Access to finance has always been one of the biggest challenges for small business owners and entrepreneurs in India. Whether you are launching a startup, expanding an MSME, or trying to stabilize cash flow, timely funding can decide how fast your business grows.

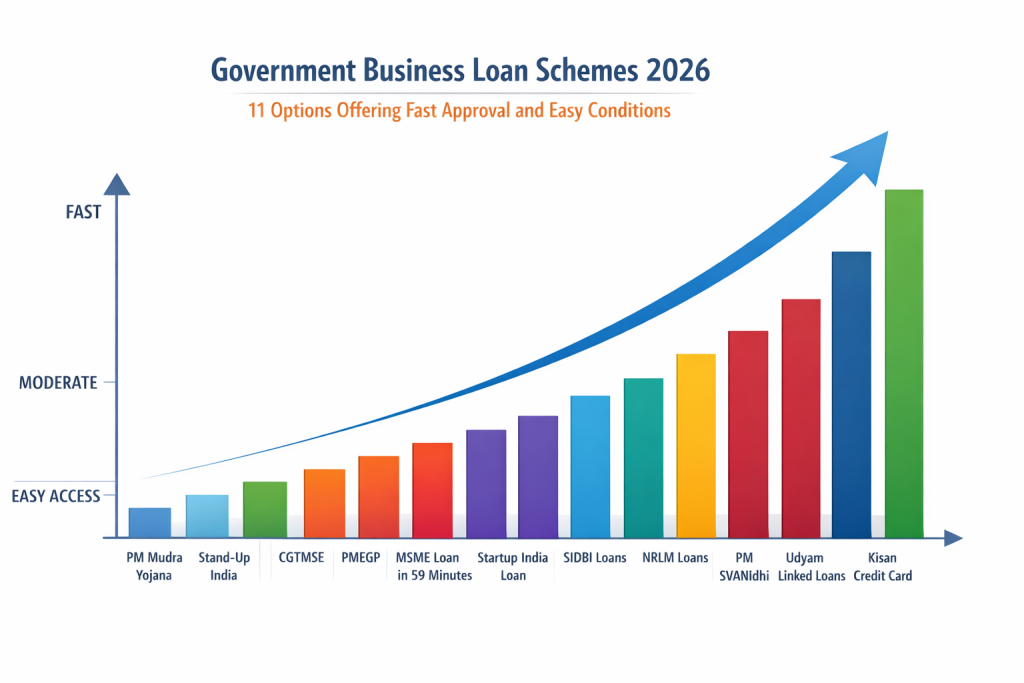

In 2026, Government Business Loan Schemes 2026 have become more structured, transparent, and entrepreneur-friendly than ever before. These schemes are designed to reduce dependency on high-interest private loans and make formal credit accessible to genuine businesses. What makes Government Business Loan Schemes 2026 especially relevant today is their focus on speed and simplicity. With online portals, reduced paperwork, and collateral-free options, the government has made it easier for MSMEs, startups, women entrepreneurs, and rural businesses to access capital. These schemes don’t just provide money; they offer long-term financial stability and help businesses build a formal credit history.

The Government Business Loan Schemes 2026 aim to empower Indian entrepreneurs by offering affordable credit with flexible conditions. These schemes cater to a wide range of businesses, from street vendors and micro-enterprises to registered MSMEs and innovative startups. Unlike traditional bank loans, government-backed schemes focus on inclusion, employment generation, and sustainable growth rather than just credit scores. In 2026, the integration of GST data, Udyam registration, and digital banking has significantly improved loan processing timelines. Many schemes now offer approvals within hours or days, making them ideal for businesses that need quick working capital or expansion funds. By choosing the right scheme, entrepreneurs can reduce financial stress and focus on scaling operations confidently.

Government Business Loan Schemes 2026

| Scheme Name | Loan Amount | Collateral | Best Suited For | Approval Speed |

|---|---|---|---|---|

| PM Mudra Yojana | Up to ₹10 lakh | No | Micro and small businesses | Fast |

| Stand Up India | ₹10 lakh to ₹1 crore | Partial | Women and SC ST entrepreneurs | Moderate |

| CGTMSE | Up to ₹5 crore | No | MSMEs | Moderate |

| PMEGP | Up to ₹50 lakh | No | New entrepreneurs | Moderate |

| MSME Loan In 59 Minutes | Up to ₹5 crore | Optional | Existing MSMEs | Very Fast |

| Startup India Loan | Varies | Case based | DPIIT startups | Moderate |

| SIDBI MSME Loans | Up to ₹10 crore | Case based | Growing MSMEs | Moderate |

| NRLM Loans | Small ticket | No | Rural SHGs | Fast |

| PM SVANidhi | Up to ₹50,000 | No | Street vendors | Fast |

| Udyam Linked Loans | Varies | Minimal | Registered MSMEs | Fast |

| Kisan Credit Card | Up to ₹3 lakh plus | No | Agri based businesses | Fast |

The Government Business Loan Schemes 2026 represent a strong commitment toward building a resilient and inclusive entrepreneurial ecosystem in India. With easier approvals, flexible terms, and affordable interest rates, these schemes reduce financial barriers and encourage sustainable business growth. For anyone planning to start or scale a business in 2026, choosing the right government loan scheme can be a decisive step toward long-term success.

