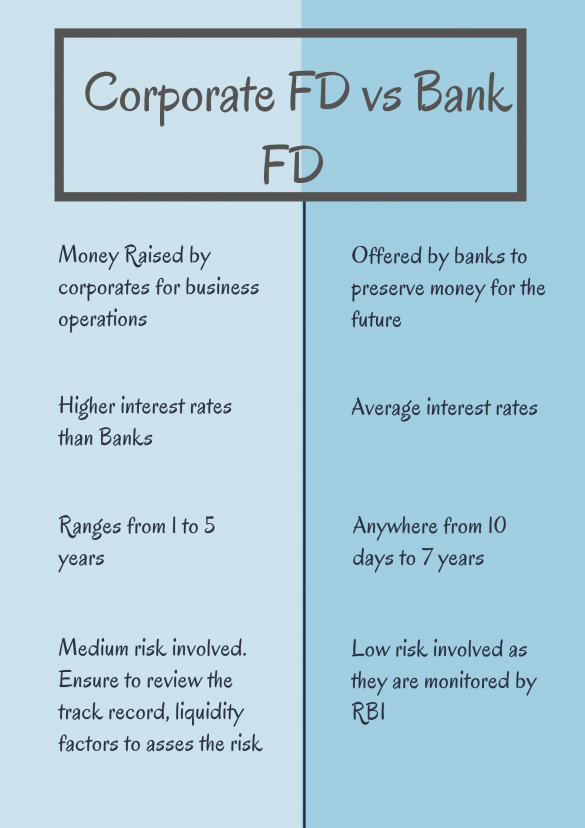

While LIC itself is primarily an insurance company, LIC HFL offers fixed deposits (FDs) to the public as part of its funding structure. These corporate FDs are distinct from traditional bank FDs but are regulated and rated for safety.

Understanding the Scheme and Returns

According to LIC HFL’s official documentation, investors can select from cumulative and non-cumulative deposit options.

- Cumulative deposits reinvest interest until maturity.

- Non-cumulative deposits pay interest monthly, quarterly, or annually.

As of November 2025, the following rates apply:

| Investor Type | 3 Years | 5 Years |

|---|---|---|

| General Public | 6.90% | 7.15% |

| Senior Citizens | 7.15% | 7.40% |

At a 7.15% annual rate, a ₹1,00,000 cumulative deposit grows to ₹1,41,180 in five years—a gain of roughly ₹41,180, close to the figure cited in viral reports. This total, however, represents the five-year cumulative return, not an annual interest payout.

“The ₹42,500 figure is a rounded estimate for cumulative growth,” explained Anupam Jain, a certified financial planner with FinVision Advisors. “It’s consistent with standard FD compounding, not an unusually high offer.”

