Buying a home is a big moment, but the loan part can quickly turn stressful once you start calculating EMIs and total interest. That’s exactly why the Home Loan Interest Subsidy Scheme has become a hot topic, it promises meaningful relief on your repayment by reducing the interest burden for eligible buyers. If you’re planning to purchase your first home in 2026, the Home Loan Interest Subsidy Scheme can be the difference between still waiting and finally booking. The Home Loan Interest Subsidy Scheme is designed to support eligible families with interest relief, so the home loan becomes more affordable, and the EMI becomes easier to manage.

The Home Loan Interest Subsidy Scheme is a government-supported interest relief benefit for eligible homebuyers, mainly aimed at first-time purchasers and families within specified income limits. The core idea is simple: if you qualify, you get interest subsidy support (up to 4% as described) on an eligible home loan, which reduces your overall borrowing cost and improves affordability. This isn’t a cash in hand giveaway. In most such subsidy structures, the benefit is linked to your sanctioned home loan and is provided through the lending institution as per scheme rules. That’s why understanding eligibility, property conditions, and loan caps matters as much as the headline 4% relief.

Home Loan Interest Subsidy Scheme

| Overview Point | Details (Quick View) |

|---|---|

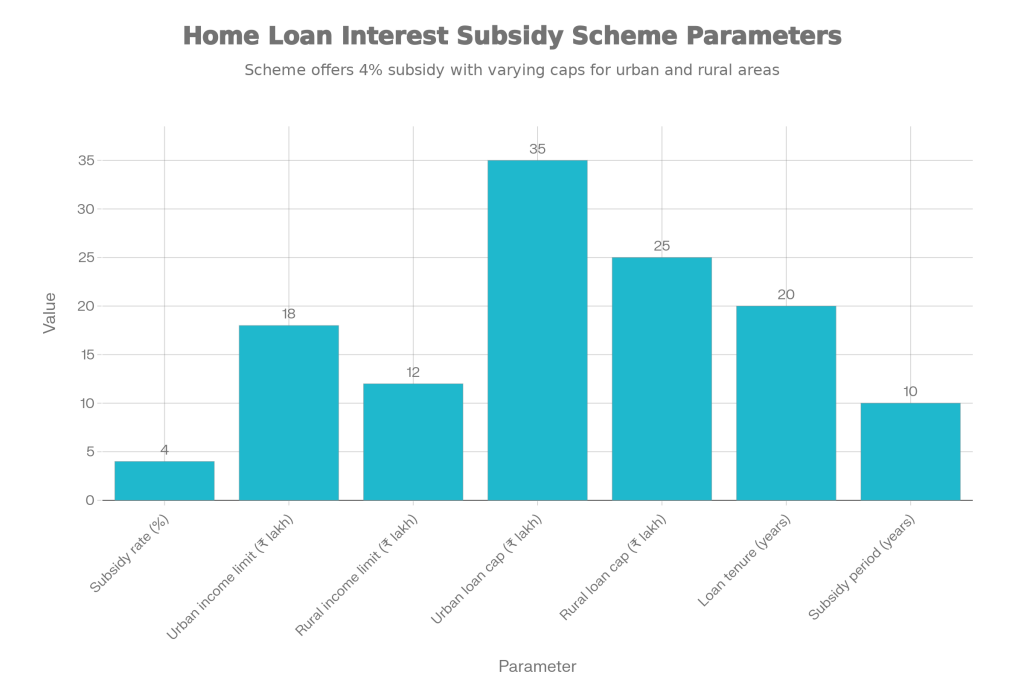

| Relief offered | Up to 4% interest subsidy benefit on eligible home loan |

| Who it is for | Primarily first-time homebuyers meeting income criteria |

| Income limits mentioned | Up to ₹18 lakh (urban) and up to ₹12 lakh (rural) |

| Loan amount cap mentioned | Up to ₹35 lakh (urban) and up to ₹25 lakh (rural) |

