Retirement rules may not come up in everyday conversations, but when they change, the impact is immediate and far-reaching. Recently, discussions around the Govt’s Big Decision on Retirement Age have gained serious momentum, especially among central government employees and job aspirants. The idea of extending the working life by two more years has sparked curiosity, hope, concern, and debate all at the same time. At its core, the Govt’s Big Decision on Retirement Age is not just about working longer. It touches on financial security, career growth, workforce balance, and how the government plans to manage experience and talent in the coming years. With increasing life expectancy and changing economic realities, retirement policies are becoming a critical part of long-term governance and workforce planning.

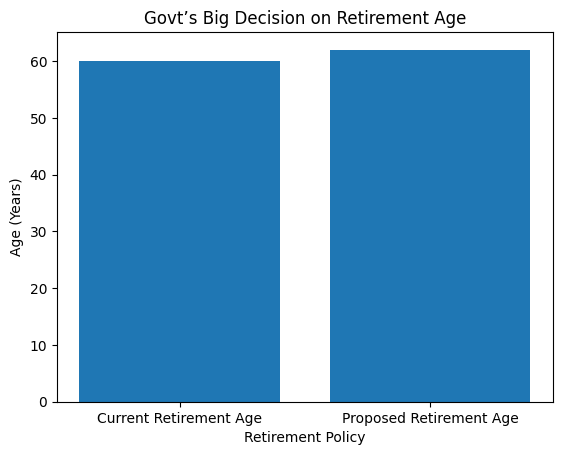

The Govt’s Big Decision on Retirement Age refers to reports suggesting that the retirement age for central government employees may be increased from 60 years to 62 years, starting in 2026. If implemented, this would be one of the most notable changes in service conditions in recent years. The rationale behind this move is simple yet impactful. Employees are healthier, more productive, and capable of contributing effectively well into their 60s. By extending the retirement age, the government aims to retain experienced professionals, reduce frequent turnover, and allow employees more time to strengthen their financial future. However, it is important to understand that retirement policies involve multiple administrative layers. Any final decision typically comes with official notifications, rule amendments, and clear implementation guidelines. Until that happens, the discussion remains highly relevant but closely watched.

Govt’s Big Decision on Retirement Age

| Key Aspect | Details |

|---|---|

| Proposed Change | Increase in retirement age |

| Current Retirement Age | 60 years |

| Proposed Retirement Age | 62 years |

| Additional Working Years | 2 years |

| Expected Implementation | From 2026 |

| Affected Employees | Central government employees |

| Primary Objective | Retain experience and improve financial security |

| Potential Impact | Promotions, recruitment cycles, pension planning |

Experienced Workforce Stays Longer

- One of the strongest arguments supporting the Govt’s Big Decision on Retirement Age is the value of experience. Senior employees carry institutional knowledge that cannot be replaced overnight. From policy interpretation to administrative processes, experience plays a crucial role in maintaining continuity within government departments.

- When employees retire at the same age in large numbers, departments often face sudden gaps in leadership and expertise. Extending the retirement age helps smoothen this transition. It allows senior staff to mentor younger colleagues, guide complex projects, and ensure that critical knowledge is passed on effectively.

- This approach also aligns with global workforce trends. Many countries are re-evaluating retirement norms as populations age and life expectancy rises. In this context, keeping skilled employees active for a little longer is seen as both practical and economically sensible.

- At the same time, retaining experienced staff does not mean blocking opportunities entirely. With proper planning, departments can balance continuity with fresh talent by adjusting recruitment and promotion strategies accordingly.

Financial Security Improves After Govt’s Big Decision on Retirement Age

- For employees, the most tangible benefit of the Govt’s Big Decision on Retirement Age lies in improved financial stability. Two additional working years mean continued income, extended contributions to retirement savings, and more time to plan life after service.

- Many government employees’ structure major financial decisions such as home loans, children’s education, or healthcare planning around their retirement timeline. An extended service period provides breathing room. It allows employees to reduce debt, build a stronger retirement corpus, and prepare more confidently for post-retirement life.

