The Indian government has officially approved a 6% Dearness Allowance (DA) hike for central government employees and pensioners, providing much-needed financial relief amid rising inflation. This move directly affects millions of households across the country, as the cost of living continues to climb, impacting essentials like groceries, fuel, and healthcare.

For employees, the DA increase translates into a higher monthly salary, while pensioners receive a corresponding Dearness Relief adjustment to help manage daily expenses more comfortably. With the government approving this DA increase, families can expect a tangible boost in their disposable income. It’s a strategic decision designed to preserve the purchasing power of central government employees and retirees, ensuring their income keeps pace with rising prices.

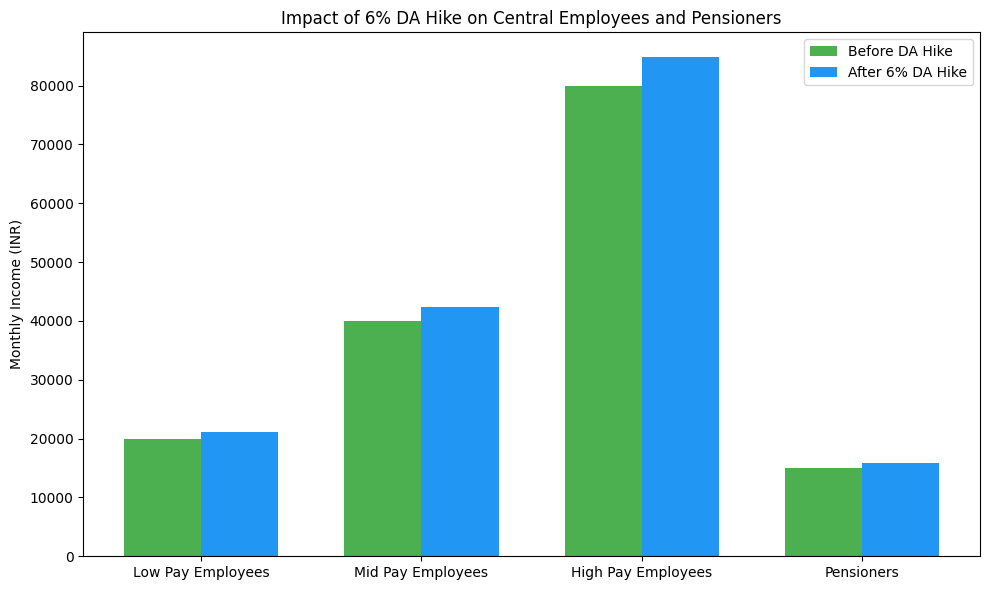

The news that the government approves 6% DA hike for central employees has created optimism among public sector workers and retirees alike. Dearness Allowance is a critical part of a government employee’s compensation, calculated as a percentage of basic pay. Its purpose is to protect the purchasing power of employees in times of rising inflation. With the new 6% hike, both lower-paid and higher-paid employees stand to benefit significantly, though in different ways. For employees in lower pay brackets, this increase can make a real difference in their day-to-day financial planning. Those in higher pay scales, while seeing larger absolute monetary benefits, gain an added cushion that allows for long-term financial security. Pensioners will also enjoy equal benefits through Dearness Relief, helping them manage healthcare costs, utilities, and other essential expenses more effectively.

Government Approves 6% DA Hike for Central Employees

| Category | Details |

|---|---|

| DA Increase Percentage | 6% |

| Beneficiaries | Central government employees and pensioners |

| Purpose | To offset inflation and preserve purchasing power |

| Calculation Basis | Percentage of basic pay |

| Pension Impact | Equal increase through Dearness Relief |

| Effective Date | Immediate (subject to official notification) |

| Economic Effect | Boosts disposable income and supports local businesses and markets |

| Arrears Possibility | One-time payment may be provided for past months |

The 6% Dearness Allowance hike is a timely and meaningful measure to improve financial security for central government employees and pensioners. It offsets inflation, boosts disposable income, and ensures that public servants can maintain a reasonable standard of living despite rising costs. Beyond personal finance, the hike supports broader economic stability by increasing spending and stimulating local markets. While it may not entirely neutralize inflation, it represents a significant step toward safeguarding purchasing power and enhancing financial confidence. As official notifications clarify effective dates and arrears payments, beneficiaries can anticipate a tangible improvement in their monthly income, allowing them to manage daily expenses and plan for the future more effectively.