| Loan tenure mentioned | Up to 20 years |

| Subsidy period mentioned | Up to 10 years |

| Property purpose | Self-occupied home (not investment or second home) |

| Age band mentioned | 21 to 60 years |

| Documents required | KYC, income proof, and property-related documents |

If you’re buying your first home and your income and loan amount fall within the specified limits, the Home Loan Interest Subsidy Scheme can reduce your overall interest cost and make your monthly EMI more comfortable. The smartest approach is to check eligibility first, keep documents ready, and apply through a lender that actively processes subsidy-linked home loans. If you want, share your city, annual household income, and tentative loan amount, and the eligibility can be mapped more clearly.

How Does the Home Loan Subsidy 2026 Work?

- Most people assume the subsidy means the bank instantly drops your interest rate. In reality, the Home Loan Interest Subsidy Scheme works as structured interest support: you pay EMIs as per the lender’s schedule, and the subsidy benefit is applied as per the scheme framework to reduce the overall interest burden.

- Think of it as the government stepping in to absorb part of your interest cost for a defined period, provided you remain eligible and the loan stays compliant. The real-world impact is usually seen in either reduced EMIs, reduced outstanding principal, or a lower effective interest outgo over the supported period (depending on how the scheme applies it).

- Another important point: the subsidy is not unlimited. It is linked to specific loan limits and typically a defined subsidy window. So even if your loan is for 20 years, the subsidy may apply only for the first 10 years, after which your loan continues at the standard terms agreed with the bank.

Key Features:

- Up to 4% interest benefit for eligible borrowers.

- Separate loan caps for urban and rural applicants.

- Aimed at first-time homebuyers with specified income ceilings.

- Tenure can be up to 20 years, but subsidy period is capped (10 years mentioned).

- Designed to improve affordability by reducing overall interest burden.

Eligibility Criteria For Home Loan Subsidy 2026

Eligibility is the make-or-break factor. Many applicants miss out not because they can’t afford the home, but because one eligibility condition doesn’t match their profile. Here are the key filters you should check before getting your hopes up.

Income Limit

- The Home Loan Interest Subsidy Scheme is tied to income categories. As mentioned, eligibility can differ for urban and rural applicants, with limits such as up to ₹18 lakh for urban areas and up to ₹12 lakh for rural areas. If your household income crosses the ceiling, the subsidy won’t apply.

- Tip: Always confirm what counts as family income for your case. In many schemes, income is calculated as the combined income of the household, not just the applicant.

First Time Homebuyers

- This is a common non-negotiable rule: the scheme is aimed at first-time homebuyers. That means if you already own a pucca house (or have previously benefited from a similar housing subsidy), you may be treated as ineligible.

- If there’s any property already in your name or in your immediate family’s name, clarify this early with your lender. It can save you from rejection later.

Loan Amount

The subsidy is linked to a maximum eligible loan size. The mentioned caps include up to ₹35 lakh in urban areas and up to ₹25 lakh in rural areas. If your sanctioned loan exceeds the scheme cap, you may either become ineligible or receive subsidy only up to the allowed portion (depending on scheme rules).

Property Type

This is where many people get confused. The Home Loan Interest Subsidy Scheme is meant for self-occupied residential homes, not for:

- Buying a second home

- Buying a house purely for rental/investment

- Purchasing a property that doesn’t meet the scheme’s “approved residential” nature

If you plan to rent it out immediately or treat it as an investment purchase, the subsidy may not be applicable.

Age And Documentation

Age eligibility such as 21 to 60 years is typically mentioned to ensure the borrower falls within standard lending and repayment norms. Also, documentation is strict:

- Identity proof and address proof (KYC)

- Income proof (salary slips, ITR, bank statements)

- Property documents (agreement, allotment letter, title papers, etc.)

A small mismatch in names, addresses, or income figures can slow down the process, so it’s worth cleaning up paperwork before applying.

How To Apply For The Home Loan Subsidy 2026

The application process is not usually separate like a standalone government form you submit directly. In practice, it typically routes through your bank or housing finance company.