- From a pension perspective, longer service often translates into better benefits. Whether under traditional pension systems or newer contribution-based frameworks, extra years of service can positively influence long-term payouts and financial comfort.

- However, financial planning must always be aligned with official rules. Employees are advised to revisit their retirement strategies once formal guidelines are released, ensuring that their plans reflect actual policy changes rather than assumptions.

Impact On Promotions and Recruitment

- While the Govt’s Big Decision on Retirement Age brings clear advantages, it also raises concerns—particularly around promotions and recruitment. When employees stay longer, vacancies open up later. This can slow down promotion cycles, especially in departments with limited sanctioned posts.

- Younger employees and aspirants may worry about delayed career progression or fewer job openings in the short term. These concerns are valid and deserve attention. A well-managed transition requires thoughtful workforce planning, including timely recruitment, skill development, and role restructuring.

- Government departments may need to explore flexible promotion structures or create additional senior roles to accommodate both experience retention and career growth. Balancing these interests will be key to ensuring that the policy benefits the workforce as a whole.

Administrative And Governance Perspective

- From an administrative standpoint, the Govt’s Big Decision on Retirement Age offers stability. Frequent retirements require constant recruitment, training, and handovers all of which demand time and resources. Extending service duration can reduce this operational pressure.

- Experienced employees often handle sensitive portfolios and long-term projects. Keeping them in service longer helps ensure consistency in policy implementation and decision-making. This is especially important in sectors where expertise develops over decades rather than years.

- At the same time, governance systems must remain dynamic. While experience is invaluable, innovation and adaptability are equally important. A balanced workforce combining seasoned professionals with younger talent can help government institutions remain effective and responsive.

What Employees Should Do Now

- As discussions around the Govt’s Big Decision on Retirement Age continue, employees should take a proactive but cautious approach. The first step is staying informed through official channels rather than relying solely on headlines or social media discussions.

- Employees can use this time to review their financial plans, assess health and insurance coverage, and think about long-term goals. Even if the retirement age change is confirmed later, early preparation ensures that employees are ready to adapt smoothly.

- Departments, on the other hand, should begin internal assessments. Understanding how an extended retirement age might affect staffing, promotions, and workload distribution will help minimize disruptions once the policy is officially implemented.

PM Kisan New Update 2026 – 22nd Installment Date Revealed, Check Payment Status Now

Long-Term Implications for Government Jobs

- The Govt’s Big Decision on Retirement Age could signal a broader shift in how government jobs are structured in the future. As demographics change, policies may increasingly focus on flexibility, skill-based roles, and performance-driven extensions rather than fixed age limits.

- For job aspirants, this means competition may evolve rather than disappear. While fewer vacancies could open in the short term, long-term demand for skilled professionals remains strong. Government roles still offer stability, purpose, and structured growth qualities that continue to attract candidates.

- For existing employees, the focus may gradually shift toward continuous learning and adaptability. Staying relevant, healthy, and productive will become just as important as years of service.

The Govt’s Big Decision on Retirement Age has sparked widespread discussion for good reason. Extending the retirement age to 62 has the potential to improve financial security for employees, retain valuable experience, and strengthen administrative continuity. At the same time, it presents challenges that require careful planning and transparent communication. Whether or not the change is implemented exactly as discussed, the conversation itself highlights an important reality: retirement policies must evolve with changing times. Employees, administrators, and policymakers all have a role to play in shaping a system that is fair, balanced, and future ready.

FAQs on Govt’s Big Decision on Retirement Age

Is the retirement age officially increased to 62?

As of now, the proposal has been widely discussed, but employees should wait for an official government notification for confirmation.

Will promotions be delayed due to this decision?

There may be some impact on promotion cycles, but departments can manage this through structured workforce planning.

Does this apply to all government employees?

The discussion mainly focuses on central government employees. Separate rules may apply to state governments or specific services.

How should employees prepare for this change?

Employees should stay updated, review financial plans, and be ready to adjust retirement strategies once official guidelines are issued.