What Dearness Allowance Means for Employees and Pensioners

Dearness Allowance is more than just a salary component it is a shield against the rising cost of living. With this 6% hike, employees across all pay scales will notice an increase in their take-home pay, and pensioners will see a matching Dearness Relief adjustment. For lower-income employees, this increase can directly improve their ability to manage monthly expenses. Essentials such as groceries, cooking gas, and transportation can become more manageable, reducing the financial stress many families face. For higher-paid employees, the benefit may not change day-to-day budgeting drastically but does provide a meaningful increase in absolute income. Pensioners, who largely depend on their monthly pensions, benefit equally. The DA hike helps retirees cover medical expenses, utility bills, and day-to-day living costs more comfortably.

Why The Timing of This DA Hike Matters

Timing is a crucial factor behind this 6% DA hike. Inflation has affected essential commodities, energy bills, and daily services, which puts a strain on household budgets. By implementing this increase now, the government ensures that employees and pensioners can maintain a reasonable standard of living despite these economic pressures. For many households, the hike provides not only financial relief but also peace of mind. It allows families to plan their finances better, reduce stress over day-to-day expenses, and allocate resources for future needs.

How The Government Determines Dearness Allowance

Dearness Allowance is adjusted based on the Consumer Price Index (CPI), which reflects changes in the cost of living. The government reviews DA twice a year to ensure that salaries and pensions retain their real value relative to inflation. This 6% increase is calculated based on the cumulative rise in CPI over recent months. By linking DA to CPI, the government ensures employees and pensioners are protected against the erosion of purchasing power. This approach is especially crucial during periods of high inflation, allowing public servants to maintain financial stability while also supporting the broader economy through sustained spending.

Possibility Of Arrears Payment

In many cases, DA hikes are applied retroactively, which results in arrears for the months since the last adjustment. If the government approves this, employees and pensioners could receive a one-time payment along with their next salary or pension installment. Arrears provide an immediate financial boost, helping households cover pending bills, healthcare expenses, or any unexpected costs. While the exact amount and payment timeline will depend on official government orders, employees and pensioners should monitor departmental circulars to stay informed.

Broader Economic Impact

The 6% DA hike is not just beneficial for individuals it also positively affects the overall economy. Increased disposable income among central government employees leads to higher spending on goods and services, which boosts local businesses and markets. This ripple effect can stimulate economic activity, benefiting both the private sector and public services. Moreover, employees with enhanced financial security are more likely to invest in education, healthcare, and personal development. This contributes indirectly to economic growth by increasing demand for quality services, improving standards of living, and supporting sustainable consumption patterns.

How Employees Can Plan with the DA Increase

Employees can use the DA hike strategically to improve their financial well-being. Some practical steps include allocating part of the increment toward essential expenses like groceries, fuel, and utility bills, setting aside a portion as savings or emergency funds to buffer against unforeseen expenses, investing in long-term financial instruments such as Public Provident Fund (PPF) or National Savings Certificates (NSC) to maximize returns. Pensioners can consider using the increase to cover medical insurance premiums or essential lifestyle needs, ensuring stability in later years.

FAQs on Government Approves 6% DA Hike for Central Employees

1. Who Is Eligible for The 6% DA Hike?

All central government employees and pensioners are eligible for the 6% DA hike. Pensioners receive an equivalent increase in Dearness Relief.

2. How Is Dearness Allowance Calculated?

DA is calculated as a percentage of an employee’s basic pay. This 6% increase means all eligible employees will see a rise proportional to their current salary.

3. When Will the DA Hike Be Implemented?

The hike is effective immediately, though the official government notification will provide the exact date. Retroactive payments or arrears may also be provided.

4. Will This DA Hike Fully Offset Inflation?

While the 6% DA hike may not completely counter inflation, it provides meaningful relief, helping employees and pensioners maintain their purchasing power.