If you’ve been waiting for clarity on retirement income, here’s the good news: 2025 is set to deliver higher pension support through an elevated EPFO minimum pension floor alongside faster processing of higher pension claims, plus a structured, assured path under the newly operational Unified Pension framework for government employees. The intent is straightforward raise the income floor, reduce uncertainty, and protect retirees from inflation-driven erosion of purchasing power.

2025 truly means something this year: higher pension support for 2025 beneficiaries signals a policy-level push to upgrade the minimum pension under EPS-95 while operationalising a unified pension pathway with clear option windows and predictable benefits for government employees. It brings two strands together relief for vulnerable EPS pensioners and assurance for those under the government’s unified pension framework.

Higher Pension Support for 2025 Beneficiaries

| Key Item | What Changes In 2025 | Who Benefits | Timeline/Status |

|---|---|---|---|

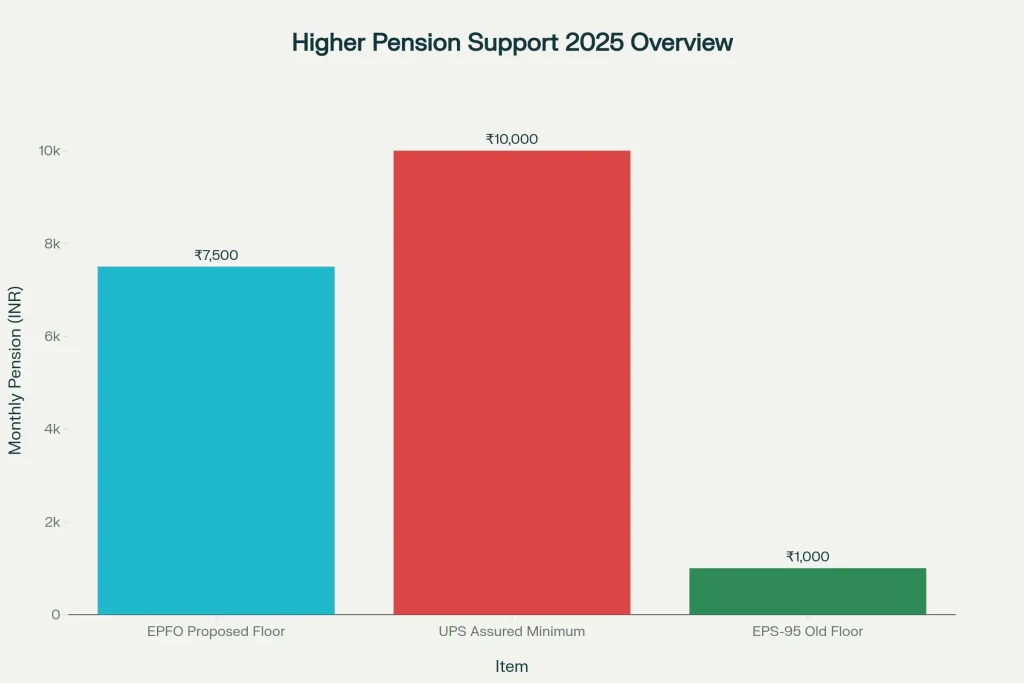

| EPFO Minimum Pension (EPS-95) | Proposed increase from ₹1,000 to ₹7,500 per month | Existing EPS-95 pensioners at the floor | Implementation post formal approvals |

| Higher Pension Processing (EPS) | Faster disposal of higher-wage pension cases with demand notices and PPO issuance | EPS members who filed valid joint options | Ongoing through 2025 with prioritised processing |

| Unified Pension Framework | Assured payout structure with indexation and family support provisions | Central government employees with defined service | Operational from April 1, 2025 with option windows |

| Option Windows And Deadlines | Time-bound choices for existing employees/retirees to opt into the unified framework | In-service and eligible retirees as notified | Windows notified departmentally; act within deadlines |

| Payout Calculations | Revised minimum floor for EPS and rule-based assured payouts under the unified system | EPS-95 and UPS participants respectively | Applied upon notification and PPO updates |

This year’s pension direction is about more than announcements it’s about execution. If you rely on EPS-95, the revised floor can lift your monthly baseline the moment it’s notified. If you filed for a higher-wage pension, tracking and timely compliance with demand notices will determine how quickly your PPO updates. And if you’re a government employee eligible for the unified pension framework, your decision within the option window locks in predictable benefits for decades. Higher pension support for 2025 beneficiaries isn’t a slogan; it’s a set of actions by you and by the system that can secure a steadier retirement.