Pradhan Mantri Mudra Yojana

- Pradhan Mantri Mudra Yojana continues to be the backbone of micro business financing in India. It offers loans under three categories Shishu, Kishor, and Tarun depending on the stage of the business. Small shop owners, service providers, freelancers, and traders benefit the most because the loans are collateral-free and easy to apply for.

- In 2026, Mudra loans are largely processed through digital banking channels, making approvals faster and tracking easier. This scheme plays a critical role in supporting self-employment and grassroots entrepreneurship across urban and rural areas.

Stand Up India Scheme

- The Stand Up India Scheme focuses on promoting entrepreneurship among women and SC ST communities. It supports greenfield enterprises in manufacturing, services, or trading sectors. Loan amounts are higher compared to micro schemes, making it suitable for medium-scale business ideas.

- Banks also provide guidance and support throughout the loan lifecycle, which improves business sustainability. In 2026, the scheme has gained popularity due to improved monitoring and simplified application procedures.

Credit Guarantee Scheme For MSMEs

- The Credit Guarantee Fund Trust for Micro and Small Enterprises allows MSMEs to access loans without pledging collateral. The government provides a credit guarantee to banks, reducing their risk and encouraging lending to small businesses.

- This scheme is ideal for enterprises with limited assets but strong business potential. In 2026, CGTMSE has become a key pillar of MSME financing, especially for manufacturing and service sectors.

Prime Minister’s Employment Generation Programme

- PMEGP supports new entrepreneurs by combining bank loans with government subsidies. The subsidy reduces the overall loan burden and helps businesses start operations with lower initial investment.

- This scheme is particularly effective in rural and semi-urban areas, where access to private finance is limited. Many small manufacturing units and service-based businesses benefit from PMEGP every year.

MSME Business Loan In 59 Minutes

- This scheme is designed for speed and efficiency. Eligible MSMEs can receive in-principle approval within an hour by submitting GST returns, income tax details, and bank statements online.

- It is best suited for existing businesses with a track record who need quick capital for expansion, inventory, or working capital. In 2026, this scheme remains one of the fastest ways to access formal business credit.

Startup India Loan Scheme

- The Startup India initiative supports innovation-driven businesses by improving access to institutional funding. While the government does not directly provide loans, it facilitates funding through partner banks, NBFCs, and credit guarantee mechanisms.

- Startups registered under DPIIT enjoy better visibility and credibility, which improves approval chances. This scheme is especially helpful for technology-driven and scalable business models.

SIDBI Loan Schemes For MSMEs

- SIDBI offers a wide range of financial products for MSMEs, including term loans, working capital, and refinancing options. These loans are structured to support long-term growth and modernization.

- In 2026, SIDBI has increased its focus on sustainability, exports, and digital transformation, making it a preferred lender for growth-oriented MSMEs.

National Rural Livelihood Mission Loans

- NRLM loans empower rural entrepreneurs through self-help groups. These loans come with lower interest rates and flexible repayment terms, making them ideal for small-scale rural businesses.

- Women-led enterprises benefit the most from NRLM, as the scheme promotes financial inclusion and livelihood generation at the grassroots level.

PM SVANidhi Scheme

- PM SVANidhi is designed specifically for street vendors and small urban traders. It provides short-term working capital to help vendors restart and expand their businesses.

- Regular repayment improves credit scores and unlocks higher loan limits over time. In 2026, this scheme continues to support urban informal businesses effectively.

Udyam Registration Linked Loans

- Businesses registered under Udyam gain easier access to formal credit. Banks prefer Udyam-registered MSMEs because their data is verified and linked with government systems.

- This registration improves loan approval chances, reduces interest rates, and opens doors to multiple government benefits.

RajSSP Pension 2026 Explained: New Benefits, Eligibility & Payment Details

Kisan Credit Card For Business Use

- Kisan Credit Cards are no longer limited to farming. They now support allied activities like dairy, fisheries, poultry, and food processing.

- Low interest rates, flexible repayment, and interest subvention make KCC a reliable funding option for rural entrepreneurs in 2026.

FAQs on Government Business Loan Schemes 2026

Is Government Business Loan Schemes 2026 suitable for startups

Yes, startups registered under Startup India or Udyam can access multiple government-backed loan options depending on their business model.

Do government business loans require collateral

Many schemes under Government Business Loan Schemes 2026 are collateral-free, especially for micro and small enterprises.

How fast can I get approval

Some schemes offer approval within hours, while others may take a few weeks depending on documentation and loan size.

Can rural entrepreneurs apply for these schemes

Yes, schemes like NRLM, PMEGP, Mudra, and Kisan Credit Card are specifically designed for rural and semi-urban businesses.