Choose A Participating Lender

Start by selecting a bank or housing finance company that processes eligible subsidy-linked home loans. If you already have a preferred lender, confirm they are facilitating the subsidy benefit for your category.

Application Process For Home Loan Interest Subsidy Scheme

Apply for the home loan normally, but make sure you clearly mention that you want to be considered under the Home Loan Interest Subsidy Scheme. Submit complete KYC, income proof, and property documents.

Loan Selection

Pick a loan amount and product that stays within the eligibility boundaries (income, property type, and loan caps). If you push beyond the cap, you may lose eligibility and end up with a standard home loan only.

Eligibility Verification

The lender checks:

- Income eligibility

- First-time homebuyer criteria

- Property type and compliance

- Credit profile and repayment capacity

Remember: subsidy eligibility does not override the bank’s credit approval. Even if you qualify for subsidy conditions, the bank can still reject your loan if your credit risk is high.

Subsidy Application

Once approved, the subsidy benefit is applied as per the scheme method. This is the stage where many borrowers should ask one clear question:

How exactly will the subsidy reduce my cost EMI reduction, principal reduction, or effective interest reduction?

Get the explanation in writing or in an official email from the lender.

Sign Loan Agreement

After approval, you sign the agreement, and disbursement happens as per the property payment plan. Keep copies of everything, especially the sanction letter and subsidy-related communication.

Benefits Of the Home Loan Subsidy 2026

This is why the Home Loan Interest Subsidy Scheme matters, it improves affordability at the time when you need it most right when EMIs begin.

Lower Monthly EMIs

With interest relief, your EMI becomes lighter compared to a normal loan at market rates. Even a small EMI drop can improve monthly cash flow and reduce stress.

Big Savings on Interest

The real saving isn’t just month-to-month. It accumulates over years. If the subsidy applies for up to 10 years, the total interest saved across that period can be substantial.

Increased Loan Affordability

Lower EMIs can increase eligibility for some borrowers because banks often approve loans based on your EMI-to-income ratio. When EMIs become manageable, approval chances may improve.

Government Support

For many first-time buyers, government backing builds confidence. It signals that the scheme is structured and targeted, not just a temporary discount from a private lender.

Important Points to Consider

Before you apply, keep these practical realities in mind.

Limited Applicability

The Home Loan Interest Subsidy Scheme is not for everyone. It is tightly defined by income limit, first-time buyer status, and property usage.

Maximum Subsidy Period

Even if your loan runs for 15–20 years, the subsidy may apply only for the first 10 years. After that, the loan continues at standard interest terms.

Tax Implications

Interest subsidy and interest deduction are different things. Home loan tax benefits (like deductions on interest/principal) have their own rules and do not automatically change because you received subsidy support. Also, confirm any tax treatment issues with a qualified tax advisor.

Property Location Limits

Loan caps can differ for rural and urban areas, and definitions can be strict. Make sure your property location category is correctly identified, otherwise your eligibility can be impacted. Even if you fit the criteria on paper, final approval depends on lender verification, document checks, and scheme compliance. Avoid booking a property solely based on an assumed subsidy unless the lender confirms it during sanction.

FAQs on Home Loan Interest Subsidy Scheme

1. Who can apply for the Home Loan Interest Subsidy Scheme?

First-time homebuyers who meet the scheme’s income limits and are purchasing a self-occupied residential property can apply, subject to lender and documentation checks.

2. Is the 4% subsidy applied for the entire home loan tenure?

Not necessarily. The mentioned structure indicates a capped subsidy period (such as up to 10 years), while the loan tenure can be longer.

3. Can I get the Home Loan Interest Subsidy Scheme for a second home?

No. The scheme is meant for self-occupied homes and typically excludes second homes and investment properties.

4. What documents are usually required to claim the subsidy?

Generally, KYC documents, income proof, and property documents are required, along with any scheme-specific declarations requested by the lender.