What’s Changing for EPFO Pensioners

For EPS-95 pensioners, the long-discussed upgrade to a ₹7,500 minimum monthly pension aims to replace the stagnant ₹1,000 floor that has lagged far behind essential costs like food, rent, utilities, and medicines. This higher pension support for 2025 beneficiaries is targeted at restoring basic adequacy and stabilising monthly cash flows for retirees who lack other income buffers. Once notified, those below the new floor are stepped up automatically; no separate application is required for the floor adjustment on existing PPOs.

Higher Pension Cases Under EPS

Separate from the minimum floor, higher-wage pension cases filed through the joint option route continue to move through verification, demand notifications for arrears, and revised PPO issuance. If you submitted within the stipulated windows and your employer uploaded validated wage data, watch for demand notices and ensure timely payment to avoid delays in pension fixation. Keep your documentation, bank details, and KYC current on the portal so your case doesn’t stall during reconciliation.

Unified Pension Scheme Explained

For central government employees, a unified pension pathway is now operational with an assured payout structure, inflation indexation, and family pension continuity. The framework clarifies who can opt in, the contribution rules, and how benefits accrue and are disbursed at superannuation. Option windows apply to different cohorts those in service as of the cutoff and specified retirees so check your department’s circulars and file within the deadline to avoid losing eligibility. This is designed to provide predictability and reduce ambiguity around retirement income.

Eligibility Criteria for Higher Pension Support

- EPS-95 Pensioners: If you currently receive an EPS pension and the new minimum is notified, the uplift to the revised floor will reflect in your PPO without a fresh application.

- Higher-Wage Pension Applicants: Your eligibility depends on proper submission of the joint option, employer wage data, and settlement of any arrear demand; keep tracking status online.

- Government Employees (UPS): You must actively exercise the option within the specified window if you wish to come under the unified pension structure; follow your ministry’s instructions.

Timelines You Should Note

- Minimum Pension Floor (EPS-95): Watch for the formal notification after board and ministry approvals; pension disbursals reflect the new floor from the effective month stated.

- Higher Pension Processing: Expect case-wise movement through demand notices and revised PPOs; timelines vary by documentation completeness and establishment type.

- Unified Pension Options: The scheme is operational from April 1, 2025; option windows for different cohorts are time-bound, and missing them can delay or forfeit intended benefits.

How Higher Pension Support Impacts Payouts

- EPS Minimum Floor: If notified at ₹7,500, retirees currently at or below the old ₹1,000 floor will see their monthly pension reset to the new minimum, directly improving liquidity and resilience.

- Higher-Wage Pension: Approved cases see pension recalculated on actual higher wages, after arrears are computed and settled; the revised PPO reflects the new entitlement going forward.

- Unified Pension Benefits: Assured payouts and indexation create a more predictable post-retirement income stream, with family support provisions reducing gaps for survivors.

What To Do Next

- For EPS Pensioners: Update KYC, Aadhaar, and bank details on the EPFO portal; monitor official circulars for the exact effective date of the new minimum and verify your PPO after the update.

- For Higher Pension Applicants: Log in periodically to check whether a demand notice has been raised, pay within the stipulated time, and track PPO issuance; keep all receipts for records.

- For Government Employees: Read the unified pension FAQs and department notices carefully; file your option and supporting documents before the deadline and keep acknowledgments safe.

Key Takeaways For 2025 Beneficiaries

Higher pension support for 2025 beneficiaries brings three practical shifts: a proposed uplift to the EPS minimum floor to protect the most vulnerable, accelerated processing for higher-wage pension cases to convert pending claims into revised PPOs, and an operational unified pension pathway that codifies assured payouts, indexation, and family support for government employees. Stay alert to official notifications, act within option windows, and keep your documentation and KYC updated those small steps are what turn policy headlines into money in your bank account.

FAQs on Higher Pension Support for 2025 Beneficiaries

Will every EPFO pensioner get ₹7,500 in 2025?

Only those whose current EPS pension is below the notified new floor are stepped up to the minimum; pensioners already above that amount will continue to receive their calculated benefit as per rules.

How do I know if my higher-wage pension is approved?

Check your EPFO account for demand notices and a revised PPO; approval shows as a completed recalculation with new pension details after arrears are settled.

Who can opt for the unified pension framework?

Central government employees covered under the notified rules as of the effective date and specified retirees within scope can opt in; exact categories and timelines are defined in official FAQs and departmental circulars.

Does the unified pension replace NPS for everyone?

No. It is an option with specific eligibility and deadlines; employees must exercise the option within the notified window if they choose to come under the unified structure.