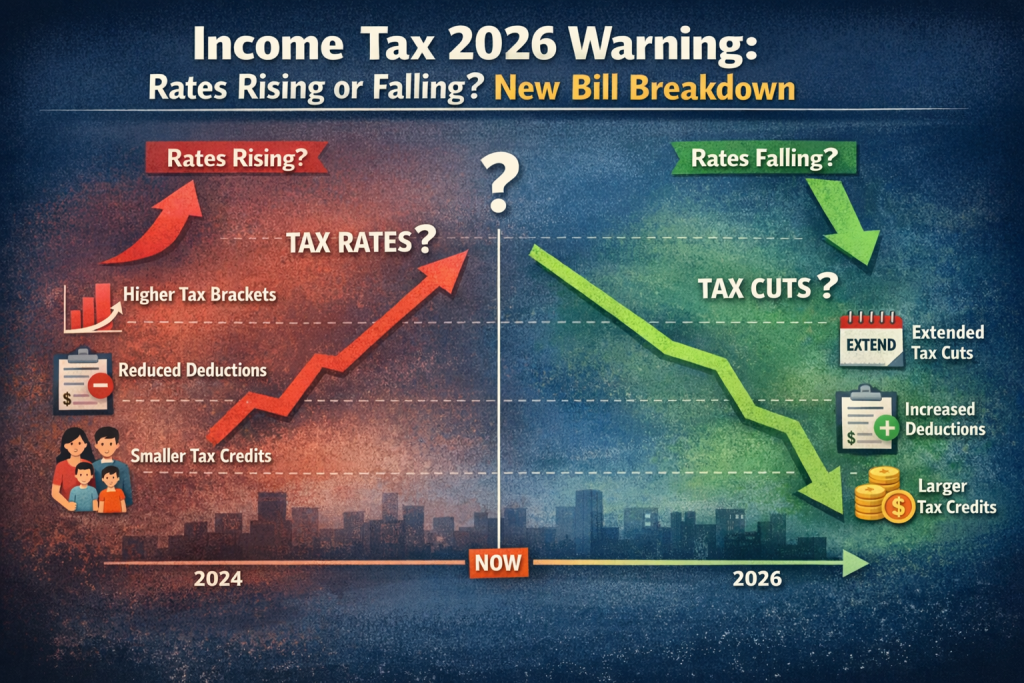

The closer we get to 2026, the louder the conversations around taxes become and for good reason. The Income Tax 2026 Warning is no longer speculation; it’s a real issue rooted in existing law. Many of the tax benefits Americans rely on today were never meant to last forever, and their expiration could reshape household finances across the country. Right now, nothing feels different. Paychecks look normal, deductions still apply, and refunds arrive as expected. But behind the scenes, automatic changes are already scheduled. The Income Tax 2026 Warning is about understanding those changes early, so you’re not caught off guard when filing future returns.

The Income Tax 2026 Warning is not a scare tactic it’s a planning signal. Current tax laws include expiration dates that trigger a rollback to older, less generous rules. If lawmakers don’t intervene, taxpayers will see higher effective tax rates, reduced deductions, and fewer credits starting in 2026. This matters because tax increases don’t always show up as headline rate hikes. Often, they appear quietly through smaller deductions or reduced credits. The Income Tax 2026 Warning is especially important for middle-income households who may assume these changes only affect the wealthy. In reality, the impact is broad and far-reaching.

Income Tax 2026 Warning

| Tax Category | Current Structure | Expected Change In 2026 | Likely Impact |

|---|---|---|---|

| Individual Tax Rates | Lower temporary rates | Higher pre-2018 rates return | Increased tax liability |

| Standard Deduction | Historically high | Reduced deduction amounts | More taxable income |

| Child Tax Credit | Expanded benefits | Smaller credit limits | Lower refunds for families |

| Estate Tax Exemption | Elevated threshold | Significant reduction | More estates subject to tax |

| Inflation Adjustments | Annual indexing | Continues | Partial relief only |

Why 2026 Is A Turning Point for Income Taxes

- The year 2026 isn’t random. It marks the expiration of several temporary individual tax provisions that were designed to sunset automatically. These provisions were introduced with time limits to meet legislative budget rules, not because lawmakers expected them to quietly disappear.