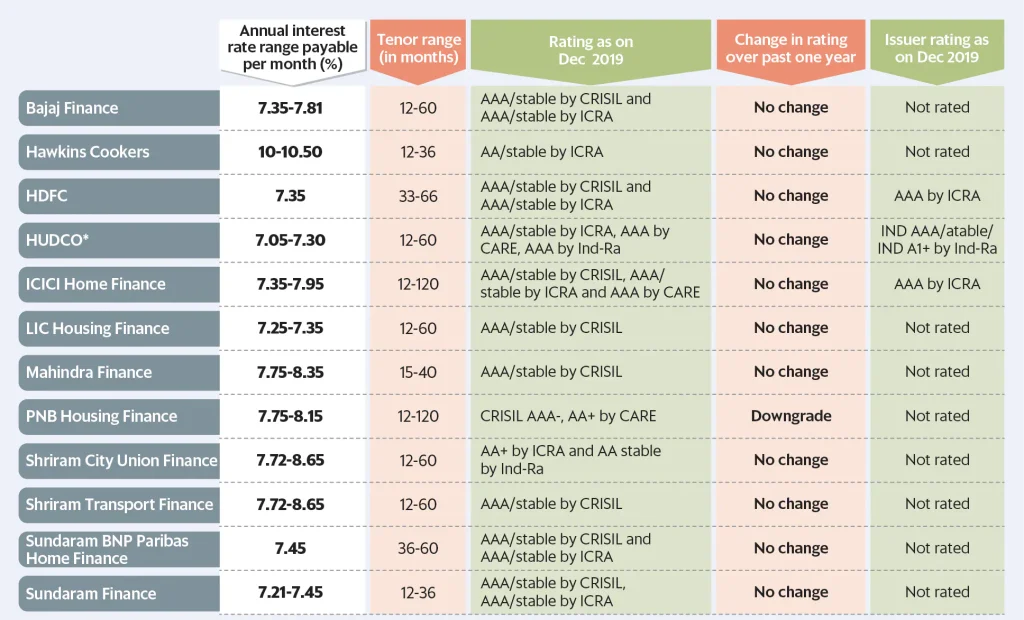

How LIC FDs Compare to Other Safe Instruments

The Reserve Bank of India (RBI) and market data indicate that most NBFC and bank FDs currently yield between 6.5% and 8.25% annually. LIC HFL’s rates sit near the middle of that range.

For comparison:

- Post Office Time Deposits offer 6.9%–7.5% depending on tenure.

- Senior Citizens Savings Scheme (SCSS) provides 8.2% for five years.

- RBI Floating Rate Bonds currently pay 8.05%, linked to the National Savings Certificate rate.

“LIC’s strength lies in brand trust and regulatory compliance rather than headline rates,” said Dr. Priya Nair, economist at the National Institute of Securities Markets (NISM). “Investors prioritizing safety may prefer this scheme despite slightly lower returns.”

Safety, Regulation, and Credit Ratings

Deposits under LIC HFL are rated FAAA/Stable by CRISIL and MAAA/Stable by ICRA, indicating “highest safety.”

However, unlike bank deposits, corporate FDs are not covered under the Deposit Insurance and Credit Guarantee Corporation (DICGC) insurance limit of ₹5 lakh.

This means investors rely on the company’s creditworthiness rather than government-backed insurance. Experts recommend checking the credit rating periodically and avoiding unregistered brokers.

Worked Example: ₹1 Lakh Investment

Here’s how ₹1 lakh grows under different deposit types with 7.15% compounding:

| Year | Balance (₹) |

|---|---|

| 1 | 1,07,150 |

| 2 | 1,14,274 |

| 3 | 1,22,085 |

| 4 | 1,30,654 |

| 5 | 1,41,180 |

Total gain: ₹41,180.

Effective return: ~41.18% over five years (approx. 7.15% compounded annually).

India’s Savings Landscape

The renewed interest in fixed deposits reflects broader shifts in India’s household financial behaviour. A CRISIL Research report in September 2025 found that the share of financial assets held in fixed-income products rose 14% year-on-year, reversing the earlier preference for equities and mutual funds.

The Reserve Bank of India’s tightening cycle, which began in 2022 to counter inflation, pushed deposit rates higher, prompting savers to lock in returns before a potential rate moderation in 2026.

“Indian households remain conservative savers,” noted Ravi Subramanian, head of retail strategy at a leading private bank. “Schemes like LIC HFL’s appeal because they combine brand trust with steady income potential.”

Investor Checklist: What to Verify Before Investing

Before opening an LIC Fixed Deposit account, financial planners recommend reviewing:

- Official Rate Card: Verify latest rates directly from LIC HFL’s website.

- Credit Rating: Check CRISIL or ICRA for current safety ratings.

- KYC Compliance: PAN and Aadhaar required for all deposits.

- TDS Applicability: Interest above ₹5,000 attracts tax deduction at source.

- Premature Withdrawal: Allowed after 3 months with reduced interest.

- Nomination: Mandatory for individual investors.

Public Trust and Transparency

LIC’s reputation as India’s largest state-owned insurer lends additional comfort to cautious investors. The company manages over ₹45 lakh crore in assets, according to its 2025 annual report, reinforcing confidence in its subsidiaries.

Still, experts stress that investors should rely solely on official communication channels. Misleading WhatsApp or social media messages have occasionally misrepresented returns to promote unauthorized deposit links.

“We have not announced any special scheme offering 42% returns,” an LIC HFL spokesperson told Business Standard. “Our FD rates are published transparently and remain within regulatory norms.”

Conclusion: A Safe, Predictable Choice — Not a Windfall

The LIC Fixed Deposit Scheme offers security and moderate returns, reflecting LIC’s long-standing commitment to conservative financial products.

For savers seeking steady income or risk-free accumulation, it remains a credible option within India’s fixed-income landscape.

However, investors should temper expectations—returns around 7% are sustainable and realistic, while any claim of extraordinary profits should be independently verified.