- Unless Congress passes new legislation, the tax system will reset to older standards overnight. This is why the Income Tax 2026 Warning matters now not in 2026. Once the changes take effect, taxpayers lose the chance to plan proactively.

Changes To Individual Tax Brackets

- One of the most impactful changes involves individual income tax brackets. Current brackets feature lower marginal rates across most income levels. In 2026, those rates are scheduled to rise.

- This doesn’t mean everyone jumps into a new tax bracket, but it does mean the percentage applied to portions of income increases. Over a full year, even a small rate hike can significantly reduce take-home pay. The Income Tax 2026 Warning here is subtle but powerful small percentage changes can add up fast.

Standard Deduction Adjustments

- The standard deduction has simplified tax filing for millions of Americans. Its higher amount reduced taxable income and made itemizing unnecessary for many households.

- In 2026, the standard deduction is expected to decrease. When that happens, more income becomes taxable even if your earnings don’t change. For many families, this is where the Income Tax 2026 Warning becomes unavoidable and immediate.

Child Tax Credit and Family Benefits

- Families with children should pay close attention to upcoming changes. The child tax credit has already shifted multiple times, and further reductions are built into current law.

- Lower credit amounts mean smaller refunds or higher balances owed. Households with multiple dependents may feel this change more than any other. The Income Tax 2026 Warning is particularly relevant for parents budgeting for education, childcare, and everyday expenses.

Estate And Gift Tax Changes

Estate planning is another area facing major adjustments. The current estate tax exemption is historically high, shielding many families from federal estate taxes. That exemption is scheduled to drop significantly in 2026. This change could expose more estates to taxation and increase the importance of early planning. For high-net-worth individuals, the Income Tax 2026 Warning applies just as much to long-term wealth transfer as it does to annual income taxes.

Inflation Adjustments And Their Limits

Tax brackets and certain deductions are indexed for inflation, and that practice will continue in 2026. These adjustments help prevent inflation alone from pushing taxpayers into higher brackets. However, inflation indexing cannot fully offset the expiration of major tax benefits. While helpful, it won’t eliminate higher overall tax bills. This limitation reinforces the Income Tax 2026 Warning don’t rely on inflation adjustments to save you.

Legislative Uncertainty and New Proposals

- Congress still has time to act. Some proposals aim to extend current tax provisions, while others suggest reshaping the tax code entirely.

- The challenge is uncertainty. Until legislation is passed, taxpayers must plan based on existing law. The Income Tax 2026 Warning encourages flexibility prepare for higher taxes and adjust if relief arrives later.

How Different Income Groups May Be Affected

Lower-income households may see modest changes due to credits and inflation adjustments. Middle-income families are likely to feel the most pressure from reduced deductions and credits. High-income earners may face higher marginal rates and estate tax exposure. Understanding where you fall helps you respond appropriately. The Income Tax 2026 Warning isn’t one-size-fits-all, but it applies to nearly everyone in some way.

What Taxpayers Should Do Now

Preparation is key. Review your tax withholding, increase contributions to tax-advantaged accounts, and consider long-term planning strategies. Consulting a tax professional now provides more options than waiting until the rules change. The Income Tax 2026 Warning is ultimately about control. Acting early gives you choices. Waiting limits them.

Namo Shetkari Yojana 8th Installment Date Out? Farmers Waiting—Big Update Today

Common Mistakes to Avoid Before 2026

- Many taxpayers assume Congress will fix everything at the last minute. Others delay planning because changes feel far away. Both approaches can be costly.

- Ignoring the Income Tax 2026 Warning could mean missed opportunities to reduce future tax burdens. Early action is almost always more effective than reactive adjustments.

FAQs on Income Tax 2026

Will income tax rates automatically increase in 2026

Yes, if current law remains unchanged, higher rates will return.

Who should be most concerned about the 2026 tax changes

Middle-income families, parents, and high-net-worth individuals should pay close attention.

Does a lower standard deduction really matter

Yes. Even small reductions can significantly increase taxable income.

Is it too early to plan for 2026 taxes

No. Early planning offers the greatest flexibility and savings.